Electrical Energy Storage Market Size (2022 – 2030)

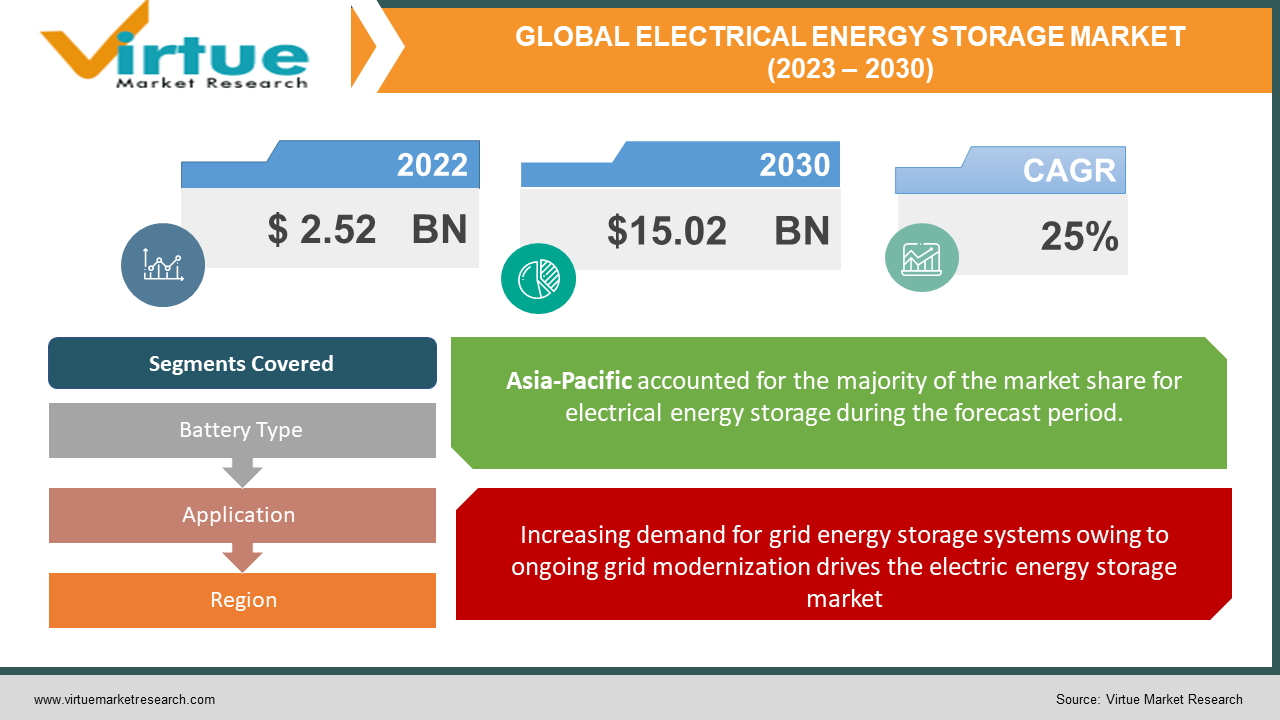

According to our research report, the global electric energy storage market was valued at USD 2.52 billion and is projected to reach a market size of USD 15.02 billion by 2030. The market is projected to grow with a CAGR of 25% per annum during the period of analysis (2023 - 2030).

Industry Overview

A fundamental requirement for daily operations in the private, commercial, industrial, and many other sectors is energy. With the rapidly growing need for energy in various sectors, various organizations and nations are continually working to achieve agreements with innovation system players. Additionally, escalating dangerous greenhouse gas (GHG) emissions that harm the ozone have compelled businesses to implement low carbon emission frameworks while generating energy. Battery Energy Storage Systems (BESS), which use various battery chemistries to store energy to meet excessive demand, are subsequently one such aspect that greatly contributes to innovation.

The ongoing grid modernization, the rising use of lithium-ion batteries in the renewable energy sector, the rising trend of adopting a low-carbon and less fossil fuel-based economy, and the ongoing renewable energy revolution are all factors that have contributed to the market's rise. However, the market's expansion is being constrained by the high capital expense needed to build battery energy storage devices. On the other hand, an increase in the number of rural electrification projects around the world, a rise in the demand for a constant power supply due to an increase in the number of data centers, and a decline in the cost of lithium-ion batteries are all anticipated to create enormous opportunities for the adoption of battery energy storage systems in the years to come. Additionally, the installation of battery energy storage systems on islands or in remote locations, the overheating of lithium-ion batteries, and the aging of lithium-ion batteries present difficulties for producers of battery energy storage systems.

