Fortified Cereals Market Size (2024 – 2030)

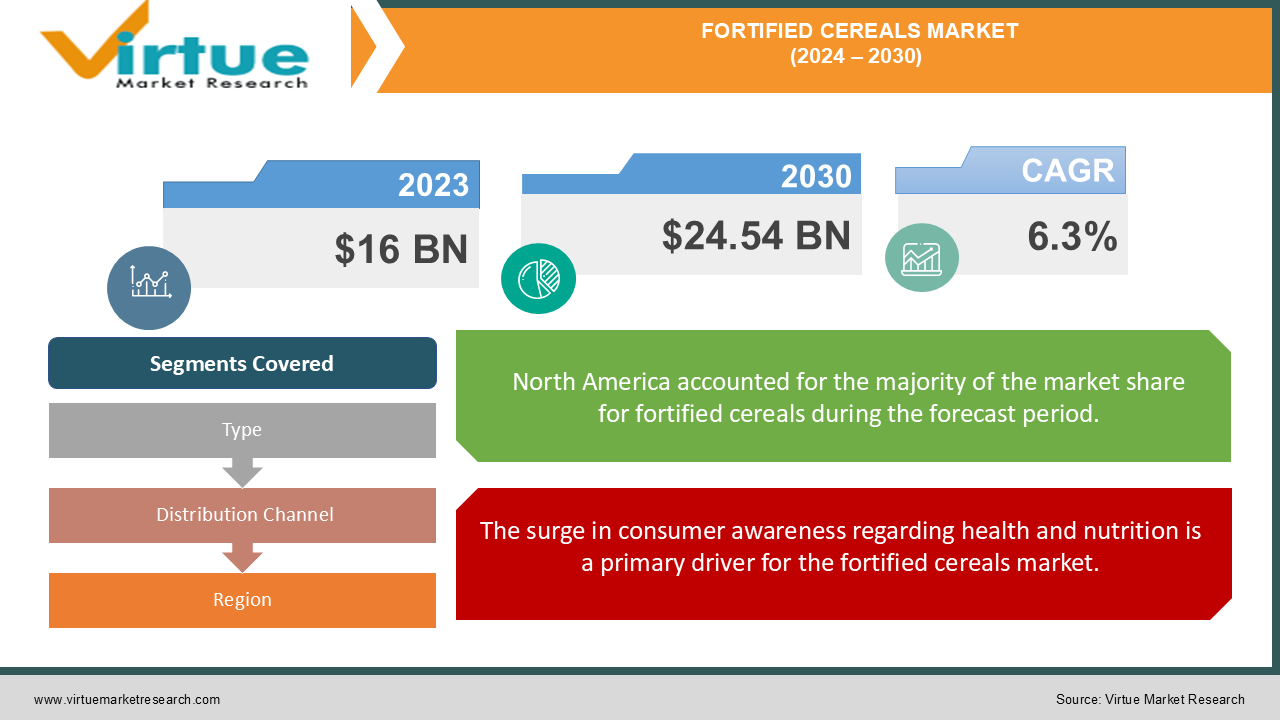

The Global Fortified Cereals Market was valued at USD 16 Billion in 2024 and is projected to reach a market size of USD 24.54 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.3%.

The fortified cereals market stands as an integral segment within the broader food industry, addressing a growing global demand for nutrient-enriched foods that cater to health-conscious consumers. Fortified cereals, which are enhanced with additional vitamins, minerals, and other nutrients, have become a staple in many households, particularly as more people seek convenient yet nutritious breakfast options. The market is characterized by ongoing innovation, driven by consumer awareness of nutrition, the rise of health-related concerns, and the need for fortification to combat micronutrient deficiencies. In 2023, the global fortified cereals market has been marked by significant growth, reflecting a broader trend toward health and wellness. This market has seen increasing penetration across different demographics, driven by both the expanding middle class in emerging markets and the evolving dietary preferences in developed economies. The market's dynamism is underpinned by a combination of consumer demand, governmental fortification programs, and the food industry's push toward healthier product offerings. In addition, a wide variety of goods that satisfy different customer preferences—such as organic, gluten-free, and non-GMO options—are available in the market. In addition to expanding the customer base, variety encourages innovation as producers work to adapt to changing market needs. Fortified cereals held a significant share of the morning cereal market in 2023, indicating their increasing societal acceptance and appeal. The demand for fortified cereals is driven by a growing awareness of the importance of a balanced diet and the role of micronutrients in maintaining health. As lifestyles become busier, the convenience of a nutritious breakfast option has become paramount, further propelling market growth.

Key Market Insights:

Fortified cereals represented about 35% of the total breakfast cereals market in 2023.

Over 60% of consumers reported purchasing fortified cereals primarily for their health benefits.

Iron and vitamin D were the most common nutrients added to cereals, with 70% and 65% inclusion rates, respectively.

Organic fortified cereals experienced a 20% increase in sales from 2022 to 2023.

Gluten-free fortified cereals grew by 15% in 2023, reflecting rising dietary preferences.

The children’s segment accounted for 40% of the fortified cereals market in 2023.

