Artificial Lift Systems Market Size (2024 – 2030)

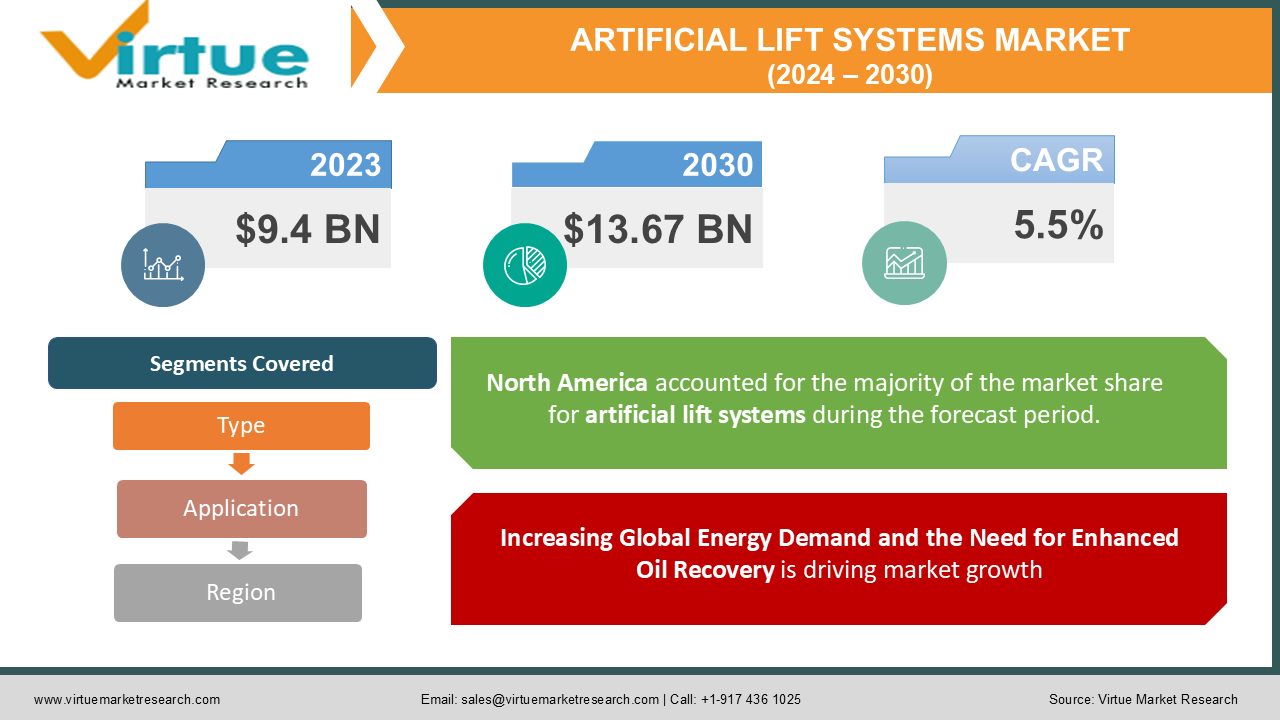

The Global Artificial Lift Systems Market was valued at USD 9.4 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.5% from 2024 to 2030. The market is expected to reach USD 13.67 billion by 2030.

Artificial lift systems are used in the oil and gas industry to enhance the extraction of crude oil and natural gas from wells with insufficient reservoir pressure. These systems help maintain or increase production when the natural drive of a reservoir is not enough to push the hydrocarbons to the surface. The market is also driven by the increasing exploration of unconventional resources, including shale oil and gas, where artificial lift systems play a crucial role in maintaining production levels. Environmental concerns and the need for energy efficiency are encouraging innovations in artificial lift systems, including energy-efficient designs and systems that reduce environmental impact.

Key Market Insights:

Electric Submersible Pumps (ESPs) dominate the market, accounting for nearly 40% of the overall market share in 2023. This is due to their effectiveness in handling high volumes of oil and their widespread use in both offshore and onshore fields.

North America leads the market, holding over 35% of the global market share in 2023, driven by significant shale oil and gas production in the U.S. and Canada, as well as the deployment of advanced artificial lift technologies in mature oil fields.

