Battery Energy Storage Market Size (2024 – 2030)

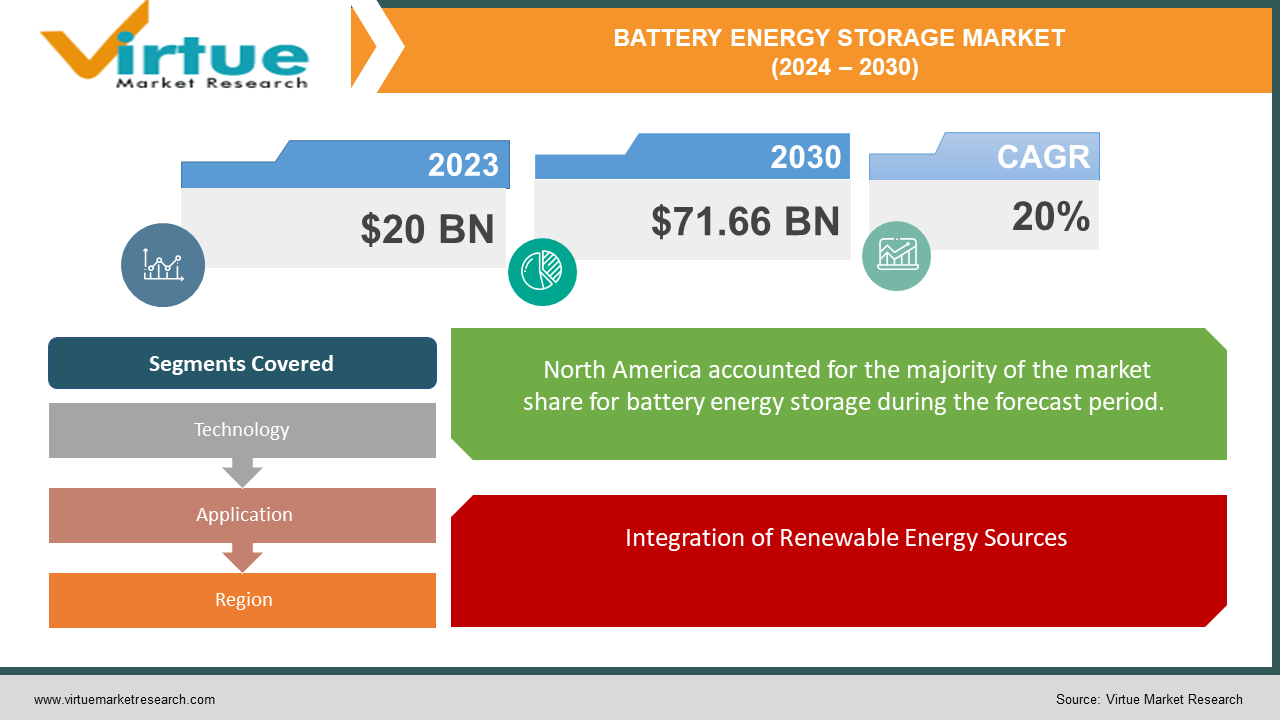

The Global Battery Energy Storage Market was valued at USD 20 billion in 2023 and is projected to reach a market size of USD 71.66 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 20% between 2024 and 2030.

The global battery energy storage market is witnessing robust growth fueled by a confluence of factors reshaping the energy landscape worldwide. As societies increasingly pivot towards renewable energy sources like solar and wind power, battery energy storage systems (BESS) have emerged as crucial enablers of reliability, stability, and efficiency in electricity grids. These systems store excess energy generated during peak production periods for use during high demand periods or when renewable sources are not producing electricity, thereby mitigating intermittency issues inherent in renewables. Technological advancements, particularly in lithium-ion batteries, have significantly bolstered the market, enhancing energy storage capacity, efficiency, and durability while driving down costs. Government policies promoting clean energy and decarbonization goals further stimulate market expansion, encouraging investments in large-scale utility projects as well as decentralized residential and commercial installations. Moreover, the increasing deployment of electric vehicles (EVs) is creating synergies by repurposing EV batteries for grid storage, adding another dimension to the market's growth trajectory. With ongoing innovation and strategic partnerships among industry leaders, the battery energy storage market is poised to play a pivotal role in the global transition towards a sustainable and resilient energy future.