80% of households with children under 12 reported regularly buying fortified cereals.

The average price of fortified cereals increased by 5% in 2023 due to rising ingredient costs.

Fortified cereals with added fiber saw a 12% increase in demand in 2023.

North America held a 40% share of the global fortified cereals market in 2023.

Europe accounted for 30% of the market share in 2023.

Asia-Pacific was the fastest-growing market with a growth rate of 18% in 2023.

Online sales of fortified cereals grew by 25% in 2023, driven by e-commerce trends.

Over 50% of new product launches in the cereals category in 2023 were fortified varieties.

Fortified Cereals Market Drivers:

The surge in consumer awareness regarding health and nutrition is a primary driver for the fortified cereals market.

There is an increasing need for food items that provide more than just basic nutrition as more people become aware of the influence diet has on overall health. This need is met by fortified cereals, which are enhanced with vital vitamins and minerals and offer a quick and easy approach to improving one's nutritional profile. The advantages of micronutrients, such as enhanced immunological response, enhanced cognitive function, and decreased risk of chronic illnesses, are becoming more widely known to consumers today. This information contributes to the popularity of fortified cereals, which provide a workable fix for vitamin deficits that frequently result from contemporary eating habits. Fortified cereals are unlikely to disappear from the diets of health-conscious people as long as educational programs and public health campaigns stress the need for a balanced diet.

Government initiatives aimed at reducing malnutrition and promoting public health are significantly driving the fortified cereals market.

Several nations have instituted programs that promote the use of fortified foods as a means of addressing vitamin deficiencies, particularly among susceptible groups like expectant mothers and children. These programs frequently involve grants, public education campaigns, and alliances with food producers in order to guarantee the accessibility and cost-effectiveness of fortified goods. For example, fortified cereals are used in school feeding programs throughout a number of nations to give kids the vital nutrients they need to promote their growth and development. These initiatives not only increase the number of people consuming fortified cereals but also encourage government and company cooperation, which results in creative product creation. The market for fortified cereals is expected to increase steadily as long as governments throughout the world maintain their emphasis on nutrition in their public health agendas and provide favorable regulatory frameworks.

Fortified Cereals Market Restraints and Challenges:

The market for fortified cereals confronts a number of obstacles that might prevent it from growing, despite the favorable outlook. An important impediment is the growing cost of production and raw materials. Complex manufacturing procedures and quality control procedures are required for adding vitamins and minerals to cereals, which can raise production costs. Since these expenses are frequently transferred to customers, fortified grains are more costly than their non-fortified equivalents. Price sensitivity can restrict market penetration and consumer acceptance, particularly in developing nations. Consumer ignorance and skepticism present another difficulty. Although a significant portion of consumers recognize the health advantages of fortified cereals, some remain doubtful about the effectiveness and safety of fortified meals. Moreover, regulatory obstacles may provide difficulties for market expansion. Regulations governing the kinds and amounts of nutrients that can be added to food differ throughout nations. For manufacturers—especially those that sell their products in many foreign markets—navigating these restrictions may be difficult and expensive. Large resources and experience are needed to ensure compliance with a variety of regulatory standards, which can be a hurdle for smaller businesses looking to get into the fortified cereal industry.

Fortified Cereals Market Opportunities:

The market for fortified cereals offers a lot of room for expansion and innovation in spite of the obstacles. The growing need for customized nutrition presents one important possibility. Products that may be tailored to fit specific health goals are becoming more and more popular as customers become more conscious of their own nutritional needs. This development presents an opportunity for producers to create customized fortified cereal products that meet certain nutritional needs, such as low-sugar or high-protein alternatives, or those with functional additives like omega-3 fatty acids or probiotics included. Furthermore, there is a significant chance for market expansion given the growth of digital and e-commerce platforms. Fortified cereal businesses may use digital platforms to attract a wider audience as more people buy groceries online. Online channels allow for direct customer interaction, tailored advice, and informational marketing about the advantages of fortified cereals. With improved data collecting and insights into customer preferences made possible by this direct-to-consumer business model, firms are better equipped to innovate and adjust to market changes.

FORTIFIED CEREALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.3% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Kellogg’s, General Mills, Nestlé, PepsiCo (Quaker), Post Consumer Brands, Nature’s Path, Bob’s Red Mill, Dr. Oetker, Hain Celestial Group, Attune Foods, Arrowhead Mills, Weetabix, Ralston Foods, Annie’s Homegrown |

Fortified Cereals Market Segmentation: By Types

-

Ready-to-eat cereals

-

Hot cereals

-

Granola/muesli

Among these, ready-to-eat cereals are the most dominant type, as they offer unparalleled convenience and are widely consumed across various demographics. They are particularly popular for their ease of preparation, appealing to busy consumers seeking quick breakfast solutions.

The fastest-growing segment, however, is hot cereals. This growth is driven by an increasing preference for warm, comforting breakfast options that are perceived as more wholesome. Hot cereals often include added benefits such as whole grains and higher fiber content, which resonate well with health-conscious consumers.

