Bulk Food Ingredients Market Size (2024 – 2030)

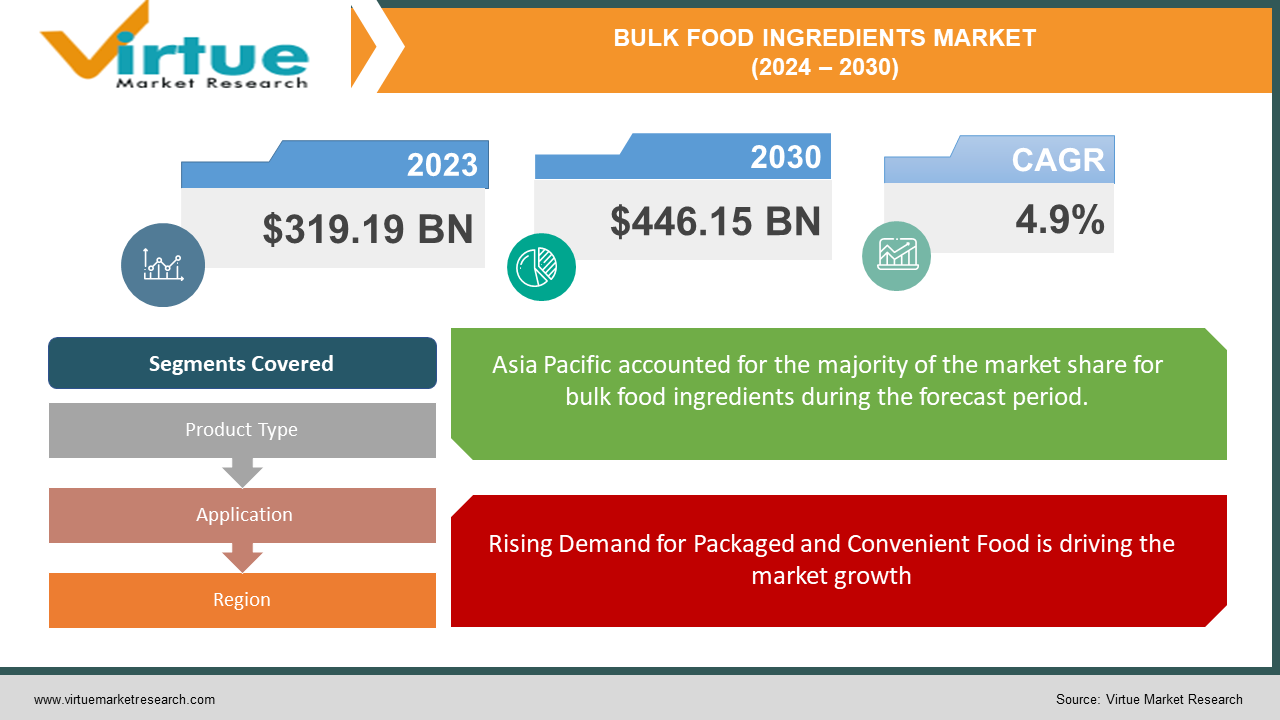

The Global Bulk Food Ingredients Market was valued at USD 319.19 billion in 2023 and will grow at a CAGR of 4.9% from 2024 to 2030. The market is expected to reach USD 446.15 billion by 2030.

Bulk food ingredients are the raw or minimally processed building blocks used in large quantities by manufacturers to create packaged and processed foods. This includes everything from grains, flour, and sugars to nuts, seeds, oils, and spices. These ingredients are often sold loose in large bins or containers at wholesale stores or to food processing companies, allowing for cost-effective production of a wide variety of familiar products like breads, snacks, sweets, and even beverages.

Key Market Insights:

Asia Pacific with a market share of 22.7% is the fastest-growing market, driven by rising disposable income, growing populations, and increasing demand for processed foods.

Stricter quality and safety standards in international markets open doors for bulk ingredients that meet these criteria.

