Asia Pacific Yogurts Market Size (2024-2030)

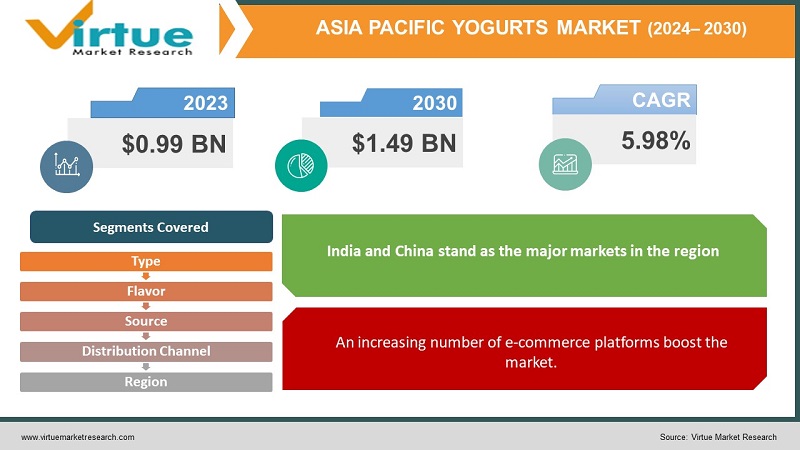

The Asia Pacific Yogurts Market was valued at USD 0.99 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 1.49 billion by 2030, growing at a CAGR of 5.98%.

Yogurt, a tangy dairy product that is frequently sweetened or flavored, is produced through the homogenization and fermentation of pasteurized milk. It is enjoyed in multiple forms, such as beverages, snacks, meal replacements, desserts, and protein-enriched sports drinks. The health advantages linked to yogurt consumption encompass promoting healthy digestion, reducing the risk of type 2 diabetes, safeguarding against colorectal cancer, preventing and managing osteoporosis, aiding in weight and fat loss, bolstering the immune system, and lowering high blood pressure and bad cholesterol levels.

Key Market Insights:

- A significant driver of growth in the Asia Pacific yogurt market is the active pursuit of healthier food options by over 50% of consumers in the region.

- Changing eating habits influenced by busy lifestyles have led to a notable increase (around 30%) in the demand for convenient grab-and-go snacks.

- This trend has notably boosted the popularity of drinkable yogurts and products featuring user-friendly packaging, catering to the needs of consumers seeking quick and hassle-free options.

- Flavored yogurts hold a significant market share, exceeding 60%, primarily due to their broader appeal compared to plain varieties.

- Off-trade channels, including supermarkets, hypermarkets, and convenience stores, dominate yogurt sales, accounting for over 70% of the market.

Asia Pacific Yogurts Market Drivers:

Improved health benefits of yogurt products drive market growth.

The increasing consumption of yogurt can be attributed to its myriad health advantages. Recognized as a protein-rich dietary option, yogurt enhances metabolism, rendering it particularly appealing to individuals seeking to increase calorie expenditure throughout the day. Moreover, aside from its role in weight management, yogurt fosters the proliferation of beneficial gut bacteria. Consequently, the demand for unflavored yogurt continues to soar across diverse geographical regions. In India, yogurt, commonly referred to as curd, holds a prominent position in the daily dietary habits of the populace, frequently integrated into meals or consumed as a refreshment. Similarly, yogurt consumption in Australia has experienced notable expansion over the last decade, being widely acknowledged as a nutritious snacking alternative.

An increasing number of e-commerce platforms boost the market.

The burgeoning presence of diverse e-commerce platforms is simplifying the yogurt purchasing process for consumers. Through a few simple clicks, individuals can acquire their preferred yogurt varieties and flavors or explore new options. Furthermore, the introduction of subscription-based models and home delivery services enhances accessibility to yogurt products, facilitating purchases from the comfort of one's residence. Additionally, the strategic placement of yogurt items in visually appealing displays and refrigerated sections within brick-and-mortar stores aims to stimulate impulse buying, thereby bolstering market growth. Moreover, a comprehensive analysis of the yogurt market prices in e-commerce underscores a competitive environment, presenting opportunities for strategic pricing and expansion within the realm of online retail.

