Autonomous Last Mile Delivery Market Size (2025 – 2030)

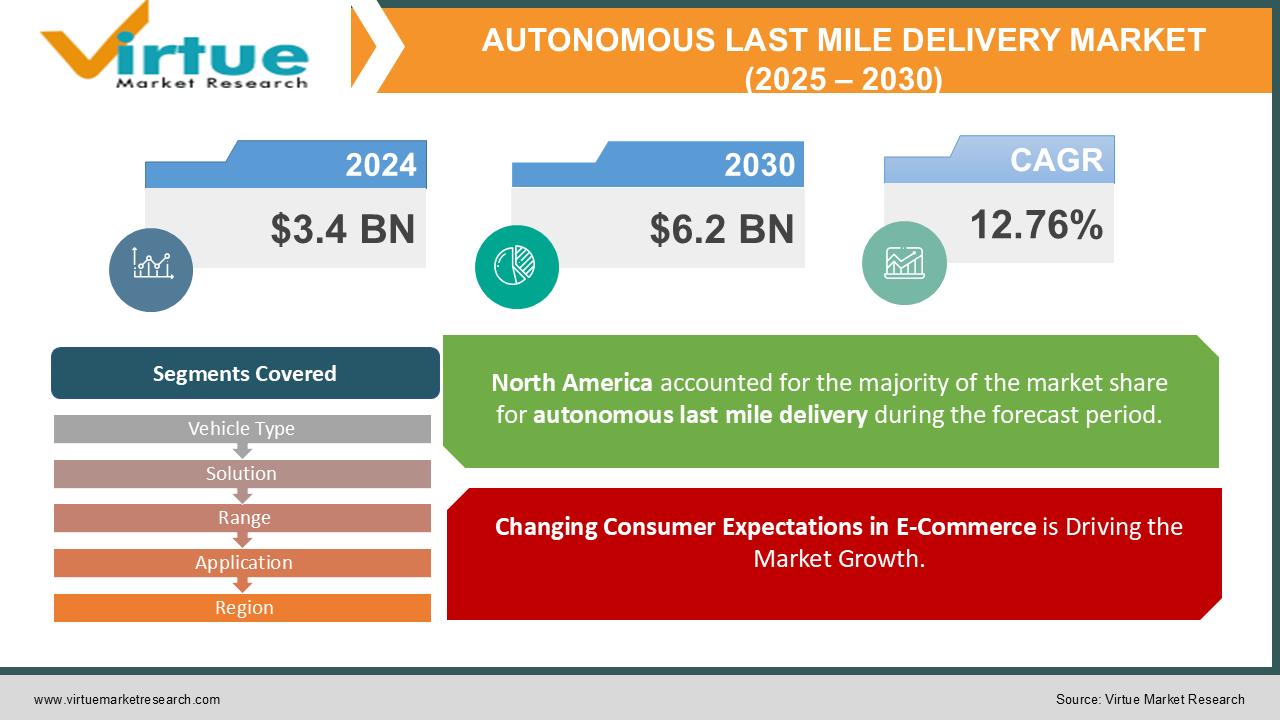

The Global Autonomous Last Mile Delivery Market was valued at USD 3.4 billion in 2024 and is projected to reach a market size of USD 6.2 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 12.76%.

With the growth of e-commerce and growing customer demands for quick, efficient delivery, autonomous last-mile delivery technology is set to improve delivery speed, convenience, and sustainability. It also contributes to lower carbon emissions since autonomous electric vehicles use less energy, ultimately leading to eco-friendly logistics solutions. This technology has the potential to transform the delivery ecosystem, establishing new benchmarks for how products are transported in the digital commerce era. The last-mile delivery market of autonomous vehicles is a real game-changer in the logistics and transportation industry. This includes the operation of advanced autonomous technologies, including drones, self-driving vehicles, and robotic systems. Advanced innovations are now efficiently transporting goods from distribution centers or hubs to their final destinations within the last leg of the supply chain. This dynamic market has gained significant momentum in response to the growing demand for faster, more cost-effective, and environmentally sustainable delivery solutions. The need is particularly evident in urban areas where congestion and delivery challenges prevail.

Key Market Insights:

-

By Platform, the ground delivery vehicles segment has captured the highest market share of 84% in 2023.

-

By End-use the food and beverage segment has captured the highest revenue share of over 86% in 2023.

-

By Range, the short-range segment accounted highest market share of 88% in 2023.

-

North America has held the highest market share of 47% in 2023.

Global Autonomous Last Mile Delivery Market Drivers:

Changing Consumer Expectations in E-Commerce is Driving the Market Growth.

