Asia Pacific Beauty Drinks Market Size (2024-2030)

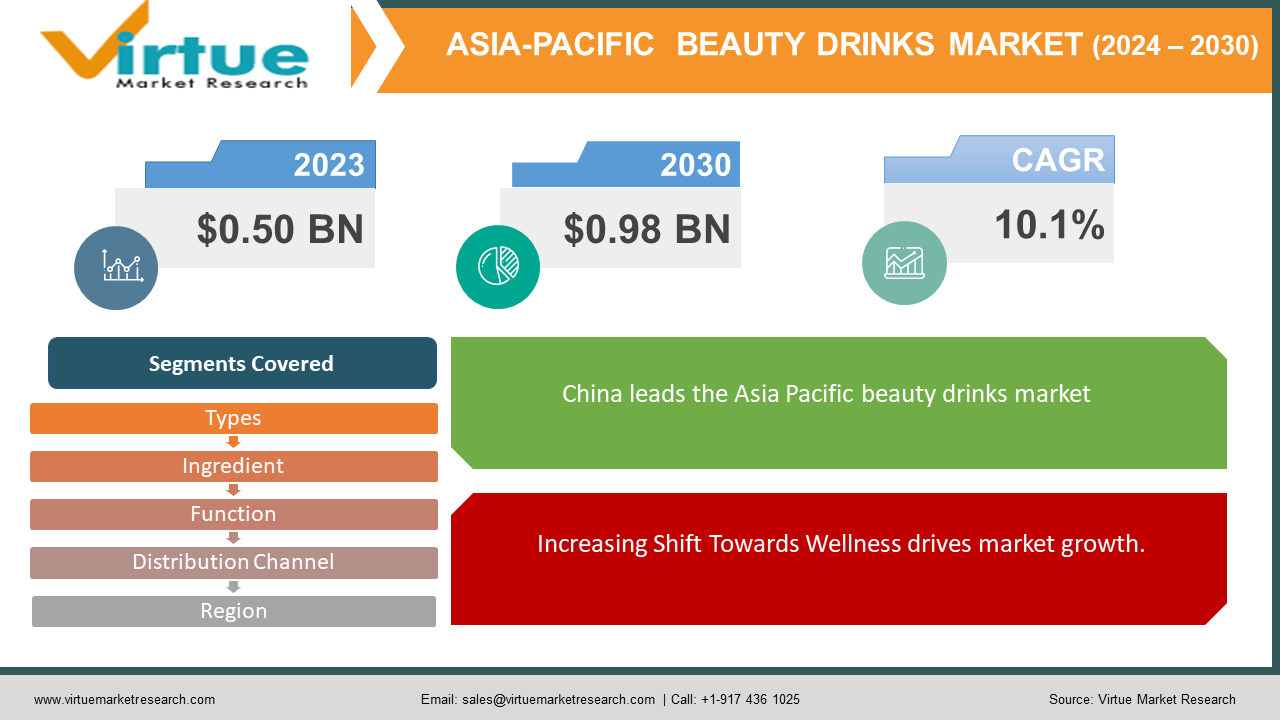

The Asia Pacific Beauty Drinks Market was valued at USD 0.50 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 0.98 billion by 2030, growing at a CAGR of 10.1%.

The market for beauty beverages has experienced notable growth in recent years, fueled by a rising consumer focus on health and wellness. There is a marked preference among women for products that streamline their beauty routines while boosting their overall health. This niche segment within the larger functional beverages market is becoming more popular as consumers look for convenient and efficient solutions to support their beauty and health practices.

Key Market Insights:

The beauty drinks market is primarily propelled by the general consumer shift towards preventive skincare, particularly among the growing elderly population. Additionally, the market is significantly boosted by a rising number of health-conscious consumers with increasing disposable incomes.

Asia Pacific Beauty Drinks Market Drivers:

Increasing Shift Towards Wellness drives market growth.

Consumers are increasingly valuing wellness, looking for products that deliver both aesthetic and health benefits. Beauty drinks fit this trend by offering a comprehensive approach to skincare from within.

