Naturally Extracted Astaxanthin Market Size (2023-2030)

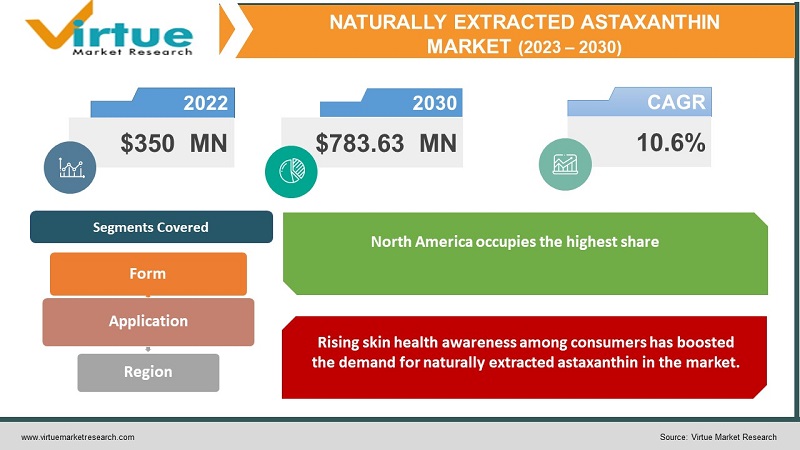

The Naturally Extracted Astaxanthin Market was valued at USD 350 million in 2022 and is estimated to reach USD 783.63 million by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 10.6%.

Astaxanthin had limited applications in the past due to a lack of knowledge regarding its numerous benefits and limited research & development. However, in the present, increasing trends in natural and sustainable products have increased the demand for astaxanthin in various industries, especially in skincare and haircare products such as creams, lotions, shampoos, and gels. Moreover, continuous research in biotechnology and botany has further increased its applications in the food industry for coloring and flavoring purposes. Additionally, health awareness among consumers has induced pharmaceutical & nutraceutical companies to incorporate natural extracts of astaxanthin in medicines, supplements, and capsules. The future holds positive for the naturally extracted astaxanthin market with growing trends in natural and sustainable production methods and shifting consumer preferences for natural and organic skin products. Furthermore, growing trends in veganism are anticipated to develop the market landscape for naturally extracted astaxanthin in the market.

Key Market Insights:

As per Skinstore US, nearly US$ 18.7 million was spent on the skincare regime by Americans in the year 2021.

As per British Beauty Council Report 2022, the personal care industry accounted for £24.5 billion of GDP contribution.

As per the CDC (Center for Disease Control & Prevention) National Health and Nutrition Examination Survey, 63.8% of women consume dietary supplements aged 20 and over in the USA.

As per a research study published in the National Library of Medicine, demand for dietary supplements increased by 44% during pre-pandemic levels (around April 2020).

There is no set dosage requirement for astaxanthin. However, some studies have suggested consuming only 4mg of astaxanthin per day, while the USDA has approved 12 mg of astaxanthin doses per day.

Naturally Extracted Astaxanthin Market Drivers:

Rising skin health awareness among consumers has boosted the demand for naturally extracted astaxanthin in the market.

Consumers have become aware of their skin health, as they understand the ill effects of harsh chemical products on their skin, such as skin irritation, skin inflammation, dark patches, and others. As per, the Mesothelioma Center’s survey, 45% of people are concerned regarding the dangers associated with unregulated cosmetics. Therefore, they are increasingly demanding natural and organic skin products that not only improve their skin texture but also improve their skin health. Astaxanthin-based skin products contain antioxidant and anti-inflammatory properties that protect the skin from cell damage, exposure to UV radiation, protection from free radicals, and others. Moreover, specialized skin products such as those meant for targeting anti-aging, skin brightening, and sun protection increasingly use natural extracts of astaxanthin in their products. These include the use of natural astaxanthin in anti-aging creams and face serums, UV creams and lotions, anti-acne face cream, skin-brightening face gel, pure astaxanthin serum capsules for the face, and others. For instance, Bianca Rosa’s Astaxanthin Algae-based face cream

Increasing demand for naturally sourced products has boosted the demand for naturally extracted astaxanthin in the market.

Increasing environmental awareness has induced manufacturers to incorporate natural production and processing methods among consumers regarding natural food and naturally sourced personal care product consumption, which further increased the demand for natural astaxanthin products in the market. As per a survey conducted by UNICEF, 73% of citizens are concerned about climate change and its impact. Manufacturers of beauty & personal care companies, food companies, pharmacy companies, and animal feed companies are utilizing naturally extracted astaxanthin in their products which helps in minimizing resource wastage and carbon footprint. Moreover, astaxanthin is derived from natural sources like microalgae and seafood such as shrimp and salmon, which makes it an environment-friendly ingredient to be used in various products. Moreover, trends in green and clean packaging & labeling have further increased the usage of natural astaxanthin in the market.

