Cereals Market Size (2025 – 2030)

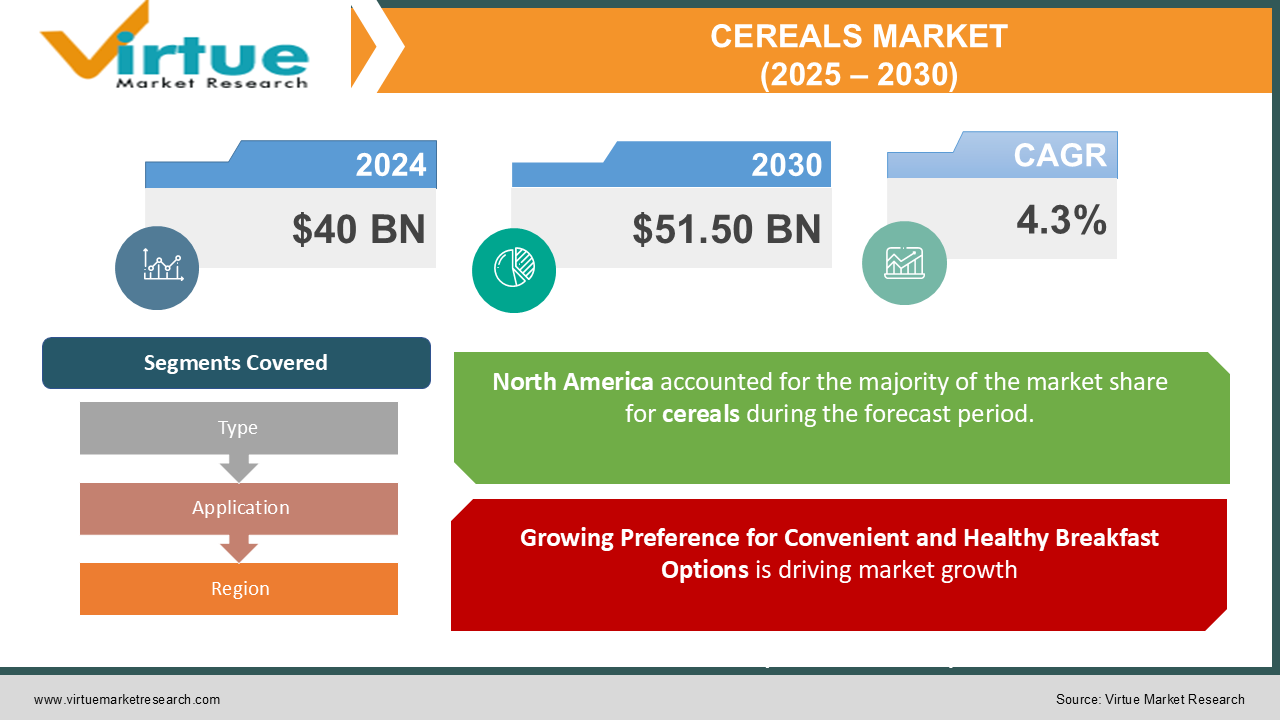

The Global Cereals Market was valued at USD 40 billion in 2024 and is projected to grow at a CAGR of 4.3% from 2025 to 2030. By 2030, the market is expected to reach USD 51.50 billion.

Cereals, a staple in diets worldwide, include grains such as wheat, rice, oats, barley, and corn, consumed for their rich nutritional value and versatility. The market has witnessed robust growth due to increasing demand for convenience foods, health-conscious choices, and fortified breakfast cereals. Cereals are extensively used in both traditional diets and innovative ready-to-eat food products, making them a vital component of the global food industry.

Key Market Insights

-

Wheat and rice are the most consumed cereals globally, accounting for over 70% of the total cereal consumption in 2024 due to their prevalence in staple diets across Asia-Pacific, Europe, and the Middle East.

-

North America and Europe lead the market in RTE cereals, with Asia-Pacific emerging as a fast-growing region due to increasing disposable incomes and Western dietary influences.

-

Organic cereals are gaining traction as consumers prioritize chemical-free, non-GMO products, with the organic segment expected to grow at a CAGR of 6.8% during the forecast period.

Global Cereals Market Drivers

Growing Preference for Convenient and Healthy Breakfast Options is driving market growth:

The modern consumer lifestyle, characterized by a preference for convenience, has significantly boosted the demand for ready-to-eat breakfast cereals. With busy schedules, consumers are increasingly seeking meal options that are quick to prepare while offering balanced nutrition. Ready-to-eat cereals cater to this demand by combining convenience with health benefits, such as being high in fiber, vitamins, and minerals. Furthermore, cereals fortified with additional nutrients like calcium, iron, and omega-3s have gained popularity among health-conscious individuals and families. The growing awareness about the importance of breakfast as the most important meal of the day is another driver for this segment, particularly in developed regions like North America and Europe.