Key Market Insights:

Grid-connected battery storage systems accounted for approximately 65% of total investments in 2022, driven by the need for grid flexibility and energy security.

The electric vehicle (EV) market's rapid expansion, with over 25% growth in sales observed in 2023 alone, is boosting demand for battery storage solutions.

Battery storage plays a crucial role in integrating renewable energy sources like solar and wind power by storing excess energy for use during peak demand periods.

While Lithium-ion batteries currently dominate the market with over 80% share, research is focusing on alternative technologies such as Sodium-ion batteries to enhance the cost-effectiveness and availability of raw materials.

Integrating battery storage with renewable energy sources can reduce greenhouse gas emissions by up to 20%, contributing significantly to environmental sustainability.

Battery Energy Storage Market Drivers:

Integration of Renewable Energy Sources

The battery energy storage market is being propelled by the increasing integration of renewable energy sources. As the global shift towards renewable energy intensifies, there is a critical need for efficient energy storage solutions to manage the variability and intermittency of renewable sources like solar and wind. Battery energy storage systems (BESS) play a crucial role in capturing excess energy during peak production periods and releasing it during times of high demand or low production, thereby ensuring a consistent and reliable power supply. This integration is essential for the broader adoption of renewables and for meeting global carbon reduction targets.

Grid Stabilization and Resilience

The necessity for enhanced grid stability and resilience is driving the adoption of battery energy storage. Modern grids face challenges from aging infrastructure, increasing energy demand, and the growing occurrence of extreme weather events. BESS can provide rapid response times to fluctuations in energy supply and demand, prevent outages, and support the grid during emergencies. They offer a flexible and scalable solution to maintain grid stability, support peak load management, and provide ancillary services such as frequency regulation. These capabilities are increasingly vital as grids modernize and transition towards more decentralized and renewable energy systems, making BESS a critical component in the future of energy infrastructure.

Battery Energy Storage Market Restraints and Challenges:

The battery energy storage market faces significant restraints and challenges, notably high initial costs and technical limitations. The capital expenditure required for advanced battery technologies, such as lithium-ion systems, remains substantial despite recent cost reductions. This includes expenses for installation, integration with existing grid infrastructure, and supportive technologies like inverters and control systems. Such high upfront costs can deter utilities and businesses from investing in battery energy storage systems (BESS), especially when compared to traditional energy solutions. Moreover, the financial viability of BESS often hinges on government incentives and subsidies, which can be inconsistent and vary by region, particularly affecting adoption in developing markets. Technical challenges further complicate market growth, with battery degradation over time leading to reduced efficiency and storage capacity, thus increasing maintenance costs and necessitating more frequent replacements. Integration with existing grids poses compatibility issues and requires advanced management systems to ensure optimal performance and safety. Additionally, the limited availability of raw materials such as lithium and cobalt can cause supply chain vulnerabilities and price volatility. Addressing these challenges demands ongoing research, technological advancements, innovative financing models, and supportive policy frameworks to enhance the feasibility and adoption of battery energy storage systems.

Battery Energy Storage Market Opportunities:

The battery energy storage market is ripe with opportunities driven by the increasing demand for renewable energy integration, advancements in battery technology, and the rising need for grid stability and resilience. As the global energy landscape shifts towards more sustainable sources like solar and wind, the role of battery energy storage systems (BESS) becomes crucial in managing the intermittent nature of these renewables. This creates a significant opportunity for BESS to enhance energy reliability and efficiency. Technological advancements, such as the development of more cost-effective and higher-capacity batteries, are opening new avenues for both utility-scale and residential applications. Additionally, the growing emphasis on smart grids and the integration of Internet of Things (IoT) technologies provide opportunities for more sophisticated energy management systems, allowing for better demand response and peak shaving. Moreover, government policies and incentives aimed at reducing carbon footprints and promoting clean energy adoption are accelerating the deployment of BESS. Emerging markets, particularly in regions with limited grid infrastructure, also present substantial growth potential as they leapfrog traditional energy systems in favor of modern, decentralized solutions. Collectively, these factors position the battery energy storage market for robust expansion, driven by the need for cleaner, more reliable, and more efficient energy systems.

