Global Cannabis Beverages Market size (2024-2030)

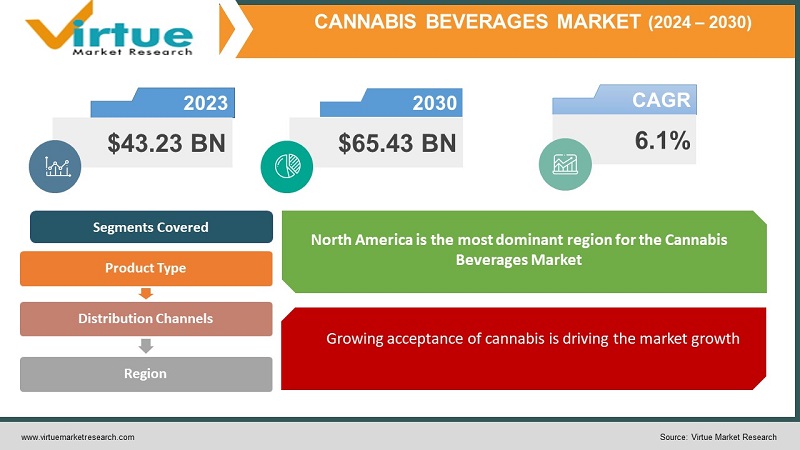

The Global Cannabis Beverages Market was valued at USD 43.23 billion in 2023 and will grow at a CAGR of 6.1% from 2024 to 2030. The market is expected to reach USD 65.43 billion by 2030.

Key Market Insights:

Cannabis legalization across North America and parts of Europe is a significant driver. As regulations ease, consumer access to cannabis-infused products, including beverages, is expanding.

Consumers are increasingly seeking convenient and discreet ways to consume cannabis. Cannabis beverages offer a measured dosage, faster onset time, and potentially lower psychoactive effects compared to smoking, appealing to a broader audience.

Currently, the market is dominated by sparkling water and sodas infused with cannabis, accounting for over 60% of the market share.

North America currently holds the leading position in the cannabis beverage market, followed by Europe.

Global Cannabis Beverages Market Drivers:

Shifting consumer preferences are driving market growth

Consumers are undergoing a significant shift in cannabis consumption preferences, moving away from traditional methods like smoking or inhalation. Cannabis-infused beverages are emerging as a highly attractive alternative due to their discretion, convenience, and measured dosing. Unlike smoking, beverages offer a more controlled experience with a faster onset time. Additionally, the potential for less psychoactive effects compared to smoking appeals to a broader audience seeking the benefits of cannabis without feeling overwhelmed. This trend highlights a growing demand for user-friendly cannabis consumption methods, paving the way for the continued rise of cannabis beverages in the market.

Growing acceptance of cannabis is driving the market growth

Two major forces are propelling the cannabis market forward: legalization and a shifting social landscape. As laws loosen around cannabis use, adults are no longer confined to an illicit market, and established businesses can enter the fray. This legitimacy fosters trust and encourages more people to explore cannabis products. Furthermore, the negative stigma historically associated with cannabis is fading. Open conversations about its potential medical benefits and responsible recreational use are chipping away at societal disapproval. This newfound acceptance is particularly evident among younger generations who are more likely to view cannabis favorably. With less social pressure and a growing awareness of its potential applications, consumers are embracing cannabis-infused products, from edibles and topicals to beverages and concentrates. This expanding market caters to a wider range of preferences, further fueling the cannabis industry's impressive growth.

Health and wellness trends are driving the market growth

The cannabis beverage market is tapping into the booming health and wellness trend by offering products that cater to consumers seeking natural solutions. A segment of the market is drawn to cannabis beverages for their perceived health benefits, which may include pain relief, relaxation, and improved sleep. This aligns perfectly with the increasing demand for natural alternatives for managing various health conditions. Unlike traditional medications, cannabis beverages offer a potentially gentler approach, appealing to health-conscious consumers who prioritize natural ingredients and a more holistic wellness experience. However, it's important to note that research on the long-term effects of cannabis beverages on specific health conditions is still ongoing. This highlights a need for further scientific studies to bridge the gap between consumer perception and established medical evidence. As research progresses, cannabis beverages have the potential to become a more widely accepted option within the health and wellness landscape.

