Butanol Market Size (2024 – 2030)

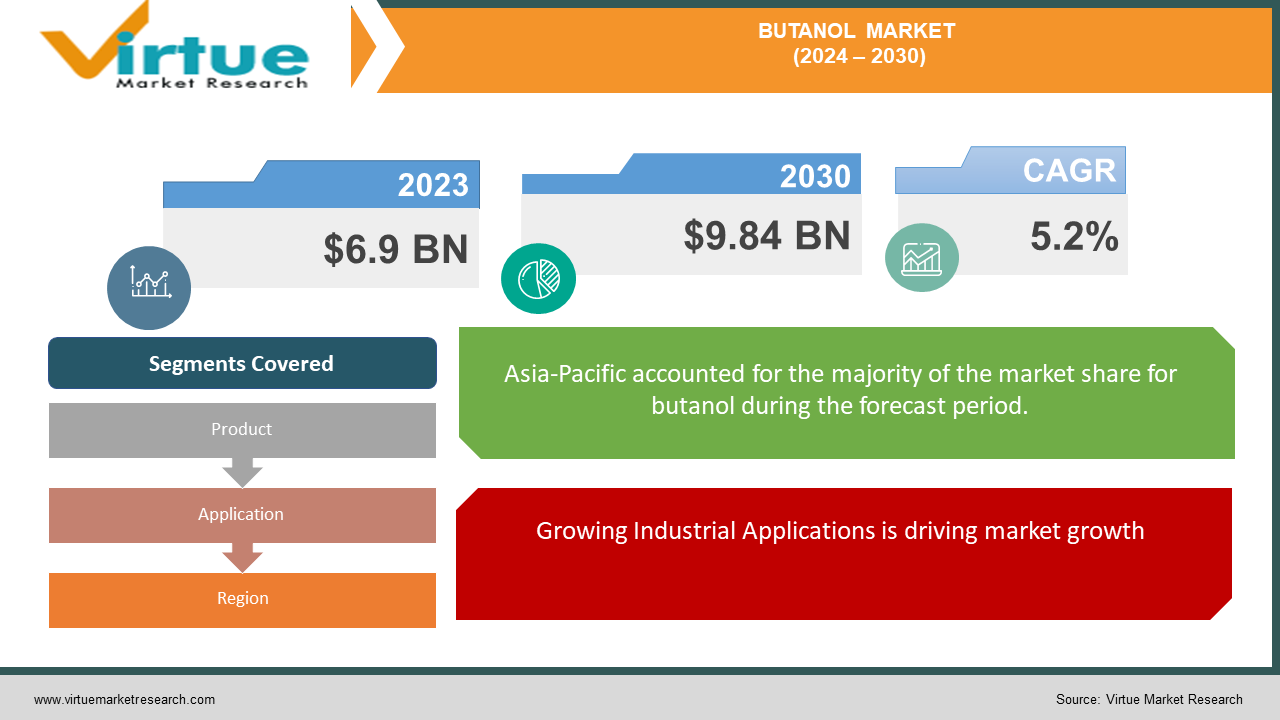

The global butanol market was valued at USD 6.9 billion in 2023 and is expected to grow at a CAGR of 5.2% from 2024 to 2030. The market is anticipated to reach USD 9.84 billion by 2030.

Butanol, a four-carbon alcohol, is used in various applications such as solvents, intermediates, and as a fuel additive. The market's growth is driven by its increasing use in the automotive and construction industries, as well as its potential as a renewable biofuel. The expanding industrial sector and rising demand for eco-friendly and sustainable products further contribute to the market's expansion.

Key Market Insights

The automotive sector's demand for butanol as a fuel additive to improve engine performance and reduce emissions is a significant growth driver.

Asia-Pacific holds the largest market share, with China and India leading due to their expanding industrial base and increasing construction activities.

The European butanol market is growing steadily, driven by stringent regulations promoting the use of eco-friendly chemicals. Technological advancements in the production processes of butanol are reducing production costs and increasing market competitiveness. The pharmaceutical industry’s increasing demand for butanol as an intermediate in drug manufacturing is boosting market growth.

Market players are increasingly investing in research and development to enhance the production of bio-based butanol, aiming to meet the rising demand for sustainable products.

Global Butanol Market Drivers

Growing Industrial Applications is driving market growth: The butanol market is primarily driven by its diverse industrial applications. Butanol is extensively used as a solvent in the production of paints, coatings, varnishes, and adhesives. The expanding construction and automotive industries are significant consumers of these products, thereby driving the demand for butanol. Additionally, butanol is used as an intermediate in the production of plasticizers, which are essential for the manufacturing of flexible PVC products. The growing demand for these industrial products is a crucial driver for the butanol market. Furthermore, the chemical industry utilizes butanol in the production of butyl acrylate, butyl acetate, glycol ethers, and other derivatives, which are essential for various industrial processes.