Rising Demand for Gluten-Free and Specialty Cereals is driving market growth:

The increasing prevalence of gluten intolerance and celiac disease has created a substantial market for gluten-free cereals. Consumers who are health-conscious or looking to avoid gluten as part of a lifestyle choice are also contributing to the growth of this segment. Manufacturers are introducing innovative cereal products made from alternative grains like quinoa, millet, and amaranth, which are naturally gluten-free and rich in essential nutrients. These cereals cater to niche dietary needs while providing variety and taste, making them a preferred choice among consumers seeking healthier or allergen-free options. This trend is further amplified by the growing awareness of plant-based diets and sustainable food practices.

Expansion of E-Commerce Platforms for Food Products is driving market growth:

The rise of e-commerce has revolutionized the way consumers shop for cereals, providing them with a convenient platform to explore a wide variety of options. Online retail channels offer numerous advantages, such as discounts, home delivery, and access to niche or specialty cereal brands that may not be available in local supermarkets. This is particularly advantageous for organic, gluten-free, and fortified cereal products, which often target specific consumer segments. The growth of e-commerce is especially pronounced in developing regions, where internet penetration and digital payment systems are on the rise. Companies are increasingly leveraging digital platforms to expand their reach and engage with tech-savvy consumers through targeted marketing campaigns.

Global Cereals Market Challenges and Restraints

Price Volatility of Raw Materials is restricting market growth:

The cereals market is heavily dependent on the availability and cost of raw materials such as wheat, corn, oats, and rice. Fluctuations in agricultural output due to unpredictable weather conditions, pest infestations, or natural disasters can significantly impact raw material prices. For instance, droughts or floods in key grain-producing regions often lead to supply shortages, driving up costs for manufacturers. Additionally, geopolitical tensions, export restrictions, and trade policies can further exacerbate price volatility. These fluctuations directly affect the pricing strategies of cereal manufacturers and can pose challenges in maintaining profit margins.

Increasing Competition from Alternative Breakfast Options is restricting market growth:

While cereals continue to be a popular breakfast choice, they face stiff competition from alternative breakfast options such as protein bars, smoothies, and yogurt. These alternatives are often marketed as healthier, more versatile, or more portable than traditional cereal products. The rise of intermittent fasting and changing consumer preferences toward high-protein or low-carb diets also pose challenges for the cereals market. To stay competitive, manufacturers must continuously innovate and adapt their product offerings to align with evolving dietary trends. Failure to address these shifts in consumer behavior could result in a decline in market share for conventional cereal products.

Market Opportunities

The cereals market offers numerous opportunities for growth, particularly in emerging economies. Rising disposable incomes, urbanization, and increased awareness about nutrition are driving the adoption of packaged cereals in regions like Asia-Pacific, the Middle East, and Latin America. Additionally, the trend toward clean-label products and the demand for transparency in food sourcing present opportunities for brands that emphasize organic, non-GMO, and sustainably sourced cereals. Manufacturers can also explore partnerships with fitness and wellness influencers to promote cereals as part of a balanced diet. Furthermore, innovations in flavor profiles, packaging, and portion sizes can help attract younger consumers and families, ensuring long-term market growth.

CEREALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

4.3% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Kellogg Company, General Mills, Nestlé, PepsiCo (Quaker Oats), Post Holdings, Weetabix Limited, Bob's Red Mill Natural Foods, Nature's Path Foods, Hain Celestial Group, Organic India |

Cereals Market Segmentation - By Type

-

Ready-to-Eat (RTE) Cereals

-

Hot Cereals

-

Organic Cereals

-

Fortified Cereals

The Ready-to-Eat (RTE) cereals segment dominates the market, accounting for 40% of total revenue in 2024. This segment's growth is driven by convenience, health benefits, and innovative flavors catering to diverse consumer preferences.

Cereals Market Segmentation - By Application

-

Household Consumption

-

Foodservice

-

Industrial Use

Household consumption remains the largest application, contributing over 55% of the market share in 2024. The increasing preference for easy-to-prepare and nutritious breakfast options among families is the key driver for this segment.

Cereals Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the most dominant region in the global cereals market, accounting for over 35% of the market share in 2024. The region’s well-established breakfast culture, coupled with high consumption of fortified and ready-to-eat cereals, drives its dominance. The presence of major cereal manufacturers and the introduction of innovative product lines tailored to local tastes further support market growth. Additionally, the increasing demand for organic and gluten-free cereals aligns with the health-conscious mindset of North American consumers.

