Astaxanthin Market Size (2024 – 2030)

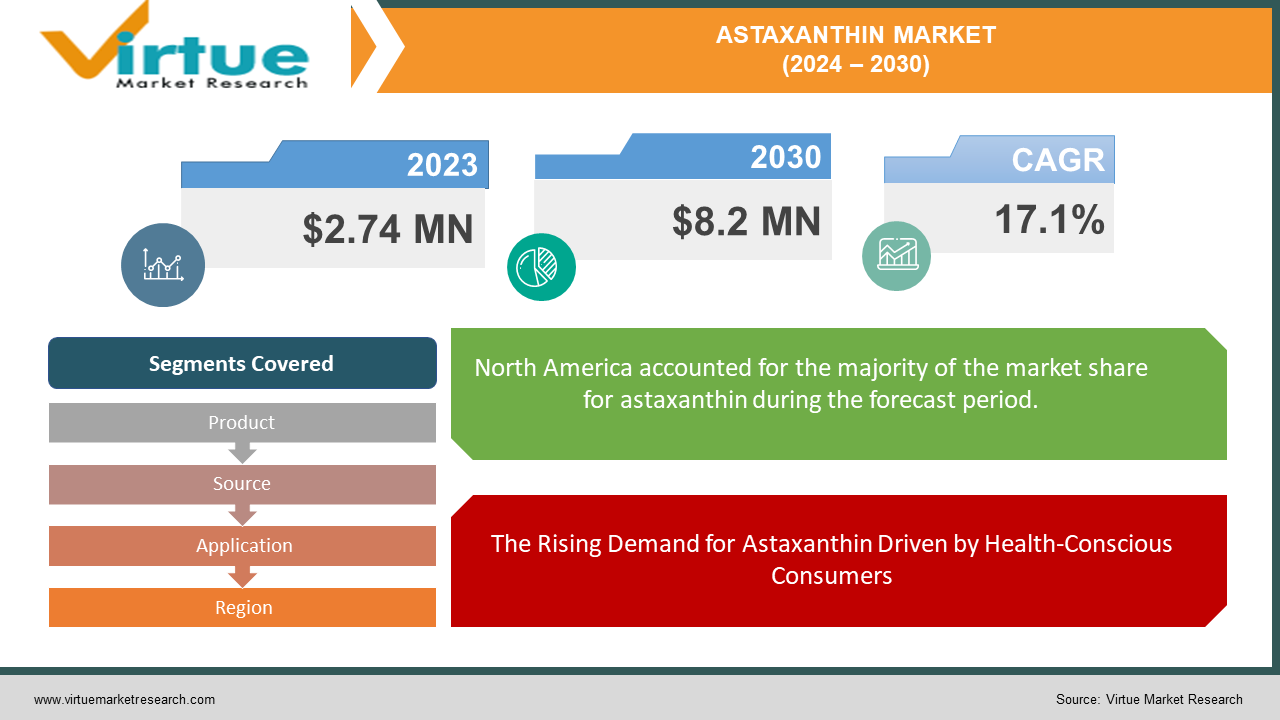

The Global Astaxanthin Market was valued at USD 2.74 million in 2023 and is projected to reach a market size of USD 8.2 Million by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 17.1% between 2024 and 2030.

The rising usage of astaxanthin in a variety of sectors, such as aquaculture, animal feed, nutraceuticals, cosmetics, medicines, and food and drink, is driving up demand for the nutrient. It is frequently used to improve the color and raise the market value of shrimp and fish, including salmon, trout, and ornamental fish. Aquatic animals also benefit from increased performance, immune-related gene expressions, stress tolerance, increased ability to reproduce, increased survival rates, and increased resistance to disease. With the need for astaxanthin in aquaculture growing, major players are concentrating on new product developments and joint ventures. Furthermore, the existence of institutions that proactively raise knowledge about the variety of uses for these goods is anticipated to fuel market expansion. One important organization that works to promote, preserve, and inform people about the advantages of natural astaxanthin in a variety of end-use applications is the Natural Algae Astaxanthin Association (NAXA). The association verifies items with the NAXA Verification Seal and funds research on natural astaxanthin. To enhance the penetration of natural astaxanthin-based products, companies are implementing tactics like launching new products and forming alliances with powerful players in end-use sectors.