Rising Demand for Bio-based Butanol is driving market growth: The increasing environmental concerns and the push for sustainable and eco-friendly products are driving the demand for bio-based butanol. Bio-butanol is produced from renewable biomass sources, making it an attractive alternative to traditional fossil-fuel-derived butanol. The market is witnessing a growing interest in bio-based chemicals due to their lower carbon footprint and reduced environmental impact. Governments and regulatory bodies are also supporting the use of bio-based products through favorable policies and incentives. This trend is encouraging manufacturers to invest in the development and production of bio-based butanol, thereby driving market growth.

Expansion of the Automotive Sector is driving market growth: The automotive industry's growth is significantly contributing to the butanol market. Butanol is used as a fuel additive in gasoline to improve engine performance and reduce emissions. The increasing focus on reducing carbon emissions and enhancing fuel efficiency is driving the demand for butanol as an alternative fuel. Moreover, butanol's high energy content and compatibility with existing gasoline engines make it a suitable option for blending with conventional fuels. The rising production and sales of automobiles, especially in emerging economies, are further boosting the demand for butanol in the automotive sector.

Global Butanol Market Challenges and Restraints

Fluctuating Raw Material Prices is restricting market growth: One of the major challenges faced by the butanol market is the volatility in raw material prices. Butanol is primarily produced from petrochemical feedstocks, such as propylene and acetaldehyde, which are derived from crude oil and natural gas. The prices of these raw materials are subject to fluctuations due to changes in global oil prices, supply-demand dynamics, and geopolitical factors. The unpredictable nature of raw material prices poses a challenge for manufacturers in maintaining stable production costs and profit margins. This volatility can also impact the pricing strategies and competitiveness of butanol products in the market.

Stringent Environmental Regulations is restricting market growth: The butanol market faces challenges due to stringent environmental regulations imposed by various governments and regulatory bodies. The production and use of butanol, particularly fossil-fuel-derived butanol, are associated with environmental concerns, including greenhouse gas emissions and potential health hazards. Regulatory agencies are implementing stricter guidelines and standards to minimize the environmental impact of chemical production processes. Compliance with these regulations requires significant investments in advanced technologies, cleaner production methods, and waste management practices. The need to adhere to stringent environmental regulations adds to the operational costs and complexities for butanol manufacturers, posing a restraint on market growth.

Market Opportunities

The butanol market presents significant growth opportunities, particularly in the development and commercialization of bio-based butanol. With the increasing focus on sustainability and environmental protection, there is a growing demand for renewable and eco-friendly alternatives to conventional petrochemical-derived products. Bio-based butanol, produced from biomass sources such as agricultural residues, is gaining traction as a sustainable and green solvent. Manufacturers are investing in research and development to enhance the production efficiency and cost-effectiveness of bio-butanol. Furthermore, the expansion of applications in emerging markets, such as Asia-Pacific and Latin America, offers immense potential for market growth. These regions are witnessing rapid industrialization, urbanization, and rising consumer demand for eco-friendly products, creating favorable conditions for the adoption of butanol and its derivatives.

BUTANOL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.2% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, Dow Inc., Eastman Chemical Company, Mitsubishi Chemical Corporation, Oxea GmbH, Sasol Limited, Green Biologics Limited, Gevo, Inc., Cobalt Technologies, Butamax Advanced Biofuels LLC |

Butanol Market Segmentation - By Product

-

N-Butanol

-

Iso-Butanol

-

Tert-Butanol

-

Bio-Butanol

N-Butanol is the dominant segment in the butanol market. Its dominance is attributed to its extensive use as a solvent and intermediate in various applications such as paints, coatings, adhesives, and plasticizers. N-Butanol's versatility, availability, and cost-effectiveness make it a preferred choice for industrial applications. Additionally, the growing demand for N-Butanol in the production of butyl acrylate and butyl acetate further strengthens its position as the dominant segment in the market.

Butanol Market Segmentation - By Application

-

Solvent

-

Intermediate

-

Fuel Additive

-

Other Applications

The Solvent segment is the most dominant in the butanol market. This dominance is driven by the widespread use of butanol as a solvent in the production of paints, coatings, adhesives, and varnishes. The increasing demand for high-performance coatings and adhesives in the construction and automotive industries is a significant factor contributing to the dominance of the solvent segment. Butanol's excellent solvency properties and compatibility with various resins and polymers make it an essential component in many solvent-based formulations.