Increasing demand for packaged food in emerging economies creates a vast market for bulk ingredients. Rising demand for packaged and convenient food like confectionery, beverages, and biscuits.

Consumers are increasingly demanding eco-friendly practices throughout the supply chain, prompting bulk ingredient suppliers to prioritize sustainable sourcing, reduced packaging waste, and lower carbon footprints. This has led to a rise in organic and fair-trade certified bulk ingredients.

Global Bulk Food Ingredients Market Drivers:

Rising Demand for Packaged and Convenient Food is driving the market growth

The hectic pace of modern life, characterized by busy schedules and a rise in dual-income households, has fueled a significant surge in the demand for convenient, processed food options. This trend directly translates to a boom in the bulk food ingredients market. Consumers increasingly seek quick and easy meal solutions, driving the popularity of confectionery items, biscuits, beverages, and chocolates. To meet this escalating demand, food manufacturers rely heavily on bulk ingredients like cocoa, sugar, grains, and dairy products. This creates a ripple effect, as the need to produce vast quantities of these convenient foods necessitates a constant supply of bulk ingredients, propelling the growth of the entire bulk food ingredients market.

Expansion of Food Service Chains and Restaurants is driving the market growth

The global restaurant and food service chain explosion is another major force propelling the bulk food ingredient market forward. Picture this: countless restaurants and cafes with menus brimming with diverse options, each requiring a substantial amount of ingredients to operate. From mountains of potatoes for french fries to vats of cooking oil and endless bags of spices, these establishments are major consumers of bulk ingredients. Their constant need to maintain consistent inventory and cater to large-scale food preparation necessitates buying in bulk. This bulk buying behavior creates a ripple effect throughout the supply chain. Wholesalers and distributors are constantly striving to meet the high-volume demands of restaurants, and in turn, rely on bulk ingredient producers to maintain a steady flow of essential food components. This ever-increasing demand from the booming food service sector translates to a flourishing bulk food ingredient market, ensuring a constant stream of essential ingredients to keep our favorite restaurants humming.

Growing Consumer Preference for Natural and Organic Ingredients is driving the market growth

The tide is turning towards natural and organic ingredients, significantly impacting the bulk food ingredient market. Today's health-conscious consumers are more informed than ever, actively seeking out natural products and expressing concern about artificial additives and genetically modified organisms (GMOs). This shift in preference translates to a growing demand for organic, non-GMO bulk ingredients. Food manufacturers are taking notice, reformulating products, and highlighting the use of natural components on packaging. This has created a ripple effect throughout the supply chain, pushing bulk ingredient suppliers to prioritize sourcing organic and natural options. The growing demand for these premium ingredients presents a lucrative opportunity for suppliers who can meet the evolving needs of health-conscious consumers and environmentally responsible manufacturers. As a result, the bulk food ingredient market is experiencing a surge in the organic and natural segment, catering to the growing desire for wholesome, unadulterated food.

Global Bulk Food Ingredients Market challenges and restraints:

Volatile Price Fluctuations is restricting the market growth

The prices of ingredients like sugar and starch can swing wildly, affecting how much it costs for companies to make our favorite foods. Imagine a bakery reliant on sugar for its cookies. If the price of sugar suddenly spikes due to a bad harvest or high global demand, the bakery's production costs soar. To keep their business afloat, they might have to raise the price of cookies for you, the consumer. This domino effect of rising raw material costs can be felt all the way at the checkout line, potentially leading to higher grocery bills.

Improper Storage and Infrastructure is restricting the market growth

Imagine a farmer in India who harvests a bumper crop of grains. However, due to poor storage facilities, a significant portion of the harvest rots before it reaches the market. This not only represents a loss of income for the farmer but also reduces the overall supply of bulk ingredients. The scarcity drives prices up, creating a ripple effect throughout the supply chain. With fewer grains available, companies may have to ration their ingredients or resort to more expensive alternatives. This can lead to production slowdowns or even shortages of certain food products. Ultimately, inadequate infrastructure in developing countries contributes to food waste, disrupts the smooth flow of bulk ingredients, and potentially pushes food prices higher for consumers worldwide.