The growth of e-commerce has totally changed the expectations of consumers. Today, consumers expect faster, more efficient, and more reliable delivery services than ever before. Autonomous last mile solutions are a promising solution to fulfill these high expectations. They enable retailers and delivery firms to provide same day or even with-in-hour delivery services. The provision of this degree of convenience not only meets consumers' needs but also builds brand loyalty and competes more effectively in a saturated marketplace. In addition, the cost savings of autonomous last mile solutions fuel market growth. Although technology and infrastructure investment could be high initially, firms can realize long-term labor cost savings, lower fuel usage, and fewer delivery mistakes. This makes cost-effectiveness a promising option for companies looking to eliminate inefficiencies and improve their bottom line.

Climate change and sustainability are more prominent concerns currently.

Environmental factors are important for the development of this market. With climate change and sustainability gaining increased attention, autonomous last mile delivery solutions are viewed as a means to reduce emissions through route optimization, electric or hybrid vehicle use, and centralized charging or refueling points. Government and regulatory incentives also drive the uptake of such green initiatives that adopt autonomous last mile technologies.

Global Autonomous Last Mile Delivery Market Restraints and Challenges:

The growth of the autonomous last mile delivery market is hampered by limited payload capacity.

The growth of the autonomous last mile delivery market faces challenges due to limited payload capacity. Although technologies like drones and small robotic vehicles provide benefits in terms of speed and accessibility, they struggle to carry heavier or larger loads. This restriction impacts the effective delivery of certain products using autonomous systems, particularly those that exceed weight or size limits. Industries that deal with bulkier or specialized items, such as furniture, appliances, or industrial equipment, may find it impractical to rely on these autonomous solutions. Additionally, businesses that need to transport multiple items in a single delivery may encounter difficulties because of the limited payload capacity of autonomous vehicles. This can result in increased operational complexity and costs, as it may require multiple trips or deliveries. Therefore, while autonomous last mile delivery is suitable for certain applications, its payload limitations pose a significant barrier to broader adoption. This highlights the need for innovative solutions that can overcome these challenges and broaden the market's potential.

Global Autonomous Last Mile Delivery Market Opportunities:

The growth of the autonomous last mile delivery market offers significant opportunities for customization and specialization. As the industry develops, companies are increasingly recognizing the need to tailor autonomous delivery solutions to specific sectors and their unique demands. Customization enables the creation of optimized autonomous systems designed for particular use cases, ensuring efficient and reliable deliveries across various industries. For instance, in healthcare, specialized autonomous vehicles equipped with refrigeration units can securely transport temperature-sensitive medications and medical supplies, maintaining their integrity during transit. Similarly, in the food delivery sector, custom-built autonomous platforms can feature advanced heating or cooling systems to ensure that hot pizzas arrive steaming and ice creams stay perfectly frozen. Moreover, customization extends beyond the vehicles themselves; it includes the development of bespoke software and algorithms to meet industry-specific needs. For example, pharmaceutical companies require enhanced security protocols and real-time monitoring to ensure the integrity and traceability of their deliveries. Customized software can effectively address these concerns while optimizing delivery routes and managing complex scheduling scenarios. Additionally, industries that handle delicate or high-value items can benefit from specialized packaging and handling mechanisms seamlessly integrated into autonomous delivery systems. This level of customization not only builds trust but also enhances reliability—two crucial factors for expanding autonomous last mile delivery into specialized niches.

AUTONOMOUS LAST MILE DELIVERY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

12.76% |

|

By Vehicle Type, Solution, Range, Application, and Region |

|

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

DPD, United Parcel Service of America, Inc, DHL International GmbH, Savioke, Starship Technologies, Marble Robot, JD.com Inc., Amazon.com, Flytrex, Drone Delivery Canada, Flirtey, Matternet |

Autonomous Last Mile Delivery Market Segmentation: By Vehicle Type

-

Aerial Delivery Drone

-

Ground Delivery Bots

-

Self-Driving Truck and Vans

The global market for autonomous last-mile delivery is divided into three main categories: Aerial Delivery Drones, Ground Delivery Bots, and Self-Driving Trucks and Vans. In 2024, Aerial Delivery Drones are becoming increasingly popular, especially in urban and remote locations, thanks to their ability to avoid traffic and ensure quick delivery. Ground Delivery Bots are also on the rise in crowded cities and university campuses, providing efficient and affordable options for short-distance deliveries. At the same time, Self-Driving Trucks and Vans are revolutionizing large-scale logistics, allowing for bulk deliveries over greater distances while minimizing reliance on human drivers. The demand for these autonomous vehicles is growing as businesses focus on speed, cost-effectiveness, and sustainability.