Naturally Extracted Astaxanthin Market Restraints and Challenges:

Expensive sourcing costs can decrease the demand for naturally extracted astaxanthin in the market. Sourcing of astaxanthin from natural sources can become costly, as it requires efficient transportation and knowledge support, which can lead to an increase in production costs.

Furthermore, since astaxanthin is sourced from microalgae and other sea animals, it can lead to the depletion of marine animals and affect the marine ecosystem. This can lead to a decline in demand for naturally extracted astaxanthin in the market.

In addition, competition from synthetic astaxanthin can deter the market growth of natural astaxanthin, due to increased effectiveness, cost-effectiveness, and quicker results of synthetic astaxanthin compared to natural counterparts.

Naturally Extracted Astaxanthin Market Opportunities:

The Naturally Extracted Astaxanthin Market is anticipated to deliver lucrative opportunities for businesses, which include acquisitions, partnerships, collaborations, product launches, and agreements during the forecasted period. Furthermore, increasing demand for environmentally friendly and sustainable ingredients in the food & and beverage, cosmetics, and nutraceuticals industry is predicted to develop the market for naturally extracted astaxanthin and enhance its future growth opportunities.

NATURALL EXTRACTED ASTAXANTHIN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

10.6% |

|

Segments Covered |

By Form, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Fermenta Biotech, Profound Nutrition, AstaReal USA, Divi’s Nutraceuticals, Algatech, Herba Diet, Algae to Omega Holdings Inc, Biolife Science, Algae Health sciences |

Naturally Extracted Astaxanthin Market Segmentation

Naturally Extracted Astaxanthin Market Segmentation: By Form

- Oil

- Powder

- Softgel

- Others

In 2022, based on market segmentation by form, the oil segment occupies the highest share of about 34% in the market. Oil-based astaxanthin is widely used in beauty & personal care and the food & beverage sector in the market. Astaxanthin possesses antioxidant properties, which are beneficial for the skin, and hence is widely used in body creams, gels, and serums. Moreover, it helps in reducing wrinkles, age spots, and blemishes, and enhances the texture of the skin. Furthermore, astaxanthin being vibrant in colour, is widely used as a colouring agent in many dishes and also as a dressing for side dishes. Moreover, naturally extracted astaxanthin contains immunity-boosting elements that can be used in vegan or plant-based diets as a functional ingredient.

The powder segment is the fastest-growing segment during the forecast period. Powdered astaxanthin is increasingly used in dietary supplements for nutritional benefits such as immunity boosting, cell repair, muscle repair, enhanced athletic performance, and others. Furthermore, powdered astaxanthin is used for the encapsulation of dietary capsules and is also used as an additive mixture in dietary mixes.

Naturally Extracted Astaxanthin Market Segmentation: By Application

- Food & Beverages

- Beauty & Personal Care

- Pharmaceuticals

- Nutraceuticals

- Animal Feed

- Others

In 2022, based on market segmentation by application, beauty & personal care occupies the highest share of about 28.6% in the market. Due to its cell repairing, skin repairing, antioxidant, and anti-inflammatory properties, astaxanthin is widely used in skincare products such as anti-acne and blemish creams, face serum, anti-aging creams, UV creams and face gels, and others. Moreover, astaxanthin helps to improve collagen production in hair by reducing hair loss, and can also reverse graying of hair, as it contains antioxidant elements in it. This further makes it a widely used ingredient in hair serums, hair gels, sprays, shampoos, and others.

Nutraceuticals are the fastest-growing segment during the forecast period. Astaxanthin is rich in vitamin E and C and also possess excellent antioxidant properties, which makes it suitable for producing nutraceutical products. Products containing astaxanthin provide numerous health benefits to people and help in curing chronic diseases such as cancer and cardiovascular. Additionally, more than one-third of Americans consume supplements. Moreover, astaxanthin capsules are an ideal choice for athletes, as they enhance their performance, increase energy levels, improve immunity, reduce the risk of diabetes, and others. Dietary and joint health supplements are the most common product in the nutraceuticals segment that accounts for the largest use of naturally extracted astaxanthin in the market.

Naturally Extracted Astaxanthin Market Segmentation: Regional Analysis:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

In 2022, based on market segmentation by region, North America occupies the highest share of about 36% in the market. Increasing skin diseases and rising awareness of consumers regarding skin health a contributing factors to the growth of naturally extracted astaxanthin in the North American market. Moreover, the rapidly booming fitness & athletic sector increasingly demands supplements, which further boosts the demand for natural astaxanthin in the region.