BATTERY ENERGY STORAGE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

20% |

|

Segments Covered |

By Technology, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Siemens AG, ABB Ltd., Fluence Energy, Inc., Eaton Corporation, Enel X, AES Corporation, NEC Energy Solutions, Saft Groupe S.A. (a subsidiary of TotalEnergies), Hitachi ABB Power Grids, Varta AG, Kokam Co., Ltd. |

Battery Energy Storage Market Segmentation: By Technology

-

Lithium-ion Batteries (Li-ion)

-

Lead-Acid Batteries

-

Sodium-ion Batteries (Na-ion)

The Global Battery Energy Storage Market by Technology, Lithium-ion Batteries (Li-ion) had the largest market share last year and is poised to maintain its dominance throughout the forecast period. Li-ion battery prices have significantly dropped in recent years due to advancements in technology and manufacturing, making them a more economical option compared to other battery types. These advancements have not only reduced costs but also enhanced the performance and reliability of Li-ion batteries. A key advantage of Li-ion technology is its high energy density, which allows these batteries to store more energy per unit weight and volume compared to alternatives like lead-acid batteries. This high energy density is crucial for developing compact and powerful battery storage systems, meeting the growing demand for efficient energy solutions. Furthermore, Li-ion batteries exhibit remarkable versatility, finding applications across a wide spectrum, from grid-scale energy storage to residential solar power systems. This broad range of applicability strengthens their market position, enabling integration into various sectors and contributing to the global shift towards renewable energy. Consequently, the combination of reduced costs, high energy density, and versatility makes Li-ion batteries a leading choice in the energy storage market, driving innovations and supporting sustainable energy initiatives worldwide.

Battery Energy Storage Market Segmentation: By Application

-

Grid-Connected Systems

-

Behind-the-Meter Systems

-

Front-of-the-Meter Systems

-

Microgrids

The Global Battery Energy Storage Market by Application, Grid-Connected Systems had the largest market share last year and is poised to maintain its dominance throughout the forecast period. Grid-connected systems play a pivotal role in the integration of renewable energy sources such as solar and wind into the electricity grid. These renewable sources are inherently variable, producing energy inconsistently due to fluctuating environmental conditions. Batteries in grid-connected systems can store excess energy generated during peak production times and release it back into the grid when demand surges, thus maintaining grid stability and reliability. This capability is essential for balancing supply and demand, ensuring a consistent power supply. Additionally, grid-connected systems facilitate peak shaving and demand charge reduction by discharging stored energy during high-demand periods, alleviating grid strain, and lowering electricity costs for both consumers and utilities, as utilities typically impose higher rates during peak hours. Beyond economic benefits, these systems enhance energy security by providing backup power during outages, thereby improving overall grid resilience. They offer additional security against power fluctuations and blackouts, ensuring a reliable electricity supply even in adverse conditions. Thus, the integration of grid-connected systems is crucial for maximizing the benefits of renewable energy, optimizing grid performance, and enhancing energy security.

Battery Energy Storage Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The Global Battery Energy Storage Market by Region, North America had the largest market share last year and is poised to maintain its dominance throughout the forecast period. North America is a significant player in the rapidly growing battery storage market, with a projected Compound Annual Growth Rate (CAGR) ranging between 16.1% and 31.28%, indicating a promising future. The region benefits from favorable conditions such as increasing integration of renewable energy, government support for clean energy initiatives, and declining Li-ion battery costs, which collectively drive market growth. However, North America's dominance in the global market is uncertain due to formidable competition from other regions. The Asia Pacific region, particularly China, is a major competitor, holding a significant share of the global battery manufacturing industry, thus influencing market dynamics. Additionally, Europe is experiencing substantial growth in battery storage driven by ambitious renewable energy targets and supportive policies. While North America leads in growth potential, claiming absolute dominance throughout the entire forecast period may be overstated. The global market will likely see intense competition from Asia and Europe, with each region leveraging its strengths and growth drivers. The specific timeframe of the forecast period, along with future advancements and policy changes, will further impact regional market shares. In conclusion, North America is a strong contender in the Global Battery Energy Storage Market, but its absolute dominance remains debatable.