Autonomous Last Mile Delivery Market Segmentation: By Solution

-

Software

-

Hardware

-

Service

The market is divided into three main categories: Hardware, Software, and Services. Hardware, which includes sensors, cameras, and LiDAR systems, continues to be a vital part of the industry, with ongoing improvements in AI-driven navigation and obstacle detection technologies. The Software segment is experiencing rapid growth as companies adopt machine learning and route optimization algorithms to improve delivery efficiency. Fleet management software and real-time tracking systems are becoming indispensable for businesses looking to optimize their operations. Meanwhile, the Services segment, which includes maintenance, fleet management, and remote monitoring, is also steadily expanding as companies turn to outsourced support to effectively manage their autonomous delivery networks.

Autonomous Last Mile Delivery Market Segmentation: By Range

-

Short Range

-

Long Range

Autonomous last-mile delivery solutions can be divided into two main categories: Short-Range and Long-Range. Short-Range deliveries, which focus on urban and suburban areas, are leading the market thanks to the growth of e-commerce and same-day delivery options. In these regions, drones and delivery bots are commonly utilized for last-mile fulfillment, helping to cut down on delivery times and costs. Conversely, Long-Range deliveries are essential for logistics between cities and in rural areas, where self-driving trucks and autonomous vans are vital for moving goods over longer distances. With advancements in battery technology and autonomous navigation, we can expect improvements in the efficiency and reliability of long-range deliveries.

Autonomous Last Mile Delivery Market Segmentation: By Application

-

Logistics

-

Healthcare and Pharmaceuticals

-

Foods and Beverages

The main uses of autonomous last-mile delivery span across Logistics, Healthcare and Pharmaceuticals, and Food and Beverages. The Logistics sector leads in adoption, with major e-commerce and retail companies investing in autonomous solutions to satisfy increasing consumer demands for quick deliveries. In the Healthcare and Pharmaceuticals field, there is a swift uptake of drones and autonomous vehicles for transporting medical supplies, vaccines, and essential medications to remote and high-risk locations. Additionally, the Food and Beverages industry is also turning to autonomous delivery, especially for online food orders, as businesses aim to cut operational costs and improve customer convenience.

Autonomous Last Mile Delivery Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2024, North America is at the forefront of the autonomous last-mile delivery market, thanks to significant technological advancements, supportive regulations, and substantial investments from major companies like Amazon, UPS, and FedEx. Europe is not far behind, benefiting from growing government backing for sustainable and autonomous transport solutions. The Asia-Pacific region is witnessing the most rapid growth, driven by a booming e-commerce industry, swift urbanization, and a rising demand for contactless delivery options. Countries such as China, Japan, and South Korea are making significant investments in drone delivery and self-driving logistics. Meanwhile, Latin America and the Middle East & Africa are slowly embracing autonomous last-mile delivery solutions, with logistics providers increasingly interested in improving delivery efficiency in challenging environments. The landscape of the autonomous last-mile delivery market in 2024 is influenced by technological progress, regulatory changes, and a rising consumer appetite for quick, contactless, and efficient delivery options, positioning it as a crucial element in the future of logistics.

COVID-19 Impact Analysis on the Global Autonomous Last Mile Delivery Market:

The COVID-19 pandemic greatly accelerated the growth of the autonomous last-mile delivery market as the demand for contactless delivery solutions surged. Lockdowns, social distancing measures, and the boom in e-commerce compelled retailers and logistics companies to embrace autonomous delivery technologies, such as drones, robots, and self-driving vehicles. Supply chain disruptions and labor shortages underscored the necessity for automation in last-mile logistics. Governments and regulatory bodies expedited approvals for autonomous delivery trials, resulting in increased investment in AI-driven logistics solutions. Although the initial rollout encountered challenges like infrastructure limitations and regulatory obstacles, the pandemic's long-term effects solidified autonomous last-mile delivery as an essential part of the future supply chain, with ongoing advancements in AI, 5G, and robotics further promoting its adoption.

Latest Trends/ Developments:

Starship Technologies, known for their autonomous delivery services, has partnered with Trafford Council and Co-op to bring robot food delivery to Greater Manchester. The service is initially available to 24,000 residents across 10,500 households in Sale. This expansion marks Starship's entry into northern England, where their robots have already gained popularity in cities like Northampton, Milton Keynes, Cambridge, Cambourne, and Leeds. Kiwibot has recently secured a $10 million partnership with Kineo Finance. This funding will enable the Colombian startup to expand its fleet of autonomous robots, significantly impacting the delivery-as-a-service (DaaS) market. Equipped with GPS, advanced camera sensors, AI, and other technologies, Kiwibot aims to revolutionize food delivery for both restaurants and customers. Grubhub and Kiwibot are collaborating to introduce robot delivery services on college campuses across the U.S., starting with the University of North Dakota in the upcoming semester. Following this initial launch, the service will be rolled out to additional schools, adding Kiwibot to Grubhub's list of partners, which includes Starship and Cartken, providing robot delivery to nearly a dozen campuses. In Lockeford, California, and College Station, Texas, Amazon has officially launched its Prime Air drone delivery service, having received approval from the Federal Aviation Administration and working alongside local authorities. For orders weighing less than 5 pounds, a drone will be sent to the customer's backyard to drop off the order before returning to its base.