Impact of Covid-19 on the Industry

The worldwide economy and all global industries have been greatly impacted by COVID-19. Lockdowns have been enacted by governments around the world to stop the epidemic's spread. In the early stages of the pandemic, the total worldwide lockdown had a devastating effect on people's quality of life and means of subsistence in many countries. The supply chain has been disrupted as a result all around the world. Due to the sharp drop in product demand, economies all around the world have suffered. The pandemic-related lack of raw materials has curtailed production across all industries. The main causes of the output reduction are the decline in exports and supply chain interruptions.

The abrupt coronavirus outbreak has hurt the expansion of utility applications. In several projects, the installation of battery energy storage systems was seen to be declining in 2021. Additionally, the worldwide closure of production facilities in 2020's first and second quarters is to blame for the slowing of the market's expansion. However, it is anticipated that the adoption of batteries and therefore the battery energy storage systems will expand due to the growing installation of battery energy storage systems in operational projects and the growing government focus on upgrading the electricity sector. The market value might not catch up to the pre-COVID-19 value until 2030, though.

Market Drivers

Increasing demand for grid energy storage systems owing to ongoing grid modernization drives the electric energy storage market

The most common renewable energy sources that are stored in grids are solar and wind energy. However, fluctuations in the energy production process result from the sun being blocked by clouds or shifting wind currents. Due to these variations, flexible grid systems that store energy are necessary. The grid modernization process is increasingly dependent on battery energy storage devices. When the amount of electricity generated exceeds the amount of electricity needed, these solutions assist grid operators in saving electricity. About the generation, transmission, and distribution of electric power, the use of these systems enhances the dependability and flexibility of electricity supply systems.

The surge in the number of rural electrification projects worldwide boosts the market growth

Making electrical power available in rural or distant locations is known as rural electrification. Systems that store energy in batteries are efficient for electrifying rural areas. Many nations are working to develop their off-the-grid territories, including small islands cut off from the national grids, isolated rural and peri-urban areas, and peri-urban areas, particularly in developing nations. As a result, they need a consistent and uninterrupted power supply from renewable and conventional energy sources, which boosts system efficiency overall and secures financial savings throughout the system life cycle. Installing battery energy storage systems in remote locations would provide a secure and dependable source of electricity for nearby businesses and people.

Market Restraints

The high capital expenditures are required for installing battery energy storage systems for market growth

Due to their high energy density and enhanced performance, battery energy storage technologies like lithium-ion batteries, flow batteries, and lead-acid batteries all require higher installation investments. Due to their high energy density, low rate of self-discharge, and low maintenance needs, lithium-ion batteries are expensive. However, it is anticipated that lithium-ion battery prices would decrease in the future. These batteries have a huge capacity and are lightweight and small, making them suitable for use in electric vehicles (EVs). Additionally, a significant barrier to the market's expansion may be the high initial investment costs necessary for the production of flow batteries.

Complexities in installing battery energy storage systems on islands or in remote areas of electric energy storage hamper market growth

Systems for storing energy using batteries are typically used in isolated or island locations. These systems are challenging to deploy in remote areas since it is challenging to get to them. Islands and off-grid distant areas are typical examples of remote locales that confront a variety of difficulties due to the fluctuating generation and supply of electricity from renewable energy sources. Ambient issues include temperature variations during the day and night, expensive maintenance because getting to these places is difficult, and a lack of infrastructure for installing equipment.

Electrical Energy Storage Market Report Coverage:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

25% |

|

Segments Covered |

By Battery Type, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

GS Yuasa Corporation, Contemporary Amperex Technology Co. Limited, BYD Co. Ltd, UniEnergy Technologies, LLCClarionios |

This research report on the global electrical energy storage market has been segmented and sub-segmented based on battery type, application, and Geography & region.

Global Electrical Energy Storage Market- By Battery Type

- Lithium-Ion Batteries

- Advanced Lead-Acid Batteries

- Flow Batteries

- Others

The biggest market share was held by lithium-ion batteries in 2021, and it is anticipated that this would continue throughout the projection period. The benefits of the battery, such as its high energy and power density, which results in reduced standby losses and a high life expectancy of roughly 5 to 15 years with 98 % efficiency, are credited with driving the expansion of this market. Additionally, frequency regulation, demand charge reduction, grid-buffering, and renewable integration are supported by lithium-ion-sulfur battery energy storage systems, which are appropriate for on-grid connections.

