Asia Pacific Butanol Market Size (2024-2030)

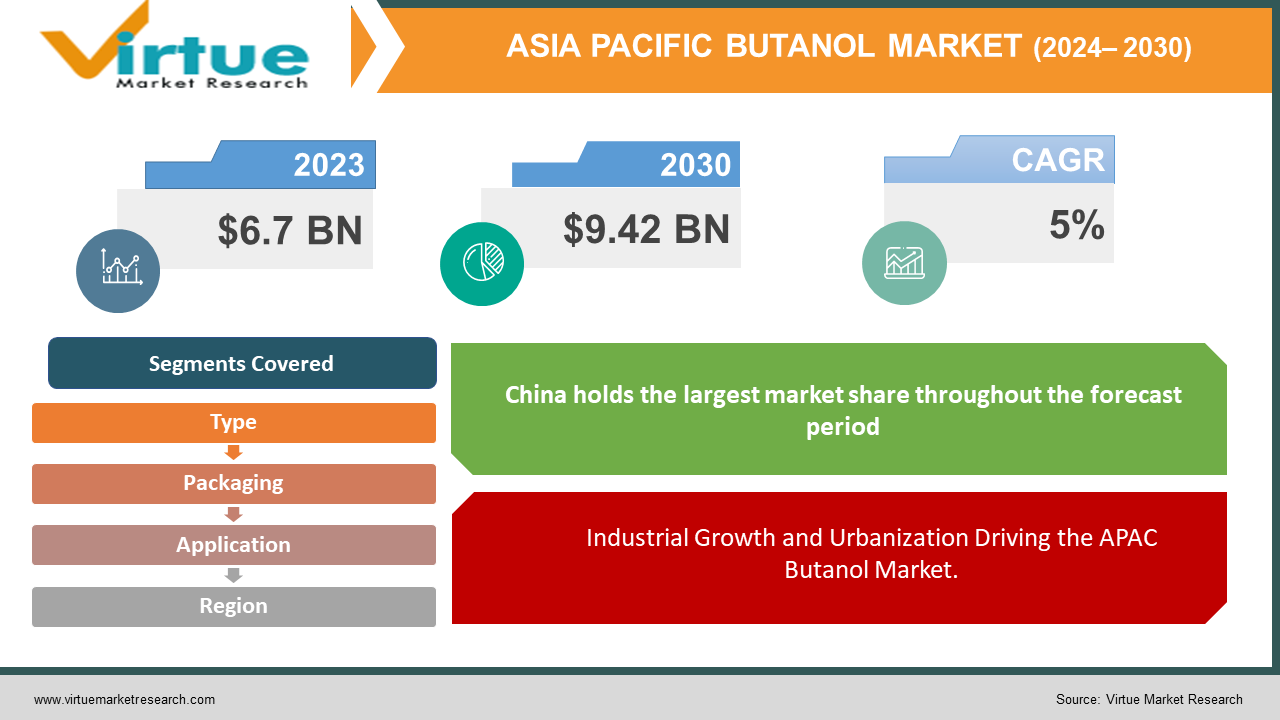

The Asia Pacific Butanol Market was valued at USD 6.7 billion in 2023 and is projected to reach a market size of USD 9.42 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 5% between 2024 and 2030.

The Asia Pacific Butanol Market is witnessing significant growth, driven by the region's expanding industrial sector and increasing demand for butanol as a versatile solvent and chemical intermediate. Butanol, a crucial component in the production of paints, coatings, adhesives, and plastics, is benefiting from the rising construction activities, automotive production, and consumer goods manufacturing across countries like China, India, and Japan. The region's rapid urbanization and industrialization are further fueling the demand for butanol, particularly in the production of chemicals like butyl acrylate and glycol ethers. Additionally, the growing focus on sustainable and eco-friendly products is propelling the use of bio-butanol, offering an alternative to traditional fossil-based butanol. The market is also influenced by fluctuations in raw material prices and regulatory policies aimed at reducing carbon emissions, pushing manufacturers to innovate and adopt greener technologies. With the presence of major global players and increasing investments in research and development, the Asia Pacific Butanol Market is poised for continued expansion, making it a key area of interest for stakeholders looking to capitalize on the region's dynamic economic landscape.