Key Market Insights:

The astaxanthin market is witnessing a high degree of innovation, with companies developing novel formulations and sustainable production methods to meet growing demand.

Microalgae, like Haematococcus pluvialis, is the dominant source of astaxanthin, though other sources like yeast are being explored.

Astaxanthin finds application in various sectors including nutraceuticals (dietary supplements), food additives (coloring and functional benefits), aquaculture (for enhanced pigmentation in fish), cosmetics (for anti-aging properties), and animal feed (for improved health in livestock).

The growing number of health-conscious consumers seeking natural ingredients with health benefits is a major driver, with astaxanthin linked to improved immunity, anti-inflammatory effects, and disease prevention. Astaxanthin's use as a natural food coloring and its health benefits are driving demand in the food industry, expected to be a key growth factor.

Global Astaxanthin Market Drivers:

The Rising Demand for Astaxanthin Driven by Health-Conscious Consumers

As consumer awareness about health and wellness continues to increase, astaxanthin, a potent antioxidant, is gaining significant attention for its myriad of potential health benefits. Known for its powerful anti-inflammatory properties, astaxanthin supports cardiovascular health by reducing oxidative stress and improving lipid profiles. Its benefits extend to eye health, where it helps mitigate issues such as eye strain and age-related macular degeneration by protecting retinal cells from oxidative damage. Furthermore, astaxanthin's ability to enhance immune function makes it a valuable supplement in promoting overall health and resilience against infections. As research continues to highlight these advantages, more consumers are seeking astaxanthin supplements as part of their health regimens. This growing demand is spurred by the desire to harness natural compounds for preventive health measures, positioning astaxanthin as a key player in the nutraceutical market. As a result, the industry is expected to see a surge in the production and availability of astaxanthin-enriched products, from dietary supplements to functional foods, catering to the increasingly health-conscious population.

Expanding Applications Fueling the Demand for Astaxanthin Across Industries.

Astaxanthin, a versatile and powerful antioxidant, is witnessing growing demand across a diverse range of industries beyond nutraceuticals. In aquaculture and animal feed, astaxanthin is prized for enhancing the pigmentation and health of farmed fish and livestock, improving both aesthetic appeal and nutritional value. The cosmetics industry leverages its antioxidant properties to create anti-aging and skin-rejuvenating products, catering to consumers seeking natural beauty solutions. Pharmaceuticals are exploring astaxanthin's potential in developing treatments for various conditions due to its anti-inflammatory and immune-boosting effects. Additionally, the food and beverage sector is increasingly incorporating astaxanthin into functional foods and drinks, driven by the rising consumer preference for natural and health-enhancing ingredients. This broad spectrum of applications is further propelled by the overall trend toward natural products and the growing awareness of the health benefits associated with astaxanthin. As a result, the market for astaxanthin is expected to experience significant growth, driven by continuous innovation and the expanding use of this potent antioxidant in various end-use industries. This surge underscores the dynamic potential of astaxanthin as an essential ingredient in promoting health and wellness across multiple domains.

Global Astaxanthin Market Restraints and Challenges:

Despite the promising potential of astaxanthin, the global market faces significant challenges that could hinder its growth. A primary restraint is the limited breadth of scientific research on the full spectrum of astaxanthin's health benefits. While preliminary studies are encouraging, more comprehensive and conclusive data is essential to firmly establish its efficacy and reassure consumers. This gap in robust scientific validation can lead to hesitation among potential users. Additionally, the production and cost of astaxanthin present substantial hurdles. Extracting high-quality astaxanthin, particularly from natural sources like microalgae, is a complex and costly process. This often results in higher prices for astaxanthin supplements compared to other antioxidants, which can be a deterrent for price-sensitive consumers. Compounding this issue is the prevalence of adulteration with cheaper, synthetic versions of astaxanthin, which undermines consumer confidence and makes it difficult to ensure product authenticity and quality. These factors collectively pose significant barriers to the widespread adoption of astaxanthin supplements, highlighting the need for increased scientific research, cost-effective production methods, and stringent quality controls to realize the market's full potential.

