Sportswear Market Size (2024-2030)

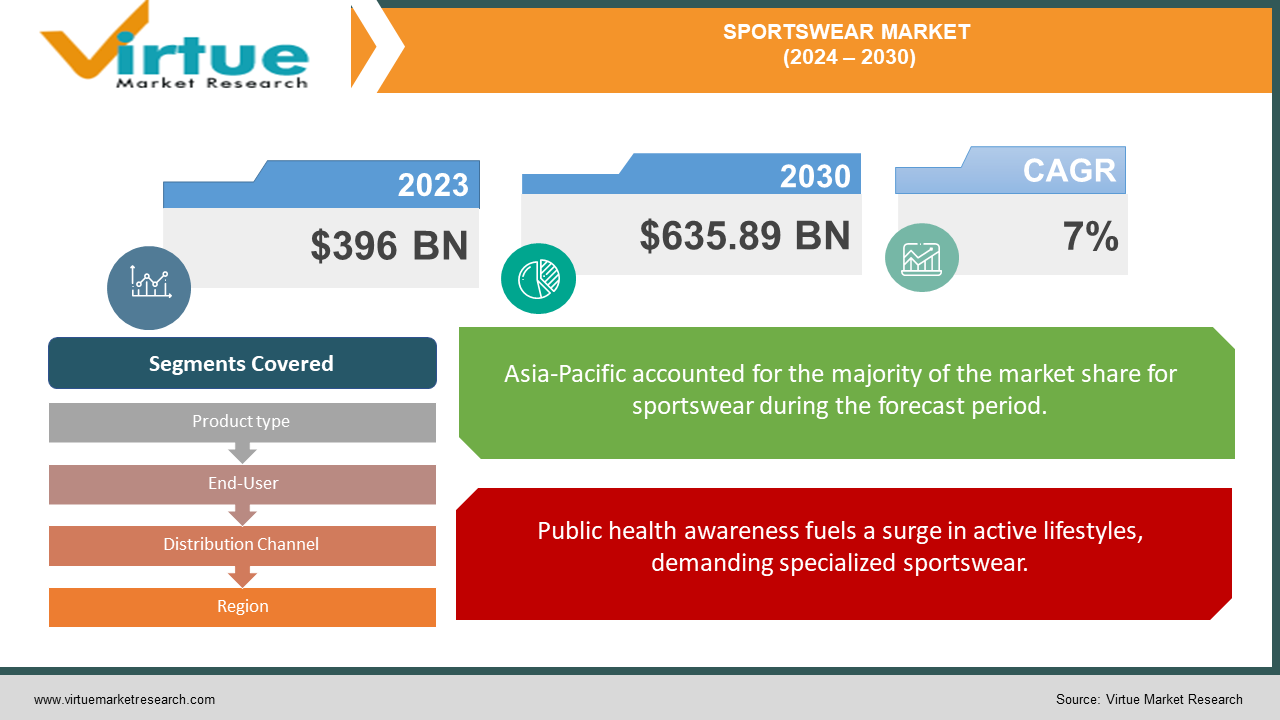

The Global Sportswear Market was valued at USD 396 billion in 2023 and is projected to reach a market size of USD 635.89 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 7%.

The sportswear market is experiencing a boom, fueled by a confluence of trends. The increasing popularity of athleisure wear, which combines comfort and style for both workouts and everyday life, is a major driver. As people become more health-conscious and prioritize wellness, they're investing in quality sportswear. This focus on fitness is also leading more people to participate in sports and recreational activities, creating demand for specialized clothing for different disciplines.

Key Market Insights:

85% of athletes prefer performance-enhancing sportswear indicating a strong market for advanced technical apparel.

The convenience and variety offered by online shopping have led to a situation where the majority of sportswear sales are conducted over the Internet. 90% of sportswear sales are online.

North America is the dominant region in the sportswear market. Asia-Pacific region is fastest growing in the sportswear market.

Sportswear Market Drivers:

Public health awareness fuels a surge in active lifestyles, demanding specialized sportswear.

Public health awareness and a growing emphasis on well-being are leading to a significant rise in participation in sports and recreational activities. People are going beyond the gym, embracing activities like running, cycling, yoga, and various fitness classes. This surge in active lifestyles is creating a massive demand for specialized sportswear that caters to the unique needs of different disciplines. Runners seek lightweight, breathable fabrics that wick away moisture, while yogis prioritize flexible and comfortable clothing that allows for a full range of motion.

The lines blur between gym and everyday wear with the rise of comfortable and stylish athleisure.

The boundaries between workout gear and everyday wear are dissolving rapidly. Athleisure wear, known for its comfort, versatility, and style, is a major driver of this shift. Consumers are increasingly opting for clothing that transitions seamlessly from the gym to errands or casual outings. This trend reflects a growing desire to prioritize both physical activity and fashionable aesthetics. Athleisure wear manufacturers are responding with innovative designs that offer both functionality and style, allowing people to integrate fitness into their daily routines without sacrificing their sense of self-expression.

Tech-infused clothing with features like biometric tracking empowers data-driven fitness enthusiasts.

