Asia Pacific Frozen Potatoes Market Size (2024-2030)

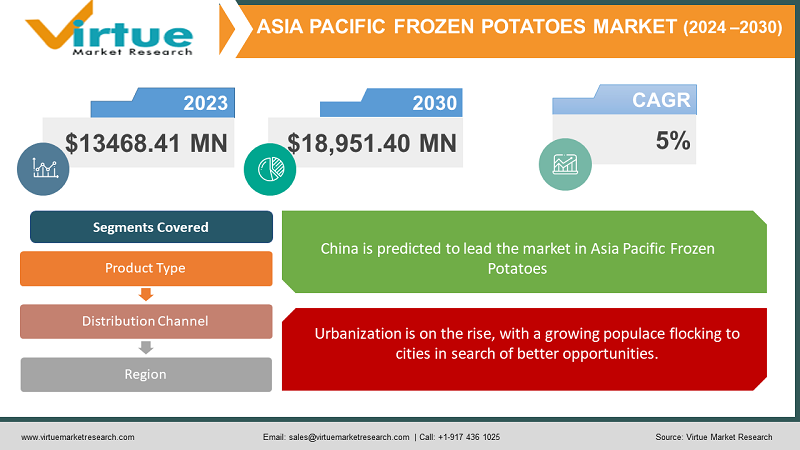

The Asia Pacific Frozen Potatoes Market is valued at USD 13468.41 Million in 2023 and is projected to reach a market size of USD 18,951.40 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5%.

The APAC (Asia Pacific) frozen potato market is a culinary landscape experiencing a significant freeze but in the best possible way. Driven by a confluence of social, economic, and dietary trends, this market is witnessing a surge in demand for convenient, versatile, and delicious frozen potato products. Rapid urbanization across APAC is fostering busy lifestyles, where convenience reigns supreme. Frozen potato products, requiring minimal preparation time, perfectly cater to this trend. Consumers can whip up quick and satisfying meals like French fries, hash browns, or potato wedges, without sacrificing taste. Economic growth in many APAC countries is leading to increased disposable incomes. This, coupled with a growing young population, translates to a demand for convenient and often indulgent food options. Frozen potato products fit the bill, offering a perceived value for money and satisfying occasional cravings.

Key Market Insights:

- A staggering 72% of APAC consumers indulge in snacking at least twice a day, creating a significant demand for convenient snacking options like frozen potato products.

- While convenience reigns supreme, an estimated 45% of APAC consumers prioritize health when making food purchases. This paves the way for healthier frozen potato options like reduced-fat varieties or vegetable-blended fries.

- Western cuisine continues to hold strong appeal, with 62% of APAC consumers expressing a desire to experiment with international flavors. Frozen potato products like French fries and wedges often evoke a Western fast-food experience, contributing to their popularity.

- The APAC frozen potato market extends far beyond just French fries. Market research suggests that over 300 different frozen potato products are available in the region, including hash browns, potato wedges, mashed potato mixes, and specialty items like curly fries or onion rings.

- An estimated 18% of research and development budgets in the APAC frozen potato industry are dedicated to product innovation. Expect to see a rise in vegetable-blended fries, air-fried options, and gluten-free varieties catering to diverse dietary needs.

- Consumers in APAC are increasingly adventurous with their palates. Market research indicates a 25% growth in demand for unique flavor profiles in frozen potato products, with potential for options like spicy Szechuan fries or herb-infused potato wedges.

- Over 60% of APAC consumers express a growing concern for environmental sustainability. This translates to a demand for eco-friendly packaging solutions and responsible sourcing practices within the frozen potato industry.

Asia Pacific Frozen Potatoes Market Drivers:

The face of APAC is rapidly transforming. Urbanization is on the rise, with a growing populace flocking to cities in search of better opportunities.