Global Astaxanthin Market Opportunities:

The global astaxanthin market is poised for significant growth, driven by increasing awareness of its potent antioxidant properties and wide-ranging health benefits. This naturally occurring carotenoid, primarily derived from microalgae, yeast, and seafood, is gaining traction in various sectors, including dietary supplements, cosmetics, food and beverages, and animal feed. The rising consumer inclination towards natural and organic products is further fueling demand. Technological advancements in extraction and production methods are enhancing the purity and potency of astaxanthin, making it more appealing for high-end applications. Additionally, the expanding body of research linking astaxanthin to improved cardiovascular health, anti-inflammatory effects, and enhanced skin health is bolstering its popularity. The burgeoning wellness trend, coupled with increasing disposable incomes, particularly in emerging economies, presents lucrative opportunities for market players. Strategic collaborations, product innovations, and aggressive marketing are likely to be key strategies for companies to capitalize on this growth potential. However, challenges such as high production costs and regulatory hurdles must be navigated to fully harness the market's opportunities. Overall, the astaxanthin market is set to witness robust expansion as health-conscious consumers continue to seek natural and effective solutions for their wellness needs.

ASTAXANTHIN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

17.1% |

|

Segments Covered |

By Product, Source, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ENEOS Corporation, Algalíf Iceland ehf, Cyanotech Corporation, Atacama Bio Natural Products S.A., Algatech Ltd, Beijing Gingko Group (BGG), Fuji Chemical Industries Co., Ltd, E.I.D. – Parry (India) Limited (Alimtec S.A., Valensa International), MicroA, PIVEG, Inc. |

Global Astaxanthin Market Segmentation: By Product

-

Oil

-

Softgel

-

Liquid

-

Dried Algae Meal or Biomass

The Global Astaxanthin Market is Segmented by Product, Dried Algae Meal or Biomass had the largest market share last year and is poised to maintain its dominance throughout the forecast period. The majority of the growth in this market is related to its applications in the biomass production of various formulations, such as tablets or capsules. various important elements driving development include bulk production that is convenient, minimum downstream processing, and a higher use rate as animal feed. Additionally, the introduction of new products, like AstaPure Arava gummies by Solabia-Algatech Nutrition Ltd. in October 2023, showed that there was a growing need for algal astaxanthin. Similar to this, in May 2023, Algalif and the startup business Marea partnered to develop a biodegradable coating for products made from leftover algae biomass. During the research period, it is anticipated that these new advancements will fuel category expansion. Over the predicted years, it is expected that the softgel category will increase at a profitable rate. Softgels are a popular choice among customers because of their ease of use and suitability for older adults. Nutraceutical providers choose veggie softgels since they are made from modified cornstarch and glycerin, have an herbal origin, and have little side effects. Additionally, the continued regulatory acceptance of soft gel products is supporting the segment's growth. For example, NextFerm Technologies reported in September 2021 that Astaferm, a novel antioxidant in the form of oil for softness, has received regulatory marketing approval in the United States.