The integration of technology is revolutionizing the sportswear market. Smart clothing with features like biometric tracking, performance monitoring, and even environmental sensors is gaining traction. These advancements cater to athletes and fitness enthusiasts who are data-driven and seek to optimize their workouts. Imagine running shoes that track your stride length and cadence, or a sports bra that monitors your heart rate during exercise.

A growing female sporting population drives demand for tailored styles and functionalities.

The demographics of sportswear consumers are undergoing a significant shift. The participation of women in sports is surging, influencing the sportswear market to cater to a wider range of styles and functionalities specifically tailored for the female form. This includes a focus on sports bras with better support and innovative designs for a more comfortable and flattering fit. Additionally, the growing popularity of fitness activities among older adults is prompting manufacturers to develop age-appropriate sportswear that prioritizes comfort and functionality for mature bodies.

Global Sportswear Market Restraints and Challenges:

While the sportswear market enjoys a surge in popularity, there are headwinds the "activewear armada" must navigate. One key challenge is market saturation and fierce competition. Established brands and innovative startups are locked in a battle, potentially leading to price wars and difficulty for companies to differentiate themselves and build brand loyalty.

Furthermore, economic uncertainty poses a threat. Sportswear is often viewed as non-essential, and during economic downturns, consumer spending on such items might decline. Disruptions in the global supply chain further complicate matters. Shortages of raw materials, manufacturing delays, and logistical hurdles can disrupt production, leading to both product availability issues and price hikes for consumers.

Another challenge is the prevalence of counterfeit sportswear. These imitations erode brand value, damage consumer trust, and eat into the profits of legitimate companies. Finally, sportswear brands need to stay nimble. Consumer preferences are evolving rapidly, with fashion trends changing quickly and tech integration becoming increasingly expected. Brands that fail to adapt to these desires by offering innovative and stylish activewear risk losing market share.

Sportswear Market Opportunities:

The "activewear armada" isn't just riding the current wave, it's actively seeking new destinations. Emerging markets with growing economies and a rising middle class present a vast opportunity for sportswear brands. As disposable incomes increase, the demand for quality activewear in these regions is expected to soar.

Personalization is another exciting frontier. Consumers are craving unique experiences, and sportswear brands can capitalize on this by offering customizable activewear. Imagine shoes tailored to your running form or workout shirts that adjust to your body temperature. Sustainability is also a key driver. Eco-conscious consumers are demanding eco-friendly practices, and brands that utilize recycled materials, adopt responsible manufacturing, and offer transparent supply chains can build strong customer loyalty.

The digital fitness revolution presents another opportunity. Integration with fitness apps and trackers can make sportswear an essential part of the digital fitness experience, allowing users to seamlessly track data and optimize their workouts. Finally, there's a growing focus on inclusivity. Traditionally, sportswear catered to a limited range of body types. However, brands are now recognizing the opportunity to develop activewear for diverse demographics, offering size-inclusive options and designs that cater to the specific needs of people with disabilities. By embracing these opportunities, the sportswear market can ensure continued growth and cater to the evolving needs of a more diverse and health-conscious consumer base.

SPORTSWEAR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7% |

|

Segments Covered |

By Product type, End-User, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nike, Adidas, Puma, Lululemon Athletica, Under Armour, Columbia Sportswear, Asics, Fila, Li Ning, Anta Sports |

Sportswear Market Segmentation: By Product Type

-

Performance Apparel

-

Athleisure Wear

-

Fitness Wear

While the athleisure trend is driving significant growth, performance apparel remains the most dominant segment in the sportswear market by product type. Performance apparel caters to athletes and prioritizes features like breathability and moisture-wicking, making it essential for serious fitness enthusiasts. Athleisure wear, on the other hand, is the fastest-growing segment, capitalizing on the rising demand for comfortable and stylish clothing that blends workouts seamlessly into daily life.

Sportswear Market Segmentation: By End-User

-

Men

-

Women

-

Children

The sportswear market is segmented by End-User, with Men's sportswear currently holding the dominant market share due to a longer history of participation in sports and a wider range of popular sports apparel categories. However, the Women's sportswear segment is experiencing the fastest growth, driven by a surge in female participation in sports and fitness activities, and a growing demand for stylish and functional activewear designed specifically for women's needs.

Sportswear Market Segmentation: By Distribution Channel

-

Specialty Stores

-

Department Stores and Sporting Goods Stores

-

Online Retailers

Within distribution channels, sporting goods stores hold the dominant position, currently accounting for the largest share of the market. This is because they offer a comprehensive selection of sportswear tailored for various sports and activities, along with expert advice for athletes and fitness enthusiasts. However, the fastest-growing segment is online retailers. With their convenience, competitive pricing, and the rise of omnichannel experiences that combine online and in-store shopping, online retailers are rapidly gaining traction.

Sportswear Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America: This region is a mature market with established sportswear giants and a strong culture of fitness and sports participation. The demand for performance apparel, athleisure wear, and footwear is high, with consumers willing to pay a premium for quality brands. However, market saturation and fierce competition are key challenges in North America.

