Forklift Market Size (2024 – 2030)

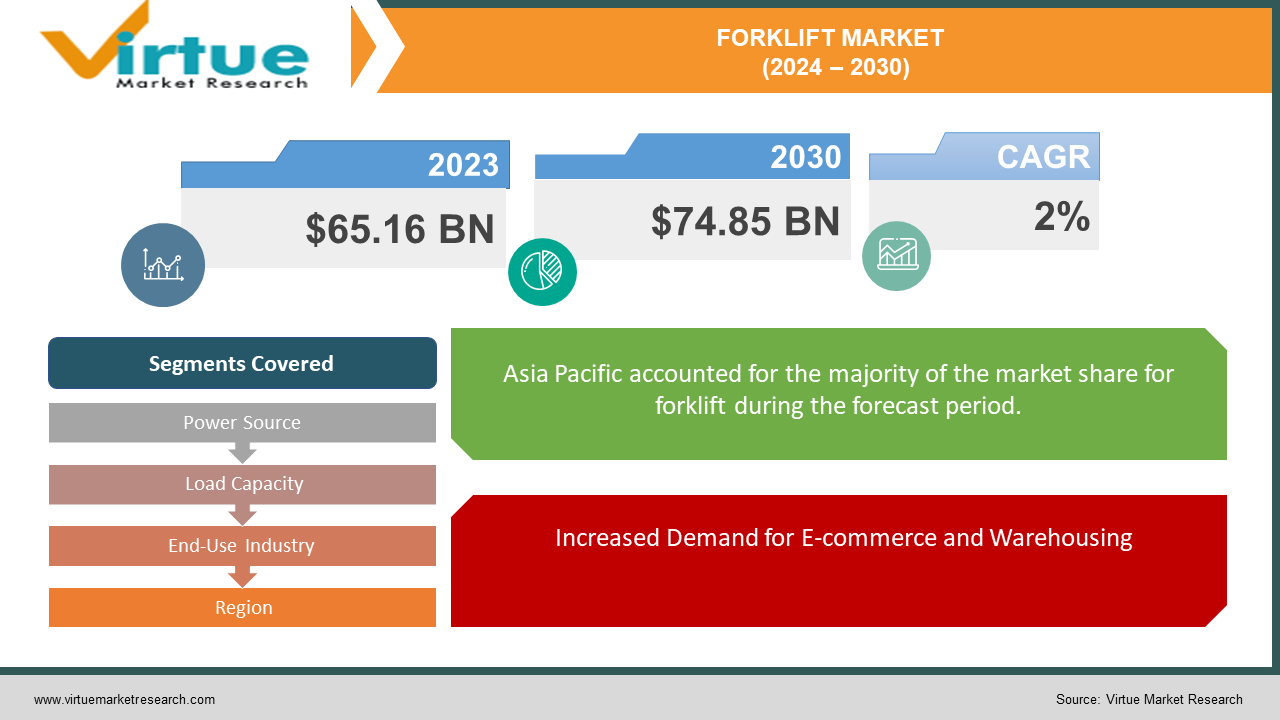

The Global Forklift Market was valued at USD 65.16 billion in 2023 and is projected to reach a market size of USD 74.85 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 2% between 2024 and 2030.

The global forklift market serves as a critical component of modern industrial and logistics operations, facilitating the efficient movement, lifting, and handling of materials across diverse sectors. Forklifts play an indispensable role in warehouses, distribution centers, manufacturing facilities, and ports, where they enable seamless operations and enhance productivity. Key drivers of the market include the expansion of e-commerce and online retail, which have spurred the demand for advanced logistics solutions capable of handling large volumes of goods swiftly and efficiently. Additionally, technological advancements such as IoT integration, artificial intelligence, and automation are transforming the industry by improving forklift performance, operational visibility, and safety features. The market is also witnessing a notable shift towards electric forklifts driven by environmental sustainability initiatives and stringent emissions regulations. These electric models offer advantages such as reduced carbon footprint, lower operating costs, and quieter operation compared to traditional internal combustion engine forklifts. Despite facing challenges such as high initial costs and maintenance requirements, the global forklift market continues to evolve with innovations aimed at meeting the growing demands of modern supply chains and industrial environments worldwide.