Global Astaxanthin Market Segmentation: By Source

-

Natural

-

Synthetic

The Global Astaxanthin Market is Segmented by Source, Natural had the largest market share last year and is poised to maintain its dominance throughout the forecast period. At the moment, it is used to treat cancer, Parkinson's disease, Alzheimer's disease, hypercholesterolemia, and stroke. Furthermore, because natural astaxanthin has a 10-fold higher free radical inhibitory action than other antioxidants, many studies have shown that it is beneficial for the skin and eyes. These studies include the treatment of ophthalmic diseases such as cataracts, glaucoma, and uveitis, as well as skin photoaging. Furthermore, continued research endeavors aimed at improving the caliber and use of astaxanthin generated from yeast should propel the market's expansion. For example, in February 2023, research from National Chung Hsing University, National Taiwan Ocean University, and China Medical University Hospital suggested that genetically modified yeast would be a suitable source of astaxanthin for shrimp diets. In the astaxanthin market, the synthetic segment is predicted to expand at a notable CAGR over the anticipated period of time. The market is being helped by rising demand in the aquaculture and animal feed industries as well as the availability of safe and authorized products like Cardax, Inc.'s anti-inflammatory ZanthoSyn. Important firms in the synthetic astaxanthin production industry are launching campaigns to expand their global market share. For example, in August 2021, DSM and Foss Analytical worked together to create a quick and accurate test to determine the amount of astaxanthin in the salmon diet. Additionally, Cardax, Inc. is investigating astaxanthin's possible use in COVID-19 patients.

Global Astaxanthin Market Segmentation: By Application

-

Aquaculture & Animal Feed

-

Nutraceuticals

The Global Astaxanthin Market is Segmented by Application, Aquaculture & Animal Feed had the largest market share last year and is poised to maintain its dominance throughout the forecast period. In order to give salmon, trout, and shrimp a reddish color, natural astaxanthin is fed to them. This is one of the main factors influencing consumer preference. Shrimp grow more quickly as a result of increased feed uptake caused by astaxanthin oil. The segment's substantial market share is thus a result of the aquaculture industry's growing use of these goods to improve seafood quality. Important industry firms are also launching new items for animal feed that have therapeutic advantages. For example, AstaReal released Novasta, an astaxanthin component intended for use in animal feed, in July 2022. The introduction of this product broadens the range of potential applications in animal feeding that can improve health. Natural astaxanthin is fed to salmon, trout, and shrimp to give them a reddish color. One of the key elements affecting customer preference is this. Astaxanthin oil increases the amount of feed that shrimp take up, which accelerates their growth. Therefore, the aquaculture industry's increasing usage of these products to enhance seafood quality accounts for the segment's significant market share. Prominent industry companies are also introducing novel products for animal feed with medical benefits. For instance, in July 2022, AstaReal launched Novasta, an astaxanthin component meant for usage in animal feed. The launch of this product expands the possible uses for animal nutrition that may enhance health.

Global Astaxanthin Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Global Astaxanthin Market is Segmented by Region, North America had the largest market share last year and is poised to maintain its dominance throughout the forecast period. One major reason driving demand in the region is the increasing prevalence of skin-related diseases and nutrition-related disorders. In addition, the market is anticipated to be supported throughout the projected period by the existence of important manufacturers in North America such as Cyanotech, Piveg, Inc., and Beijing Ginko Group (BGG), as well as synthetic producers like Cardax, Inc. Furthermore, a well-established cosmeceutical sector, a significant number of health-conscious consumers, and the rising acceptance of nutraceuticals all contribute to the acceleration of market expansion in North America. All of these elements work together to fuel the region's rising market demand. Asia Pacific is anticipated to develop at the quickest rate over the projected period. Demand for these products in Asia Pacific is rising due to a number of important causes, including rising R&D spending, increased production in the area, and economic expansion. Furthermore, following a successful market test run, BodyFirst Wellness Nutrition, an Indian nutraceutical company, introduced its products both nationally and internationally. The official launch aims for a wider market reach, building on nine months of online and retail sales as well as a strong presence in North India through 15 distributors. The expansion highlights the rising popularity of conventional, natural components like ashwagandha and astaxanthin in the Indian market by working with 100 additional Indian distributors and making the product available online for customers worldwide.

COVID-19 Impact Analysis on the Global Astaxanthin Market.