Key Market Insights:

- Bio-butanol currently represents about 15% of the total butanol market in the Asia Pacific, with a rising trend due to the increasing emphasis on sustainability and eco-friendly products.

- China dominates the Asia Pacific Butanol Market, contributing nearly 50% of the region's total butanol production and consumption, followed by India and Japan.

- Approximately 30% of butanol produced in the Asia Pacific is used as a solvent in the production of adhesives and sealants, highlighting its importance in the manufacturing sector.

- Southeast Asian countries are witnessing a rapid increase in butanol demand, with an expected annual growth rate of 6-7% due to industrialization and urbanization.

Asia Pacific Butanol Market Drivers:

Industrial Growth and Urbanization Driving the APAC Butanol Market.

The Asia Pacific Butanol Market is significantly driven by rapid industrial growth and urbanization across the region. Countries like China, India, and Southeast Asian nations are experiencing unprecedented levels of industrialization, which is fueling the demand for butanol as a key raw material in various industrial applications. Butanol is widely used as a solvent in the production of paints, coatings, adhesives, and plastics—industries that are directly benefiting from the ongoing construction boom and infrastructure development in these nations. The rise in automotive manufacturing, driven by increasing disposable income and urban migration, also contributes to the growing demand for butanol. As these industries expand to meet the needs of the burgeoning urban populations, the consumption of butanol is expected to rise steadily. Moreover, the shift towards modernization in these countries is leading to higher consumption of consumer goods, which in turn drives the demand for packaging materials where butanol plays a crucial role.

Shift Towards Sustainable Products Revolutionizing the APAC Butanol Market.

Another significant driver of the Asia Pacific Butanol Market is the growing shift towards sustainable and environmentally friendly products. With rising awareness about climate change and the need to reduce carbon footprints, industries are increasingly adopting bio-based butanol as an alternative to conventional, fossil-fuel-derived butanol. Bio-butanol, which is produced from renewable feedstocks such as corn, sugarcane, and other biomass, offers a more sustainable solution without compromising on performance. Governments across the Asia Pacific region are implementing stricter environmental regulations, pushing industries to adopt greener practices. This trend is particularly strong in countries like Japan and South Korea, where environmental sustainability is a critical aspect of industrial policy. The growing consumer preference for eco-friendly products is also driving manufacturers to innovate and produce bio-based alternatives, further boosting the demand for bio-butanol. As the region continues to emphasize sustainability, the shift towards bio-butanol is expected to be a key growth driver in the Asia Pacific Butanol Market.

Asia Pacific Butanol Market Restraints and Challenges:

The Asia Pacific Butanol Market faces several restraints and challenges that could hinder its growth. One of the primary challenges is the volatility in raw material prices, particularly the cost of petrochemical feedstocks used in butanol production. Fluctuations in crude oil prices directly impact the production cost of butanol, leading to uncertainties in pricing and supply stability. Additionally, the market is challenged by stringent environmental regulations aimed at reducing carbon emissions and promoting sustainable practices. Compliance with these regulations often requires significant investments in cleaner technologies and processes, which can be financially burdensome for manufacturers, particularly small and medium-sized enterprises. The market is also facing competition from alternative chemicals and solvents that offer similar properties but are cheaper or more sustainable, such as bio-based solvents and other alcohols. Moreover, the slow adoption of bio-butanol, despite its environmental benefits, is a challenge due to its higher production costs and limited availability compared to conventional butanol. The lack of infrastructure and technological advancements in some Asia Pacific countries further complicates the market dynamics, limiting the widespread adoption of more sustainable practices. These challenges collectively pose significant barriers to the growth of the Asia-Pacific Butanol Market.