Global Cannabis Beverages Market challenges and restraints:

Stringent Regulations restrict market growth

Strict government regulations regarding THC content throw a wrench into the growth of the cannabis beverage market. These regulations often impose low dosage limits per serving, aiming to ensure consumer safety. However, this can lead to a double-edged sword. While these limitations safeguard users from overwhelming psychoactive effects, they can also result in products that fail to meet consumer expectations. Consumers seeking a more pronounced effect may feel the drinks are too weak, requiring them to consume multiple servings to achieve the desired outcome. This not only increases costs but also raises concerns about potential overconsumption. Navigating this challenge requires a delicate balance. Industry leaders are pushing for research-backed adjustments to dosage limits, allowing for a wider range of options that cater to both new and experienced consumers. This, coupled with clear labeling and responsible marketing practices, could pave the way for a more sustainable and consumer-friendly cannabis beverage market.

High Production Costs are restricting market growth

High production costs are a thorn in the side of the cannabis beverage market. A significant factor driving these costs is the process of cannabis oil extraction. Extracting high-quality THC or CBD oil requires specialized equipment and expertise, adding a hefty price tag to production. Furthermore, the regulatory landscape adds another layer of complexity. Strict compliance measures, including testing and licensing requirements, can be expensive for manufacturers to navigate. Unfortunately, these high production costs often translate to higher prices for consumers. This can be a major barrier to entry, especially for budget-conscious consumers who might be hesitant to pay a premium for a new product.

The industry is looking for ways to bridge this gap. Streamlining extraction processes and advocating for streamlined regulations could potentially bring down production costs. Additionally, economies of scale as the market matures could lead to more efficient production and potentially lower prices. Ultimately, finding solutions to this cost conundrum is crucial for making cannabis beverages a more accessible and competitive option for consumers.

Market Opportunities:

The Cannabis Beverage Market is brimming with exciting opportunities for future growth. A key opportunity lies in catering to the evolving preferences of health-conscious consumers. Developing functional beverages infused with specific cannabinoids for targeted benefits like pain management, sleep improvement, or stress reduction could unlock a new market segment. This aligns perfectly with the growing demand for natural wellness solutions. Furthermore, innovation in beverage types presents a vast potential. Moving beyond the current dominance of sparkling water and sodas, incorporating cannabis into coffees, teas, sports drinks, or even juice blends could broaden the market's appeal and cater to diverse consumer tastes. Technological advancements in THC or CBD emulsion technology hold promise for creating beverages with a more consistent and faster onset time, addressing a current consumer pain point. Additionally, untapped markets like Asia Pacific offer immense potential for growth as legalization efforts gain traction in the region. Here, educating consumers about the responsible use of cannabis beverages and dispelling social stigma will be crucial for market acceptance. Finally, a collaboration between beverage giants and established cannabis producers can leverage existing distribution networks and marketing expertise to propel the cannabis beverage industry forward. By capitalizing on these opportunities, the Cannabis Beverage Market is poised to become a mainstream force within the beverage industry.

CANNABIS BEVERAGE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.1% |

|

Segments Covered |

By Product Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Canopy Growth Corporation, The Cronos Group, Tilray Brands, Inc., Aurora Cannabis Inc., Heineken NV, Molson Coors Beverage Company, Boston Beer Company, Constellation Brands, PepsiCo, Coca-Cola |

Cannabis Beverage Market Segmentation

Cannabis Beverage Market Segmentation By Product Type:

- Sparkling Water & Sodas

- Coffee & Tea

- Sports Drinks

- Juices & Smoothies

Sparkling water and sodas currently hold the top spot in the Cannabis Beverage Market, accounting for over 60% of the market share. This dominance can be attributed to several factors. They offer a familiar and refreshing format that consumers are already accustomed to, making it an easier transition into cannabis-infused beverages. Additionally, the light and bubbly nature of these drinks can effectively mask the taste of cannabis, which might be unpleasant for some new users. This combination of familiarity and taste-masking properties has propelled sparkling water and sodas to the forefront of the cannabis beverage market, for now. However, as the market matures and consumer preferences evolve, we might see a rise in other beverage categories like coffees, teas, sports drinks, and juices gaining significant traction.

Cannabis Beverage Market Segmentation By Distribution Channels:

- Dispensaries

- Bars & Restaurants

- Grocery Stores & Convenience Stores

- Online Retailers

Dispensaries reign supreme as the dominant distribution channel for cannabis beverages. These established cannabis retailers offer a curated selection, catering to informed consumers who can benefit from the expertise of dispensary staff. This environment allows for personalized recommendations and guidance on product selection, especially considering the diverse options available in the market. However, as regulations loosen and cannabis becomes more mainstream, grocery stores, convenience stores, and even online retailers have the potential to emerge as significant distribution channels, offering wider product accessibility and potentially lower prices for consumers.

Cannabis Beverage Market Segmentation Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America and Asia-Pacific are often powerhouses due to their large and developed economies. Europe boasts high disposable income and a mature market. South America the Middle East and Africa hold significant growth potential, but their dominance can vary by product category.