Asia Pacific Yogurts Market Restraints and Challenges:

An increase in vegan product demand restrains market growth.

The surging popularity of vegan or dairy-free alternatives, coupled with the rising prevalence of lactose intolerance, is poised to support the market's growth trajectory. Moreover, the proliferation of a diverse array of plant-based yogurt options and a shift in consumer preferences toward vegan products are anticipated to propel market expansion. Additionally, the escalating health consciousness among consumers is expected to exert a significant influence on the growth rate of the market.

Asia Pacific Yogurts Market Opportunities:

The increasing demand for yogurt-based recipes from cafes and restaurants is contributing to the sustained growth of the market. This trend is notably pronounced in Southeast Asia, where the food service sector has witnessed substantial growth, marked by the strategic expansion of foreign food chains in the region.

ASIA PACIFIC YOGURTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.98% |

|

Segments Covered |

By Type, flavor, source, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

China, India, Japan, Australia & New Zealand, South Korea, Rest of APAC |

|

Key Companies Profiled |

Gujarat Cooperative Milk Marketing Federation Ltd (Amul), China Mengniu Dairy Company Ltd, Inner Mongolia Yili Industrial Group Co. Ltd, Unilever, Yakult Honsha Co. Ltd, Meiji Dairies Corporation, General Mills Inc., Nestle, Danone and Britannia industries limited. |

Asia Pacific Yogurts Market Segmentation:

Asia Pacific Yogurts Market Segmentation By Type:

- Set Yogurt

- Greek Yogurt

- Yogurt Drinks

- Frozen Yogurt

The set yogurt segment has emerged as the dominant force in the yogurt market. Set yogurt, characterized by its firmer texture attained through pot setting, retains its creamy and smooth consistency. The preparation of yogurt involves the utilization of raw materials such as milk sourced from cows or goats, live and active bacterial cultures for fermentation, as well as various fruits and flavors to augment its taste profile. The ready availability of raw materials, coupled with a growing awareness regarding healthy dietary choices, and the expanding base of health-conscious young consumers, collectively contribute to the burgeoning growth of the set yogurt market.

Asia Pacific Yogurts Market Segmentation By Flavor:

- Plain

- Flavored

- Strawberry Blend

- Vanilla

- Plain

- Strawberry

- Peach

- Others

The plain segment emerged as the primary driver of market growth. Non-flavored yogurt holds significant popularity within the food services sector, often utilized to enhance the taste and texture of processed foods. Moreover, the accessibility of yogurt offerings boasting high nutritional value, elevated protein content, and the continual introduction of new products and innovations are anticipated to fuel the expansion of the yogurt market size across the forecast period.

Strawberries command the largest share in the market. Strawberry-flavored yogurt typically incorporates flavorings rather than actual fruit extracts, resulting in a consistent texture and taste. It may contain artificial flavors or sugar to impart a sweet and fruity flavor profile. Vanilla-flavored yogurt is crafted by incorporating vanilla extract or vanilla bean into yogurt, boasting an aromatic flavor profile with a smooth texture compared to fruit-based variants. It complements various fruits and nuts exceptionally well.

Asia Pacific Yogurts Market Segmentation By Source:

- Dairy-Based Yogurt

- Non-Dairy Based Yogurt

The dairy-based segment emerged as the primary contributor to the market and is projected to continue its growth trajectory throughout the forecast period. The dairy-based segment remains highly favored within the yogurt market, largely due to the widespread popularity of dairy-based food products and their cost-effectiveness compared to non-dairy alternatives. Additionally, the increasing production of animal milk, which serves as the foundational ingredient for yogurt, further supports market expansion.

