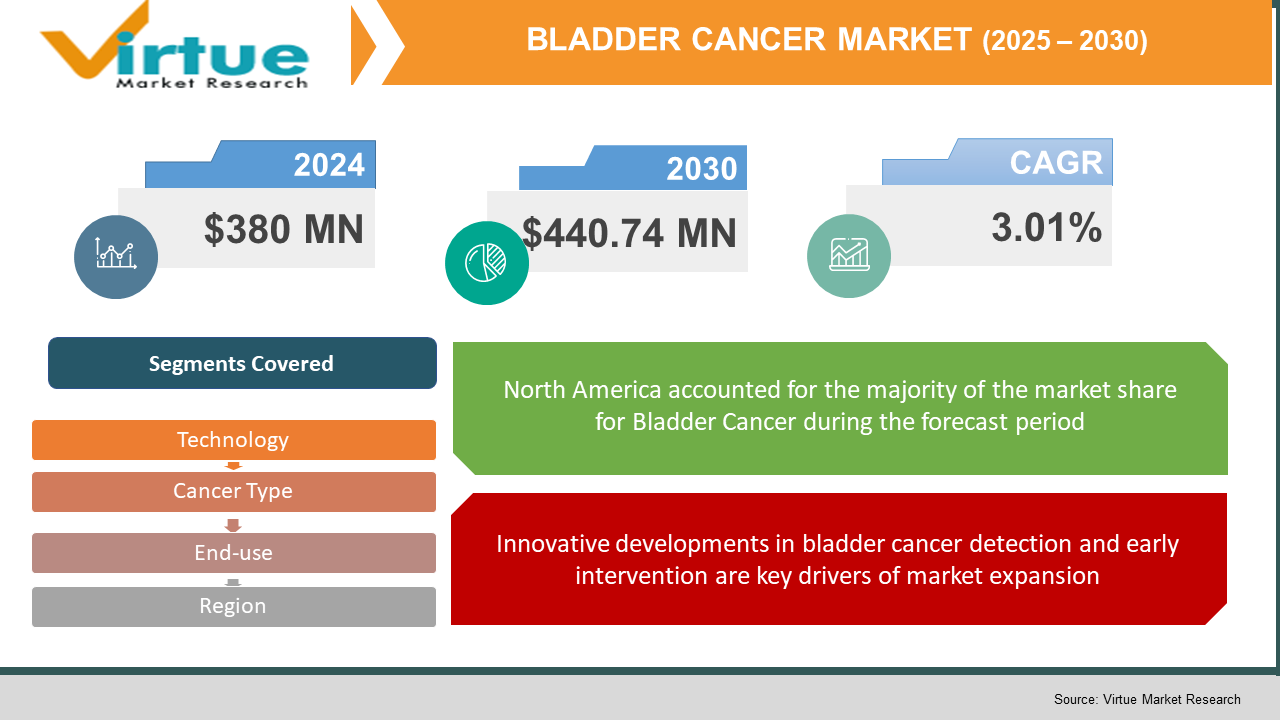

Bladder Cancer Market Size (2025-2030)

The Bladder Cancer Market was valued at USD 380 million in 2024. Over the forecast period of 2025-2030 it is projected to reach USD 440.74 million by 2030, growing at a CAGR of 3.01%.

The diagnostic process for this condition generally involves evaluating the patient’s medical history, conducting a physical examination, and performing a series of laboratory tests. During this procedure, a biopsy may be conducted to obtain tissue samples for further pathological analysis. Additional diagnostic methods may include urine tests to detect the presence of cancer cells or blood, as well as imaging techniques such as CT scans or MRIs to assess the bladder and nearby structures. Further biopsies might be required to accurately determine the cancer’s stage and grade.

Key Market Insights:

These technologies play a vital role in enhancing diagnostic accuracy and improving patient outcomes. MRI and CT imaging are especially important in cancer staging and in evaluating treatment effectiveness through detailed anatomical visualization.

