Athleisure Personal Care Market Size (2025 – 2030)

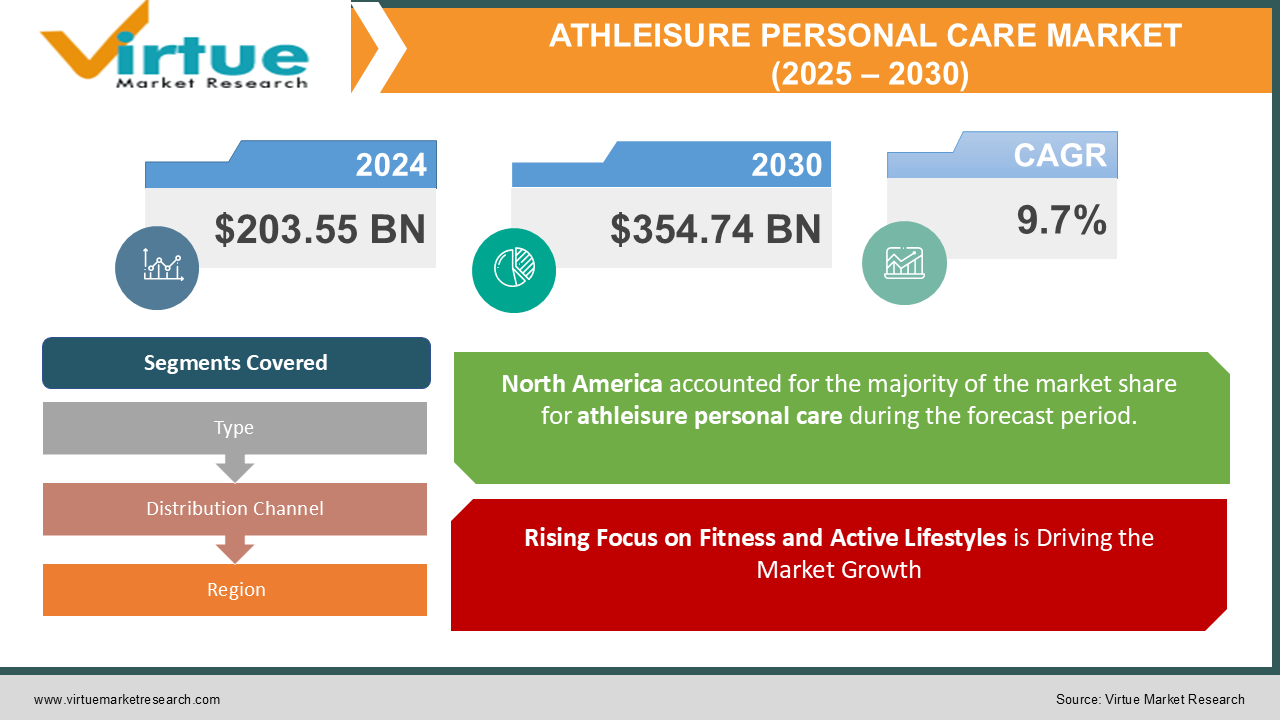

The Athleisure Personal Care Market was valued at USD 203.55 Billion in 2024 and is projected to reach a market size of USD 354.74 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 9.7%.

The athleisure personal care market has emerged as a dynamic and transformative segment within the broader personal care industry, fueled by evolving consumer preferences, the rising focus on fitness, and a seamless blending of performance and lifestyle. Athleisure personal care encompasses products designed to cater specifically to active individuals, combining skincare, hygiene, and functionality for those with busy and fitness-oriented lifestyles. From sweat-proof cosmetics to anti-pollution skincare and refreshing deodorants, this market addresses the nuanced needs of modern consumers who demand efficacy, convenience, and innovation in their personal care routines. The popularity of athleisure fashion has acted as a catalyst for this market, creating a synergy between apparel and personal care that resonates with an active demographic. In 2023, the market saw an impressive diversification of product portfolios, with brands introducing items tailored to pre- and post-workout needs, such as lightweight moisturizers, quick-drying body sprays, and detoxifying face masks. This innovation is underpinned by a growing awareness of the impact of sweat, pollution, and environmental stressors on the skin, making multifunctional products with clean and sustainable formulations highly sought after. The integration of cutting-edge technologies such as AI-driven customization in product development and smart packaging solutions has further elevated consumer engagement and brand differentiation. Consumers are increasingly drawn to athleisure personal care products that are dermatologically tested, cruelty-free, and free from harmful chemicals like parabens and sulphates. These attributes align with the broader "clean beauty" movement, which prioritizes transparency and ethical practices. E-commerce channels and social media platforms have played a pivotal role in driving market growth, enabling brands to connect directly with consumers and offer tailored solutions. Influencer marketing and targeted advertisements have amplified the visibility of these products, turning them into staples for those who prioritize health, fitness, and self-care. The target audience of this market spans fitness enthusiasts, athletes, and casual consumers who appreciate the hybrid functionality of these products. With its inclusive appeal, the market has attracted participation from both established personal care giants and emerging niche players, fostering healthy competition and continuous innovation. Moreover, partnerships between athleisure brands and personal care companies have created collaborative products that reflect a shared commitment to wellness and performance. As urbanization accelerates and the global middle class expands, the demand for athleisure personal care products is poised to grow. The increasing number of gyms, fitness studios, and wellness centers, coupled with a societal shift toward preventive healthcare, further bolsters the market's potential. Regional disparities in product adoption are narrowing as awareness campaigns and affordable pricing make these products accessible to a broader demographic. Despite the market’s tremendous promise, challenges such as high product pricing, regulatory hurdles, and consumer scepticism about performance claims need to be addressed for sustained growth.