The demand for gas lift systems is expected to grow at a CAGR of 6.2% from 2024 to 2030 due to their ability to increase production efficiency in deepwater offshore projects, where traditional methods are less effective.

The Asia-Pacific region is projected to show the highest growth rate, with a CAGR of 6.8% during the forecast period, as emerging economies such as China and India ramp up their energy production activities to meet growing domestic demand.

Environmental concerns are pushing companies toward more energy-efficient artificial lift systems, with some manufacturers focusing on systems that can reduce power consumption by up to 20%.

Global Artificial Lift Systems Market Drivers:

Increasing Global Energy Demand and the Need for Enhanced Oil Recovery is driving market growth:

The growing global demand for energy is a major driver for the artificial lift systems market. As economies grow and industrialization expands, the need for oil and gas continues to rise, particularly in developing regions. This has intensified efforts to maximize the production of existing oil fields and explore new ones. However, many of these fields have low reservoir pressures, making it challenging to extract hydrocarbons through natural flow. Artificial lift systems address this challenge by providing the necessary force to bring oil and gas to the surface, even in fields that would otherwise be non-productive. Enhanced oil recovery (EOR) techniques, of which artificial lift systems are a crucial part, are increasingly being employed to improve production in mature oil fields. According to industry estimates, nearly 70% of the world’s oil reserves are located in mature fields, where natural pressure has declined significantly. Artificial lift systems, especially electric submersible pumps and gas lifts, are highly effective in these environments, extending the lifespan of wells and boosting production. Additionally, as new oil fields are being discovered in deeper offshore environments, where natural pressures are even lower, the demand for artificial lift systems continues to grow.

Technological Advancements in Artificial Lift Systems is driving market growth:

Over the years, significant technological advancements have taken place in artificial lift systems, making them more efficient, reliable, and adaptable to a wider range of well conditions. Companies are investing in research and development to create innovative solutions that can improve oil and gas recovery rates, lower operational costs, and reduce the environmental impact of lifting systems. For instance, the development of intelligent artificial lift systems equipped with real-time monitoring capabilities is a game changer. These systems can optimize production by automatically adjusting to changing well conditions, reducing the need for manual intervention and improving operational efficiency. The integration of digital technologies, such as Internet of Things (IoT) sensors, artificial intelligence (AI), and machine learning algorithms, is another key development in the market. These technologies enable predictive maintenance of artificial lift systems, minimizing downtime and extending the lifespan of the equipment. Additionally, modern artificial lift systems are designed to operate in more challenging environments, including deepwater and high-temperature wells. This flexibility has expanded the applicability of these systems in unconventional resources, such as shale oil and gas, which are playing an increasingly important role in global energy supply.

Growing Focus on Unconventional Oil and Gas Resources is driving market growth:

The exploration and production of unconventional oil and gas resources, such as shale oil, tight gas, and coalbed methane, have witnessed significant growth over the past decade. Countries like the United States, Canada, and Argentina have been at the forefront of shale oil and gas production, which requires advanced drilling techniques and enhanced recovery methods like hydraulic fracturing and artificial lift systems. Unconventional resources are typically located in formations with low permeability, where the natural flow of hydrocarbons is insufficient for commercial production. As a result, artificial lift systems are essential in maintaining production levels in these wells. The rising investment in unconventional resource development is expected to drive the demand for artificial lift systems. In the U.S., for example, the shale oil boom has significantly increased the deployment of artificial lift systems, particularly rod lifts and electric submersible pumps. Similarly, other regions with substantial unconventional reserves, such as China, Australia, and Russia, are expected to invest in artificial lift technologies to maximize production. As the global shift toward energy independence continues, countries with large unconventional reserves are likely to increase their reliance on artificial lift systems, further boosting market growth.

