Asia Pacific Chocolate Based Spreads Market Size (2024-2030)

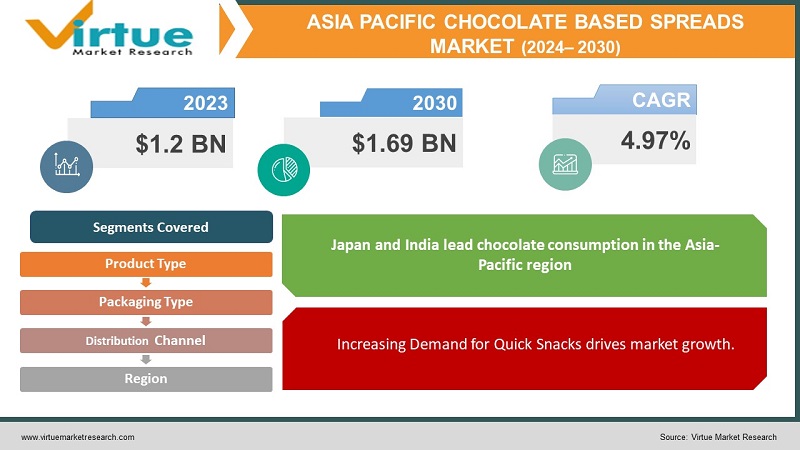

The Asia Pacific Chocolate Based Spreads Market was valued at USD 1.2 billion in 2023. Over the forecast period of 2024-2030 it is projected to reach USD 1.69 billion by 2030, growing at a CAGR of 4.97%.

Chocolate Spread is a sweetened, chocolate-flavored liquid that originates from the United Kingdom. It can be utilized as a filling for crepes, pancakes, or waffles; in creating sauces for desserts such as cake pops, pudding pops, ice cream sundaes, and chocolate chip cookies; or as a topping for toast alongside peanut butter or Nutella.

Chocolate spreads are employed to enhance the flavor of various foods. They typically feature lower levels of fat and sugar while offering a rich taste. This makes them a favored option for individuals seeking to maintain a healthy diet yet still enjoy a sweet treat on occasion.

Key Market Insights:

The Asia-Pacific region represents the fastest-growing market, driven by its rapid population growth. Australia leads this market, holding the largest share due to the high consumption of chocolate spread compared to other food spreads in the country. Shifts in lifestyle and breakfast habits have notably influenced chocolate spread sales within the region. In response to the rising demand for chocolate-based spreads, numerous innovations are emerging, with many companies launching new flavors to cater to consumer preferences.

Asia Pacific Chocolate Based Spreads Market Drivers:

Increasing Demand for Quick Snacks drives market growth.

As lifestyles become more hectic with multiple jobs and varying shifts, individuals often find themselves with limited time for meal preparation. Consequently, many consumers are leaning towards convenient, nutritious snacks that support a healthy diet. For instance, chocolate spreads are commonly used on slices of bread for a quick breakfast or carried as an evening snack. The

trend of snacking has gained traction across various regions due to its ability to provide energy and essential nutrients like proteins, minerals, vitamins, and fiber. Consuming healthy snacks can also help manage hunger and prevent overeating during main meals. As a result, the demand for products like chocolate-based spreads is increasing, driven by a changing retail environment and an expanding foodservice sector.

Innovative dishes prepared using chocolate based spreads drives market growth.

Chocolate spread has a diverse range of applications, including consumption with bread, toast, waffles, pancakes, and cookies. Increased urbanization and the adoption of Western cultural practices have contributed to a higher consumption of this product. Innovations in food products are further driving the demand for chocolate spread. Additionally, the introduction of new dishes at cafes, restaurants, and other eateries is also supporting market growth. The wide availability of various types of chocolate spreads in the market is additionally fueling the industry's expansion.

Asia Pacific Chocolate Based Spreads Market Restraints and Challenges: Substitute Products available in the market hinder growth.

Despite the growing popularity of chocolate spreads in Asian markets such as India and China, they continue to face significant competition from traditional spreads. Although there is an increasing acceptance of Western indulgences in breakfast routines, many Asian consumers have not fully embraced chocolate spreads. To overcome this challenge, manufacturers need to invest significantly in advertising and promotional efforts to educate consumers about the health and environmental benefits of their products.

Furthermore, chocolate spread brands are contending with strong competition from fruit spreads, jams, and marmalades. While chocolate spreads primarily target chocolate lovers and children, fruit spreads attract a wider demographic globally. The ongoing innovation and frequent product launches within the fruit spread sector present additional challenges for chocolate spread brands, necessitating continuous innovation to stay competitive.

