Chocolate Based Spreads Market Size (2024 – 2030)

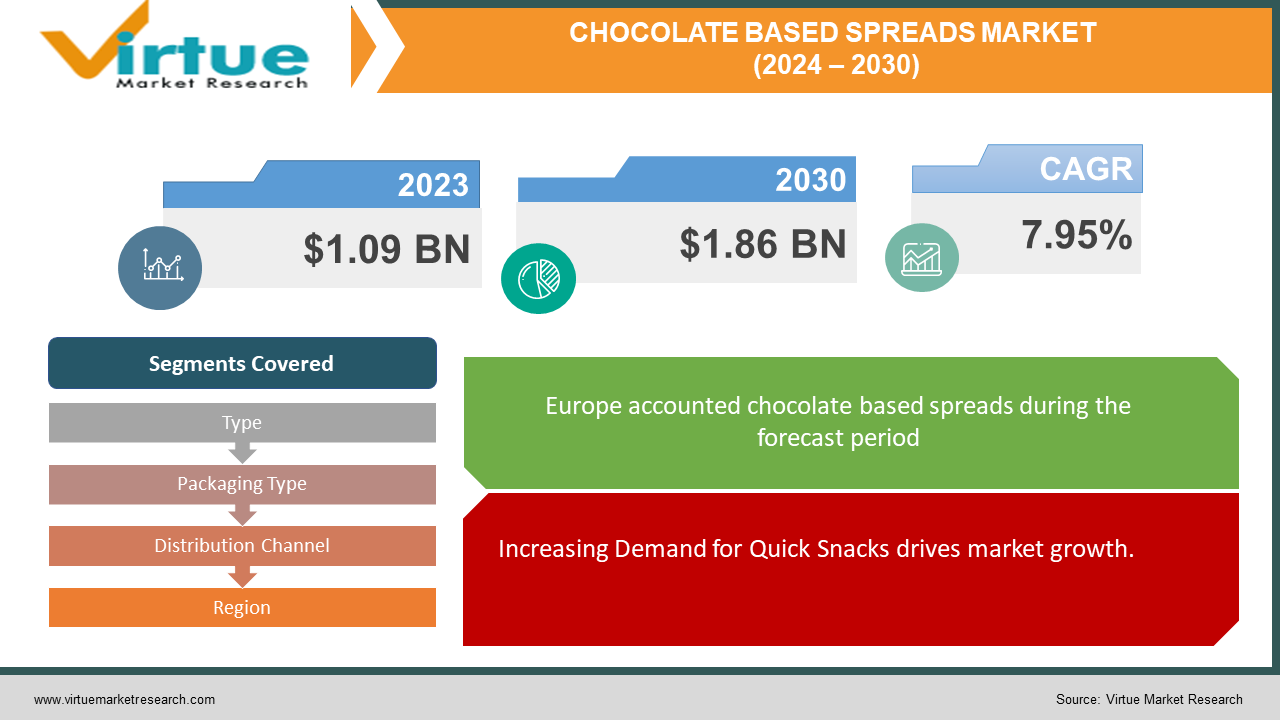

The Chocolate Based Spreads Market was valued at USD 1.09 billion in 2023. Over the forecast period of 2024-2030 it is projected to reach USD 1.86 billion by 2030, growing at a CAGR of 7.95%.

Key Market Insights:

With over 1.7 billion kilograms of chocolate-based spreads consumed globally in 2023, the market continues to expand, fueled by growing urbanization, changing dietary habits, and rising disposable incomes. Online sales of chocolate-based spreads have surged, with a growth rate exceeding 25% annually, as consumers increasingly turn to convenient online shopping options, aided by a wider range of product choices and doorstep delivery services.

Chocolate Based Spreads Market Drivers:

Increasing Demand for Quick Snacks drives market growth.

As lifestyles evolve, individuals are increasingly occupied with diverse jobs and varying schedules, leaving little time for meal preparation. Consequently, many consumers seek convenient, nutritious snacks that can sustain them throughout the day. For instance, chocolate spreads are often used on bread slices for quick breakfasts or carried as evening snacks. Snacking has emerged as a prevalent trend globally, offering a source of energy and essential nutrients like proteins, minerals, vitamins, and fiber. Incorporating healthy snacks into one's diet can also help curb hunger and prevent overeating during main meals. Therefore, the demand for food products like chocolate-based spreads is rising, driven by the need for additional nutrients and energy in a fast-paced lifestyle. These trends are contributing to the growing popularity of chocolate spreads in both retail and foodservice sectors.

Demand for organic food products increases the market growth.

With increasing consumer awareness about health and nutrition, the chocolate spread market is experiencing a notable shift towards healthier options. There is a rising demand for chocolate spreads with reduced sugar content, natural ingredients, and added beneficial components such as vitamins and minerals. To meet this demand, brands are reformulating their products to offer healthier alternatives while ensuring that flavor is not compromised.