Asia Pacific Butanol Market Opportunities:

The Asia Pacific Butanol Market presents several lucrative opportunities, primarily driven by the region's increasing focus on sustainable development and the growing demand for eco-friendly products. One of the most promising opportunities lies in the expansion of bio-butanol production. As governments and industries across the Asia Pacific region intensify their efforts to reduce carbon emissions and reliance on fossil fuels, bio-butanol, derived from renewable resources, is gaining traction as a greener alternative to conventional butanol. This shift is particularly strong in countries like Japan, South Korea, and Australia, where there is a growing consumer preference for environmentally friendly products. Additionally, the rapid industrialization and urbanization in emerging economies such as India and Southeast Asian countries offer opportunities for market expansion, particularly in sectors like construction, automotive, and consumer goods, where butanol is a key component. Furthermore, the increasing investment in research and development to enhance the efficiency and scalability of bio-butanol production technologies presents an opportunity for innovation and market growth. Companies that can capitalize on these trends by offering sustainable solutions and expanding their presence in these high-growth markets stand to gain a significant competitive advantage in the Asia Pacific Butanol Market.

ASIA PACIFIC BUTANOL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5% |

|

Segments Covered |

By Type, packaging, application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

china, Japan, India, South Korea, Rest of Asia-Pacific |

|

Key Companies Profiled |

BASF SE, Dow Inc., Eastman Chemical Company, Mitsubishi Chemical Corporation, Oxea GmbH, China National Petroleum Corporation (CNPC), Sinopec Limited, Formosa Plastics Corporation, Sasol Limited, PETRONAS Chemicals Group Berhad, Grupa Azoty S.A., Solventis Ltd. |

Asia Pacific Butanol Market Segmentation:

Asia Pacific Butanol Market Segmentation By Type:

- n-Butanol

- 2-Butanol

- Iso-butanol

- tert-Butanol

The Asia Pacific Butanol Market by Type, n-butanol market share last year and is poised to maintain its dominance throughout the forecast period. n-Butanol, a highly versatile chemical, finds extensive use in coatings, solvents, plasticizers, and butyl esters, driving its strong and consistent demand. Its established production processes ensure cost-efficiency and scalability, contributing to its market dominance. Key end-use industries like paints and coatings, which are major consumers of n-butanol, further support its prominent market position. Reports from ChemAnalyst and MarketsandMarkets emphasize n-butanol's significant market share in the Asia Pacific region and forecast its continued dominance. However, several factors could influence its future market standing. The rising demand for bio-based butanol alternatives, driven by sustainability concerns, may impact n-butanol's market share over time. Additionally, technological advancements in production processes for other butanol types could introduce cost efficiencies and expanded applications, posing challenges to n-butanol's current supremacy. Economic fluctuations and changes in industrial activity may also affect demand for n-butanol. In summary, while n-butanol is a leading player in the Asia Pacific butanol market, it is essential to stay attuned to emerging trends and competitive dynamics to evaluate its long-term position.

Asia Pacific Butanol Market Segmentation By Packaging:

- Drums

- Bottles

- Bags

- Others

The Asia Pacific Butanol Market by Packaging and drums market share last year and is poised to maintain its dominance throughout the forecast period. Drums dominate the packaging of butanol due to their cost-effectiveness, versatility, established handling infrastructure, and safety features. They provide a relatively low-cost solution for bulk packaging, are easy to transport and store, and are supported by a robust infrastructure for handling and logistics in the Asia Pacific region. Furthermore, drums offer adequate protection for butanol during transportation and storage, making them a preferred choice. Industry reports consistently highlight that drums are the leading packaging type for butanol in this region. However, potential challenges could impact their continued dominance. Environmental concerns are driving a shift towards more sustainable packaging options, which could reduce reliance on drums. Additionally, rising transportation costs due to increasing fuel prices and logistics challenges may affect the cost-effectiveness of drum packaging. Innovations in packaging materials that offer superior properties could also erode the market share of drums. In conclusion, while drums currently lead the butanol packaging market in Asia Pacific, evolving industry trends and technological advancements may influence their position in the future.