Protein-rich beauty drinks are expected to capture a significant market share in the forecast period, largely due to their essential role in skincare routines. Regular intake of these protein-enriched beverages helps rejuvenate the complexion from within. They provide numerous anti-aging benefits, including improved hair and skin health, joint revitalization, and gut healing.

Simplicity and Convenience lifestyle increase the demand of the market.

Hectic lifestyles have led consumers to look for simplified beauty routines. Beauty drinks provide an easy way to nourish the skin from within, reducing the reliance on multiple skincare products. Drinks infused with functional ingredients like antioxidants and vitamins are becoming increasingly popular. These components are believed to protect the skin from free radical damage and promote healthy skin.

Natural and Functional Ingredients attract consumers, which benefits the market growth.

There is a rising preference for products made with natural ingredients known for their skin-enhancing properties. Beauty drinks commonly include components such as collagen, hyaluronic acid, antioxidants, and vitamins, which are acclaimed for their hydrating and anti-aging effects.

These beverages often feature collagen peptides, which boost the production of natural collagen cells and diminish premature wrinkles. Collagen-based drinks are in high demand due to the growing interest in beauty beverages that provide anti-aging benefits, especially for facial, scalp, and nail health.

Increasing consumer awareness of the benefits of collagen peptides and tripeptides in human nutrition has gained momentum in both the nutrition and cosmetic industries. This trend has driven the rise of nutricosmetic solutions.

Asia Pacific Beauty Drinks Market Restraints and Challenges:

High Prices hinder market growth.

The surging cost of beauty drinks is a major factor that can hinder the growth and adoption of this market. The elevated price of nutricosmetics is a significant barrier to their widespread use. This premium pricing is attributed to the inclusion of high-quality ingredients and the extensive research and development involved in creating these products.

Asia Pacific Beauty Drinks Market Opportunities:

The influence of social media creates more opportunities for market growth.

Social media platforms are powerful channels for beauty trends and product recommendations. Consumers frequently discover new beauty drinks through social media influencers and online reviews.

The rise of social media and influencer marketing significantly impacts the beauty drinks market. Through various online platforms, consumers are exposed to beauty and wellness trends, influencing their purchasing decisions. Endorsements and testimonials from influencers and celebrities increase the visibility and attractiveness of beauty drinks, boosting consumer confidence and driving market growth.

Increasing Consumer Awareness of Collagen-infused Nutri-cosmetics creates market buzz.

The growing female population has led to increased awareness of beauty drinks that aid in anti-aging, enhance skin radiance, and reduce acne, scars, and pigmentation. Acne, particularly prevalent among women, drives demand for beauty drinks that promote healthy aging and improve skin, hair, and nail health.

This rising consumer awareness of the benefits of collagen peptides and tripeptides in nutrition has boosted demand for collagen-based drinks, fueling the growth of nutricosmetic solutions. Consumers' desire to prevent premature aging and preference for natural, safe, and effective beauty products have made protein- and amino acid-derived nutricosmetics, like collagen drinks, significant players in the market.

Consequently, leading nutraceutical companies are expanding their product lines to strengthen their presence in the beauty drinks market.

ASIA PACIFIC BEAUTY DRINKS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.1% |

|

Segments Covered |

By Type, Ingredient, function, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

China, India, Japan, South Korea |

|

Key Companies Profiled |

Elantas GmbH (Germany), Axalta Coating Systems (the U.S.), Von Roll Holdings AG (Switzerland), Hitachi Chemicals Company Ltd. (Japan), 3M Company (the U.S.), and Kyocera Corporation (Japan) |

Asia Pacific Beauty Drinks Market Segmentation:

Asia Pacific Beauty Drinks Market Segmentation- By Type:

- Natural Drinks

- Artificial Drinks

The natural drinks segment is expected to grow at a higher CAGR during the forecast period due to increasing health consciousness and concerns about the side effects of artificial drinks. Natural drinks are made from naturally derived ingredients that include fruit juices, milk, sugar, malt, acid, flavoring, and coloring materials. Beauty drinks typically contain ingredients like Goji Berry juice, which helps keep the skin smooth and healthy, and Pomegranate juice, known for its potent antioxidant properties.