Key Market Insights:

-

Over 68% of athleisure personal care product users cited sweat-proof functionality as their primary purchase driver. Sales of post-workout facial cleansers increased by 21% compared to the previous year.

-

Products targeting pollution defense saw a 17% rise in demand among urban consumers.

-

Over 60% of purchases were made online through e-commerce platforms in 2023.

-

The average consumer spent approximately $110 annually on athleisure personal care products. Anti-chafing solutions experienced a 25% surge in sales during summer months.

Market Drivers:

Rising Focus on Fitness and Active Lifestyles is Driving the Market Growth

The increasing awareness of fitness and health among individuals globally has significantly boosted the demand for athleisure personal care products. This trend is fueled by growing urbanization and the rise of fitness culture, with people integrating physical activity into their daily routines. Fitness enthusiasts and athletes now seek personal care products specifically designed to complement their active lifestyles. Products that cater to post-workout recovery, sweat management, and hydration are becoming indispensable for consumers who aim to maintain their skin and hair health while leading an active life. The adoption of wearable fitness devices and mobile health applications further amplifies this trend, as they encourage users to engage in physical activities. Consumers now prioritize personal care solutions that align with their health goals and fit seamlessly into their fast-paced schedules. This shift has prompted brands to develop products that are quick to use, easy to carry, and highly effective. Additionally, the COVID-19 pandemic brought a heightened focus on hygiene, making sweat-proof and anti-bacterial formulations more appealing to consumers.

Demand for Multifunctional and Sustainable Products Fuelling Market Growth

Modern consumers demand products that serve multiple purposes, blending convenience with efficiency. The athleisure personal care market has capitalized on this trend by introducing multifunctional products, such as sweat-resistant sunscreens that also hydrate the skin or deodorants with skincare benefits. These products resonate particularly well with time-conscious individuals who prefer fewer, but more effective, personal care items. Sustainability is another critical factor driving market growth. Consumers are increasingly conscious of their environmental impact, leading them to favour brands that prioritize eco-friendly practices. Recyclable packaging, cruelty-free testing, and plant-based formulations are key attributes that influence purchasing decisions. Brands that demonstrate a commitment to sustainability and transparency in their supply chains are building stronger relationships with environmentally aware consumers, driving sales and fostering brand loyalty.

Market Restraints and Challenges:

Despite its growing popularity, the athleisure personal care market faces several challenges that could potentially hinder its growth. One primary concern is the premium pricing of these products, which limits their accessibility to a broader audience. Many consumers perceive athleisure personal care items as niche products with high costs, making it difficult for price-sensitive markets to adopt them widely. Additionally, regulatory complexities surrounding product claims, especially for multifunctional and performance-oriented formulations, create hurdles for manufacturers. Strict compliance with safety standards and labelling requirements often delays product launches, impacting market expansion. Another significant challenge is consumer scepticism about product efficacy. Claims such as sweat-proof, anti-pollution, or skin-healing properties need to be backed by credible research and testing. Failure to meet these claims can damage a brand’s reputation and erode consumer trust. Moreover, competition from traditional personal care products poses a restraint, as many consumers continue to rely on their usual skincare and hygiene routines instead of investing in specialized athleisure products.

Market Opportunities

The athleisure personal care market holds immense potential for growth, driven by emerging trends and untapped consumer segments. One significant opportunity lies in targeting the male demographic, which remains underserved compared to female consumers. With the rise of men's grooming and wellness trends, brands have the chance to develop products that cater specifically to the needs of active men, such as post-shave soothing balms or sweat-resistant colognes. Another promising avenue is technological innovation in product formulations. Brands that integrate advanced technologies, such as nanotechnology for long-lasting effects or AI-driven personalization, can capture the attention of tech-savvy consumers. Collaborations between athleisure fashion brands and personal care companies also present lucrative opportunities to create co-branded products that appeal to a shared audience. Expanding into emerging markets with affordable product lines tailored to local preferences is another growth strategy. These regions are witnessing rapid urbanization and a growing middle class, making them ripe for athleisure personal care adoption. Finally, brands that invest in educational marketing campaigns to raise awareness about the benefits of these products can drive consumer engagement and foster market expansion.