Fortified Cereals Market Segmentation: By Distribution Channel

-

Supermarkets/Hypermarkets

-

Online Channels

-

Specialty Stores

-

Convenience Stores

-

Others

Supermarkets and hypermarkets are the most dominant distribution channels due to their extensive reach and variety of available products. These outlets offer consumers the convenience of one-stop shopping and access to a wide range of fortified cereal options.

Online retailers represent the fastest-growing distribution channel. The convenience of online shopping, coupled with the ability to easily compare products and access detailed nutritional information, makes this channel increasingly popular. The growth of e-commerce has been further accelerated by the COVID-19 pandemic, which shifted more consumers towards online shopping.

Fortified Cereals Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America holds the largest share of the global fortified cereals market, accounting for approximately 40% in 2023. This dominance is attributed to high consumer awareness, established distribution networks, and a strong preference for convenient breakfast options.

Asia-Pacific is the fastest-growing region, with a growth rate of 18% in 2023. The region's rapid urbanization, rising disposable incomes, and increasing awareness of nutritional deficiencies contribute to the burgeoning demand for fortified cereals. Additionally, government initiatives to combat malnutrition further support market growth in this region.

COVID-19 Impact Analysis on the Fortified Cereals Market:

The market for fortified cereals has been significantly impacted by the COVID-19 epidemic, which has changed consumer tastes and behavior. Customers started buying more health-conscious food items during the pandemic as they became more aware of their immune systems and general well-being. Due to the perception that fortified cereals are an easy approach to enhance nutrient intake and promote general health, this change has resulted in a rise in demand for them. The epidemic increased people's attention to health and well-being as they tried to preserve their well-being and fortify their immune systems in the face of a worldwide health emergency. Because there were fewer opportunities for eating out due to lockdowns and social distancing efforts, the pandemic further hastened the trend toward home consumption. However, there were drawbacks to the epidemic as well, especially with regard to supply chain interruptions. Cereal production and delivery were impacted by lockdowns and limitations, which resulted in brief shortages and higher prices for specific ingredients and packaging materials. Manufacturers have to overcome these obstacles by strengthening the robustness of their supply chains and streamlining their logistics to guarantee product availability. All things considered, even while the pandemic presented difficulties, it also offered chances for expansion and creativity in the market for fortified grains. Beyond the epidemic, there is probably going to be a continued emphasis on nutrition and health, which will keep people buying fortified cereals as part of a balanced diet.

Latest Trends/ Developments:

Growing consumer desire for clean-label products is one important development. Food components are becoming more important to consumers, who are looking for items without chemical additives or preservatives. Manufacturers have been compelled by this tendency to create fortified cereals that retain their nutritious value while using straightforward, identifiable components. The popularity of fortified plant-based and vegan cereals is another noteworthy development. Cereals that support plant-based diets are becoming increasingly popular as more people switch to them for ethical, environmental, and health-related reasons. In response, producers are expanding their selection of plant-based cereals and fortifying them with vital elements like calcium, iron, and vitamin B12—all of which are frequently deficient in vegan diets.

Key Players:

-

Kellogg’s

-

General Mills

-

Nestlé

-

PepsiCo (Quaker)

-

Post Consumer Brands

-

Nature’s Path

-

Bob’s Red Mill

-

Dr. Oetker

-

Hain Celestial Group

-

Attune Foods

-

Arrowhead Mills

-

Weetabix

-

Ralston Foods

-

Annie’s Homegrown

Chapter 1. Fortified Cereals Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Fortified Cereals Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Fortified Cereals Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Fortified Cereals Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Fortified Cereals Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Fortified Cereals Market – By Type

6.1 Introduction/Key Findings

6.2 Ready-to-eat cereals

6.3 Hot cereals

6.4 Granola/muesli

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Fortified Cereals Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets/Hypermarkets

7.3 Online Channels

7.4 Specialty Stores

7.5 Convenience Stores

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Distribution Channel

7.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Fortified Cereals Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Fortified Cereals Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Kellogg’s

9.2 General Mills

9.3 Nestlé

9.4 PepsiCo (Quaker)

9.5 Post Consumer Brands

9.6 Nature’s Path

9.7 Bob’s Red Mill

9.8 Dr. Oetker

9.9 Hain Celestial Group

9.10 Attune Foods

9.11 Arrowhead Mills

9.12 Weetabix

9.13 Ralston Foods

9.14 Annie’s Homegrown

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Consumers are increasingly aware of the importance of consuming fortified foods to meet their daily nutritional requirements. Fortified cereals offer a convenient and affordable way to supplement your diet with essential vitamins, minerals, and fiber.

Many fortified cereals contain added sugars, which can contribute to weight gain and other health problems. This has led to increased demand for low-sugar or sugar-free options.

The market is dominated by a diverse range of players, both established and emerging. Key players in the market include Kellogg’s, General Mills, Nestlé, Nature’s Path, Bob’s Red Mill, Dr. Oetker, Ralston Foods, and Annie’s Homegrown. Additionally, regional and local brands have also gained traction in specific markets.

North America is the most dominant region in the market, accounting for approximately 35% of the total market share.

Asia Pacific is the fastest-growing region in the market.