Cannabis Gummies Market Size (2025 – 2030)

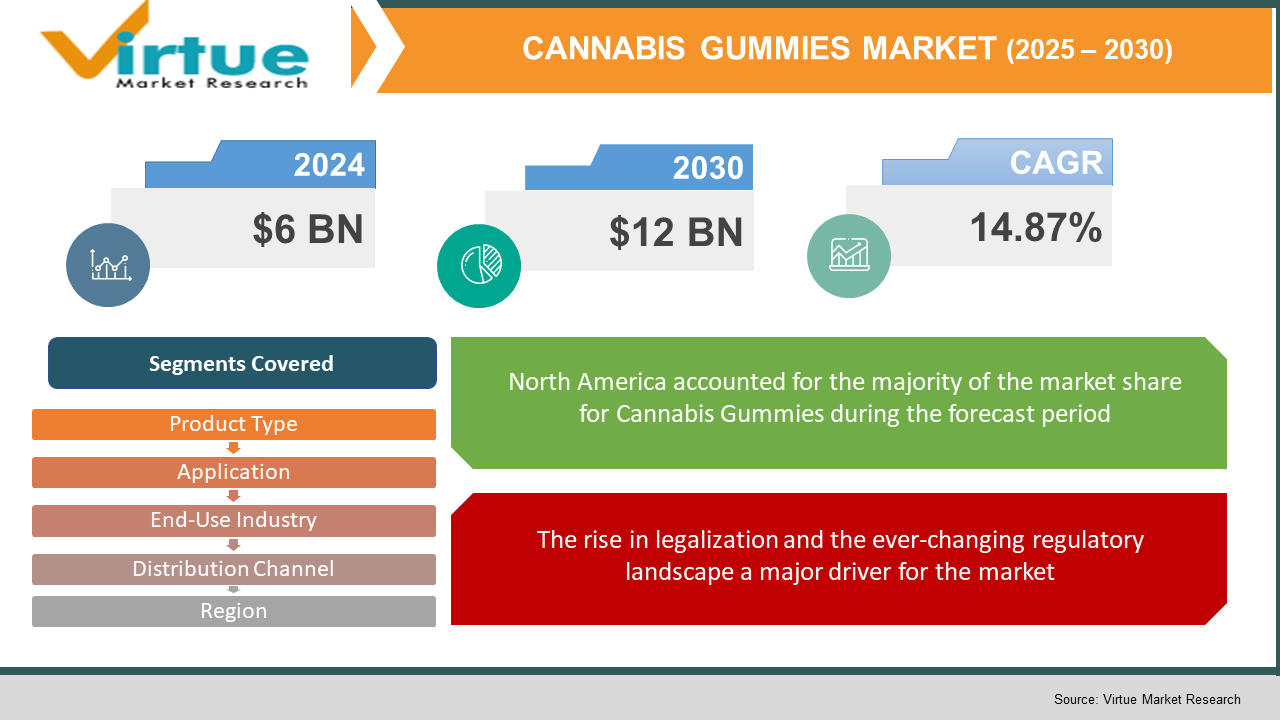

The Global Cannabis Gummies Market was valued at USD 6 billion and is projected to reach a market size of USD 12 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 14.87%.

Growing legality, increasing consumer health awareness, and growing product innovations will drive strong expansion of the worldwide Cannabis Gummies Market till 2030. Perceived medicinal advantages and simplicity of use are driving the rising acceptance of cannabis gummies made from cannabinoids found in CBD, THC, or a hybrid blend. Along with the increasing need in developing nations, changing legal frameworks throughout Europe and North America are helping to drive the market's growth. Manufacturers are developing sophisticated formulations and marketing plans to appeal to a wide spectrum of consumer profiles, from wellness-focused individuals to patients seeking symptom relief, and both recreational and medical uses are expanding.

Key Market Insights:

- More than 60% of new marijuana users choose gummies for simplicity of dosing and discreet consumption, therefore pushing product invention and brand separation.

- Roughly 40% of areas have changed cannabis laws in the last two years, therefore fueling market growth and more general product acceptance.

- The cannabis edibles business sees more than 30% yearly growth in research and development spending, which results in better ingredients and varied product lines.

- Companies that use digital sales and focused social media strategies show a 25% higher consumer contact level than those using conventional sources.

Cannabis Gummies Market Drivers:

The rise in legalization and the ever-changing regulatory landscape a major driver for the market.