Asia Pacific Beauty Drinks Market Segmentation- By Ingredients:

- Collagen Proteins

- Vitamins and Minerals

- Fruit Extracts

- Others

Collagen-based beauty drinks hold the highest market share and are expected to maintain this position over the forecast period. These drinks provide structural protein to the skin, making it look young and plump while protecting it from sun exposure and environmental pollution. Collagen supplements prevent early aging, increasing the demand for collagen beauty drinks.

Collagen-based products are particularly popular among elderly consumers due to the natural decline in collagen production with age. This has heightened regional demand for beverages containing collagen. Increased consumer awareness of collagen's skin health benefits and greater investments by ingredient manufacturers have led prominent companies to expand their product lines by introducing collagen-infused beauty drinks.

The desire to prevent premature aging and the growing preference for natural, safe, and effective beauty solutions like collagen drive market growth. Companies focusing on developing collagen-infused products further support this trend.

Asia Pacific Beauty Drinks Market Segmentation- By Function:

- Anti-Ageing

- Detoxification

- Radiance

- Vitality

- Others

The anti-aging segment is expected to maintain its leading position in the market, driven by the extensive availability of anti-aging products in Asian countries.

Detoxification is a prevailing trend aimed at eliminating toxins and impurities from the body. This can be achieved through specialized diets or drinks designed to cleanse the body. Including a green detox drink in your diet helps purify the body from within, promoting radiant skin.

Asia Pacific Beauty Drinks Market Segmentation- By Distribution Channel:

- Grocery Retailers

- Beauty Specialty Stores

- Drug Stores and Pharmacies

- Others

With the rising demand for beauty drinks, supermarkets and hypermarkets have begun stocking these products. Many consumers prefer shopping at these locations due to their extensive retail space and immediate availability. The variety of brands available also appeals to brand-conscious consumers. Supermarkets and hypermarkets boast large consumer bases and enjoy widespread success across many countries, offering a perception of ample brand variety based on consumer demand.

Manufacturers are increasingly focused on ensuring high visibility for their beauty drink products, facilitating rapid scalability. Supermarkets and hypermarkets provide a comprehensive selection of flavors and varieties of beauty drinks, enhancing convenience for consumers to choose products that align with their tastes and preferences.

Asia Pacific Beauty Drinks Market Segmentation- by region

- China

- Japan

- India

- South Korea

- Australia & New Zealand

- Rest of Asia-Pacific (APAC)

China leads the Asia Pacific beauty drinks market, followed closely by Japan. The high demand in these countries is driven by stringent beauty standards and a strong emphasis on personal care and hygiene among both genders.

India represents the fastest-growing segment within this market. The country is experiencing a notable increase in demand for solutions addressing acne-prone and dull skin concerns, including beauty drinks. Patanjali Ayurveda has emerged as a prominent player, with products like Aloe Vera Juice and Nutrela Collagen Prash Supplement gaining popularity among both men and women seeking glowing and youthful skin.

COVID-19 Pandemic: Impact Analysis

The beauty drinks market showed resilience during the COVID-19 pandemic, benefiting from increased consumer focus on health and beauty. With more people staying at home, there was a notable shift from traditional makeup routines to nutricosmetics and natural beauty looks, driving up demand for beauty drinks. Products that were already trending before the pandemic saw heightened popularity as consumers sought effective solutions for their beauty regimens amidst changing lifestyles and priorities.

Latest Trends/ Developments:

In July 2023, Iconic Beauty introduced its latest innovation, The Secret Ingredient, aimed at empowering individuals to enhance their best selves. This product promotes a philosophy of look-good, feel-good, and do-good, inspiring consumers to embrace their true brilliance.

In February 2022, Nestle Health Science completed its acquisition of Vital Proteins, a Chicago-based manufacturer specializing in collagen-based foods, beverages, and supplements.

Key Players:

These are the top 10 players in the Asia Pacific Beauty Drinks Market: -

- DECIEM The Abnormal Beauty Company

- Asterism Healthcare Plus Inc.

- Vital Proteins LLC (Nestlé Health Science)

- Hangzhou Nutrition Biotechnology Co. Ltd.