Asia Pacific Butanol Market Segmentation By Application:

- Coating Resins

- Butyl Carboxylates

- Direct Solvent Use

- Plasticizers

- Fuels & Lubricants

- Others

The Asia Pacific Butanol Market by Application, Coating Resins market share last year and is poised to maintain its dominance throughout the forecast period. Butanol plays a pivotal role as a key component in the production of coating resins, serving both as a solvent and reactant. The burgeoning construction sector in the Asia Pacific region significantly drives demand for paints and coatings, thereby increasing butanol consumption. Similarly, the expanding automotive industry further fuels the need for coatings, enhancing the market for butanol. Industry reports frequently emphasize the dominant role of coating resins in butanol consumption within the region, driven by factors such as urbanization, infrastructure development, and rising disposable incomes. However, potential challenges could impact this dominance. Stricter environmental regulations may influence the formulation of coatings, potentially reducing butanol demand. Additionally, the shift towards water-based coatings could diminish the use of solvent-based coatings, thereby affecting butanol consumption. Technological advancements in alternative solvents or resins might also challenge butanol’s prominent role in the coatings industry. In summary, while butanol remains a crucial ingredient in coating resins, evolving environmental standards, shifts in coating technologies, and the development of alternative materials could influence its market position in the future.

Asia Pacific Butanol Market Segmentation By Country:

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- Rest of APAC

The Asia Pacific Butanol Market by Country, China market share leads last year and is poised to maintain its dominance throughout the forecast period. China's dominance in butanol production is supported by its massive production capacity, driven by a robust chemical industry. The country's substantial domestic demand for butanol, fueled by thriving manufacturing sectors such as paints, coatings, and chemicals, reinforces its leading position. Additionally, favorable government policies promoting industrial growth and chemical production, combined with lower labor and production costs, enhance China's cost competitiveness in the butanol market. However, several challenges could impact this dominance. Increasingly stringent environmental regulations may affect the chemical industry, including butanol production, potentially raising operational costs. Rising labor costs could gradually diminish China's cost advantage. Furthermore, the expansion of butanol production capacities in other regional countries like India and South Korea could erode China’s market share over time. In summary, while China currently leads in butanol production due to its significant capacity, strong domestic demand, and cost advantages, emerging environmental regulations, rising labor costs, and regional competition pose potential challenges to its continued dominance.

COVID-19 Impact Analysis on the Asia Pacific Butanol Market.

The COVID-19 pandemic had a mixed impact on the Asia Pacific Butanol Market, disrupting supply chains while also creating opportunities in specific sectors. During the initial phases of the pandemic, the market faced significant challenges due to lockdowns, factory shutdowns, and reduced industrial activities, leading to a decline in demand for butanol across various industries such as automotive, construction, and manufacturing. The disruption of global supply chains also caused delays in the availability of raw materials, further impacting production capacities. However, the pandemic also accelerated demand in certain segments, particularly in the production of sanitizers and disinfectants, where butanol is a critical ingredient. As hygiene became a top priority, the increased consumption of these products partially offset the decline in other sectors. Additionally, the focus on sustainable recovery post-pandemic has led to renewed interest in bio-butanol, as industries seek greener alternatives to traditional chemicals. The pandemic highlighted the need for more resilient supply chains and diversified production bases, prompting companies in the region to invest in local production and reduce dependence on imports. Overall, while COVID-19 posed significant challenges, it also paved the way for new opportunities in the Asia Pacific Butanol Market, particularly in the areas of sustainability and health-related applications.

