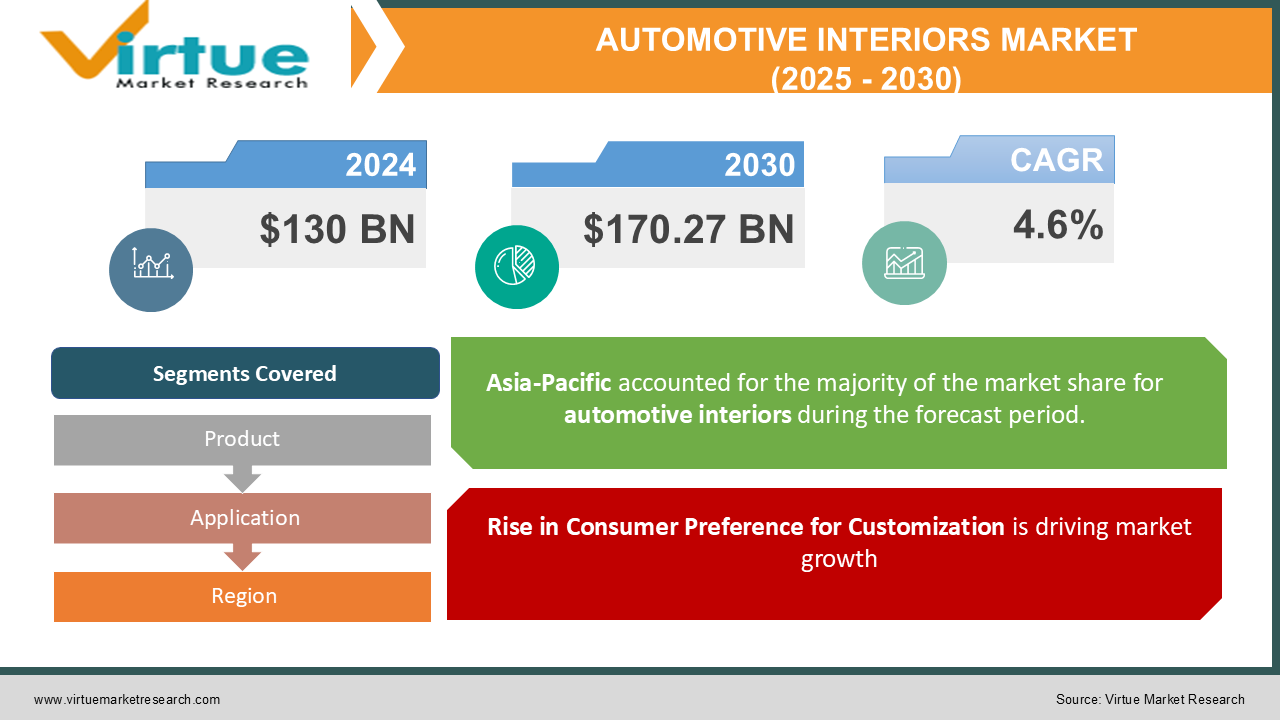

Automotive Interiors Market Size (2025 – 2030)

The Global Automotive Interiors Market was valued at USD 130 billion in 2024 and is expected to grow at a CAGR of 4.6% from 2025 to 2030. By 2030, the market is anticipated to reach USD 170.27 billion.

Automotive interiors encompass components such as dashboard systems, seats, infotainment systems, door panels, flooring, and cabin materials. These elements are crucial for enhancing the vehicle's aesthetic appeal, comfort, and functionality. The market is driven by advancements in materials, rising consumer demand for customization, and an increased focus on passenger safety and comfort. The growing penetration of electric vehicles (EVs) and autonomous driving systems further amplify the demand for innovative and sustainable automotive interiors.

Key Market Insights

-

The integration of lightweight materials like carbon fiber and advanced polymers in automotive interiors is growing at a CAGR of 7.2%, aiding in fuel efficiency and carbon footprint reduction.

-

Smart infotainment systems with AI-enabled features saw a 12% market growth in 2024, fueled by the rising popularity of connected vehicles.

-

Sustainable interior materials, including biodegradable and recycled options, account for 15% of the market and are expected to rise significantly in response to environmental regulations.

-

Increasing adoption of EVs has resulted in a 9% annual rise in demand for innovative interiors to accommodate battery systems and futuristic designs.

-

Premium and luxury vehicle segments contribute 25% of the market, driven by rising disposable incomes and demand for high-end finishes and smart technologies.

-

Enhanced safety features such as advanced airbags and impact-resistant dashboards recorded a 5% annual growth in demand.

Global Automotive Interiors Market Drivers

Rise in Consumer Preference for Customization is driving market growth:

The increasing consumer inclination toward personalization in automotive interiors is a major growth driver. As modern vehicles transition into personal and professional spaces, there is rising demand for bespoke solutions such as leather upholstery, wood veneers, and ambient lighting systems. Automakers are introducing a variety of trim options, materials, and infotainment features to cater to diverse preferences. Additionally, digital displays and customizable dashboards have become crucial in enhancing the user experience. The adoption of cutting-edge technologies like AR-driven heads-up displays and gesture-controlled systems is transforming the market. This personalization trend is particularly robust in luxury and premium car segments, where interiors significantly impact purchase decisions.