By standardizing quality and safety standards, this development has not only raised consumer trust but has also drawn large sums of money into the cannabis edibles field. Clearer rules of legislation and quicker approval procedures will enable manufacturers to introduce creative goods more rapidly, therefore increasing market access and accelerating growth. Increased transparency and compliance demands have also raised consumer confidence, therefore making it easier for brands to scale their offerings internationally.

The awareness related to consumer health and wellness has increased gradually, driving the growth of the market.

An increasing focus on health, wellness, and preventive care among contemporary consumers is driving demand for goods with both recreational enjoyment and therapeutic properties. Particularly those made with non-psychoactive CBD or very balanced THC levels, cannabis gummies have become popular for their capacity to relieve pain, calm anxiety, and boost general well-being. Wider acceptance of cannabinoids as functional components in daily wellness products has come from scientific research as well as advocacy by peers. Market surveys reveal that a major percentage of customers, especially among Millennials and Gen Z, are actively looking for natural alternatives to traditional medications. Increased product differentiation is resulting from this health-focused approach as companies create blends for particular wellness objectives such as stress relief, sleep improvement, and cognitive enhancement. This trend leads to increased consumer acceptance and market-driven constant product variety.

The recent advancements in the field of technology play a crucial role in developing the market.

Advances in food chemistry, extraction methods, and pharmaceutical formulation have greatly enhanced the effectiveness, uniformity, and safety profile of cannabis gummy bears. Through sophisticated extraction techniques such as CO₂ extraction and ethanol-based methods, manufacturers can now accurately control cannabinoid content and use creative encapsulation technologies to improve bioavailability and guarantee proper dosing. Recent developments have produced gummies with better flavor profiles, longer shelf life, and more constant potency, which are essential for establishing consumer trust. Moreover, these technical advances help to meet strict legal requirements by way of accurate formulations enabling increased reproducibility and stronger clinical validation of health claims. The ongoing research and development funding in these geographies underpins the launch of fresh product variations meeting different consumer needs, thereby driving market growth and raising general competitiveness.

The retail and digital sales channels are expanding at a high rate, driving the market towards growth.

Digital transformation is changing everything about how cannabinoid gummies find their way to consumers. Market access has grown as e-commerce platforms, direct-to-consumer sites, and mobile applications abound, enabling companies to contact a more internationally dispersed audience. Along with online ordering and home delivery, mainstream retail outlets have also grown to include health-centric businesses and specialized cannabis dispensaries. Brands can create close, engaging connections with customers using improved digital marketing strategies such as influencer partnerships, social media advertising, and data-driven customer targeting. This omnichannel strategy has proven especially successful in drawing younger consumers who value tailored, convenient shopping opportunities. Digital sales have soared as a result, propelling fast market expansion and enabling faster product releases as well as market response to emerging trends.

Cannabis Gummies Market Restraints and Challenges:

The high cost of production and the need for advanced level technologies are the major challenges being faced by the market.

Sourcing top-notch cannabis gummies calls for major investment all along the value chain from best extraction techniques (such as CO₂ extraction) to exact formulation and thorough quality control measures. To guarantee consistent cannabinoid concentrations and even dosage per unit, manufacturers have to buy sophisticated machinery and spend on modern production methods. Maintaining consumer trust is contingent on consistent batch-to-batch quality, but this also raises manufacturing expenditure since strong quality assurance systems and frequent third-party audits are needed. For tiny companies and growing brands, the large capital outlay and operating costs serve as significant obstacles to scaling production. These processes demand continuous R&D efforts to fine-tune formulations and follow strict testing standards prescribed by regulatory agencies.

Fluctuating rules and regulations across the globe make it challenging for the market to navigate through them.

Though there have been great advances in legislation, cannabis is still a highly regulated sector with several legal systems across nations and even inside various states or provinces. Because regulations on product claims, labelling, marketing, and safety are always changing, companies face substantial instability. In addition to consistent legal oversight, conformity with these rules calls for significant resources in quality control, documentation, and certification procedures. These forces might slow down product releases, raise manufacturing expenses, and present obstacles to market growth. The variation and complexity of regulatory environments present obstacles to local as well as global growth since businesses have to customize their compliance plans for every market, therefore impacting general innovation and operational efficiency.

The existence of social stigma regarding the product in many parts of the world remains a big challenge faced by the market.

Many parts still have a continuous social stigma, even if marijuana is getting more and more accepted. This prejudice, based on years of prohibition, can affect consumer perception and slow down market expansion, especially in conservative settings. Moreover, the growing popularity of health claims associated with cannabis gummies that some companies overstated without enough scientific support has resulted in greater consumer disbelief. Significant investment in independent clinical studies, honest labelling, and vigorous consumer education marketing initiatives are all required to establish trust in the potency and safety of cannabis gummies. Overcoming this skepticism is crucial; it calls for honest communication on dosages, possible benefits, and side effects, all of which takes time and great cost to establish legitimacy.