Market Opportunities:

The bulk food ingredient market presents exciting opportunities for companies that can address consumer trends and adapt to a changing landscape. The rising interest in health and wellness creates a gap between organic and functional bulk ingredients. Moreover, the growing demand for convenience fosters opportunities for pre-washed, chopped, and packaged ingredients that save time in the kitchen. Additionally, with sustainability gaining traction, companies that focus on eco-friendly packaging and minimize food waste throughout the supply chain will be well-positioned. Furthermore, the booming e-commerce sector opens doors for online retailers to tap into the bulk ingredient market, offering convenience and potentially lower prices to a wider customer base. Finally, emerging economies present a vast potential for market expansion. By investing in infrastructure development and cold chain logistics in these regions, companies can ensure better storage, reduce spoilage, and cater to the growing demand for processed and packaged food. By capitalizing on these trends and adapting to the evolving needs of the market, businesses in the bulk food ingredient sector can unlock significant growth potential.

BULK FOOD INGREDIENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.9% |

|

Segments Covered |

By Product Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Archer Daniels Midland Company, Bunge Limited, Cargill Incorporated, Ingredion Incorporated, Louis Dreyfus Company, ADM Milling, Ajinomoto Co., Inc., Ingredion Inc., Roquette Frères, Tate & Lyle PLC |

Bulk Food Ingredients Market Segmentation - By Product Type

-

Grains, Pulses, and Cereals

-

Tea, Coffee, and Cocoa

-

Herbs and Spices

-

Oilseeds

-

Sugar and Sweeteners

-

Edible Oils

Grains, Pulses, and Cereals stand out as the most dominant segment. This is driven by several factors. Firstly, these ingredients form the base of numerous food products, including bread, pasta, breakfast cereals, and countless snacks. Their versatility and affordability make them a staple across the globe. Secondly, with the rising global population, the demand for staple foods like rice and wheat is expected to keep growing steadily. Finally, the increasing focus on health and wellness is driving a surge in demand for whole grains and ancient grains like quinoa and oats, further solidifying the dominant position of Grains, Pulses, and Cereals within the bulk food ingredient market.

Bulk Food Ingredients Market Segmentation - By Application

-

Bakery and Confectionery

-

Snacks and Spreads

-

Ready Meals

Bakery & Confectionery has a strong case for the top spot. This segment utilizes a vast array of bulk ingredients, from grains (flour) and sugars to cocoa, nuts, and dairy products. The sheer variety of baked goods produced, from breads and pastries to cookies and cakes, fuels a constant demand for these ingredients. Additionally, the global indulgence trend keeps the demand for sweet treats high. While Snacks & Spreads and Ready Meals represent significant sectors, Bakery & Confectionery's breadth of products and enduring popularity make it a powerful driver of the bulk food ingredient market.

Bulk Food Ingredients Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

While currently the largest market, North America faces strong competition from the fastest-growing region, Asia-Pacific. This dominance is shifting due to several factors in Asia-Pacific. The region boasts a large and rapidly growing population with rising disposable incomes. This translates to a surge in demand for convenience foods and a booming food processing industry, both of which rely heavily on bulk food ingredients. Additionally, changing consumer preferences towards healthier options opens doors for functional and organic ingredients in this region. These combined forces are propelling the Asia-Pacific market to become the dominant leader in the global bulk food ingredients landscape.