Furthermore, the integration of ultrasound with AI-powered diagnostic tools is accelerating, as machine learning algorithms enable more efficient and precise analysis of imaging data. The shift toward AI-enhanced diagnostics is largely fueled by the demand for faster detection of conditions such as squamous cell bladder cancer and the need for personalized treatment strategies. AI assists radiologists in identifying malignancies that may be overlooked through conventional methods, thus supporting more accurate and timely diagnosis.

Bladder Cancer Market Drivers:

Innovative developments in bladder cancer detection and early intervention are key drivers of market expansion.

Next-generation sequencing (NGS) and cutting-edge imaging technologies are revolutionizing the diagnostic landscape for bladder cancer. NGS enables the development of treatment strategies tailored to an individual’s genetic profile, enhancing therapeutic outcomes and improving survival rates. On the imaging front, technological advancements such as white light cystoscopy (WLC) and fluorescence cystoscopy (FC) have significantly improved the ability to detect bladder abnormalities, enabling more precise diagnoses and facilitating timely intervention. These minimally invasive techniques contribute to the early identification of precancerous changes and reduce reliance on more invasive surgical approaches. Furthermore, public education initiatives and increased media exposure have resulted in greater awareness of bladder cancer risk factors, early symptoms, and the importance of prompt medical evaluation. Rising healthcare spending, combined with improved public understanding of the disease, is contributing to earlier detection and an increase in the number of patients seeking timely treatment.

Bladder Cancer Market Restraints and Challenges:

Elevated costs act as a significant barrier to market growth.

Adherence to rigorous standards, such as those outlined in the In Vitro Diagnostic Regulation (IVDR), directly affects product development cycles, market access, and approval procedures. While these regulations are essential for ensuring diagnostic reliability and patient safety, they often lead to increased operational costs for manufacturers. For companies operating in the global bladder cancer diagnostics space, staying aligned with evolving regulatory frameworks is essential to sustaining competitiveness and fostering continued innovation.

Bladder Cancer Market Opportunities:

Artificial intelligence (AI) and machine learning technologies present substantial opportunities to transform the management of non-muscle invasive bladder cancer (NMIBC). These tools enhance image interpretation, facilitate the identification of high-risk patients, and support more informed clinical decision-making. Additionally, AI-driven software can improve the precision of surgical interventions by integrating imaging data—such as that obtained from blue light cystoscopy—with patient medical records and pathology assessments. This integration enables more accurate outcome predictions and the development of personalized treatment strategies.

BLADDER CANCER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

3.01% |

|

Segments Covered |

By cancer Type, technology, end user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Abbott, Danaher Corporation and Nucleix. |

Bladder Cancer Market Segmentation:

Bladder Cancer Market Segmentation By Technology:

- Cystoscopy

- Urinalysis

- Ultrasound

- Others

Cystoscopy generated the highest revenue share in the bladder cancer diagnostics market. As a critical diagnostic tool, cystoscopy enables direct visualization of the bladder, making it essential for early detection and ongoing monitoring of bladder cancer. Its integration with complementary diagnostic methods has further improved its utility, contributing to overall market growth. The adoption of cystoscopy is expected to continue rising, driven by the increasing incidence of bladder cancer and the emphasis on early diagnosis and surveillance. Notably, the European Association of Urology (EAU) Clinical Guidelines recognize cystoscopy as a fundamental diagnostic method for bladder cancer evaluation.

Meanwhile, the "Other" segment is projected to experience the fastest growth during the forecast period. This category encompasses MRI, CT scans, AI-based diagnostics, and emerging technologies, all of which are contributing to significant advancements in the diagnostic landscape.