Key Market Insights:

Asia-Pacific dominates the forklift market with a share of about 40.3% in 2023, driven by rapid industrialization and infrastructure development in countries like China and India.

Internal combustion engine forklifts, powered by gasoline and propane, still dominate the market despite the growing popularity of electric models due to stricter emission regulations.

The industrial sector is the largest consumer of forklifts, accounting for over 24% of market revenue in 2023, primarily for material handling and warehousing in factories and production facilities.

Automation in warehouses, including the adoption of automated storage and retrieval systems (ASRS), is on the rise, potentially impacting traditional forklift demand as industries seek efficiency and reduced human error.

Global Forklift Market Drivers:

Increased Demand for E-commerce and Warehousing.

The surge in e-commerce activities has significantly driven the demand for forklifts in the global market. The proliferation of online shopping platforms has necessitated the expansion of warehousing and logistics facilities, which in turn has created a substantial need for efficient material handling equipment. Forklifts are essential in the logistics chain for transporting, lifting, and organizing goods within warehouses, distribution centers, and retail outlets. As businesses strive to meet consumer expectations for faster delivery times and manage higher volumes of orders, the reliance on forklifts has intensified. This trend is further amplified by the advent of automation in warehouses, where forklifts are integrated into advanced systems to enhance operational efficiency and accuracy. The ongoing growth in the e-commerce sector, coupled with the increasing sophistication of warehousing solutions, is expected to continue bolstering the forklift market globally.

Advancements in Forklift Technology.

Technological innovations in forklift design and functionality are pivotal drivers of the global forklift market. Modern forklifts are being equipped with advanced features such as IoT integration, telematics, and automated guided vehicle (AGV) capabilities, which significantly enhance their operational efficiency and safety. The integration of IoT allows for real-time monitoring and predictive maintenance, reducing downtime and increasing productivity. Telematics systems provide valuable insights into forklift usage patterns, helping businesses optimize their fleet management. Additionally, the development of electric forklifts has gained momentum due to environmental regulations and the push for sustainability. Electric forklifts offer advantages such as lower emissions, reduced noise levels, and lower operating costs compared to their internal combustion counterparts. These technological advancements not only improve the performance and reliability of forklifts but also align with the evolving preferences of businesses seeking sustainable and efficient material handling solutions.

Global Forklift Market Restraints and Challenges:

Despite the growth prospects in the global forklift market, high initial costs and maintenance requirements pose significant restraints and challenges. Acquiring advanced forklifts, especially those with cutting-edge technologies such as IoT integration and automation, entails substantial capital investment. This can be a deterrent for small and medium-sized enterprises (SMEs) with limited budgets, restricting their ability to upgrade or expand their forklift fleets. Furthermore, the maintenance and operational costs associated with these technologically advanced forklifts can be considerable. Regular maintenance is crucial to ensure the efficiency and longevity of the equipment, which involves not only routine check-ups but also potential repairs and parts replacements. These ongoing expenses can add up, impacting the overall cost-effectiveness of forklift operations. Additionally, the need for specialized training for operators to handle advanced forklifts safely and efficiently can incur further costs and pose a logistical challenge for businesses. This financial burden, coupled with the complexity of managing and maintaining sophisticated forklift systems, can hinder market growth and adoption, particularly among cost-sensitive segments. Thus, while technological advancements drive market expansion, the associated costs and maintenance challenges remain significant barriers.

Global Forklift Market Opportunities:

The global forklift market presents significant opportunities driven by the increasing adoption of industrial automation and the shift towards electric forklifts. As industries worldwide embrace automation to enhance efficiency and productivity, the demand for automated guided vehicles (AGVs) and other robotic solutions, including automated forklifts, is on the rise. AGVs offer advantages such as reduced labor costs, improved safety, and streamlined warehouse operations. This trend is bolstered by advancements in sensor technology, artificial intelligence, and machine learning, enabling forklifts to operate autonomously or semi-autonomously in complex environments. Moreover, the growing emphasis on sustainability and environmental regulations is fueling the transition from internal combustion engine (ICE) forklifts to electric models. Electric forklifts offer benefits such as zero emissions, lower noise levels, and reduced operational costs over their lifetime. These advantages appeal to businesses looking to minimize their carbon footprint and comply with stringent environmental standards. The increasing availability of government incentives and subsidies for electric vehicle adoption further supports market growth. Therefore, the convergence of industrial automation trends and the shift towards electric forklifts presents lucrative opportunities for manufacturers and stakeholders in the global forklift market.