Global Artificial Lift Systems Market Challenges and Restraints:

Fluctuations in Crude Oil Prices are driving market growth:

The artificial lift systems market is highly sensitive to fluctuations in crude oil prices, which directly impact exploration and production activities. When oil prices are high, oil companies are more likely to invest in new projects and employ artificial lift systems to maximize production. However, when prices drop, many companies scale back their production efforts, delay new projects, and reduce capital expenditure on enhanced recovery techniques, including artificial lift systems. The oil price collapse in 2020, driven by the COVID-19 pandemic, is a recent example of how volatility in oil prices can significantly affect the artificial lift systems market. In periods of low oil prices, companies focus on cutting costs, which often leads to a reduction in the demand for artificial lift systems. Smaller operators, in particular, may find it difficult to justify the high upfront costs of installing and maintaining these systems when oil prices are low. Additionally, oil price fluctuations can lead to uncertainty in the market, making it challenging for manufacturers and service providers to plan their production and sales strategies effectively. The cyclical nature of the oil and gas industry poses a significant challenge to the steady growth of the artificial lift systems market.

Environmental and Regulatory Concerns is driving market growth:

The oil and gas industry, including the artificial lift systems market, faces increasing scrutiny over its environmental impact. Governments around the world are implementing stricter regulations to reduce carbon emissions, minimize the environmental footprint of oil production, and ensure the safe disposal of waste products. Artificial lift systems, especially in offshore and unconventional drilling operations, can be energy-intensive and contribute to environmental degradation if not managed properly. For instance, the use of gas lift systems in deepwater projects may result in increased emissions if the associated gas is flared instead of captured. Companies operating in this market must comply with environmental regulations, which can increase operational costs and limit growth opportunities. In some cases, these regulations may require oil producers to adopt more environmentally friendly technologies, leading to additional investment in research and development. The growing focus on renewable energy sources and the global transition toward a low-carbon economy may also affect the long-term demand for oil and gas, indirectly impacting the artificial lift systems market. To mitigate these challenges, companies are exploring the development of more energy-efficient lift systems and improving the environmental performance of existing technologies.

Market Opportunities:

The Artificial Lift Systems Market presents several growth opportunities driven by ongoing advancements in technology, the increasing focus on enhancing oil recovery from mature fields, and the rising importance of unconventional oil and gas resources. One of the most significant opportunities lies in the development of intelligent artificial lift systems that incorporate digital technologies such as IoT, AI, and machine learning. These systems can optimize production processes by monitoring well conditions in real time and making automatic adjustments to improve efficiency. This trend aligns with the broader industry shift toward digitalization and automation, where oil companies are seeking ways to reduce operational costs, improve safety, and maximize output. Another key opportunity is the growing demand for artificial lift systems in offshore oil and gas production. Offshore fields, particularly in deepwater and ultra-deepwater environments, are becoming increasingly important as onshore reserves are depleted. These fields often face significant pressure challenges that require advanced artificial lift systems to maintain production levels. Technologies like electric submersible pumps and gas lifts are particularly well-suited for offshore applications, offering high efficiency and reliability in challenging conditions. As offshore drilling activities pick up, particularly in regions like the Gulf of Mexico, Brazil, and West Africa, the demand for artificial lift systems is expected to rise. The market also offers opportunities in emerging economies such as China, India, and Southeast Asia, where energy demand is growing rapidly, and domestic oil production is increasing. These regions are investing heavily in infrastructure development and energy projects to reduce their reliance on imports, creating a favorable environment for the adoption of artificial lift systems. Additionally, the exploration of unconventional oil and gas resources in countries like Argentina, Australia, and Mexico presents significant growth potential for companies operating in this market.

ARTIFICIAL LIFT SYSTEMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.5% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Schlumberger Limited, Baker Hughes, Halliburton, Weatherford International, Dover Corporation, National Oilwell Varco (NOV), Borets International, JJ Tech, Quick Connector, Inc., Occidental Petroleum Corporation |

Artificial Lift Systems Market Segmentation: By Type

-

Electric Submersible Pumps (ESPs)

-

Rod Lifts

-

Gas Lift Systems

-

Progressive Cavity Pumps (PCPs)

-

Hydraulic Lift Systems

Electric submersible pumps (ESPs) are the most dominant product segment in the artificial lift systems market, accounting for nearly 40% of the market share in 2023. ESPs are widely used in both onshore and offshore oil fields due to their ability to handle high volumes of oil and their reliability in challenging well conditions.

Artificial Lift Systems Market Segmentation: By Application

-

Onshore

-

Offshore

The onshore segment dominates the market, driven by the high number of mature oil fields that require artificial lift systems to maintain production. However, the offshore segment is expected to show significant growth as deepwater exploration and production activities increase.

