Asia Pacific Tomato Ketchup Market Size (2024-2030)

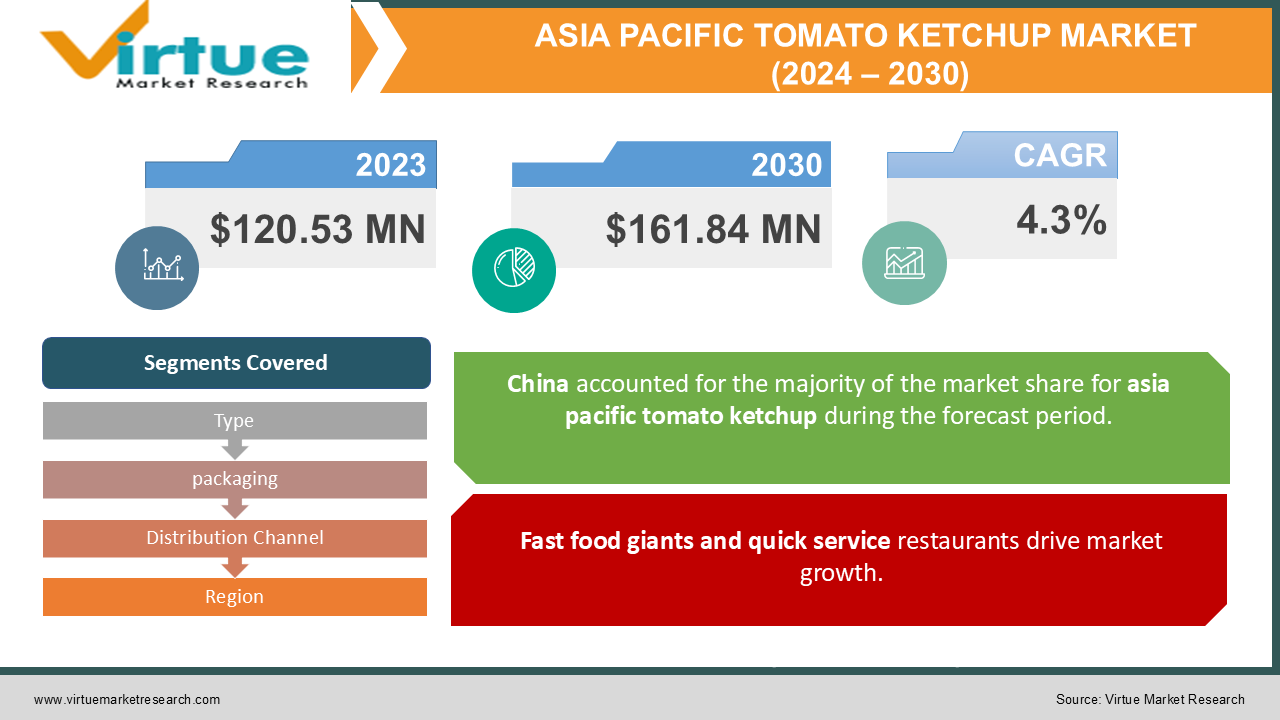

The Asia Pacific Tomato Ketchup Market was valued at USD 120.53 million in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 161.84 million by 2030, growing at a CAGR of 4.3%.

Tomatoes, identified as fruits within the Solanaceae family, originate from Central and Western South America. They are known for their impressive nutritional profile, offering high levels of vitamin C, vitamin K, lycopene, potassium, folate, and antioxidants. These nutrients provide several health advantages, such as supporting healthy digestion, lowering cancer risk, offering sunburn protection, and aiding in cardiovascular health, blood pressure regulation, and blood glucose management in diabetic individuals. Currently, the majority of tomato production is directed towards fresh consumption, representing 80% of the output, with the remaining 20% allocated to the processing sector for creating products such as purees, soups, ketchup, pickles, juices, and sauces.