Technological Advancements in Infotainment and Connectivity is driving market growth:

Rapid technological evolution is reshaping automotive interiors. The integration of advanced infotainment systems, voice command functionality, and wireless charging capabilities has become standard in mid-range and high-end vehicles. Connectivity options like Apple CarPlay, Android Auto, and Bluetooth are critical for a seamless user experience. Furthermore, developments in AI and IoT are enabling smarter cabin ecosystems, with features such as predictive climate control and driver fatigue monitoring. The shift toward connected vehicles further emphasizes the importance of interactive and intelligent interiors, boosting market growth globally.

Growth in Electric and Autonomous Vehicles is driving market growth:

EVs, due to their unique structural design, offer more flexibility for cabin innovation, such as spacious layouts and flat flooring. Autonomous vehicles demand higher safety standards and entertainment systems to enhance passenger experience during self-driving modes. As governments promote EV adoption through incentives, automakers are focusing on developing interiors with minimalistic designs and advanced technologies to cater to the growing market. The EV segment is expected to be a primary driver of futuristic automotive interiors in the coming years.

Global Automotive Interiors Market Challenges and Restraints

High Costs of Advanced Materials and Technologies is restricting market growth:

The incorporation of premium materials such as carbon fiber, leather, and advanced polymers increases production costs significantly. For example, a shift to sustainable and lightweight materials can elevate manufacturing expenses by 15-20%, which impacts the affordability of vehicles, particularly in price-sensitive markets. Similarly, the integration of high-tech infotainment systems and AI-enabled features incurs substantial R&D and hardware costs. Manufacturers face challenges in maintaining cost-effectiveness while delivering innovation, especially in the mass-market segment.

Stringent Regulations and Environmental Concerns is restricting market growth:

Environmental regulations and sustainability concerns pose significant challenges for the automotive interiors market. Governments worldwide are implementing strict guidelines to reduce plastic usage and carbon emissions, urging automakers to switch to eco-friendly materials. However, the development and adoption of biodegradable or recyclable materials come with technical and financial hurdles. Additionally, regulations surrounding occupant safety and crashworthiness necessitate extensive testing and compliance, which can delay product rollouts and increase costs. Navigating these regulatory landscapes is a key restraint for market players.

Market Opportunities

The growing emphasis on sustainability and innovation presents lucrative opportunities for the automotive interiors market. Automakers are investing heavily in research and development to create environmentally friendly materials like bio-based plastics, recycled composites, and natural fibers. These materials not only reduce the carbon footprint but also align with shifting consumer preferences for sustainable solutions. The expansion of EVs and autonomous vehicles opens new avenues for interior design, allowing for more spacious and adaptable cabin layouts. Additionally, the rising trend of shared mobility services demands durable and easy-to-maintain interior solutions. Customizable options for ride-sharing vehicles and fleet management also create niche opportunities. Governments' push for clean energy vehicles and tax benefits for green initiatives further support market expansion.

AUTOMOTIVE INTERIORS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

4.6% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Faurecia, Lear Corporation, Adient, Magna International, Toyota Boshoku Corporation, Grupo Antolin, Yanfeng Automotive Interiors, Continental AG, Calsonic Kansei Corporation, Johnson Controls |

Automotive Interiors Market Segmentation - By Product

-

Seats

-

Dashboard and Instrument Panels

-

Door Panels

-

Flooring and Carpets

-

Infotainment Systems

-

Others

Seats dominate the market, contributing 30% of the revenue share in 2024. The rising demand for comfort-enhancing features such as ventilated seats, memory foam cushioning, and massaging capabilities makes this segment a critical component of automotive interiors.

Automotive Interiors Market Segmentation - By Application

-

Passenger Cars

-

Commercial Vehicles

-

Electric Vehicles

-

Others

Passenger cars account for the largest share, at 55% of the market in 2024. The increasing demand for advanced infotainment, luxurious materials, and customizable interiors in passenger vehicles drives this segment.

Automotive Interiors Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific leads the automotive interiors market with a 38% share in 2024, driven by rapid industrialization and the robust automotive industry in countries like China, Japan, and India. High vehicle production volumes, increasing disposable incomes, and a growing preference for premium features fuel market growth. China's significant role in EV production further amplifies the demand for innovative interiors. Additionally, government initiatives supporting electric and hybrid vehicle adoption strengthen the region's dominance.