COVID-19 Impact Analysis on the Global Bulk Food Ingredients Market

The COVID-19 pandemic delivered a complex blow to the global bulk food ingredients market. Initial lockdowns caused significant disruptions in the supply chain. Trade barriers, limited transportation options, and restricted movement of labor hindered the smooth flow of raw materials, leading to price hikes for bulk ingredients. Additionally, the closure of restaurants and food service outlets caused a sudden drop in demand for large quantities of ingredients. However, this initial shockwave wasn't entirely negative. The shift in consumer behavior towards home cooking during lockdowns led to a surge in demand for retail packaged foods like flour, sugar, and baking ingredients. This unexpected surge put pressure on manufacturers to ramp up production, requiring a consistent supply of bulk ingredients. This, in turn, benefited bulk ingredient suppliers who could adapt to the changing landscape. As the pandemic progressed, the market witnessed a gradual recovery as restaurants reopened and supply chains adapted to the "new normal." The long-term impact of COVID-19 on the bulk food ingredient market remains to be seen, but it has undoubtedly accelerated the trend towards e-commerce for bulk ingredients and highlighted the need for a more resilient and adaptable global supply chain.

Latest trends/Developments

The bulk food ingredient market is constantly evolving, with several exciting trends emerging. One key trend is the growing focus on sustainability. Consumers are increasingly demanding eco-friendly practices throughout the supply chain, prompting bulk ingredient suppliers to prioritize sustainable sourcing, reduced packaging waste, and lower carbon footprints. This has led to a rise in organic and fair-trade certified bulk ingredients. Additionally, e-commerce is playing a more prominent role. Online marketplaces are making it easier for restaurants, manufacturers, and even home cooks to access a wider variety of bulk ingredients at competitive prices. This trend is expected to continue, driven by the convenience and efficiency of online purchasing. Furthermore, innovation in ingredient functionality is gaining traction. Food scientists are developing new bulk ingredients with enhanced properties, such as extended shelf life, improved nutritional profiles, and unique textures. This focus on innovation caters to the evolving needs of food manufacturers seeking to differentiate their products in an ever-competitive market. These trends, along with the ongoing influence of health and wellness concerns, paint a vibrant picture of the future of the bulk food ingredient market.

Key Players:

-

Archer Daniels Midland Company

-

Bunge Limited

-

Cargill Incorporated

-

Ingredion Incorporated

-

Louis Dreyfus Company

-

ADM Milling

-

Ajinomoto Co., Inc.

-

Ingredion Inc.

-

Roquette Frères

-

Tate & Lyle PLC

Chapter 1. Bulk Food Ingredients Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Bulk Food Ingredients Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Bulk Food Ingredients Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Bulk Food Ingredients Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Bulk Food Ingredients Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Bulk Food Ingredients Market – By Product Type

6.1 Introduction/Key Findings

6.2 Grains, Pulses, and Cereals

6.3 Tea, Coffee, and Cocoa

6.4 Herbs and Spices

6.5 Oilseeds

6.6 Sugar and Sweeteners

6.7 Edible Oils

6.8 Y-O-Y Growth trend Analysis By Product Type

6.9 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Bulk Food Ingredients Market – By Application

7.1 Introduction/Key Findings

7.2 Bakery and Confectionery

7.3 Snacks and Spreads

7.4 Ready Meals

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Bulk Food Ingredients Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Bulk Food Ingredients Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Archer Daniels Midland Company

9.2 Bunge Limited

9.3 Cargill Incorporated

9.4 Ingredion Incorporated

9.5 Louis Dreyfus Company

9.6 ADM Milling

9.7 Ajinomoto Co., Inc.

9.8 Ingredion Inc.

9.9 Roquette Frères

9.10 Tate & Lyle PLC

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Bulk Food Ingredients Market was valued at USD 319.19 billion in 2023 and will grow at a CAGR of 4.9% from 2024 to 2030. The market is expected to reach USD 446.15 billion by 2030.

Rising Demand for Packaged and Convenient Food and Growing Consumer Preference for Natural and Organic Ingredients These are the reasons which are driving the market.

Based on Application it is divided into three segments – Bakery and Confectionery, Snacks and Spreads, Ready Meals

North America is the most dominant region for the Bulk Food Ingredients Market.

Ajinomoto Co., Inc., Ingredion Inc., Roquette Frères, Tate & Lyle PLC