Asia Pacific Chocolate Based Spreads Market Opportunities:

The demand for fair trade chocolates and innovations in flavor are anticipated to be pivotal trends driving market growth in the coming years. While milk chocolate remains highly popular, there is a notable rise in the sales of dark and compound chocolates, which are favored for their extended flavor release and are increasingly preferred by consumers.

In certain regions, chocolates are traditionally viewed as luxury and premium confectionery. The high cost of raw materials used in chocolate production contributes to the elevated prices of these products in the market.

ASIA-PACIFIC CHOCOLATE BASED SPREADS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.2% |

|

Segments Covered |

By Product Type, PACKAGING TYPE, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

china, Japan, India, South Korea, Rest of Asia-Pacific |

|

Key Companies Profiled |

The Hershey Company, Ferrero International SA, Atypic Chocolate Pty Ltd, Chocoladefabriken Lindt & Sprüngli AG, Barry callebaut AG, Mars Incorporated, Morinaga & Co. LTD, Gujarat Cooperative Milk Marketing Federation Ltd., Yuraku Confectionery Co. Ltd and ITC Limited. |

Asia Pacific Chocolate Based Spreads Market Segmentation By Product Type:

- Hazel Chocolate

- Dark Chocolate

- Milk

- White Chocolate

The hazelnut segment is a dominant force in the market, celebrated for its heart-healthy properties and high nutritional value. Rich in vitamins, minerals, antioxidant compounds, and beneficial fats, hazelnuts are a key driver of the segment's popularity. Health experts recommend hazelnut consumption as part of a balanced diet due to its high dietary fiber content, which supports digestive health.

Hazelnut chocolate spread not only provides a delicious snack but also enhances the flavor of various dishes. The growing consumer preference for hazelnuts as a nutritious and flavorful ingredient has led manufacturers to incorporate it into a wide range of food products. This favorable perception and the versatility of hazelnut chocolate spread contribute to the segment's expansion across diverse culinary applications.

In India, the chocolate market is experiencing increased demand and consumption, driven by several factors such as a shift from traditional sweet treats, rising disposable income, higher consumer expectations for premium products, and growing health awareness.

To attract a broader customer base, key market players are introducing innovative product lines featuring premium cocoa, unique flavors, and organic ingredients, including fruits, nuts, caramel, salt, and sugar-free options. This approach offers a positive outlook for the market's continued growth.

Asia Pacific Chocolate Based Spreads Market Segmentation- By Packaging Type:

- Bottles

- Pouches

- Cups

- Others

The market is currently led by the bottle segment, while the cans segment is expected to experience growth in the coming years. The dominance of bottles is due to their familiarity and established consumer preferences. However, the anticipated rise in the cans segment can be attributed to the benefits offered by aluminum cans. Aluminum cans are known for their superior durability compared to plastic, as they are less likely to crack or break. Additionally, aluminum cans are 100% recyclable, unlike plastic bottles, which can only be recycled a limited number of times before requiring disposal in landfills. These advantages are contributing to the growing popularity and projected expansion of the cans segment in the market.

Asia Pacific Chocolate Based Spreads Market Segmentation-By Distribution Channel:

- Convenience Store

- Online Retail Store

- Supermarket/Hypermarket

- Others

Supermarkets and hypermarkets rank as the second-largest retailers in the Asia-Pacific chocolate market. These retail outlets typically offer a broad selection of chocolate products, often featuring innovative promotions. In 2022, the sales volume of chocolate products in these stores increased by 4.22% compared to 2021. The sector is expected to register a compound annual growth rate (CAGR) of 19.7% in the Asia-Pacific region. Chocolate is anticipated to maintain the largest share of 58.8% among all confectionery products sold through supermarkets and hypermarkets in 2023, driven by a growing demand for premium offerings.

Online retailing, or e-commerce, is identified as the fastest-growing segment in the Asia-Pacific market. E-commerce experienced a CAGR of 5.92% in 2023. The expansion of e-commerce is primarily driven by the increasing number of internet users across the region, which is significantly boosting the growth of online shopping platforms.

Asia Pacific Chocolate Based Spreads Market Segmentation- by region

- China

- Japan

- India

- South Korea

- Australia & New Zealand

- Rest of Asia-Pacific (APAC)

Japan and India lead chocolate consumption in the Asia-Pacific region, together accounting for nearly 50% of the market value, driven by a rising interest in innovative premium chocolates. Japan and China are recognized as the major markets, with Japan and China collectively representing 52.02% of chocolate value sales in 2022. In these countries, chocolate is viewed as an exotic delicacy and is often purchased as a luxury gift for occasions such as the Lunar New Year, contributing to increased consumption.