Long working hours and hectic schedules leave many APAC consumers with limited time for cooking. Frozen potato products offer a quick and effortless solution. With minimal preparation required, consumers can whip up restaurant-style French fries, crispy hash browns, or satisfying potato wedges in a matter of minutes. This convenience factor aligns perfectly with the fast-paced lives of urban dwellers. The number of single-person households is increasing across APAC. These individuals often seek convenient and portion-controlled meal options. Frozen potato products cater to this need, offering individual-sized servings or resealable packages that prevent spoilage. Traditional three-meal-a-day structures are giving way to more flexible eating patterns in APAC. Busy consumers are opting for smaller, more frequent meals throughout the day. Frozen potato products offer versatility, serving as a quick side dish, a satisfying snack, or even a base for a creative main course.

Economic growth across many APAC countries is leading to increased disposable incomes. This translates to a growing demand for new and exciting food experiences, with consumers venturing beyond traditional cuisines.

Western cuisine continues to hold strong appeal in APAC, particularly among younger generations. Frozen potato products like French fries, onion rings, and hash browns are often associated with Western-style fast food and casual dining experiences. This association positions them as trendy and desirable, particularly in urban areas with a strong international influence. While consumers in APAC are willing to experiment with new flavors, affordability remains a key consideration. Frozen potato products offer a perceived value for money. They are a relatively inexpensive way to incorporate these trendy Western flavors into the home kitchen, allowing consumers to indulge in restaurant-style experiences without breaking the bank. Frozen potato products are often seen as an occasional indulgence, a way to add variety and excitement to the home menu. The diverse product range available caters to different taste preferences, with options like crinkle-cut fries, seasoned wedges, or gourmet potato bakes satisfying cravings and offering a break from routine meals.

Asia Pacific Frozen Potatoes Market Restraints and Challenges:

The vastness and diverse landscapes within APAC pose challenges in maintaining consistent quality standards. Sourcing practices need to be robust, with checks in place to ensure potatoes meet specific criteria for size, maturity, and absence of defects. Additionally, stringent quality control measures throughout processing and packaging are crucial to prevent contamination and maintain product integrity. Frozen potato products require proper storage and transportation within the cold chain. Maintaining consistent temperatures throughout the supply chain is essential to prevent spoilage, preserve texture, and ensure food safety. This can be particularly challenging in remote areas or regions with less developed infrastructure. Supermarkets and hypermarkets often offer their own private-label brands of frozen potato products. These private labels typically compete on price, putting pressure on established brands to offer competitive pricing or risk losing market share. The dominance of international giants like McCain and Lamb Weston is being challenged by the rise of regional players. These regional players often have lower production costs and can offer competitive pricing strategies, further intensifying competition.

Asia Pacific Frozen Potatoes Market Opportunities:

The success of Western-style frozen potato products in APAC paves the way for a fusion of global flavors. Manufacturers can develop innovative product lines that incorporate regional spices and ingredients, catering to local tastes and creating a sense of culinary adventure. Imagine Sriracha crinkle-cut fries, tandoori-spiced potato wedges, or kimchi-infused hash browns – these are just a few possibilities. Busy consumers are willing to pay a premium for convenience and unique flavor experiences. Manufacturers can create premium frozen potato products with gourmet ingredients, unique cuts, or innovative cooking methods. Pre-seasoned or pre-sauced options can further enhance convenience and cater to the desire for hassle-free meal solutions. The growing popularity of subscription boxes creates a potential market for curated selections of frozen potato products. These boxes could cater to specific dietary needs or preferences, offering variety and convenience to consumers. Additionally, frozen potato products can be integrated into meal kit delivery services, creating a one-stop shop for convenient meal solutions.

ASIA-PACIFIC FROZEN POTATOES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5% |

|

Segments Covered |

By Product Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

China , Japan , South Korea, India , Australia & New Zealand, Rest of Asia-Pacific |

|

Key Companies Profiled |

McCain Foods Limited, Lamb Weston Holdings, Inc., Agristo NV, Aviko B.V, J.R. Simplot Company , Himalaya Food International Ltd, Godrej Agrovet Ltd |

Asia Pacific Frozen Potatoes Market Segmentation:

Asia Pacific Frozen Potatoes Market Segmentation: By Product Type:

- French Fries

- Hash Browns

- Potato Shapes

- Mashed Potato Mixes

- Sweet Potatoes/Yams

- Battered/Cooked

- Topped/Stuffed

- Other

With a commanding lead, French fries make up between 55 and 60 percent of the frozen potato industry in Asia-Pacific. Their appeal among younger generations in metropolitan settings is primarily due to their price, adaptability, and affiliation with Western-style fast food. You can eat french fries by themselves, dip them in different sauces, or use them in a plethora of dishes. Their versatility makes them a well-liked option for time-pressed customers looking for quick lunch options. A reasonably priced method to enjoy Western-style fast food at home is with french fries. Around APAC, this value promise appeals to consumers who are cost-conscious.