Asia-Pacific is the fastest-growing region during the forecast period. Increasing health awareness in Southeast Asia regions post-pandemic, and ever-increasing demand for natural and authentic food, particularly vegan and plant-based food products, have contributed to the demand for naturally extracted astaxanthin in the market.

COVID-19 Impact Analysis on the Naturally Extracted Astaxanthin Market:

The pandemic had a significant impact on the naturally extracted astaxanthin market. Due to the spread of virus infection globally, there was an increase in health awareness during the pandemic, which induced consumers to purchase immunity-boosting and healthy medicines and supplements that protect them from getting infected. This increased the demand for naturally extracted astaxanthin from e-commerce platforms in the market. However, the sourcing of natural extracts of astaxanthin witnessed a slowdown due to geographical restrictions and a shortage of labor during the pandemic. Additionally, the closure of major industries such as food & beverage, cosmetics, and others reduced the demand for naturally extracted astaxanthin in the market. This further affected the production, manufacturing, and processing of natural astaxanthin products, such as supplements, gels, creams, lotions, and food products.

Latest Developments:

The market for naturally extracted astaxanthin is anticipated to witness an increasing demand on account of new product innovations and launches and continuous research on its benefits and applications. Furthermore, sustainable production & cultivation trends are further surging the demand for natural astaxanthin in various industries such as food & beverage, pharmaceuticals, cosmetics, nutraceuticals, and others.

- In July 2021, AstaReal AB launched an astaxanthin brand called NOVASTA in Europe. The product of this segment is meant for aquaculture nutrition, as it helps in ensuring optimal growth, health, and pigmentation of fish and crustaceans. Moreover, the product is naturally sourced from algae and limits the need for aquaculturists to produce astaxanthin from fish-based products.

- In February 2021, Solabia-Algatech Nutrition launched astaxanthin-based powder for supplements and beverages. The product is a microencapsulated cold-water dispersible powder that contains 2.5% natural astaxanthin sourced from haematococcus pluvialis microalgae by using the supercritical CO2 method. Moreover, the product can be used in ready-to-mix supplements, drinks, suspensions, sports drinks, and other beverages.

Key Players:

- Fermenta Biotech

- Profound Nutrition

- AstaReal USA

- Divi’s Nutraceuticals

- Algatech

- Herba Diet

- Algae to Omega Holdings Inc

- Biolife Science

- Algae Health sciences

Chapter 1. GLOBAL NATURALLY EXTRACTED ASTAXANTHIN MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL NATURALLY EXTRACTED ASTAXANTHIN MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL NATURALLY EXTRACTED ASTAXANTHIN MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL NATURALLY EXTRACTED ASTAXANTHIN MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL NATURALLY EXTRACTED ASTAXANTHIN MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL NATURALLY EXTRACTED ASTAXANTHIN MARKET – By Form

6.1. Introduction/Key Findings

6.2. Oil

6.3. Powder

6.4. Softgel

6.5. Others

6.6. Y-O-Y Growth trend Analysis By Form

6.7. Absolute $ Opportunity Analysis By Form , 2023-2030

Chapter 7. GLOBAL NATURALLY EXTRACTED ASTAXANTHIN MARKET – By Application

7.1. Introduction/Key Findings

7.2. Food & Beverages

7.3. Beauty & Personal Care

7.4. Pharmaceuticals

7.5. Nutraceuticals

7.6. Animal Feed

7.7. Others

7.8. Y-O-Y Growth trend Analysis By Application

7.9 . Absolute $ Opportunity Analysis By Application , 2023-2030

Chapter 8. GLOBAL NATURALLY EXTRACTED ASTAXANTHIN MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Form

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Application

8.2.3. By Form

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Application

8.3.3. By Form

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Application

8.4.3. By Form

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Application

8.5.3. By Form

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL NATURALLY EXTRACTED ASTAXANTHIN MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Fermenta Biotech

9.2. Profound Nutrition

9.3. AstaReal USA

9.4. Divi’s Nutraceuticals

9.5. Algatech

9.6. Herba Diet

9.7. Algae to Omega Holdings Inc

9.8. Biolife Science

9.9. Algae Health sciences

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Naturally Extracted Astaxanthin Market was valued at USD 350 million in 2022 and is estimated to reach USD 783.63 million by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 10.6%.

Rising skin health awareness among consumers and increasing demand for naturally sourced products have boosted the market growth for liquid carbon dioxide are the market drivers of the Naturally Extracted Astaxanthin Market.

Oil, Powder, Softgel, and Others are the segments under the Naturally Extracted Astaxanthin Market by form

North America is the most dominant region for the Naturally Extracted Astaxanthin Market

Asia-Pacific is the fastest-growing region in the Naturally Extracted Astaxanthin Market.