Latest trends / Developments:

The Asia Pacific Butanol Market is witnessing several emerging trends and developments, driven by evolving industry needs and a growing focus on sustainability. One of the most notable trends is the increasing adoption of bio-butanol as a greener alternative to traditional petrochemical-based butanol. This shift is supported by stringent environmental regulations and rising consumer demand for eco-friendly products. Industries are exploring bio-based production methods using renewable feedstocks, which not only reduce carbon footprints but also align with global sustainability goals. Additionally, there is a growing interest in expanding butanol's application beyond traditional sectors like paints, coatings, and adhesives. For instance, butanol is increasingly being used in the production of biofuels, where its properties as an energy-dense alcohol make it a viable alternative to conventional fuels. The market is also seeing technological advancements aimed at improving production efficiency and reducing costs, particularly in the synthesis of bio-butanol. Another trend is the regional shift in manufacturing hubs within Asia Pacific, with countries like India and Vietnam emerging as key players due to their favorable regulatory environments and lower production costs. These trends highlight the market's dynamic nature, with sustainability, innovation, and regional diversification playing critical roles in its future growth.

Key Players:

- BASF SE

- Dow Inc.

- Eastman Chemical Company

- Mitsubishi Chemical Corporation

- Oxea GmbH

- China National Petroleum Corporation (CNPC)

- Sinopec Limited

- Formosa Plastics Corporation

- Sasol Limited

- PETRONAS Chemicals Group Berhad

- Grupa Azoty S.A.

- Solventis Ltd.

Chapter 1. Asia Pacific Butanol Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Butanol Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Butanol Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Butanol Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Butanol Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Butanol Market– By Type

6.1. Introduction/Key Findings

6.2. n-Butanol

6.3. 2-Butanol

6.4. Iso-butanol

6.5. tert-Butanol

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type , 2023-2030

Chapter 7. Asia Pacific Butanol Market– By Packaging

7.1. Introduction/Key Findings

7.2. Drums

7.3. Bottles

7.4. Bags

7.5. Others

7.6. Y-O-Y Growth trend Analysis By Packaging

7.7. Absolute $ Opportunity Analysis By Packaging , 2023-2030

Chapter 8. Asia Pacific Butanol Market– By Application

8.1. Introduction/Key Findings

8.2. Coating Resins

8.3. Butyl Carboxylates

8.4. Direct Solvent Use

8.5. Plasticizers

8.6. Fuels & Lubricants

8.7. Others

8.8. Y-O-Y Growth trend Analysis Application

8.9. Absolute $ Opportunity Analysis Application , 2023-2030

Chapter 9. Asia Pacific Butanol Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Asia Pacific

9.1.1. By Country

9.1.1.1. China

9.1.1.2. Japan

9.1.1.3. South Korea

9.1.1.4. India

9.1.1.5. Australia & New Zealand

9.1.1.6. Rest of Asia-Pacific

9.1.2. By Application

9.1.3. By Type

9.1.4. By Packaging

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Asia Pacific Butanol Market– Company Profiles – (Overview, Packaging Portfolio, Financials, Strategies & Developments)

10.1 BASF SE

10.2. Dow Inc.

10.3. Eastman Chemical Company

10.4. Mitsubishi Chemical Corporation

10.5. Oxea GmbH

10.6. China National Petroleum Corporation (CNPC)

10.7. Sinopec Limited

10.8. Formosa Plastics Corporation

10.9. Sasol Limited

10.10. PETRONAS Chemicals Group Berhad

10.11. Grupa Azoty S.A.

10.12. Solventis Ltd.

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

By 2023, the Asia Pacific Butanol market is expected to be valued at US$ 6.7 billion

Through 2030, the Asia Pacific Butanol market is expected to grow at a CAGR of 5%.

By 2030, the Asia Pacific Butanol Market is expected to grow to a value of US$ 9.42 billion.

China is predicted to lead the Asia Pacific Butanol market

The Asia Pacific Butanol Market has segments By Type, Packaging, Application, and Region