The COVID-19 pandemic had a profound impact on the global astaxanthin market, affecting both supply and demand dynamics. Initially, the market faced challenges due to disrupted supply chains, restrictions on transportation, and labor shortages, leading to a slowdown in production and distribution. However, as the pandemic progressed, there was a notable shift in consumer behavior towards health and wellness products. Astaxanthin, known for its potent antioxidant properties and potential immune-supporting benefits, saw increased demand, particularly in the nutraceutical and dietary supplement sectors. The heightened awareness of the importance of immune health drove consumers to seek out products like astaxanthin, which were perceived to offer additional protection against illness. Furthermore, the rise of e-commerce platforms during lockdowns facilitated easier access to these supplements, supporting market growth. Research studies suggesting astaxanthin’s role in reducing oxidative stress and inflammation, factors relevant to severe COVID-19 cases, also spurred interest. Consequently, despite initial disruptions, the astaxanthin market experienced a rebound and growth, reflecting a broader trend of heightened health consciousness and a sustained increase in demand for functional ingredients during and after the pandemic.

Latest trends / Developments:

The global astaxanthin market is currently witnessing several key trends and developments. One significant trend is the increasing adoption of natural astaxanthin derived from microalgae, driven by consumer preference for natural and clean-label products over synthetic alternatives. Advances in cultivation technologies and extraction methods are enhancing the efficiency and sustainability of natural astaxanthin production. Additionally, there's a growing interest in astaxanthin’s applications beyond dietary supplements, extending into skincare and cosmetics due to its potent anti-aging and skin-protective properties. The aquaculture industry continues to be a major driver, utilizing astaxanthin to improve the health and pigmentation of farmed fish and shrimp. Regulatory approvals and scientific endorsements of astaxanthin's health benefits are further bolstering market growth. The trend towards personalized nutrition is also influencing product innovation, with manufacturers developing customized astaxanthin formulations targeting specific health concerns. Moreover, the expansion of e-commerce platforms is making astaxanthin products more accessible to a global consumer base. Collectively, these trends are contributing to a robust and dynamic market landscape for astaxanthin, reflecting its versatile applications and increasing consumer awareness of its health benefits.

Key Players:

-

ENEOS Corporation

-

Algalíf Iceland ehf

-

Cyanotech Corporation

-

Atacama Bio Natural Products S.A.

-

Algatech Ltd

-

Beijing Gingko Group (BGG)

-

Fuji Chemical Industries Co., Ltd

-

E.I.D. – Parry (India) Limited (Alimtec S.A., Valensa International)

-

MicroA

-

PIVEG, Inc.

Chapter 1. Astaxanthin Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Deployment Models

1.5 Secondary Deployment Models

Chapter 2. Astaxanthin Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Astaxanthin Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Astaxanthin Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Astaxanthin Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Astaxanthin Market – By Product

6.1 Introduction/Key Findings

6.2 Oil

6.3 Softgel

6.4 Liquid

6.5 Dried Algae Meal or Biomass

6.6 Y-O-Y Growth trend Analysis By Product

6.7 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Astaxanthin Market – By Source

7.1 Introduction/Key Findings

7.2 Natural

7.3 Synthetic

7.4 Y-O-Y Growth trend Analysis By Source

7.5 Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 8. Astaxanthin Market – By Application

8.1 Introduction/Key Findings

8.2 Aquaculture & Animal Feed

8.3 Nutraceuticals

8.4 Y-O-Y Growth trend Analysis By Application

8.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Astaxanthin Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product

9.1.3 By Source

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product

9.2.3 By Source

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product

9.3.3 By Source

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product

9.4.3 By Source

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product

9.5.3 By Source

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Astaxanthin Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 ENEOS Corporation

10.2 Algalíf Iceland ehf

10.3 Cyanotech Corporation

10.4 Atacama Bio Natural Products S.A.

10.5 Algatech Ltd

10.6 Beijing Gingko Group (BGG)

10.7 Fuji Chemical Industries Co., Ltd

10.8 E.I.D. – Parry (India) Limited (Alimtec S.A., Valensa International)

10.9 MicroA

10.10 PIVEG, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

By 2023, the Global astaxanthin market is expected to be valued at US$ 2.74 million.

Through 2030, the global astaxanthin market is expected to grow at a CAGR of 17.1%.

By 2030, the global astaxanthin is expected to grow to a value of US$ 8.27 Million.

North America is predicted to lead the market globally for astaxanthin.

The global astaxanthin has segments like Application, Source, Product, and Region.