FORKLIFT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

2% |

|

Segments Covered |

By Power Source, Load Capacity, End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Toyota Industries Corporation, KION Group AG (includes brands like Linde and STILL), Jungheinrich AG, Mitsubishi Logisnext Co., Ltd. (includes Mitsubishi Forklift Trucks), Crown Equipment Corporation, Hyster-Yale Materials Handling, Inc. (includes Hyster and Yale brands), Anhui Heli Co., Ltd., Hangcha Group Co., Ltd., Clark Material Handling Company, Doosan Industrial Vehicle |

Global Forklift Market Segmentation: Power Source

-

Internal Combustion (IC) Engine Powered

-

Electric Powered

The Global Forklift Market by Power Source, Internal Combustion (IC) Engine Powered market share last year and is poised to maintain its dominance throughout the forecast period. Internal combustion (IC) engine forklifts remain a cornerstone in the global market, prized for their robust power capabilities and adaptability to demanding outdoor and heavy lifting applications. Their engines, powered by gasoline, diesel, or propane, provide versatility tailored to varying operational needs and existing infrastructure setups. Moreover, IC engine forklifts generally boast lower initial acquisition costs compared to their electric counterparts, making them a preferred choice for businesses mindful of upfront investment considerations. Looking ahead, while electric forklifts are gaining momentum driven by stringent environmental regulations and lower operational expenses over time, IC engine models are expected to maintain their dominance in the foreseeable future. This forecast hinges on their established strengths in power output and operational flexibility, factors critical for industries requiring reliable performance in rugged environments. However, the landscape is evolving. The electric forklift segment is projected to witness accelerated growth, propelled by ongoing advancements in battery technology and a global shift towards sustainable practices. Stricter emissions standards worldwide could further bolster the adoption of electric alternatives, potentially challenging the long-standing supremacy of IC engine forklifts over the coming decades. As such, while IC engine forklifts currently hold sway in the market, the trajectory suggests a gradual transition towards electric-powered solutions as technological innovation and regulatory pressures continue to shape the future of material handling equipment.

Global Forklift Market Segmentation: Load Capacity

-

Below 5 tons

-

5-10 tons

-

11-36 tons

-

Above 36 tons

The Global Forklift Market by Load Capacity had a 5-10 tons market share last year and is poised to maintain its dominance throughout the forecast period. The 5-10 ton capacity range of forklifts represents a critical segment within the global market, renowned for its optimal balance of power and maneuverability. These forklifts are versatile in handling various materials such as pallets, machinery, and construction supplies, making them indispensable across a spectrum of industries including warehouses, logistics centers, manufacturing facilities, and construction sites. Their ability to operate effectively both indoors and outdoors underscores their versatility, catering to diverse operational needs and environments. Industry trends underscore the significance of the 5-10 ton forklift segment. The growth of e-commerce and the proliferation of automated warehouses, which prioritize higher storage densities, further drive demand for these forklifts capable of handling heavier pallets and goods with efficiency and reliability. Moreover, expansions in the manufacturing and construction sectors globally contribute to sustained demand for robust material-handling equipment like forklifts in this capacity range. Market research consistently highlights the 5-10 ton segment as a leader in the forklift market by market share, emphasizing its pivotal role in the industry's landscape (e.g., reports from UnivDatos and Grand View Research). Nonetheless, competition exists from smaller, more maneuverable forklifts for confined spaces and larger, heavy-duty models for specialized industrial applications. Despite these dynamics, the 5-10 ton forklift segment remains well-positioned to maintain its leadership position, driven by its adaptability, broad applicability, and essential role in modern supply chain operations worldwide.