Asia Pacific Yogurts Market Segmentation By Distribution Channel:

- Supermarkets And Hypermarkets

- Convenience Stores

- Specialist Retailers

- Online Stores

- Others

The supermarket and hypermarket segment stands out as the predominant distribution channel, driving the highest yogurt sales, capturing approximately half of the market share. Additionally, other distribution channels such as online stores and home deliveries are experiencing rapid growth during the forecast period. The market share of yogurt and yogurt-fortified product brands in supermarkets and hypermarkets is anticipated to witness significant expansion in the forecast period. Moreover, customers benefit from the convenience of product selection due to the diverse range of brands available under one roof.

In the non-store retailing category in Asia-Pacific, e-commerce emerges as the fastest-growing channel for yogurt sales. The segment accounted for a share of 4.81% in 2022 within the region. Notably, in 2023, 54% of Chinese consumers expressed a preference for e-commerce platforms when purchasing food products, including dairy items. Marketing strategies such as group buying, live streaming events, and discounts are being employed to attract consumers to e-commerce platforms. In China, popular e-commerce platforms for yogurt sales include Tmall Global, JD Worldwide, and Pinduoduo.

Asia Pacific Yogurts Market Segmentation- by Region

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- Rest of APAC

India and China stand as the major markets in the region, with New Zealand and Japan following suit. Together, India and China accounted for a 65.25% share of yogurt volume sales across the region in 2023. Yogurt, an ancient food, has been a staple in the daily diets of various regional countries for thousands of years. Key drivers include the high production of raw milk, an increasing consumer preference for quality dairy products, and robust industry regulations facilitating the manufacturing and trading of dairy products. Notably, the Government of India has allowed 100% Foreign Direct Investment (FDI) through the automatic route for food processing, leading to substantial FDIs in the dairy industry, which constitute about 40% of FDIs in the Indian food industry. India also ranks among the largest consumers of yogurt globally, as it holds a prominent place in many Indian cuisines.

China emerges as the fastest-growing yogurt market in Asia-Pacific. Fruit-flavored yogurts, including strawberry, raspberry, and blueberry variants, enjoy widespread preference among Chinese consumers. China notably demonstrates a strong inclination towards lactose-free yogurt, with over 92% of the population experiencing allergic reactions to lactose found in dairy products, leading to discomforts such as flatulence and diarrhea. Yogurt products, through fermentation, effectively break down a significant portion of lactose, thereby substantially reducing the likelihood of allergic reactions.

COVID-19 Pandemic: Impact Analysis

Initially, yogurt sales faced a downturn due to COVID-19 restrictions imposed on brick-and-mortar stores. However, notable industry players are now strategically redirecting their focus towards fortifying their market presence through e-commerce platforms and online marketing endeavors, aiming to engage consumers beyond traditional geographical boundaries. Furthermore, the pandemic-induced shift in consumer behavior towards seeking immunity-boosting products and fortified options with health benefits has prompted major players to enhance the formulation of their yogurt offerings. This involves integrating organic ingredients, eliminating cholesterol, and introducing vegan variants free from added preservatives or additives, in alignment with evolving consumer preferences for healthier and more sustainable food choices.

Latest Trends/ Developments:

July 2022: Amul unveiled plans for a USD 60 million investment aimed at constructing a new dairy facility in Rajkot, to expand its production capacity for milk, yogurt, and buttermilk products.

Key Players:

These are the top 10 players in the Asia Pacific yogurt market: -

- Gujarat Cooperative Milk Marketing Federation Ltd (Amul)

- China Mengniu Dairy Company Ltd

- Inner Mongolia Yili Industrial Group Co. Ltd

- Unilever

- Yakult Honsha Co. Ltd

- Meiji Dairies Corporation

- General Mills Inc.