COVID-19 Impact Analysis on the Cereals Market

The COVID-19 pandemic had a significant, yet mixed, impact on the cereals market. On the positive side, the surge in at-home cooking and eating during the pandemic led to increased demand for packaged and ready-to-eat cereals, as consumers stocked up on pantry staples. The heightened focus on health and immunity also contributed to a rise in the consumption of fortified and whole-grain cereals, as people sought healthier options during uncertain times. This shift in consumer preferences provided a boost to the market, especially for cereals marketed as nutritious and health-focused. However, the pandemic also brought several challenges to the cereals industry. Disruptions in supply chains, labor shortages, and logistical issues created significant hurdles for manufacturers, particularly in sourcing raw materials and meeting the sudden increase in demand. Additionally, the foodservice sector, a key consumer of cereals in some regions, saw a decline in demand due to restaurant closures and reduced dining-out activities. This resulted in a temporary setback for manufacturers relying on the foodservice industry for a significant portion of their sales. As economies gradually recover and consumer preferences stabilize, the cereals market is expected to return to its pre-pandemic growth trajectory. The focus on health, convenience, and nutritious options is likely to remain a key driver for the market, with an ongoing emphasis on offering products that cater to changing consumer needs. With the global recovery underway, the cereals market is poised to regain momentum, capitalizing on the enduring demand for convenient, healthy food options.

Latest Trends/Developments

The cereals market is undergoing several transformative trends that reflect changing consumer preferences and technological advancements. One significant trend is the shift toward plant-based and vegan diets, which has led to the introduction of cereal products made from alternative grains and legumes. These products cater to environmentally conscious consumers who are seeking sustainable and plant-based options. The rise of functional foods is also driving innovation, with many manufacturers focusing on fortified cereals that offer specific health benefits, such as improved digestion or enhanced immunity, to meet the growing demand for wellness-focused products. Another notable trend is the growing popularity of single-serve and on-the-go cereal formats, which cater to the needs of busy, convenience-driven consumers. These portable options make it easier for individuals to incorporate cereal into their fast-paced lifestyles without compromising on nutrition. Alongside these trends, manufacturers are increasingly leveraging artificial intelligence (AI) and big data to analyze consumer preferences, optimize product development, and create more personalized cereal offerings. By utilizing these technologies, brands can better predict market trends and develop products that resonate with their target audiences. Sustainability is also a major factor influencing the cereals market. Consumers are becoming more conscious of the environmental impact of their purchases, driving demand for sustainable packaging solutions and ethical sourcing practices. Brands that prioritize eco-friendly packaging and responsible sourcing are more likely to build consumer loyalty and influence purchase decisions. As these trends continue to evolve, the cereals market is expected to see further innovation and growth, with an emphasis on health, convenience, and sustainability.

Key Players

-

Kellogg Company

-

General Mills

-

Nestlé

-

PepsiCo (Quaker Oats)

-

Post Holdings

-

Weetabix Limited

-

Bob's Red Mill Natural Foods

-

Nature's Path Foods

-

Hain Celestial Group

-

Organic India

Chapter 1. Cereals Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Cereals Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Cereals Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Cereals Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Cereals Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Cereals Market – By Type

6.1 Introduction/Key Findings

6.2 Ready-to-Eat (RTE) Cereals

6.3 Hot Cereals

6.4 Organic Cereals

6.5 Fortified Cereals

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Cereals Market – By Application

7.1 Introduction/Key Findings

7.2 Household Consumption

7.3 Foodservice

7.4 Industrial Use

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Cereals Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Cereals Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Kellogg Company

9.2 General Mills

9.3 Nestlé

9.4 PepsiCo (Quaker Oats)

9.5 Post Holdings

9.6 Weetabix Limited

9.7 Bob's Red Mill Natural Foods

9.8 Nature's Path Foods

9.9 Hain Celestial Group

9.10 Organic India

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Cereals Market was valued at USD 40 billion in 2024 and is projected to grow at a CAGR of 4.3% from 2025 to 2030. By 2030, the market is expected to reach USD 51.50 billion.

Key drivers include the growing demand for convenient breakfast options, the rise of gluten-free and specialty cereals, and the expansion of e-commerce platforms for food products.

The market is segmented by product (ready-to-eat cereals, hot cereals, organic cereals, fortified cereals) and application (household consumption, foodservice industry, industrial use).

North America is the most dominant region, accounting for over 35% of the market share in 2024, driven by high consumption of fortified and ready-to-eat cereals.

Key players include Kellogg Company, General Mills, Nestlé, PepsiCo (Quaker Oats), Post Holdings, and Weetabix Limited.