The frequent fluctuations in the supply chain pose a great challenge to the market, affecting its growth.

The availability and quality of raw ingredients, particularly top-quality cannabis extracts and normal flavouring compounds, greatly influence the manufacture of cannabis gummies. Variable growing yields, seasonal variations, and regulatory issues influencing cannabis agriculture combine with the sector's unstable nature. These elements can cause irregular supply, which can in turn cause price swings and maybe production interruptions. Furthermore, disturbances in supply chains, as shown during events like the COVID‑19 epidemic, can cause production delays and increase raw material costs. To reduce these risks, which usually lead to higher operating costs and affect general market profitability and growth, manufacturers must have strong supply chain management plans and source diversity.

Cannabis Gummies Market Opportunities:

The developing nations present a big opportunity for the market to expand its reach and grow.

Fledgling markets in areas like Asia-Pacific and Latin America are undergoing fast urbanization and growing disposable incomes, driving more consumer interest in wellness and other health products, including cannabis gummies. Changing governmental actions and an evolving legal environment in these areas are slowly opening the market for cannabis-based goods to a larger range of people. For example, in some Southeast Asian nations, as well as Mexico, Brazil, fresh rules have begun to relax limitations on medical and lifestyle marijuana consumption. Significant market share can be captured by businesses that change their goods to match regional cultural tastes, such as flavourings unique to the area or recipes designed to suit local wellness practices. Furthermore, enabling the broad distribution of these goods is digital commerce and better logistics in developing markets, which lets firms reach into new customer segments that are more and more accepting of inventive, health-oriented edibles.

The recent innovations in the market that are making the product better are seen as an opportunity to grow.

Manufacturers are putting big money into research and development to make distinctive goods, so the cannabis gummies business is accelerating the drive toward premiumization. Modern advances in formulation now allow for the addition of more functional components, including vitamins, adaptogens, and nootropic agents that appeal to particular customers, ranging from improved cognitive performance to stress relief. Beyond the basic cannabis effects, these value-added gummies have other advantages and appeal to a chosen section of consumers ready to spend top dollar. Scientific confirmation and clinical studies are increasingly driving consumer trust, therefore compelling companies to highlight in their promotional messages both effectiveness and safety. As companies seek to develop a distinct market identity, increase consumer loyalty, and demand higher margins in a very competitive environment, therefore, product diversification via advanced formulations is fast gaining acceptance.

The recent adoption of advanced digital marketing is helping the market to prosper.

Advanced digital marketing has become a strong instrument in the cannabis gummies industry as consumer purchasing behaviour swings toward online distribution. Increasingly, companies are using targeted social media advertisements, influencer alliances, and AI-powered analytics to reach particular demographics and develop direct-to-consumer connections. Companies can use digital platforms to collect consumer data in real time, customize marketing plans, and perfect their campaigns based on response and user behaviour. By allowing more individualized and interactive shopping experiences, this integrated digital solution not only improves brand visibility and customer engagement but also reduces the obstacles to market entry. Particularly in regions with high digital penetration, sophisticated digital marketing offers a scalable and inexpensive means to raise sales, increase customer loyalty, and grow market share as e-commerce expands globally.

The complex rules and regulations create both challenges and opportunities for the market.

The complexity of the regulatory environment for cannabis products, which varies greatly from area to area, presents both an obstacle and a possibility. The maturing sector calls for more attention from companies, industry organizations, and government agencies working together on setting standardized quality criteria and more obvious safety rules. Harmonized rules can alleviate confusion, simplify compliance procedures, and speed up the introduction of goods in worldwide markets. Advocacy for standardization not only benefits consumers by ensuring product quality and safety but also provides manufacturers with a level playing field that encourages innovation. Lowering entry obstacles will help established businesses as well as new ones to rapidly grow their market reach, therefore, a more consistent regulatory setting will foster consumer confidence. Expected to promote long-term market stability and support worldwide growth, industry players are actively participating in policy debates and suggesting common standards.