Butanol Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the dominant region in the butanol market, primarily due to the rapid industrialization, urbanization, and economic growth in countries such as China, India, and Japan. The region's expanding construction, automotive, and chemical industries are driving the demand for butanol and its derivatives. China, in particular, is a significant consumer and producer of butanol, supported by its large manufacturing base and robust demand for coatings, adhesives, and plasticizers. Additionally, favorable government policies, investments in infrastructure, and the presence of major market players contribute to the dominance of Asia-Pacific in the butanol market.

COVID-19 Impact Analysis on the Butanol Market

The COVID-19 pandemic had a complex impact on the butanol market. The initial phase of the pandemic, marked by widespread lockdowns and disruptions, significantly affected global supply chains and production activities. This led to substantial slowdowns in key sectors like automotive and construction, both of which are major consumers of butanol. The temporary reduction in demand from these industries contributed to a downturn in the market for butanol-based products. On the other hand, the pandemic heightened the importance of hygiene and sanitation, which created a notable increase in the demand for cleaning agents and sanitizers. Butanol, being a crucial ingredient in many disinfectants, saw a boost in demand from this sector. Additionally, the ongoing global emphasis on environmental sustainability and eco-friendly products persisted during the pandemic. This trend fueled interest in bio-based butanol, as industries and consumers alike continued to prioritize green and sustainable alternatives. As the world gradually adjusts to post-pandemic conditions, the butanol market is expected to recover and regain momentum. The resumption of industrial activities and the growing focus on sustainability and hygiene are likely to drive the market's revival. Industries are expected to adapt to new norms, incorporating butanol into various applications as they recover. The long-term outlook for the butanol market remains positive, with anticipated growth driven by evolving industrial needs and a continued emphasis on eco-friendly practices.

Latest Trends/Developments

The butanol market is witnessing several key trends and developments that are shaping its growth trajectory. One notable trend is the increasing adoption of bio-based butanol as a sustainable alternative to fossil-fuel-derived butanol. Bio-butanol, produced from renewable biomass sources, offers lower carbon emissions and reduced environmental impact, aligning with the global shift towards green and eco-friendly products. Another significant trend is the advancement in production technologies, such as catalytic processes and biotechnological methods, which enhance the efficiency and cost-effectiveness of butanol production. Furthermore, the integration of butanol as a fuel additive in gasoline and diesel is gaining traction, driven by the need to improve fuel efficiency and reduce emissions. Strategic partnerships and collaborations between butanol manufacturers and end-user industries are also fostering innovation and expanding the applications of butanol. These trends and developments are expected to drive the growth and competitiveness of the butanol market in the coming years.

Key Players

-

BASF SE

-

Dow Inc.

-

Eastman Chemical Company

-

Mitsubishi Chemical Corporation

-

Oxea GmbH

-

Sasol Limited

-

Green Biologics Limited

-

Gevo, Inc.

-

Cobalt Technologies

-

Butamax Advanced Biofuels LLC

Chapter 1. Butanol Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Butanol Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Butanol Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Butanol Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Butanol Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Butanol Market – By Product

6.1 Introduction/Key Findings

6.2 N-Butanol

6.3 Iso-Butanol

6.4 Tert-Butanol

6.5 Bio-Butanol

6.6 Y-O-Y Growth trend Analysis By Product

6.7 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Butanol Market – By Application

7.1 Introduction/Key Findings

7.2 Solvent

7.3 Intermediate

7.4 Fuel Additive

7.5 Other Applications

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Butanol Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Butanol Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 BASF SE

9.2 Dow Inc.

9.3 Eastman Chemical Company

9.4 Mitsubishi Chemical Corporation

9.5 Oxea GmbH

9.6 Sasol Limited

9.7 Green Biologics Limited

9.8 Gevo, Inc.

9.9 Cobalt Technologies

9.10 Butamax Advanced Biofuels LLC

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global butanol market was valued at approximately USD 6.9 billion in 2023 and is expected to reach USD 9.84 billion by 2030, growing at a CAGR of 5.2% from 2024 to 2030.

Key drivers of the butanol market include its growing industrial applications, rising demand for bio-based butanol, and expansion of the automotive sector which uses butanol as a fuel additive to improve engine performance and reduce emissions.

The butanol market is segmented by product type and application. By product type, the segments are (N-Butanol, Iso-Butanol, Tert-Butanol, and Bio-Butanol) and by application (Solvent, Intermediate, Fuel Additive, and Other Applications).

Asia-Pacific is the dominant region in the butanol market, driven by rapid industrialization, urbanization, and economic growth, particularly in countries like China and India.

Leading players in the butanol market include BASF SE, Dow Inc., Eastman Chemical Company, Mitsubishi Chemical Corporation, Oxea GmbH, Sasol Limited, Green Biologics Limited, Gevo, Inc., Cobalt Technologies, and Butamax Advanced Biofuels LLC.