- Nestle

- Danone

- Britannia industries limited

Chapter 1. ASIA PACIFIC YOGURT MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. ASIA PACIFIC YOGURT MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. ASIA PACIFIC YOGURT MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. ASIA PACIFIC YOGURT MARK ET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. ASIA PACIFIC YOGURT MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. ASIA PACIFIC YOGURT MARKET – By Type

6.1 Introduction/Key Findings

6.2. Set Yogurt

6.3. Greek Yogurt

6.4. Yogurt Drinks

6.5. Frozen Yogurt

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type, 2023-2030

Chapter 7. ASIA PACIFIC YOGURT MARKET – By Flavor

7.1. Introduction/Key Findings

7.2. Plain

7.3. Flavored

7.4. Strawberry Blend

7.5. Vanilla

7.6. Plain

7.7. Strawberry

7.8. Peach

7.9. Others

7.10. Y-O-Y Growth trend Analysis By Flavor

7.11. Absolute $ Opportunity Analysis By Flavor , 2023-2030

Chapter 8. ASIA PACIFIC YOGURT MARKET – By Distribution Channel

8.1. Introduction/Key Findings

8.2. Supermarkets/Hypermarkets

8.3. Convenience Stores

8.4. Specialist Retailers

8.5. Online Stores

8.6. Others

8.7. Y-O-Y Growth trend Analysis Distribution Channel

8.8. Absolute $ Opportunity Analysis Distribution Channel , 2023-2030

Chapter 9. ASIA PACIFIC YOGURT MARKET –By Source

9.1. Introduction/Key Findings

9.2. Dairy-Based Yogurt

9.3. Non-Dairy Based Yogurt

9.4. Y-O-Y Growth trend Analysis Source

9.5. Absolute $ Opportunity Analysis Source , 2023-2030

Chapter 10. ASIA PACIFIC YOGURT MARKET – By Region

10.1. Asia Pacific

10.1.1. By Country

10.1.1.1. China

10.1.1.2. Japan

10.1.1.3. South Korea

10.1.1.4. India

10.1.1.5. Australia & New Zealand

10.1.1.6. Rest of Asia-Pacific

10.1.2. By Distribution Channel

10.1.3. By Flavor

10.1.4. By Source

10.1.5. By Type

10.1.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. ASIA PACIFIC YOGURT MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

11.1. Gujarat Cooperative Milk Marketing Federation Ltd (Amul)

11.2. China Mengniu Dairy Company Ltd

11.3. Inner Mongolia Yili Industrial Group Co. Ltd

11.4. Unilever

11.5. Yakult Honsha Co. Ltd

11.6. Meiji Dairies Corporation

11.7. General Mills Inc.

11.8. Nestle

11.9. Danone

11.10. Britannia industries limited

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The increasing consumption of yogurt can be attributed to its myriad health advantages. Recognized as a protein-rich dietary option, yogurt enhances metabolism, rendering it particularly appealing to individuals seeking to increase calorie expenditure throughout the day.

The top players operating in the Asia Pacific Yogurts Market are - Gujarat Cooperative Milk Marketing Federation Ltd (Amul), China Mengniu Dairy Company Ltd, Inner Mongolia Yili Industrial Group Co. Ltd, Unilever, Yakult Honsha Co. Ltd, Meiji Dairies Corporation, General Mills Inc., Nestle, Danone and Britannia industries limited.

Yogurt sales faced a downturn due to COVID-19 restrictions imposed on brick-and-mortar stores. However, notable industry players are now strategically redirecting their focus towards fortifying their market presence through e-commerce platforms and online marketing endeavors, aiming to engage consumers beyond traditional geographical boundaries.

Amul unveiled plans for a USD 60 million investment aimed at constructing a new dairy facility in Rajkot, to expand its production capacity for milk, yogurt, and buttermilk products.

China emerges as the fastest-growing yogurt market in Asia-Pacific. Fruit-flavored yogurts, including strawberry, raspberry, and blueberry variants, enjoy widespread preference among Chinese consumers.