Global Forklift Market Segmentation: End-Use Industry

-

Manufacturing

-

Warehousing & Logistics

-

Retail & E-commerce

-

Construction

-

Food & Beverages

-

Chemical Industry

-

Mining

-

Natural Resources

The Global Forklift Market by End-Use Industry, Manufacturing market share last year and is poised to maintain its dominance throughout the forecast period. Manufacturing stands as a cornerstone of the global forklift market, driving significant demand due to its extensive reliance on these versatile machines. Within manufacturing facilities, forklifts play critical roles in material handling, seamlessly transporting raw materials, work-in-progress components, and finished goods throughout production processes. They integrate into production lines by feeding materials into machines and facilitating the movement of parts between workstations, enhancing operational efficiency. Moreover, forklifts are essential in warehousing and storage operations within manufacturing settings, efficiently loading and unloading pallets and stacking goods within warehouses. Market research consistently underscores Manufacturing as the leading consumer of forklifts by end-use industry, holding a substantial 24% market share in 2023 according to data from Grand View Research. This dominance is expected to endure due to several factors: the sustained activity in global manufacturing, diversified applications across sectors such as automotive, electronics, and food processing, and the indispensable role of forklifts even amidst increasing automation trends. While other sectors like Warehousing & Logistics may experience faster growth driven by e-commerce expansion, manufacturing's diverse and continuous demands for forklifts ensure a robust market outlook. Technological advancements in automation and telematics further enhance forklift capabilities, reinforcing their relevance across both manufacturing and evolving industrial landscapes. Thus, Manufacturing is poised to maintain its pivotal role in driving the future trajectory of the forklift market worldwide.

Global Forklift Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The Global Forklift Market by Region, Asia-Pacific market share last year and is poised to maintain its dominance throughout the forecast period. The Asia-Pacific region currently commands the largest share of the global forklift market, driven by dynamic factors that underline its economic vitality and industrial expansion. Rapid industrialization in countries like China and India has spurred significant growth in manufacturing and construction sectors, intensifying the demand for forklifts across various applications. Investments in infrastructure projects further bolster this demand, requiring efficient material handling and transportation solutions provided by forklifts. Additionally, the burgeoning e-commerce sector has catalyzed the need for robust logistics and warehousing capabilities, elevating the role of forklifts in managing increased logistics activities within distribution centers. Looking forward, Asia-Pacific is poised to maintain its dominance in the forklift market for several compelling reasons. The region's sustained economic growth trajectory is expected to continue, fueling ongoing industrialization and infrastructure development initiatives that inherently rely on forklifts for operational efficiency. Supportive government policies promoting manufacturing and infrastructure investments contribute further to market expansion. Moreover, a rising middle class with expanding disposable incomes is anticipated to drive consumer goods consumption, necessitating efficient warehousing and logistics solutions, thus sustaining the demand for forklifts in the foreseeable future. These factors collectively underscore Asia-Pacific's pivotal role in shaping the global forklift market landscape amid evolving economic dynamics and industrial trends.

COVID-19 Impact Analysis on the Global Forklift Market.

The COVID-19 pandemic had a multifaceted impact on the global forklift market, presenting both challenges and opportunities. Initially, the market faced disruptions due to widespread lockdowns, supply chain disruptions, and reduced manufacturing activities across industries. Many businesses suspended or scaled back their operations, leading to a decline in demand for forklifts, particularly in sectors like automotive, manufacturing, and construction. Uncertainties surrounding global trade and economic slowdown further dampened market growth during the early stages of the pandemic. However, as economies gradually reopened and industries adapted to new operational norms, the forklift market began to recover. The pandemic accelerated trends toward e-commerce and online retail, increasing the need for efficient logistics and warehousing solutions, thus driving demand for forklifts. Moreover, the emphasis on maintaining social distancing and hygiene protocols in workplaces spurred interest in automated and electric forklifts, which offer enhanced safety features and reduced reliance on manual labor. Looking forward, the recovery trajectory of the forklift market is closely linked to global economic conditions, vaccination efforts, and the pace of industrial recovery. Opportunities lie in the continued adoption of automation, technological advancements in forklifts, and the ongoing shift toward sustainable practices. However, challenges persist in terms of supply chain resilience, fluctuating demand across sectors, and evolving regulatory landscapes impacted by the aftermath of the pandemic.