Bladder Cancer Market Segmentation By Cancer Type:

- Squamous Cell Bladder Cancer

- Transitional Cell Bladder Cancer

- Others

The transitional cell bladder cancer (TCBC) segment held the largest share of the European bladder cancer diagnostics market. Accounting for over 90% of bladder cancer cases in the region, TCBC’s dominance underscores the need for advanced diagnostic tools to facilitate early detection and improve clinical outcomes. Market growth in this segment is driven by a strong focus on integrated diagnostic strategies, including cystoscopy, molecular testing, and imaging techniques—each vital for accurate diagnosis and staging of TCBC. This comprehensive approach is particularly important given the high prevalence of the disease and the necessity for optimized patient management across Europe. According to Cancer Research UK, approximately 90% of bladder cancers in the UK are classified as urothelial (transitional cell) cancers. Diagnostic accuracy is enhanced through a combination of cystoscopy, urine cytology, urinalysis, imaging modalities, and biopsy—all contributing to effective detection, staging, and treatment planning for TCBC.

In contrast, the squamous cell carcinoma (SCC) segment is projected to witness more rapid growth. Developments in molecular biology are opening new avenues for early detection, with biomarkers such as Psoriasin and Galectin-3 showing promise when used alongside cystoscopic techniques. In regions where SCC is more prevalent due to schistosomiasis, public health interventions—including anti-bilharzia therapies—have helped reduce incidence rates. However, ongoing surveillance and early intervention remain critical for managing this aggressive cancer type. Innovations in prevention and molecular diagnostics, such as annual screenings and targeted cystoscopy, are contributing to market expansion. Technologies aimed at monitoring chronic infections and identifying early-stage SCC cases are further accelerating demand and supporting market growth in this segment.

Bladder Cancer Market Segmentation By End-use:

- Hospital Settings

- Non-Hospital Settings

The hospital settings segment dominated the bladder cancer diagnostics market. Hospitals play a crucial role in the diagnosis and management of squamous cell bladder cancer and other bladder cancer types, offering advantages over non-hospital environments such as clinics. These facilities are equipped with advanced diagnostic technologies, including cystoscopy, urine laboratory tests, and imaging modalities, which are vital for accurate diagnosis and effective treatment of bladder cancer. The increasing prevalence of bladder cancer in Europe has driven demand for these sophisticated diagnostic services within hospital settings. Enhancements in ultrasound technology and the development of more sensitive diagnostic assays have facilitated earlier detection and improved disease monitoring.

A significant factor fueling the rising demand for bladder cancer diagnostics in hospitals is the low level of public awareness about the disease. According to a European Association of Urology (EAU) survey conducted in September 2022, 60% of adults are unaware of the severity of bladder cancer, and many fail to recognize key symptoms such as changes in urine color. This knowledge gap underscores the importance of intensified public education and early detection initiatives, which may encourage more individuals to seek diagnostic evaluations. As awareness campaigns successfully increase public understanding, hospital settings are expected to see a rise in diagnostic procedures, further expanding the market.

Meanwhile, the non-hospital settings segment is anticipated to experience faster growth. Facilities such as specialty clinics, ambulatory surgical centers, and cancer treatment centers are gaining prominence by providing specialized bladder cancer diagnostic services outside traditional hospital environments. These centers utilize advanced diagnostic tools like ultrasound and urine cytology to support early detection and continuous monitoring. This trend reflects a broader shift toward patient-centered care, emphasizing minimally invasive techniques and cost-efficient healthcare delivery.

Bladder Cancer Market Segmentation- by region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

North America has established itself as the leading region in the global bladder cancer market and is projected to sustain this dominance throughout the forecast period. This region represents one of the world’s largest healthcare markets, characterized by a substantial patient population and significant healthcare expenditure. It is home to numerous pharmaceutical and biotechnology companies, academic institutions, and research organizations with a strong focus on oncology research. The region’s considerable investment in research and development facilitates a continuous introduction of innovative drugs and medical devices, expanding treatment options for bladder cancer patients.