Key Players:

-

DPD

-

United Parcel Service of America, Inc

-

DHL International GmbH

-

Savioke

-

Starship Technologies

-

Marble Robot

-

JD.com Inc.

-

Amazon.com

-

Flytrex

-

Drone Delivery Canada

-

Flirtey

-

Matternet

Chapter 1. Autonomous Last Mile Delivery Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Autonomous Last Mile Delivery Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Autonomous Last Mile Delivery Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Autonomous Last Mile Delivery Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Autonomous Last Mile Delivery Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Autonomous Last Mile Delivery Market – BY VEHICLE TYPE

6.1 Introduction/Key Findings

6.2 Aerial Delivery Drone

6.3 Ground Delivery Bots

6.4 Self-Driving Truck and Vans

6.5 Y-O-Y Growth trend Analysis BY VEHICLE TYPE

6.6 Absolute $ Opportunity Analysis BY VEHICLE TYPE , 2025-2030

Chapter 7. Autonomous Last Mile Delivery Market – BY SOLUTION

7.1 Introduction/Key Findings

7.2 Software

7.3 Hardware

7.4 Service

7.5 Y-O-Y Growth trend Analysis BY SOLUTION

7.6 Absolute $ Opportunity Analysis BY SOLUTION, 2025-2030

Chapter 8. Autonomous Last Mile Delivery Market – BY RANGE

8.1 Introduction/Key Findings

8.2 Short Range

8.3 Long Range

8.4 Y-O-Y Growth trend Analysis BY RANGE

8.5 Absolute $ Opportunity Analysis BY RANGE, 2025-2030

Chapter 9. Autonomous Last Mile Delivery Market – BY APPLICATION

9.1 Introduction/Key Findings

9.2 Logistics

9.3 Healthcare and Pharmaceuticals

9.4 Foods and Beverages

9.5 Y-O-Y Growth trend Analysis BY APPLICATION

9.6 Absolute $ Opportunity Analysis BY APPLICATION , 2025-2030

Chapter 10. Autonomous Last Mile Delivery Market , By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 BY VEHICLE TYPE

10.1.2.1 BY SOLUTION

10.1.3 BY RANGE

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 BY VEHICLE TYPE

10.2.3 BY SOLUTION

10.2.4 BY RANGE

10.2.5 By BY APPLICATION

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 BY VEHICLE TYPE

10.3.3 BY SOLUTION

10.3.4 BY RANGE

10.3.5 By BY APPLICATION

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 BY VEHICLE TYPE

10.4.3 BY SOLUTION

10.4.4 BY RANGE

10.4.5 By BY APPLICATION

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 BY VEHICLE TYPE

10.5.3 BY SOLUTION

10.5.4 BY RANGE

10.5.5 By Application

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Autonomous Last Mile Delivery Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 DPD

11.2 United Parcel Service of America, Inc

11.3 DHL International GmbH

11.4 Savioke

11.5 Starship Technologies

11.6 Marble Robot

11.7 JD.com Inc.

11.8 Amazon.com

11.9 Flytrex

11.10 Drone Delivery Canada

11.11 Flirtey

11.12 Matternet

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Autonomous Last Mile Delivery Market was valued at USD 3.4 billion in 2024 and is projected to reach a market size of USD 6.2 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 12.76%.

Nowadays people demand faster, more efficient and dependable delivery services like never before and climate conservation is a big concern.

Based on Service Provider, the Global Autonomous Last Mile Delivery Market is segmented in-to Retailers, Logistics Providers, Technology Providers, Healthcare and Pharmaceutical Companies..

North America is the most dominant region for the Global Autonomous Last Mile Delivery Market.

DPD, United Parcel Serivce of America, Inc, DHL International GmbH, Savioke, Sarship Technologies, Savioke, Starship Technologies, Marble Robot are the key players operating in the Global Autonomous Last Mile Delivery Market.

DPD, United Parcel Serivce of America, Inc, DHL International GmbH, Savioke, Sarship Technologies, Savioke, Starship Technologies, Marble Robot are the key players operating in the Global Autonomous Last Mile Delivery Market.