Artificial Lift Systems Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the most dominant region in the artificial lift systems market, holding over 35% of the market share in 2023. This dominance is driven by the high production of shale oil and gas in the U.S. and Canada, along with the deployment of advanced artificial lift systems in mature oil fields across the region.

COVID-19 Impact Analysis on the Artificial Lift Systems Market:

The COVID-19 pandemic had a significant impact on the global artificial lift systems market, primarily due to the sharp decline in oil prices and reduced demand for oil and gas. The sudden drop in oil prices in early 2020 led many oil and gas companies to scale back their exploration and production activities, particularly in high-cost regions such as deepwater offshore fields. As a result, the demand for artificial lift systems declined during the initial stages of the pandemic, with many projects being delayed or put on hold. However, the market began to recover in late 2021 and 2022 as oil prices stabilized and global demand for energy rebounded. The pandemic also accelerated the adoption of digital technologies and automation in the oil and gas industry, including artificial lift systems. Companies are increasingly using remote monitoring and predictive maintenance technologies to improve the efficiency and reliability of their artificial lift systems, reducing the need for manual intervention and minimizing operational disruptions.

Latest Trends/Developments:

The artificial lift systems market is witnessing several key trends and developments. One of the most significant trends is the growing use of digital technologies and automation in artificial lift systems. Companies are integrating IoT sensors, AI algorithms, and predictive analytics into their lift systems to optimize production processes, reduce downtime, and extend the lifespan of the equipment. These intelligent lift systems can automatically adjust to changing well conditions, improving overall efficiency and reducing operational costs. Another emerging trend is the increasing demand for energy-efficient artificial lift systems. With rising environmental concerns and stricter regulations, oil and gas companies are seeking ways to reduce their energy consumption and minimize their environmental footprint. Some manufacturers are developing lift systems that are more energy-efficient, reducing power consumption by up to 20% compared to conventional systems. The adoption of electric submersible pumps (ESPs) in offshore production is also gaining momentum, driven by the need for reliable and efficient systems in deepwater environments. ESPs are particularly well-suited for handling high volumes of oil and gas in challenging offshore conditions, making them a preferred choice for many offshore operators.

Key Players:

-

Schlumberger Limited

-

Baker Hughes

-

Halliburton

-

Weatherford International

-

Dover Corporation

-

National Oilwell Varco (NOV)

-

Borets International

-

JJ Tech

-

Quick Connector, Inc.

-

Occidental Petroleum Corporation

Chapter 1. Artificial Lift Systems Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Artificial Lift Systems Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Artificial Lift Systems Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Artificial Lift Systems Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Artificial Lift Systems Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Artificial Lift Systems Market – By Type

6.1 Introduction/Key Findings

6.2 Electric Submersible Pumps (ESPs)

6.3 Rod Lifts

6.4 Gas Lift Systems

6.5 Progressive Cavity Pumps (PCPs)

6.6 Hydraulic Lift Systems

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Artificial Lift Systems Market – By Application

7.1 Introduction/Key Findings

7.2 Onshore

7.3 Offshore

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Artificial Lift Systems Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Artificial Lift Systems Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Schlumberger Limited

9.2 Baker Hughes

9.3 Halliburton

9.4 Weatherford International

9.5 Dover Corporation

9.6 National Oilwell Varco (NOV)

9.7 Borets International

9.8 JJ Tech

9.9 Quick Connector, Inc.

9.10 Occidental Petroleum Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Artificial Lift Systems Market was valued at USD 9.4 billion in 2023 and is expected to reach USD 13.67 billion by 2030, growing at a CAGR of 5.5% during the forecast period.

Key drivers include increasing global energy demand, technological advancements in lift systems, and the growing focus on unconventional oil and gas resources.

The market is segmented by product (electric submersible pumps, rod lifts, gas lift systems, progressive cavity pumps, hydraulic lift systems) and by application (onshore and offshore).

North America is the most dominant region, accounting for over 35% of the market share, driven by significant shale oil and gas production and advanced technologies in mature oil fields.

Leading players include Schlumberger Limited, Baker Hughes, Halliburton, Weatherford International, and Dover Corporation.