CANNABIS GUMMIES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

14.87% |

|

Segments Covered |

By Product Type, application, end user industries , Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Canopy Growth Corporation, Aphria Inc., Aurora Cannabis Inc., Tilray Brands, Inc., Cronos Group, HEXO Corp., Curaleaf Holdings, Inc., Green Thumb Industries, Trulieve Cannabis Corp., Cresco Labs Inc. |

Cannabis Gummies Market Segmentation:

Cannabis Gummies Market Segmentation: By Product Type

- CBD Gummies

- THC Gummies

- Hybrid Gummies

- Edible Extract Gummies

The CBD Gummies segment rules the market because of large consumer acceptance and an intense emphasis on non-psychoactive advantages. These are the gummies created just from cannabidiol, aimed at therapeutic and wellness advantages. The hybrid gummies segment is the fastest-growing, as localities legislate cannabis both recreationally and medicinally. It is a combination of THC and CBD, designed for balanced effects.

THC Gummies are recreational and therapeutic gummies with tetrahydrocannabinol. Development relies on legal progress; these are well-liked in areas with developed economies. The edible extract gummies are made with complete spectrum marijuana extracts for a whole approach. It is a niche segment with potential in premium markets.

Cannabis Gummies Market Segmentation: By Application

- Recreational Use

- Medical Use

- Wellness

- Others

The recreational use segment is the dominant one, and the medical use segment is the fastest-growing segment. Recreational products dominate in developed markets with complete legalization aimed at customers looking for psychoactive properties. Clinical approval and patient demand are driving the fast expansion of medical use. These are the gummies created specifically to relieve discomfort or decrease anxiety.

The wellness segment includes products aimed at wellness, stress relief, and general health. The others segment includes niche uses such as anti-inflammatory advantages or cognitive improvement.

Cannabis Gummies Market Segmentation: By End-Use Industry

- Food & Beverages

- Healthcare

- Retail

- E-Commerce

The Food & Beverages segment dominates the market, bottled and packaged cannabis gummies sold through supermarkets and specialty stores are dominantly consumed thanks to the broad distribution networks and consumer familiarity of edible cannabis products. Driven by growing consumer demand for online shopping and convenience, e-commerce is the fastest‑growing end-use channel. It includes sales directly to consumers via digital channels that are rising quickly.

For the healthcare segment, it is used in medical treatments and for therapeutic purposes. The retail segment emphasizes ready-to-eat items found across physical and internet retail channels.

Cannabis Gummies Market Segmentation: By Distribution Channel

- Direct Sales

- Distributors

- Online Retail

Here, the direct sales segment is the dominant segment of the market, as it often controls legal markets where quality control and authenticity are critical. It includes sales from producers directly to major retailers or institutional purchasers. The online retail segment is considered the fastest-growing segment, which is due to digital marketing and the increasing e-commerce trend. It offers products directly to consumers, hence e-commerce platforms are rapidly growing. Wholesale companies and third-party distributors that enlarge market access, especially in developing areas, come under the distributors segment.

Cannabis Gummies Market Segmentation: By Region

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America is the leading region in this market, it remains dominant due to established regulatory frameworks and robust market infrastructure. It is a mature market with extensive legalization and consumer acceptance across recreational and medical segments. The Asia-Pacific region is said to be the fastest-growing region for this market, as gradual regulatory changes and gradual awareness drive this market expansion. It is a market with fast-growing disposable incomes and changing attitudes toward cannabis.

Europe is a growing market with rapidly rising legal acceptance for medical use. It is characterized by regulatory harmonization and consumer health trends. South America is a developing market with a fast-growing need for natural wellness goods. Though they have a small market share, the MEA region is considered an emerging market. This is due to the evolving regulatory environment and a change in the attitudes of consumers.

COVID-19 Impact Analysis on the Global Cannabis Gummies Market:

By increasing consumer interest in health and immunity-boosting goods, the epidemic rapidly influenced the Global Cannabis Gummies Market. Lockdown constraints and increased health consciousness drove a surge in demand for functional edibles, including cannabis gummies, in the course of the epidemic. In some sectors, online sales increased by more than 30% as conventional retail was upset, hence firms rapidly turned to e-commerce platforms. Furthermore, greater research and development activity during lockdown produced new formulations meant to boost immunity, sleep quality, and stress relief. Although source chain problems and regulatory delays were initially thorny, the long-term shift to digital distribution and consumer focus on health benefits has laid the groundwork for continuous market expansion in the post-COVID era.

Latest Trends/ Developments:

Recent developments include expanded legalization in important regions, most particularly across North America and some parts of Europe, hence setting the scene for greater consumer access and greater market competition.

A continuously growing spectrum of goods aimed at both wellness and medical use arises from gummy formulations, including hybrid blends and advanced bioavailability methods, as well as constant innovation.

Rising focus on direct-to-consumer sales models via e-commerce along with targeted social media campaigns is changing market dynamics and fueling fast sales growth.