Key Market Insights:

- Initially, unripe tomatoes were utilized, which required the addition of a preservative, sodium benzoate, to prevent spoilage and flavor deterioration. However, the FDA banned this preservative in the early 1900s. Consequently, Heinz started producing ketchup using ripe tomatoes, which naturally contain higher levels of pectin, along with added sugar and vinegar. The increased pectin content resulted in a thicker consistency compared to the previously thin formulation.

Asia Pacific Tomato Ketchup Market Drivers:

Fast food giants and quick service restaurants drive market growth.

The growth of the tomato ketchup market during the forecast period is being driven by several factors, including rising disposable incomes among urban consumers, the adoption of Western culture, the proliferation of fast food outlets and quick-service restaurants, and the increasing trend of Westernization.

An increase in organic ketchup due to the growing prevalence of chronic diseases improves market growth.

Organic tomato ketchup represents a promising development for the future of the ketchup market. Its growing popularity stems from several advantages over traditional ketchup. With diabetes affecting around 8-9% of the population and projections indicating an increase to 11-12% by 2045, the demand for organic ketchup is rising, as organic sugars help regulate blood sugar levels. Additionally, organic condiments are rich in antioxidants, including polyphenols, which help lower the risk of cardiovascular diseases such as cancer and heart disease.

Consumer behavior and changed Lifestyles increase market growth.

Development and urbanization within the food industry are expected to drive growth in the tomato ketchup market. Increasing consumer interest in Western culture, evolving food preferences, and changing lifestyles are contributing to this market expansion. The introduction of various ketchup flavors caters to diverse consumer tastes, while the rise of food trucks allows vendors to present traditional recipes with unique ketchup variations. This innovation presents a significant opportunity for market growth. Additionally, the market is poised for further expansion through the production of organic ketchup, made from tomatoes free of chemicals and pesticides, and incorporating natural sweeteners, which offer ketchup rich in antioxidants and nutrients. Convenient accessibility through online sales and retail outlets will also support market growth.

Asia Pacific Tomato Ketchup Market Restraints and Challenges:

Health awareness restrains market growth.

Tomatoes are a crucial ingredient in ketchup, and fluctuations in their prices—driven by factors such as weather conditions, diseases, or market dynamics—can impact production costs. Increased awareness of health issues, such as high sugar levels and additives in some ketchup varieties, may lead consumers to seek healthier alternatives, potentially affecting the sales of traditional ketchup. Additionally, the market could encounter competition from a variety of condiments and sauces with diverse flavors and ethnic profiles, which may encourage consumers to explore and adopt different options, thereby influencing market share.

Asia Pacific Tomato Ketchup Market Opportunities:

Increased awareness of the nutritional benefits of vegetables, including tomatoes, has led to higher consumption rates. This surge in demand is driven by preferences for fresh produce and the adoption of advanced farming practices, such as indoor cultivation, which enhances domestic tomato production. However, challenges such as climate change, evolving insect resistance, inadequate infrastructure, and post-harvest losses highlight the need for new high-yielding hybrid seeds to improve farmer productivity.

Efforts to boost tomato production are underway to meet this rising demand. Additionally, the growing demand for processed tomato products—such as sauces, pastes, ketchup, and diced tomatoes—further drives sector growth. To address market needs, growers are investing in improved production techniques, including sheltered cultivation, plastic mulching, and drip irrigation, to increase tomato yields and effectively meet demand.

To meet the increasing demand, efforts are being made to enhance tomato production. The rising need for processed tomato products—such as sauces, pastes, ketchup, and diced tomatoes—on international markets is further driving growth in the sector and strengthening tomato production. Growers are investing in improved production techniques, including sheltered cultivation and practices like plastic mulching and drip irrigation, to increase tomato yields and effectively meet market demands.

Different varieties of tomato ketchup offer a range of nutrients, which can drive market growth by providing consumers with diverse options. Tomato ketchup is also a more affordable alternative to fresh tomatoes, contributing to market expansion. The increasing popularity of organic foods among health-conscious consumers is expected to boost the organic tomato ketchup market. Additionally, the availability of numerous types of tomato ketchup in the market will broaden its scope and opportunities in the coming years.