The integration of plant-based ingredients and superfoods addresses the growing preference among health-conscious consumers for chocolate spread options that are not only delicious but also nutritious. By incorporating these ingredients, brands are catering to the evolving tastes and preferences of consumers who seek flavorful spreads that align with their wellness goals.

Chocolate Based Spreads Market Restraints and Challenges:

Threat of Substitute Products hinder market growth.

Although chocolate spreads have gained popularity in Asian markets like India and China in recent years, they still face stiff competition from traditional spreads. Despite the increasing acceptance of Western indulgences in breakfast routines, the average Asian consumer has yet to fully embrace chocolate spreads. To address this, chocolate spread manufacturers must invest heavily in advertising and promotional activities to educate consumers about the health and environmental benefits associated with their products.

Moreover, chocolate spread brands encounter strong competition from fruit spreads, jams, and marmalades. While chocolate spreads mainly target chocolate enthusiasts and children, fruit spreads appeal to a broader range of consumers worldwide. The constant innovation and product launches in the fruit spread sector pose additional challenges for chocolate spread brands, requiring them to continually innovate to remain competitive.

Chocolate Based Spreads Market Opportunities:

The chocolate spread market is witnessing a shift influenced by increasing ethical and environmental considerations among consumers. As awareness about eco-friendly practices rises, factors such as sustainable sourcing of cocoa, transparent supply chains, and environmentally conscious packaging are gaining significance. In response to these trends, chocolate spread producers are adopting fair trade policies, implementing ethical sourcing protocols, and prioritizing the use of environmentally friendly packaging materials. Companies aligning with the values of their target audience regarding environmental and social responsibility are gaining a competitive edge in the market.

CHOCOLATE BASED SPREADS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.95% |

|

Segments Covered |

By Type, Packaging Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

The Hershey Company, Dr. Oetker, The J.M. Smucker Company, Ferrero, Nestlé, Lake Champlain Chocolates, Britannia Industries, Godiva, petra Foods Limited, The Kraft Heinz Company |

Chocolate Based Spreads Market Segmentation: By Type

-

Hazelnut

-

Duo

-

Milk

-

Dark

-

Others

The hazelnut segment stands as a dominant force in the global market, projected to maintain a Compound Annual Growth Rate (CAGR) of 4% throughout the forecast period. Recognized for its heart-healthy properties, hazelnut boasts high nutritional value, enriched with vitamins, minerals, antioxidant compounds, and beneficial fats, which are pivotal drivers of its widespread popularity. Health experts advocate for hazelnut consumption as part of a well-rounded diet due to its abundance of dietary fiber, facilitating digestive regularity.

Furthermore, hazelnut chocolate spread not only serves as a delectable snack but also enhances the flavor profile of various dishes. The consumer's growing preference for hazelnut as a nutritious and flavorful ingredient has spurred manufacturers to integrate it into a diverse array of food items. This positive perception, coupled with the versatility of hazelnut chocolate spread, propels the segment's expansion as it finds application across a wide range of food products.

Chocolate Based Spreads Market Segmentation: By Packaging Type

-

Bottles

-

Pouches

-

Cups

-

Others

The bottle segment not only dominates the market but also represents the fastest-growing sector within it.

Chocolate Based Spreads Market Segmentation: By Distribution Channel

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Online Stores

-

Specialist Stores

-

Others

The supermarket and hypermarket segment hold a dominant position in the global market, poised to achieve a Compound Annual Growth Rate (CAGR) of 3.9% throughout the forecast period. These retail giants serve as key channels for both organic and conventional chocolate spreads, sourced from local and international manufacturers. Strategically located within city centers, supermarkets and hypermarkets attract a large customer base, particularly on weekends and holidays, catering to their household and grocery needs.

Offering a wide range of products, these establishments provide consumers with the flexibility to choose from various brands based on their preferences and budget. With the escalating demand for chocolate spreads and the expanding shelf space dedicated to them, many supermarkets and hypermarkets employ knowledgeable professionals who can address consumer queries regarding product specifications, ingredients, and manufacturing processes. This proactive approach enhances consumer trust and satisfaction, further fueling the segment's growth.

Chocolate Based Spreads Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

Europe holds the largest market share in the global chocolate spread market and is projected to maintain a Compound Annual Growth Rate (CAGR) of 4.2% over the forecast period. Renowned for its robust food industry, Europe boasts key revenue-generating countries like Russia, Spain, and Switzerland, which significantly contribute to its market dominance. The region's status as the world's leading chocolate producer, coupled with a high number of certified firms specializing in spreads, further solidifies its position in the market. Additionally, the emergence of fair-trade certified cocoa enterprises and the emphasis on regional product sales are anticipated to propel market expansion in Europe. Furthermore, the substantial millennial and Gen Z populations in the region are expected to drive considerable demand for chocolate spreads.