- Lacka Foods Limited

- Kino Biotech

- Sappe Public Company Limited

- Skinade.com (Bottled Science Ltd.)

- Shiseido Company Limited

- The Coca-Cola Company

Chapter 1. ASIA PACIFIC BEAUTY DRINKS MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. ASIA PACIFIC BEAUTY DRINKS MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. ASIA PACIFIC BEAUTY DRINKS MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. ASIA PACIFIC BEAUTY DRINKS MARK ET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. ASIA PACIFIC BEAUTY DRINKS MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. ASIA PACIFIC BEAUTY DRINKS MARKET – By Type

6.1 Introduction/Key Findings

6.2. Natural Drinks

6.3. Artificial Drinks

6.9 . Y-O-Y Growth trend Analysis By Type

6.10. Absolute $ Opportunity Analysis By Type, 2023-2030

Chapter 7. ASIA PACIFIC BEAUTY DRINKS MARKET – By Ingredients

7.1. Introduction/Key Findings

7.2. Collagen Proteins

7.3. Vitamins and Minerals

7.4. Fruit Extracts

7.5. Others

7.6. Y-O-Y Growth trend Analysis By Ingredients

7.7. Absolute $ Opportunity Analysis By Ingredients , 2023-2030

Chapter 8. ASIA PACIFIC BEAUTY DRINKS MARKET – By Distribution Channel

8.1. Introduction/Key Findings

8.2. Grocery Retailers

8.3. Beauty Specialty Stores

8.4. Drug Stores and Pharmacies

8.5. Others

8.6. Y-O-Y Growth trend Analysis Growing Mechanism

8.7. Absolute $ Opportunity Analysis Distribution Channel , 2023-2030

Chapter 9. ASIA PACIFIC BEAUTY DRINKS MARKET –By Function

9.1. Introduction/Key Findings

9.2. Anti-Ageing

9.3. Detoxification

9.4. Radiance

9.5. Vitality

9.6. Others

9.5. Y-O-Y Growth trend Analysis Function

9.6. Absolute $ Opportunity Analysis Function , 2023-2030

Chapter 10. ASIA PACIFIC BEAUTY DRINKS MARKET – By Region

10.1. Asia Pacific

10.1.1. By Country

10.1.1.1. China

10.1.1.2. Japan

10.1.1.3. South Korea

10.1.1.4. India

10.1.1.5. Australia & New Zealand

10.1.1.6. Rest of Asia-Pacific

10.1.2. By Distribution Channel

10.1.3. By Ingredients

10.1.4. By Function

10.1.5. By Type

10.1.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. ASIA PACIFIC BEAUTY DRINKS MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

11.1. DECIEM The Abnormal Beauty Company

11.2. Asterism Healthcare Plus Inc.

11.3. Vital Proteins LLC (Nestlé Health Science)

11.4. Hangzhou Nutrition Biotechnology Co. Ltd.

11.5. Lacka Foods Limited

11.6. Kino Biotech

11.7. Sappe Public Company Limited

11.8. Skinade.com (Bottled Science Ltd.)

11.9. Shiseido Company Limited

11.10. The Coca-Cola Company

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Consumers are increasingly valuing wellness, looking for products that deliver both aesthetic and health benefits. Beauty drinks fit this trend by offering a comprehensive approach to skincare from within.

The top players operating in the Asia Pacific Beauty Drinks Market are - DECIEM The Abnormal Beauty Company, Asterism Healthcare Plus Inc., Vital Proteins LLC (Nestlé Health Science), Hangzhou Nutrition Biotechnology Co. Ltd., Lacka Foods Limited, Kino Biotech, Sappe Public Company Limited, Skinade.com (Bottled Science Ltd.), Shiseido Company Limited, The Coca-Cola Company.

The beauty drinks market showed resilience during the COVID-19 pandemic, benefiting from increased consumer focus on health and beauty.

Endorsements and testimonials from influencers and celebrities increase the visibility and attractiveness of beauty drinks, boosting consumer confidence and driving market growth.

India represents the fastest-growing segment within this market. The country is experiencing a notable increase in demand for solutions addressing acne-prone and dull skin concerns, including beauty drinks.