COVID-19 Impact Analysis on the Global Cannabis Beverages Market

The COVID-19 pandemic's impact on the global cannabis beverages market was a mixed bag. Initial lockdowns disrupted supply chains and limited access to dispensaries, hurting sales. However, some consumers turned to cannabis beverages for stress relief and relaxation during isolation, leading to a short-term boost. E-commerce platforms emerged as a lifeline for many companies, allowing them to reach customers directly. Interestingly, the pandemic also coincided with a rise in interest in health and wellness products, potentially benefiting the cannabis beverage market in the long run as consumers associate these drinks with potential health benefits like anxiety reduction. Overall, the pandemic's impact appears to be short-lived, with the market returning to its pre-pandemic growth trajectory, fueled by increasing legalization, rising consumer awareness, and the growing acceptance of cannabis-infused products.

Latest trends/Developments

The Cannabis Beverage Market is bubbling with innovation as it strives to address consumer preferences and capitalize on emerging trends. A key development is the diversification of product types. Moving beyond the dominance of sparkling water and sodas, manufacturers are brewing up new categories like cannabis-infused coffees and teas, targeting health-conscious consumers seeking a functional and relaxing option. Similarly, sports drinks infused with CBD are emerging to cater to fitness enthusiasts seeking a post-workout recovery beverage with a twist. Technology is also playing a role, with research focusing on methods to improve the consistency and speed of onset for cannabis beverages, addressing a pain point for some consumers. The growing focus on health and wellness is another driving force. Manufacturers are exploring options with specific cannabinoid profiles, targeting potential benefits like pain relief, sleep improvement, and stress reduction. This aligns perfectly with the rise of natural alternatives in the health and wellness space. Sustainability is another area gaining traction. Producers are implementing eco-friendly practices throughout the cannabis beverage lifecycle, from cultivation to packaging, resonating with environmentally conscious consumers. Looking ahead, partnerships between beverage giants and established cannabis producers hold promise for the development of innovative cannabis-infused beverages. By embracing these trends and catering to evolving consumer demands, the Cannabis Beverage Market is poised for continued growth and mainstream acceptance

Key Players:

- Canopy Growth Corporation

- The Cronos Group

- Tilray Brands, Inc.

- Aurora Cannabis Inc.

- Heineken NV

- Molson Coors Beverage Company

- Boston Beer Company

- Constellation Brands

- PepsiCo

- Coca-Cola

Chapter 1. GLOBAL CANNABIS BEVERAGES MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL CANNABIS BEVERAGES MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL CANNABIS BEVERAGES MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL CANNABIS BEVERAGES MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL CANNABIS BEVERAGES MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL CANNABIS BEVERAGES MARKET – By Product Type

6.1. Introduction/Key Findings

6.2. Sparkling Water & Sodas

6.3. Coffee & Tea

6.4. Sports Drinks

6.5. Juices & Smoothies

6.6. Y-O-Y Growth trend Analysis By Product Type

6.7. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. GLOBAL CANNABIS BEVERAGES MARKET – By Distribution Channels

7.1. Introduction/Key Findings

7.2 Dispensaries

7.3. Bars & Restaurants

7.4. Grocery Stores & Convenience Stores

7.5. Online Retailers

7.6. Y-O-Y Growth trend Analysis By Distribution Channels

7.7. Absolute $ Opportunity Analysis By Distribution Channels , 2024-2030

Chapter 8. GLOBAL CANNABIS BEVERAGES MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Distribution Channels

8.1.3. By Product Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Distribution Channels

8.2.3. By Product Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Distribution Channels

8.3.3. By Product Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Distribution Channels

8.4.3. By Product Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Distribution Channels

8.5.3. By Product Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL CANNABIS BEVERAGES MARKET – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

9.1.Canopy Growth Corporation

9.2. The Cronos Group

9.3. Tilray Brands, Inc.

9.4. Aurora Cannabis Inc.

9.5. Heineken NV

9.6. Molson Coors Beverage Company

9.7. Boston Beer Company

9.8. Constellation Brands

9.9. PepsiCo

9.10. Coca-Cola

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Cannabis Beverages Market was valued at USD 43.23 billion in 2023 and will grow at a CAGR of 6.1% from 2024 to 2030. The market is expected to reach USD 65.43 billion by 2030.

Shifting consumer preferences, Health and wellness trends Results are the reasons that are driving the market

Based on product type it is divided into four segments – Sparkling Water & Sodas, Coffee & Tea, Sports Drinks, Juices & Smoothies.

North America is the most dominant region for the Cannabis Beverages Market

Boston Beer Company, Constellation Brands, PepsiCo, Coca-Cola