In the frozen potato industry in Asia-Pacific, sweet potato products are growing at the quickest rate. Sweet potatoes are thought to be a healthier option than normal potatoes because they are high in antioxidants, fiber, and vitamins. Customers who are health-conscious and looking for convenient and nourishing solutions may find this appealing. Products made from sweet potatoes can automatically be made gluten-free and vegan to accommodate certain dietary needs. The business potential for these products is increased by their inclusion.

Asia Pacific Frozen Potatoes Market Segmentation: By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retailers

Supermarkets and Hypermarkets hold the lion's share of the market, accounting for approximately 60-65% of frozen potato sales in APAC. Their extensive reach, one-stop shopping convenience, and a wide variety of brands and product options solidify their dominance. These retail giants boast a vast network of stores, ensuring widespread availability of frozen potato products across urban and even some rural areas. This accessibility makes them a convenient choice for most consumers. The physical layout of supermarkets allows for strategic product placement. Frozen potato products can be placed near complementary items like condiments, proteins, or vegetables, encouraging impulse purchases and complete meal solutions.

In the APAC frozen potato market, e-commerce is the distribution channel with the quickest rate of growth. Online grocery shopping platforms are the epitome of convenience, saving customers time and effort by enabling them to explore and buy frozen potato items from the comfort of their homes. Online platforms collect valuable customer data, enabling manufacturers and retailers to employ targeted marketing strategies and personalized product recommendations. The growing popularity of subscription boxes creates an opportunity for curated selections of frozen potato products. These boxes could cater to specific dietary needs, and preferences, or offer recipe kits featuring unique potato dishes.

Asia Pacific Frozen Potatoes Market Segmentation: Regional Analysis:

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Rest of Asia-Pacific

With a significant market share and enormous growth potential, China emerges as the dominant force in the Asia-Pacific frozen potato industry. Rising disposable incomes, urbanization, and the embrace of Western culinary influences have all contributed to a dramatic transformation in consumer preferences and eating habits in this economic powerhouse. China has become a desirable location for frozen potato producers and suppliers due to its enormous market size and rising demand for processed and convenient foods. The growing food service sector in the nation, which includes eateries, fast-food chains, and catering services, has increased consumer demand for frozen potatoes, especially French fries and other snacks made with potatoes.

India is the nation with the quickest rate of growth in this area. The fast urbanization, rising disposable incomes, and expanding population of India have increased demand for ready-to-eat and handy food goods, such as frozen potatoes. The fast-food chains' and quick-service restaurants' expanding popularity, the growing impact of Western culture, and shifting lifestyle patterns have all contributed to the extraordinary development of the Indian frozen potato market in recent years. The popularity of frozen foods in urban families has led to a rise in demand for frozen potato items including potato wedges, hash browns, and French fries. In addition, the market has grown as a result of the Indian government's attempts to support the food processing sectors, as well as the influx of foreign capital and the entrance of foreign firms.

COVID-19 Impact Analysis on the Asia Pacific Frozen Potatoes Market:

As lockdowns became a reality, consumers flocked to supermarkets, stockpiling shelf-stable items like frozen potato products. This surge in demand initially outpaced supply, leading to temporary shortages in some regions. Lockdowns and travel restrictions disrupted the flow of raw materials and finished products. The movement of potatoes from farms to processing facilities, as well as the transportation of frozen potato products across borders, faced significant hurdles. The closure of restaurants and restrictions on dining-in services significantly impacted the food service channel, a major buyer of frozen potato products. This led to a decline in demand from restaurants, hotels, and quick-service restaurants (QSRs). With physical stores facing limited capacity and social distancing norms, consumers turned to online platforms for grocery shopping. This accelerated the growth of e-commerce, creating a new avenue for frozen potato manufacturers to reach consumers directly. The rise of e-commerce and potential hygiene concerns led to a focus on innovative packaging solutions. Resealable bags, tamper-evident seals, and individual portion packs gained traction, catering to online purchases and single-serve convenience.