ASIA PACIFIC TOMATO KETCHUP MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.3% |

|

Segments Covered |

By Type, packaging, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

china, Japan, India, South Korea, Rest of Asia-Pacific |

|

Key Companies Profiled |

McCormick & Company, Inc., Nestle S.A., Conagra Brands, Inc., Kissan, The Kraft Heinz Company, Bolton Group S.r.l, Unilever PLC, General Mills, Inc., Del Monte Pacific Limited, Campbell Soup Company, and Premier Foods PLC. |

Asia Pacific Tomato Ketchup Market Segmentation:

Asia Pacific Tomato Ketchup Market Segmentation- By Type:

- Flavored

- Regular

The regular segment of the tomato ketchup market is anticipated to experience the fastest growth during the forecast period. This increase in demand is due to the balanced combination of spices, seasoning, color, and consistency characteristic of regular tomato ketchup. Its familiar taste, which many consumers associate with comfort and nostalgia, contributes to its enduring popularity. Additionally, regular tomato ketchup's versatility—suitable for a variety of dishes including burgers, hot dogs, fries, and sandwiches—along with its neutral flavor profile, makes it a desirable condiment for diverse cuisines.

Asia Pacific Tomato Ketchup Market Segmentation- By Packaging:

- Bottled

- Pouch

- Others

The bottled segment is projected to dominate the tomato ketchup market during the forecast period. Bottles provide a larger surface area for branding and labeling, enhancing marketing effectiveness and product visibility on store shelves. They also allow consumers to dispense the exact amount of ketchup needed, facilitating easier control over usage. Additionally, bottles, particularly glass ones, offer superior protection against light and air exposure, which can cause spoilage or loss of flavor, compared to other packaging options such as pouches or jars.

Asia Pacific Tomato Ketchup Market Segmentation- By Distribution Channel:

- Online Stores

- Convenience Stores

- Supermarkets & Hypermarkets

- Others

The supermarkets and hypermarkets segment is anticipated to grow at the fastest rate in the tomato ketchup market during the forecast period. These retail outlets offer a broad selection of tomato ketchup brands and variants, giving consumers many choices. Their accessibility and convenient shopping experience are likely to drive segment growth. Additionally, supermarkets frequently offer promotions, discounts, and bundle deals, which encourage bulk purchases and benefit both consumers and manufacturers.

Asia Pacific Tomato Ketchup Market Segmentation- by Region

- China

- Japan

- India

- South Korea

- Australia & New Zealand

- Rest of Asia-Pacific (APAC)

The Asia-Pacific region is the leading player in the tomato ketchup market, with significant revenue contributions and an expected Compound Annual Growth Rate (CAGR) of 5.36% during the forecast period. This growth is largely driven by the expansion of high-intensity tomato cultivation practices. In India, tomatoes are the third most important horticultural crop after potatoes and onions, bolstered by the government’s "Operation Greens" initiative to enhance farmers' livelihoods. China also plays a major role, with extensive tomato plantations, including greenhouse and open-field cultivation, particularly in the Xinjiang Uygur region, which produces over 70% of the country's total tomato output.

In Malaysia, ketchup's balance of sour, salty, and sweet flavors aligns with the country's culinary preferences, making it a versatile condiment.

In Japan, the market is expected to grow as ketchup continues to be used in various dishes. Japanese cuisine incorporates ketchup in recipes such as Japanese Curry, Omurice, Ebi Chili, and Spaghetti Napolitan, benefiting from its sweet-tangy flavor profile.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic has indeed affected the market to some extent. The pandemic led to shifts in consumer behavior and business operations, with many companies adapting their strategies to address new challenges and changing demands. In response to the COVID-19 pandemic, many fast-food franchises have increasingly recognized the need to diversify their revenue streams. The businesses that thrived during this period were those that adapted by offering a range of options to their customers. One successful adaptation was the introduction of at-home meal kits, which blended the convenience of dining out with the ability to enjoy restaurant-quality ingredients at home.