The supply chain for cancer vaccines and therapeutics also plays a critical role in influencing the profitability of major pharmaceutical companies operating in North America. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) contribute significantly by streamlining the approval process for bladder cancer therapies, thereby encouraging pharmaceutical firms to intensify their research and development efforts. This regulatory support further solidifies North America’s leadership in the bladder cancer market.

High demand for bladder cancer treatments and diagnostic services within the region drives ongoing investment in product development, marketing, and distribution, reinforcing North America’s strong position in the global market. Additionally, import-export regulations influence the economic viability of manufacturing and distributing these essential therapies. By prioritizing prevention and early detection initiatives, North America effectively mitigates the burden of bladder cancer and advances public health outcomes.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic had a notable impact on the growth of the bladder cancer market. A study published in June 2022, titled “The Impact of the COVID-19 Pandemic on Bladder Cancer Care in the Netherlands,” reported a 14% decline in bladder cancer diagnoses during the first wave of the pandemic. However, diagnosis rates returned to pre-pandemic levels by the end of 2020, reaching approximately 600 diagnoses per month. Treatment modifications were minimal and aligned with updated clinical guidelines. Importantly, surgical volumes were maintained during the initial wave. Overall, the effect of the COVID-19 outbreak on bladder cancer care in the Netherlands was comparatively less disruptive than the impact observed for other solid tumors both within the country and internationally.

Latest Trends/ Developments:

In April 2024, ImmunityBio, Inc. announced that the U.S. Food and Drug Administration (FDA) granted approval for ANKTIVA in combination with Bacillus Calmette-Guérin (BCG) for the treatment of patients with BCG-unresponsive non-muscle invasive bladder cancer (NMIBC) featuring carcinoma in situ (CIS), with or without accompanying papillary tumors.

During the same month, Protara Therapeutics, Inc. disclosed positive outcomes from a three-month evaluation of CIS patients treated with TARA-002, an investigational cell-based therapy targeting high-risk NMIBC. This study included patient groups categorized as BCG-unresponsive, BCG-experienced, and BCG-naive.

Key Players:

These are top 10 players in the Bladder Cancer Market :-

Chapter 1. Bladder Cancer Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Bladder Cancer Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Bladder Cancer Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Packaging TECHNOLOGY Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Bladder Cancer Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. Bladder Cancer Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Bladder Cancer Market – By Technology

6.1 Introduction/Key Findings

6.2 Cystoscopy

6.3 Urinalysis

6.4 Ultrasound

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Technology

6.7 Absolute $ Opportunity Analysis By Technology , 2025-2030

Chapter 7. Bladder Cancer Market – By End-User

7.1 Introduction/Key Findings

7.2 Hospital Settings

7.3 Non-Hospital Settings

7.4 Y-O-Y Growth trend Analysis By End-User

7.5 Absolute $ Opportunity Analysis By End-User , 2025-2030

Chapter 8. Bladder Cancer Market – By Cancer Type

8.1 Introduction/Key Findings

8.2 Squamous Cell Bladder Cancer

8.3 Transitional Cell Bladder Cancer

8.4 Others

8.5 Y-O-Y Growth trend Analysis Cancer Type

8.6 Absolute $ Opportunity Analysis Cancer Type , 2025-2030

Chapter 9. Bladder Cancer Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Technology

9.1.3. By Cancer Type

9.1.4. By End-User

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Technology

9.2.3. By Cancer Type

9.2.4. By End-User

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Technology

9.3.3. By Cancer Type

9.3.4. By End-User

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By Cancer Type

9.4.3. By End-User

9.4.4. By Technology

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By Cancer Type

9.5.3. By Technology

9.5.4. By End-User

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Bladder Cancer Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Abbott

10.2 Danaher Corporation

10.3 Nucleix

10.4 Polymedco, LLC.

10.5 Pacific Edge

10.6 KARL STORZ

10.7 Micromedic Technologies

10.8 AroCell (IDL Biotech)

10.9 Vesica Health

10.10 Sysmex Corporation

Download Sample

Choose License Type

2500

4250

5250

6900