On the other hand, the Asia-Pacific region emerges as the fastest-growing market, primarily due to its burgeoning population. Australia, in particular, holds a significant share in the chocolate spread market, with chocolate spread being a popular choice among various food spreads in the country. Changing lifestyles and breakfast patterns have notably influenced chocolate spread sales in the region. As the demand for chocolate-based spreads continues to rise, numerous innovations are underway, including the introduction of new flavors tailored to consumer preferences.

COVID-19 Pandemic: Impact Analysis

The COVID-19 crisis has had a notable impact on the chocolate-based spreads market, primarily due to shifts in consumer purchasing behavior prompted by the closure of various quick-service restaurants, fast-food outlets, bakeries, and similar establishments. With limited access to desserts outside the home, consumers turned to experimenting with new food options such as cakes, pastries, and chocolate-based desserts to alleviate boredom. Additionally, many consumers opted to incorporate chocolate spreads into their breakfast routines for added convenience.

Furthermore, the preference for e-commerce platforms surged during the pandemic, driven by the closure of retail stores and other brick-and-mortar shops in compliance with government regulations. This shift in shopping habits reflects consumers' adaptation to the changing landscape, seeking convenient and accessible means to procure their desired products amid challenging circumstances.

Latest Trends/ Developments:

-

In 2022, The Hershey Company unveiled a new chocolate spread flavor called "Crunchy Cookie." The company's primary objective behind this launch was to diversify its product portfolio and introduce fresh options to consumers, thereby catering to evolving preferences.

-

In 2022, Dr. Oetker acquired Kuppies, a startup based in Noida. This acquisition was strategically aimed at leveraging Kuppies' manufacturing unit to innovate new products in the food-spread segment. By adopting this approach, the company anticipates driving revenue growth and reaching a broader consumer base through enhanced product offerings.

Key Players:

These are top 10 players in the Chocolate Based Spreads Market :-

-

The Hershey Company

-

Dr. Oetker

-

The J.M. Smucker Company

-

Ferrero

-

Nestlé

-

Lake Champlain Chocolates

-

Britannia Industries

-

Godiva

-

Petra Foods Limited

-

The Kraft Heinz Company

Chapter 1. Chocolate Based Spreads Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Chocolate Based Spreads Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Chocolate Based Spreads Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Chocolate Based Spreads Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Chocolate Based Spreads Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Chocolate Based Spreads Market – By Type

6.1 Introduction/Key Findings

6.2 Hazelnut

6.3 Duo

6.4 Milk

6.5 Dark

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Chocolate Based Spreads Market – By Packaging Type

7.1 Introduction/Key Findings

7.2 Bottles

7.3 Pouches

7.4 Cups

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Packaging Type

7.7 Absolute $ Opportunity Analysis By Packaging Type, 2024-2030

Chapter 8. Chocolate Based Spreads Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Supermarkets/Hypermarkets

8.3 Convenience Stores

8.4 Online Stores

8.5 Specialist Stores

8.6 Others

8.7 Y-O-Y Growth trend Analysis By Distribution Channel

8.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Chocolate Based Spreads Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Packaging Type

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Packaging Type

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Packaging Type

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Packaging Type

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Packaging Type

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Chocolate Based Spreads Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 The Hershey Company

10.2 Dr. Oetker

10.3 The J.M. Smucker Company

10.4 Ferrero

10.5 Nestlé

10.6 Lake Champlain Chocolates

10.7 Britannia Industries

10.8 Godiva

10.9 Petra Foods Limited

10.10 The Kraft Heinz Company

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

As lifestyles evolve, individuals are increasingly occupied with diverse jobs and varying schedules, leaving little time for meal preparation. Consequently, many consumers seek convenient, nutritious snacks that can sustain them throughout the day.

The top players operating in the Chocolate Based Spreads Market are - The Hershey Company, Dr. Oetker, The J.M. Smucker Company, Ferrero, Nestlé, Lake Champlain Chocolates, Britannia Industries, Godiva, Petra Foods Limited, The Kraft Heinz Company.

The COVID-19 crisis has had a notable impact on the chocolate-based spreads market, primarily due to shifts in consumer purchasing behavior prompted by the closure of various quick-service restaurants, fast-food outlets, bakeries, and similar establishments. With limited access to desserts outside the home, consumers turned to experimenting with new food options such as cakes, pastries, and chocolate-based desserts to alleviate boredom.

Chocolate spread producers are adopting fair trade policies, implementing ethical sourcing protocols, and prioritizing the use of environmentally friendly packaging materials. Companies aligning with the values of their target audience regarding environmental and social responsibility are gaining a competitive edge in the market.

The Asia-Pacific region emerges as the fastest-growing market, primarily due to its burgeoning population. Australia, in particular, holds a significant share in the chocolate spread market, with chocolate spread being a popular choice among various food spreads in the country.