Latest Trends/ Developments:

- In 2022, Queen Elizabeth will enter the condiments market with a new tomato ketchup brand, utilizing ingredients grown on the Sandringham Estate.

Key Players:

These are the top 10 players in the Asia Pacific Tomato Ketchup Market: -

- McCormick & Company, Inc.

- Nestle S.A.

- Conagra Brands, Inc.

- Kissan

- The Kraft Heinz Company

- Bolton Group S.r.l

- Unilever PLC

- General Mills, Inc.

- Del Monte Pacific Limited

- Campbell Soup Company

- Premier Foods PLC

Chapter 1. Asia Pacific Tomato Ketchup Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Tomato Ketchup Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Tomato Ketchup Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Tomato Ketchup Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Tomato Ketchup Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Tomato Ketchup Market– By Type

6.1. Introduction/Key Findings

6.2. Flavored

6.3. Regular

6.4. Y-O-Y Growth trend Analysis By Type

6.5. Absolute $ Opportunity Analysis By Type , 2023-2030

Chapter 7. Asia Pacific Tomato Ketchup Market– By Packaging

7.1. Introduction/Key Findings

7.2. Bottled

7.3. Pouch

7.4. Others

7.5. Y-O-Y Growth trend Analysis By Packaging

7.6. Absolute $ Opportunity Analysis By Packaging , 2023-2030

Chapter 8. Asia Pacific Tomato Ketchup Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Online Stores

8.3. Convenience Stores

8.4. Supermarkets & Hypermarkets

8.5. Others

8.6. Y-O-Y Growth trend Analysis Distribution Channel

8.7. Absolute $ Opportunity Analysis Distribution Channel , 2023-2030

Chapter 9. Asia Pacific Tomato Ketchup Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Asia Pacific

9.1.1. By Country

9.1.1.1. China

9.1.1.2. Japan

9.1.1.3. South Korea

9.1.1.4. India

9.1.1.5. Australia & New Zealand

9.1.1.6. Rest of Asia-Pacific

9.1.2. By Distribution Channel

9.1.3. By Type

9.1.4. By Packaging

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Asia Pacific Tomato Ketchup Market– Company Profiles – (Overview, Packaging Portfolio, Financials, Strategies & Developments)

10.1 McCormick & Company, Inc.

10.2. Nestle S.A.

10.3. Conagra Brands, Inc.

10.4. Kissan

10.5. The Kraft Heinz Company

10.6. Bolton Group S.r.l

10.7. Unilever PLC

10.8. General Mills, Inc.

10.9. Del Monte Pacific Limited

10.10. Campbell Soup Company

10.11. Premier Foods PLC

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The growth of the tomato ketchup market during the forecast period is being driven by several factors, including rising disposable incomes among urban consumers, the adoption of Western culture, the proliferation of fast food outlets and quick-service restaurants, and the increasing trend of Westernization.

The top players operating in the Asia Pacific Tomato Ketchup Market are - McCormick & Company, Inc., Nestle S.A., Conagra Brands, Inc., Kissan, The Kraft Heinz Company, Bolton Group S.r.l, Unilever PLC, General Mills, Inc., Del Monte Pacific Limited, Campbell Soup Company, and Premier Foods PLC.

The COVID-19 pandemic has indeed affected the market to some extent. The pandemic led to shifts in consumer behavior and business operations, with many companies adapting their strategies to address new challenges and changing demands

In 2022, Queen Elizabeth will enter the condiments market with a new tomato ketchup brand, utilizing ingredients grown on the Sandringham Estate.

In Japan, the market is expected to grow as ketchup continues to be used in various dishes. Japanese cuisine incorporates ketchup in recipes such as Japanese Curry, Omurice, Ebi Chili, and Spaghetti Napolitan, benefiting from its sweet-tangy flavor profile.