Europe: A significant market for sportswear, Europe boasts a health-conscious population with a growing interest in running, cycling, and fitness activities. The European market is further segmented by strong national preferences and a thriving market for football (soccer) apparel. However, economic fluctuations and varying consumer spending habits across European countries require a nuanced approach for sportswear brands.

Asia-Pacific: This region is experiencing the fastest growth in the sportswear market, driven by a burgeoning middle class with rising disposable incomes and an increasing focus on health and wellness. China and India are key growth markets, with a growing demand for affordable yet stylish activewear. However, intellectual property concerns and efficient supply chain management are crucial considerations for brands entering the Asia-Pacific market.

COVID-19 Impact Analysis on the Sportswear Market:

The COVID-19 pandemic undoubtedly threw a curveball at the previously flourishing sportswear market, disrupting its growth trajectory. Lockdowns, mandated gym closures, and the cancellation of major sporting events led to a sharp decline in demand for sportswear in 2020. Confined to their homes, people had less need for performance apparel and traditional activewear designed for specific sports and activities. This sudden shift in consumer behavior, coupled with global supply chain disruptions caused by lockdowns and travel restrictions, resulted in shortages of raw materials, manufacturing delays, and ultimately, limited availability of sportswear across the board.

However, the pandemic's impact wasn't entirely negative. It also triggered a shift in consumer preferences towards athleisure wear and comfortable clothing suitable for home workouts. This trend, fueled by a growing focus on staying active despite limitations, partially mitigated the decline in demand for traditional sportswear. Additionally, with the rise of social distancing measures, the pandemic significantly accelerated the existing boom in e-commerce. This shift in shopping habits benefitted online retailers of sportswear, as consumers turned to them to fulfill their activewear needs during lockdowns and gym closures. Looking ahead, the sportswear market has shown signs of recovery as restrictions ease and people return to a more active lifestyle. The growing focus on health and wellness post-pandemic, coupled with the continued rise of digital fitness platforms offering convenient at-home workout options, is expected to drive renewed demand for sportswear. However, the long-term impact of COVID-19 on consumer spending habits and brand preferences remains to be seen. It will be crucial for sportswear brands to stay agile and adapt to this evolving landscape to capitalize on the opportunities that lie ahead.

Latest Trends/ Developments:

The sportswear market is constantly pushing the boundaries of innovation and functionality. One exciting trend is the rise of subscription services. These services offer consumers access to a curated selection of high-end activewear for a monthly fee, allowing them to experiment with different styles and brands without a significant upfront investment. This caters to a growing desire for flexibility and convenience among consumers.

Another trend is the rise of Athleisure 2.0. Athleisure wear continues to dominate, but it's evolving beyond just comfort and style. Athleisure 2.0 focuses on functionality, with activewear seamlessly integrating features like moisture-wicking fabrics, odor-resistant materials, and even built-in sun protection. This allows users to transition effortlessly from workouts to everyday activities without compromising on performance or aesthetics.

Key Players:

-

Nike

-

Adidas

-

Puma

-

Lululemon Athletica

-

Under Armour

-

Columbia Sportswear

-

Asics

-

Fila

-

Li Ning

-

Anta Sports

Chapter 1. Sportswear Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Sportswear Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Sportswear Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Sportswear Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Sportswear Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Sportswear Market – By Product Type

6.1 Introduction/Key Findings

6.2 Performance Apparel

6.3 Athleisure Wear

6.4 Fitness Wear

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Sportswear Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Specialty Stores

7.3 Department Stores and Sporting Goods Stores

7.4 Online Retailers

7.5 Y-O-Y Growth trend Analysis By Distribution Channel

7.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Sportswear Market – By End User

8.1 Introduction/Key Findings

8.2 Men

8.3 Women

8.4 Children

8.5 Y-O-Y Growth trend Analysis By End User

8.6 Absolute $ Opportunity Analysis By End User , 2024-2030

Chapter 9. Sportswear Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Distribution Channel

9.1.4 By End User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Distribution Channel

9.2.4 By End User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Distribution Channel

9.3.4 By End User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Distribution Channel

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Distribution Channel

9.5.4 By End User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Sportswear Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Nike

10.2 Adidas

10.3 Puma

10.4 Lululemon Athletica

10.5 Under Armour

10.6 Columbia Sportswear

10.7 Asics

10.8 Fila

10.9 Li Ning

10.10 Anta Sports

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Sportswear Market was valued at USD 396 billion in 2023 and is projected to reach a market size of USD 635.89 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 7%.

The Active Lifestyle Boom, The Athleisure Revolution, Tech-Enabled Fitness, Evolving Demographics.

Performance Apparel, Athleisure Wear, Fitness Wear.

North America is the most dominant region for the sportswear market, boasting a strong culture of fitness and established sportswear giants. However, Asia-Pacific is experiencing the fastest growth due to a rising middle class and increasing focus on health and wellness.

Nike, Adidas, Puma, Lululemon Athletica, Under Armour, Columbia Sportswear, Asics, Fila, Li Ning, Anta Sports.