Latest Trends/ Developments:

Manufacturers are developing frozen potato products with lower fat and sodium content, catering to health-conscious consumers without sacrificing flavor. Techniques like air-frying and using healthier oils are gaining traction. Products fortified with additional nutrients like vitamins, minerals, or even protein are emerging. Imagine antioxidant-rich sweet potato fries or veggie-blended fries containing hidden cauliflower or broccoli florets. Manufacturers are incorporating regional spice blends like tandoori masala (India), rendang spices (Indonesia), or za'atar (Middle East) into potato seasonings, offering familiar flavors with a convenient twist. Innovative products like kimchi and sweet potato wedges or Thai green curry-infused hash browns are emerging, offering a fusion of international flavors and familiar textures. Frozen potato products are being integrated into meal kit delivery services, offering pre-portioned options alongside fresh ingredients for a complete and convenient meal solution.

Key Players:

- McCain Foods Limited

- Lamb Weston Holdings, Inc.

- Agristo NV

- Aviko B.V

- J.R. Simplot Company

- Himalaya Food International Ltd

- Godrej Agrovet Ltd

Chapter 1. Asia Pacific Frozen Potatoes Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Frozen Potatoes Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Frozen Potatoes Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Frozen Potatoes Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitute

Chapter 5. Asia Pacific Frozen Potatoes Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Frozen Potatoes Market– By Product Type

6.1. Introduction/Key Findings

6.2. French Fries

6.3. Hash Browns

6.4. Potato Shapes

6.5. Mashed Potato Mixes

6.6. Sweet Potatoes/Yams

6.7. Battered/Cooked

6.8. Topped/Stuffed

6.9. Other

6.10. Y-O-Y Growth trend Analysis By Product Type

6.11. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. Asia Pacific Frozen Potatoes Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2. Supermarkets & Hypermarkets

7.3. Convenience Stores

7.4. Online retailers

7.5. Y-O-Y Growth trend Analysis By Distribution Channel

7.6. Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Asia Pacific Frozen Potatoes Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Asia-Pacific

8.1.1. By Country

8.1.1.1. India

8.1.1.2. china

8.1.1.3. Japan

8.1.1.4. South korea

8.1.1.5. Australia

8.1.1.6. Rest of MEA

8.1.2. By Product Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Asia Pacific Frozen Potatoes Market– Company Profiles – (Overview, Type Portfolio, Financials, Strategies & Developments)

9.1 McCain Foods Limited

9.2. Lamb Weston Holdings, Inc.

9.3. Agristo NV

9.4. Aviko B.V

9.5. J.R. Simplot Company

9.6. Himalaya Food International Ltd

9.7. Godrej Agrovet Ltd

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The rapid urbanization across APAC is a major growth driver. As people migrate to cities, their lifestyles become busier, leading to a demand for convenient and time-saving meal solutions. Frozen potato products offer a perfect fit, requiring minimal preparation time and offering versatility for various meals

While healthier alternatives like air-fried frozen potatoes or vegetable-blended varieties are emerging, consumer awareness of these options might be limited. Manufacturers need to bridge this gap through effective communication and product education.

McCain Foods Limited, Lamb Weston Holdings, Inc., Agristo NV, Aviko B.V

J.R. Simplot Company, Himalaya Food International Ltd, Godrej Agrovet Ltd.

. China has firmly established itself as the most dominant player in the Asia-Pacific market, commanding an impressive 45% market share.

India emerges as the fastest-growing country in this sector. India's burgeoning population, rising disposable incomes, and rapid urbanization have fueled the demand for convenient and ready-to-consume food products, including frozen potatoes.