COVID-19 Impact Analysis on the Automotive Interiors Market

The COVID-19 pandemic had a profound impact on the automotive interiors market, causing significant disruptions across the industry. Factory shutdowns and supply chain challenges resulted in a sharp 25% decline in production in 2020, severely affecting vehicle manufacturing. However, as the world began to recover from the pandemic, the automotive industry shifted its focus towards enhancing vehicle interiors to meet new consumer priorities driven by health and safety concerns. In the post-pandemic phase, automakers prioritized hygiene and passenger safety, leading to the integration of advanced features in vehicle cabins. These included antimicrobial surfaces, state-of-the-art air filtration systems, and touchless control interfaces, all designed to provide a safer, more hygienic environment for passengers. The pandemic also accelerated the adoption of health-conscious vehicle features, with an increasing demand for shared mobility solutions. Consumers sought durable, easy-to-clean interiors that would help reduce the spread of germs, further driving the trend toward more hygienic and practical cabin designs. Additionally, the recovery period highlighted the growing importance of electrification and sustainability in the automotive industry. With heightened awareness of environmental issues, automakers began emphasizing eco-friendly materials and energy-efficient systems in vehicle interiors. This shift towards sustainability is expected to continue shaping the market for years to come, as both manufacturers and consumers place increasing value on environmentally responsible choices. Looking ahead, the automotive interiors market is poised for steady growth, supported by innovations in hygiene, sustainability, and shared mobility. The industry’s long-term outlook remains positive, with the pandemic having accelerated many of the trends that are likely to define the future of vehicle cabins. As electrification and health-conscious features continue to evolve, the automotive interiors market is expected to adapt to meet new consumer demands and expectations.

Latest Trends/Developments

The automotive interiors market is currently experiencing a significant surge in demand for both eco-friendly materials and cutting-edge smart technologies. As consumer preferences shift toward sustainability, automakers are increasingly prioritizing the use of recycled and renewable materials in vehicle cabins. This trend is complemented by an emphasis on innovative technologies aimed at enhancing the driving experience. Automakers are collaborating with tech companies to develop advanced features such as augmented reality dashboards, which provide drivers with real-time information in a visually immersive manner. Gesture control systems are gaining popularity, offering a more intuitive, hands-free interface for vehicle functions, while personalized ambient lighting is allowing drivers to create customized atmospheres inside their vehicles. Biometric systems are also on the rise, with features like heart rate and temperature sensors providing real-time health monitoring and enhancing vehicle security. These systems are designed to improve the overall safety and comfort of passengers, responding to a growing demand for health-conscious features in the wake of the COVID-19 pandemic. In electric vehicle (EV) interiors, there is a clear shift toward minimalist designs that prioritize both functionality and aesthetics. This approach not only maximizes space but also aligns with the modern consumer’s desire for simplicity and elegance in cabin layouts. Furthermore, modular interior systems are emerging as a key trend in autonomous and shared vehicles. These systems enable flexible reconfiguration of the cabin space to suit different uses, whether for ride-sharing or private driving, highlighting the growing demand for adaptability in vehicle interiors. These innovations reflect the market's focus on sustainability, advanced technology, and enhancing the user experience. As the automotive industry continues to evolve, the integration of eco-friendly materials and smart technologies is set to redefine the future of automotive interiors.

Key Players

-

Faurecia

-

Lear Corporation

-

Adient

-

Magna International

-

Toyota Boshoku Corporation

-

Grupo Antolin

-

Yanfeng Automotive Interiors

-

Continental AG

-

Calsonic Kansei Corporation

-

Johnson Controls

Chapter 1. Automotive Interiors Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Automotive Interiors Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Automotive Interiors Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Automotive Interiors Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Automotive Interiors Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Automotive Interiors Market – By Product

6.1 Introduction/Key Findings

6.2 Seats

6.3 Dashboard and Instrument Panels

6.4 Door Panels

6.5 Flooring and Carpets

6.6 Infotainment Systems

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Product

6.9 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7. Automotive Interiors Market – By Application

7.1 Introduction/Key Findings

7.2 Passenger Cars

7.3 Commercial Vehicles

7.4 Electric Vehicles

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Automotive Interiors Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Automotive Interiors Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Faurecia

9.2 Lear Corporation

9.3 Adient

9.4 Magna International

9.5 Toyota Boshoku Corporation

9.6 Grupo Antolin

9.7 Yanfeng Automotive Interiors

9.8 Continental AG

9.9 Calsonic Kansei Corporation

9.10 Johnson Controls

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Automotive Interiors Market was valued at USD 130 billion in 2024 and is expected to grow at a CAGR of 4.6% from 2025 to 2030. By 2030, the market is anticipated to reach USD 170.27 billion.

The market is driven by the rise in consumer demand for customization, advancements in infotainment technologies, and the growth of electric and autonomous vehicles.

The market segments include products such as seats, dashboards, and infotainment systems, and applications like passenger cars, commercial vehicles, and EVs.

Asia-Pacific is the dominant region, with a 38% market share in 2024, due to its strong automotive industry and increasing EV adoption.

Key players include Faurecia, Lear Corporation, Adient, Magna International, Toyota Boshoku Corporation, and Yanfeng Automotive Interiors.