ATHLEISURE PERSONAL CARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

9.7% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

L’Oréal, Procter & Gamble, Unilever, Beiersdorf, Shiseido, Estée Lauder Companies, Coty Inc., Johnson & Johnson, Kao Corporation, Revlon, Amore pacific, Natura & Co, Clarins Group, Henkel AG & Co., Himalaya Wellness |

Athleisure Personal Care Market Segmentation: by Type

-

Skincare

-

Haircare

-

Body care

-

Cosmetics

Among these, skincare products are the most dominant type, accounting for a significant share of market revenue in 2024. Their popularity stems from the demand for sweat-proof and pollution-resistant formulations that cater to active lifestyles. Haircare products are the fastest-growing segment, driven by the rising interest in dry shampoos, leave-in conditioners, and scalp care solutions tailored for post-workout use.

Athleisure Personal Care Market Segmentation: by Distribution Channel

-

E-commerce

-

Specialty stores

-

Supermarkets

-

Hypermarkets

E-commerce emerged as the most dominant channel in 2023, representing over 60% of total sales, owing to its convenience, variety, and access to global brands. However, specialty stores are the fastest-growing distribution channel, as consumers seek expert advice and personalized recommendations for their athleisure personal care needs.

Athleisure Personal Care Market Segmentation: by Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Middle East and Africa

-

Latin America

North America dominated the market, accounting for 38% of global revenue, driven by high awareness and disposable income.

Asia-Pacific emerged as the fastest-growing region, with a growth rate of 22%, fueled by urbanization and a growing middle-class population.

COVID-19 Impact Analysis:

The COVID-19 pandemic had a multifaceted impact on the athleisure personal care market. On one hand, heightened awareness of personal hygiene and wellness led to increased demand for skincare and hygiene products. The pandemic accelerated the adoption of online shopping, boosting e-commerce sales for athleisure personal care products. However, disruptions in global supply chains and manufacturing activities initially hindered market growth. Brands that adapted quickly by focusing on digital marketing and localized production were able to mitigate these challenges.

Latest Trends and Developments:

The athleisure personal care market is witnessing several transformative trends in 2023. A significant development is the integration of biotechnology in product formulations, enabling brands to create performance-enhancing products with natural ingredients. Minimalistic skincare routines are gaining popularity, with products designed to offer multiple benefits in a single application. Another trend is the rise of gender-neutral formulations, appealing to a broader consumer base. Brands are also leveraging augmented reality (AR) and virtual try-ons to enhance the online shopping experience, while sustainable packaging innovations, such as refillable containers, are addressing environmental concerns.

Key Players in the Market:

-

L’Oréal

-

Procter & Gamble

-

Unilever

-

Beiersdorf

-

Shiseido

-

Estée Lauder Companies

-

Coty Inc.

-

Johnson & Johnson

-

Kao Corporation

-

Revlon

-

Amore pacific

-

Natura & Co

-

Clarins Group

-

Henkel AG & Co.

-

Himalaya Wellness

Chapter 1. Athleisure Personal Care Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Athleisure Personal Care Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Athleisure Personal Care Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Athleisure Personal Care Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Athleisure Personal Care Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Athleisure Personal Care Market – By Type

6.1 Introduction/Key Findings

6.2 Skincare

6.3 Haircare

6.4 Body care

6.5 Cosmetics

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Athleisure Personal Care Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 E-commerce

7.3 Specialty stores

7.4 Supermarkets

7.5 Hypermarkets

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Athleisure Personal Care Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Athleisure Personal Care Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 L’Oréal

9.2 Procter & Gamble

9.3 Unilever

9.4 Beiersdorf

9.5 Shiseido

9.6 Estée Lauder Companies

9.7 Coty Inc.

9.8 Johnson & Johnson

9.9 Kao Corporation

9.10 Revlon

9.11 Amore pacific

9.12 Natura & Co

9.13 Clarins Group

9.14 Henkel AG & Co.

9.15 Himalaya Wellness

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Key factors driving the growth of the athleisure personal care market include rising consumer focus on fitness and active lifestyles, demand for sweat-proof and multifunctional products, increasing awareness of personal hygiene, advancements in product formulations, and a shift toward eco-friendly and sustainable solutions appealing to environmentally conscious consumers globally.

Main concerns about the athleisure personal care market include high product costs limiting accessibility, regulatory complexities delaying product launches, competition from traditional personal care brands, and consumer scepticism regarding efficacy claims. Additionally, sustainability challenges in manufacturing and packaging practices pose hurdles for brands aiming to meet environmentally conscious consumer demands.

L’Oréal, Procter & Gamble, Unilever, Beiersdorf, Shiseido, Estée Lauder Companies, Coty Inc.

North America currently holds the largest market share, estimated around 35%.

Asia Pacific has shown significant room for growth in specific segments.