The increasing premiumization of products is driving companies to launch specialized items, like gummies enhanced with nootropics and adaptogens. These products meet certain consumer health needs and justify more expensive pricing points.

Key Players:

- Canopy Growth Corporation

- Aphria Inc.

- Aurora Cannabis Inc.

- Tilray Brands, Inc.

- Cronos Group

- HEXO Corp.

- Curaleaf Holdings, Inc.

- Green Thumb Industries

- Trulieve Cannabis Corp.

- Cresco Labs Inc.

Chapter 1. CANNABIS GUMMIES MARKET– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources`

1.5. Secondary Sources

Chapter 2. CANNABIS GUMMIES MARKET– Executive Summary

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. CANNABIS GUMMIES MARKET– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. CANNABIS GUMMIES MARKET- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. CANNABIS GUMMIES MARKET- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. CANNABIS GUMMIES MARKET– By Product Type

6.1 Introduction/Key Findings

6.2 CBD Gummies

6.3 THC Gummies

6.4 Hybrid Gummies

6.5 Edible Extract Gummies

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type , 2025-2030

Chapter 7. CANNABIS GUMMIES MARKET– By Application

7.1 Introduction/Key Findings

7.2 Recreational Use

7.3 Medical Use

7.4 Wellness

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. CANNABIS GUMMIES MARKET– By Distribution Channels

8.1 Introduction/Key Findings

8.2 Direct Sales

8.3 Distributors

8.4 Online Retail

8.5 Y-O-Y Growth trend Analysis Distribution Channels

8.6 Absolute $ Opportunity Analysis Distribution Channels , 2025-2030

Chapter 9. CANNABIS GUMMIES Market– By End-Use Industry

9.1 Introduction/Key Findings

9.2 Food & Beverages

9.3 Healthcare

9.4 Retail

9.5 E-Commerce

9.6 Y-O-Y Growth trend Analysis End-Use Industry

9.7 Absolute $ Opportunity Analysis End-Use Industry , 2025-2030

Chapter 10. CANNABIS GUMMIES MARKET, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Product Type

10.1.3. By Distribution Channels

10.1.4. By Application

10.1.5. End-Use Industry

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Product Type

10.2.3. By Distribution Channels

10.2.4. By Application

10.2.5. End-Use Industry

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.1. By Country

10.3.1.2. China

10.3.1.2. Japan

10.3.1.3. South Korea

10.3.1.4. India

10.3.1.5. Australia & New Zealand

10.3.1.6. Rest of Asia-Pacific

10.3.2. By Product Type

10.3.3. By End-Use Industry

10.3.4. By Application

10.3.5. Distribution Channels

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.1. By Country

10.4.1.1. Brazil

10.4.1.2. Argentina

10.4.1.3. Colombia

10.4.1.4. Chile

10.4.1.5. Rest of South America

10.4.2. By End-Use Industry

10.4.3. By Application

10.4.4. By Product Product Type

10.4.5. Distribution Channels

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.1. By Country

10.5.1.4. United Arab Emirates (UAE)

10.5.1.2. Saudi Arabia

10.5.1.3. Qatar

10.5.1.4. Israel

10.5.1.5. South Africa

10.5.1.6. Nigeria

10.5.1.7. Kenya

10.5.1.10. Egypt

10.5.1.10. Rest of MEA

10.5.2. By Distribution Channels

10.5.3. By End-Use Industry

10.5.4. By Application

10.5.5. Product Type

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. CANNABIS GUMMIES MARKET– Company Profiles – (Overview, Service End-Use Industry Product Product Type Portfolio, Financials, Strategies & Developments)

11.1 Canopy Growth Corporation

11.2 Aphria Inc.

11.3 Aurora Cannabis Inc.

11.4 Tilray Brands, Inc.

11.5 Cronos Group

11.6 HEXO Corp.

11.7 Curaleaf Holdings, Inc.

11.8 Green Thumb Industries

11.9 Trulieve Cannabis Corp.

11.10 Cresco Labs Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

Rising legalization, health-aware customer habits, and product innovation in recreational and medicinal sectors propel the market growth

The coronavirus fast-tracked internet sales, raised demand for health products, and drove R&D for new treatments, therefore raising market development

Major hurdles that are faced by the Cannabis Gummies Market are consumer doubt about health claims, supply chain disturbances, high production costs, and regulatory uncertainties.

Growing quickly and propelled by rising digital engagement and ease, online retail has become a key marketing channel.

Rising disposable incomes, changing legislation, and increasing consumer demand in cannabis-based wellness items are driving the fastest‑growing Asia-Pacific region