Malaysia is emerging as the fastest-growing chocolate market in the Asia-Pacific region. The market is projected to expand at a rate of 8.53% from 2024 to 2030 in terms of value. Traditional Malaysian confectionery often features ingredients like honey, sugar, almonds, walnuts, or crystallized fruits. However, there is a growing preference for health-oriented chocolates, such as sugar-free or gluten-free options, due to the rising diabetic population in the country.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic had a profound impact on the chocolate-based spreads market. The closure of numerous quick-service restaurants, fast-food outlets, and bakeries led to a shift in consumer behavior. With limited access to external dining options, consumers began exploring new food items such as cakes, pastries, and chocolate-based desserts, driven largely by boredom and restricted access to outside food. Additionally, chocolate spreads became a popular choice for breakfast due to their convenience. During the pandemic, there was a significant increase in preference for e-commerce platforms, as retail stores and other shops were closed in accordance with government regulations.

Latest Trends/ Developments:

In 2022, The Hershey Company introduced a new chocolate spread flavor called "Crunchy Cookie." The company's primary strategy behind this launch is to diversify its product portfolio and provide consumers with fresh options. This approach is designed to align with evolving consumer preferences.

Key Players:

These are top 10 players in the Asia Pacific Chocolate Based Spreads Market :-

- The Hershey Company

- Ferrero International SA

- Atypic Chocolate Pty Ltd

- Chocoladefabriken Lindt & Sprüngli AG

- Barry callebaut AG

- Mars Incorporated

- Morinaga & Co. LTD

- Gujarat Cooperative Milk Marketing Federation Ltd.

- Yuraku Confectionery Co. Ltd

- ITC Limited

Chapter 1. Asia Pacific Chocolate Based Spreads Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Chocolate Based Spreads Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Chocolate Based Spreads Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Chocolate Based Spreads Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Chocolate Based Spreads Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Chocolate Based Spreads Market– By Product Type

6.1. Introduction/Key Findings

6.2. Hazel Chocolate

6.3. Dark Chocolate

6.4. Milk

6.5. White Chocolate

6.6. Y-O-Y Growth trend Analysis By Product Type

6.7. Absolute $ Opportunity Analysis By Product Type, 2023-2030

Chapter 7. Asia Pacific Chocolate Based Spreads Market– By Packaging Type

7.1. Introduction/Key Findings

7.2. Bottles

7.3. Pouches

7.4. Cups

7.5. Others

7.6. Y-O-Y Growth trend Analysis By Packaging Type

7.7. Absolute $ Opportunity Analysis By Packaging Type , 2023-2030

Chapter 8. Asia Pacific Chocolate Based Spreads Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Convenience Store

8.3. Online Retail Store

8.4. Supermarket/Hypermarket

8.5. Others

8.6. Y-O-Y Growth trend Analysis Distribution Channel

8.7. Absolute $ Opportunity Analysis Distribution Channel , 2023-2030

Chapter 9. Asia Pacific Chocolate Based Spreads Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Asia Pacific

9.1.1. By Country

9.1.1.1. China

9.1.1.2. Japan

9.1.1.3. South Korea

9.1.1.4. India

9.1.1.5. Australia & New Zealand

9.1.1.6. Rest of Asia-Pacific

9.1.2. By Distribution Channel

9.1.3. By Product Type

9.1.4. By Packaging Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Asia Pacific Chocolate Based Spreads Market– Company Profiles – (Overview, Packaging Type Portfolio, Financials, Strategies & Developments)

10.1 The Hershey Company

10.2. Ferrero International SA

10.3. Atypic Chocolate Pty Ltd

10.4. Chocoladefabriken Lindt & Sprüngli AG

10.5. Barry callebaut AG

10.6. Mars Incorporate

10.7. Morinaga & Co. LTD

10.8. Gujarat Cooperative Milk Marketing Federation Ltd.

10.9. Yuraku Confectionery Co. Ltd

10.10. ITC Limited

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Asia-Pacific region represents the fastest-growing market, driven by its rapid population growth. Australia leads this market, holding the largest share due to the high consumption of chocolate spread compared to other food spreads in the country.

The top players operating in the Asia Pacific Chocolate Based Spreads Market are - The Hershey Company, Ferrero International SA, Atypic Chocolate Pty Ltd, Chocoladefabriken Lindt & Sprüngli AG, Barry callebaut AG, Mars Incorporated, Morinaga & Co. LTD, Gujarat Cooperative Milk Marketing Federation Ltd., Yuraku Confectionery Co. Ltd and ITC Limited.

The COVID-19 pandemic had a profound impact on the chocolate-based spreads market. The closure of numerous quick-service restaurants, fast-food outlets, and bakeries led to a shift in consumer behavior

In 2022, The Hershey Company introduced a new chocolate spread flavor called "Crunchy Cookie." The company's primary strategy behind this launch is to diversify its product portfolio and provide consumers with fresh options. This approach is designed to align with evolving consumer preferences

Malaysia is emerging as the fastest-growing chocolate market in the Asia-Pacific region