Global Electrical Energy Storage Market- By Application

- Residential

- Commercial

- Utility

In 2021, the utility application market will rule. The primary driver of the expansion of the utility sector is the requirement to meet peak electricity demands. In the event of an abrupt change in the energy supply, the utility BESS offers control services for power quality, frequency, and voltage. When there is an excess of renewable energy, grid operators can reduce their electricity use thanks to battery energy storage systems. The increased demand for battery energy storage systems in the utility industry is caused by the growing need for renewable energy and the increasing requirement for a consistent and efficient supply of electricity in most locations.

Global Electrical Energy Storage Market- By Geography & Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

From 2023 - 2030, the market in APAC is anticipated to see the greatest CAGR. In 2021, the area will hold the biggest market share for battery energy storage systems. The market for battery energy storage systems is centered in APAC. Plans for electrifying rural areas in APAC, which are largely off-grid in various nations, are anticipated. These isolated island villages in the area will have more access to electricity thanks to the deployment of domestic energy storage technologies. As governments in developing countries implement new laws to boost the dependability and quality of the power distribution facilities to residential customers, energy storage investments are anticipated to rise significantly in the APAC area. The governments of several nations in this region are concentrating on reducing the negative environmental effects of the energy sector. These elements contribute to the expansion of battery energy storage systems' use in household and industrial applications.

Global Electrical Energy Storage Market- By Companies

- GS Yuasa Corporation

- Contemporary Amperex Technology Co. Limited

- BYD Co. Ltd

- UniEnergy Technologies, LLCClarionios

NOTABLE HAPPENINGS IN THE GLOBAL ELECTRICAL ENERGY STORAGE MARKET IN THE RECENT PAST:

- Government Investment: - In 2021, Expressions of interest (EoI) are now being accepted for the installation of a 1000 MWh battery energy storage system as a pilot project, with approval from the Central Government of IndInross to establish a roadmap for the implementation of the energy storage system in the nation, the Ministries of New and Renewable Energy and Power have been working together on this.

- Business Expansion: - In 20Tor to explore the potential for the development of a Renewable Energy (RE) based RTC, flexible and dispatchable power supply offering based on the integration of RE sources and Pumped Storage projects, Greenko Energies Pvt Ltd (Greenko) and NTPC Vidyut Vyapar Nigam Ltd. (NVVN), a wholly-owned subsidiary of NTPC Limited—largest India's power generation—which has a generation flowers of 60 GW—have Over 40 GWh of pumped hydro storage projects are being developed and constructed by Greenko throughout six Indian states.

- Business Partnership: - In 2020, A long-term relationship between Siemens Energy and the Norwegian technology firm EnergyNest has been established. The startup sells thermal energy storage equipment. The partnership's goal is to jointly provide industrial customers with modularized and standardized thermal energy storage solutions.

Chapter 1. ELECTRICAL ENERGY STORAGE MARKET– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. ELECTRICAL ENERGY STORAGE MARKET– Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-110 Impact Analysis

2.3.1. Impact during 2023 – 2030

2.3.2. Impact on Supply – Demand

Chapter 3. ELECTRICAL ENERGY STORAGE MARKET– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. ELECTRICAL ENERGY STORAGE MARKET- Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. ELECTRICAL ENERGY STORAGE MARKET- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. ELECTRICAL ENERGY STORAGE MARKET– By Technology

6.1. Battery Energy Storage

6.2. Compressed Air Energy Storage

6.3. Flywheel Energy Storage

6.4. Pumped Hydro Storage

Chapter 7. ELECTRICAL ENERGY STORAGE MARKET– By End User

7.1. Residential

7.2. Non-Residential

7.3. Utilities

Chapter 8. ELECTRICAL ENERGY STORAGE MARKET– By Application

8.1. Stationary

8.2. Transportation

Chapter 9. ELECTRICAL ENERGY STORAGE MARKET– By Region

9.1. North America

9.2. Europe

9.3. The Asia Pacific

9.4. Latin America

9.5. Middle-East and Africa

Chapter 10. ELECTRICAL ENERGY STORAGE MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

10.1. Company 1

10.2. Company 2

10.3. Company 3

10.4. Company 4

10.5. Company 5

10.6. Company 6

10.7. Company 7

10.8. Company 8

10.9. Company 9

10.10. Company 10

Download Sample

Choose License Type

2500

4250

5250

6900