COVID-19 Impact Analysis on the Battery Energy Storage Market.

The COVID-19 pandemic has had a multifaceted impact on the battery energy storage market, presenting both challenges and opportunities. Initially, the pandemic disrupted global supply chains, leading to delays in the production and deployment of battery energy storage systems (BESS). Restrictions on manufacturing activities, logistical hurdles, and shortages of key raw materials like lithium and cobalt exacerbated these delays, impacting project timelines and increasing costs. However, the pandemic also underscored the importance of resilient energy infrastructure, as lockdowns and shifts in energy consumption patterns highlighted the need for reliable and flexible energy systems. This realization has accelerated interest in BESS as a solution for enhancing grid stability and supporting renewable energy integration. Moreover, governments and private sector players have increasingly recognized the strategic value of energy storage in ensuring energy security and advancing sustainability goals. Stimulus packages and recovery plans in several countries have included significant investments in clean energy technologies, including battery storage, to foster economic recovery and drive long-term decarbonization efforts.

Latest trends / Developments:

The battery energy storage market is experiencing rapid growth driven by technological advancements and increasing demand for renewable energy integration. Key trends include the development of higher capacity and more efficient lithium-ion batteries, as well as the emergence of alternative chemistries such as solid-state and flow batteries. These innovations are enhancing storage duration, safety, and lifecycle, making energy storage more viable for large-scale grid applications. Additionally, declining costs of battery systems are accelerating their adoption in both utility-scale and residential projects. Governments and private sectors are investing heavily in storage infrastructure to support grid stability and renewable energy goals. Moreover, advancements in software and energy management systems are optimizing battery performance and enabling more sophisticated applications, such as demand response and microgrids. Strategic partnerships and acquisitions are also shaping the market, with major companies seeking to expand their capabilities and market presence. Overall, the battery energy storage market is poised for significant expansion, driven by technological progress, cost reductions, and the increasing necessity for reliable and sustainable energy solutions.

Key Players:

-

Siemens AG

-

ABB Ltd.

-

Fluence Energy, Inc.

-

Eaton Corporation

-

Enel X

-

AES Corporation

-

NEC Energy Solutions

-

Saft Groupe S.A. (a subsidiary of TotalEnergies)

-

Hitachi ABB Power Grids

-

Varta AG

-

Kokam Co., Ltd.

Chapter 1. Battery Energy Storage Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Battery Energy Storage Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Battery Energy Storage Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Battery Energy Storage Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Battery Energy Storage Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Battery Energy Storage Market – By Technology

6.1 Introduction/Key Findings

6.2 Lithium-ion Batteries (Li-ion)

6.3 Lead-Acid Batteries

6.4 Sodium-ion Batteries (Na-ion)

6.5 Y-O-Y Growth trend Analysis By Technology

6.6 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 7. Battery Energy Storage Market – By Application

7.1 Introduction/Key Findings

7.2 Grid-Connected Systems

7.3 Behind-the-Meter Systems

7.4 Front-of-the-Meter Systems

7.5 Microgrids

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Battery Energy Storage Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Technology

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Technology

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Technology

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Technology

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Technology

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Battery Energy Storage Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Siemens AG

9.2 ABB Ltd.

9.3 Fluence Energy, Inc.

9.4 Eaton Corporation

9.5 Enel X

9.6 AES Corporation

9.7 NEC Energy Solutions

9.8 Saft Groupe S.A. (a subsidiary of TotalEnergies)

9.9 Hitachi ABB Power Grids

9.10 Varta AG

9.11 Kokam Co., Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the Global Battery Energy Storage market is expected to be valued at USD 20 billion.

Through 2030, the Global Battery Energy Storage market is expected to grow at a CAGR of 20 %.

By 2030, Global Battery Energy Storage is expected to grow to a value of USD 71.66 billion.

North America is predicted to lead the Global Battery Energy Storage market.

The Global Battery Energy Storage Market has segments By Application, Technology, and Region.