Latest trends / Developments:

The global forklift market is witnessing several significant trends and developments that are shaping its landscape. One prominent trend is the increasing integration of advanced technologies such as IoT (Internet of Things), AI (Artificial Intelligence), and telematics into forklifts. These technologies enable real-time data monitoring, predictive maintenance, and improved operational efficiencies, catering to the growing demand for smarter and more efficient material handling solutions. Another notable development is the rising adoption of electric forklifts driven by environmental concerns and regulatory pressures. Electric forklifts offer advantages such as zero emissions, lower operating costs over their lifespan, and quieter operations, making them increasingly attractive to industries aiming to reduce their carbon footprint and comply with stringent emissions standards. Furthermore, there is a growing emphasis on safety features in forklifts, including enhanced operator assistance systems, collision avoidance technologies, and ergonomic designs. These innovations aim to improve workplace safety and reduce accidents, thereby enhancing overall productivity. Additionally, the COVID-19 pandemic has accelerated trends toward automation and remote operations, pushing the integration of autonomous guided vehicles (AGVs) and robotic solutions in warehouses and distribution centers. This shift towards automation not only improves efficiency but also addresses labor shortages and the need for social distancing in workplace environments. Overall, these trends indicate a dynamic evolution within the global forklift market, driven by technological advancements, sustainability initiatives, and changing operational needs across various industries.

Key Players:

-

Toyota Industries Corporation

-

KION Group AG (includes brands like Linde and STILL)

-

Jungheinrich AG

-

Mitsubishi Logisnext Co., Ltd. (includes Mitsubishi Forklift Trucks)

-

Crown Equipment Corporation

-

Hyster-Yale Materials Handling, Inc. (includes Hyster and Yale brands)

-

Anhui Heli Co., Ltd.

-

Hangcha Group Co., Ltd.

-

Clark Material Handling Company

-

Doosan Industrial Vehicle

Chapter 1. Forklift Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Forklift Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Forklift Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Forklift Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Forklift Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Forklift Market – Power Source

6.1 Introduction/Key Findings

6.2 Internal Combustion (IC) Engine Powered

6.3 Electric Powered

6.4 Y-O-Y Growth trend Analysis Power Source

6.5 Absolute $ Opportunity Analysis Power Source, 2024-2030

Chapter 7. Forklift Market – By Load Capacity

7.1 Introduction/Key Findings

7.2 Below 5 tons

7.3 5-10 tons

7.4 11-36 tons

7.5 Above 36 tons

7.6 Y-O-Y Growth trend Analysis By Load Capacity

7.7 Absolute $ Opportunity Analysis By Load Capacity, 2024-2030

Chapter 8. Forklift Market – By End User

8.1 Introduction/Key Findings

8.2 Manufacturing

8.3 Warehousing & Logistics

8.4 Retail & E-commerce

8.5 Construction

8.6 Food & Beverages

8.7 Chemical Industry

8.8 Mining

8.9 Natural Resources

8.10 Y-O-Y Growth trend Analysis By End User

8.11 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 9. Forklift Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 Power Source

9.1.3 By Load Capacity

9.1.4 By End User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 Power Source

9.2.3 By Load Capacity

9.2.4 By End User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 Power Source

9.3.3 By Load Capacity

9.3.4 By End User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 Power Source

9.4.3 By Load Capacity

9.4.4 By End User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 Power Source

9.5.3 By Load Capacity

9.5.4 By End User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Forklift Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Toyota Industries Corporation

10.2 KION Group AG (includes brands like Linde and STILL)

10.3 Jungheinrich AG

10.4 Mitsubishi Logisnext Co., Ltd. (includes Mitsubishi Forklift Trucks)

10.5 Crown Equipment Corporation

10.6 Hyster-Yale Materials Handling, Inc. (includes Hyster and Yale brands)

10.7 Anhui Heli Co., Ltd.

10.8 Hangcha Group Co., Ltd.

10.9 Clark Material Handling Company

10.10 Doosan Industrial Vehicle

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

By 2023, the Global Forklift market is expected to be valued at US$ 65.16 billion.

Through 2030, the Global Forklift market is expected to grow at a CAGR of 2%.

By 2030, the Global Forklift Market expected to grow to a value of US$ 74.85 billion.

Asia-Pacific is predicted to lead the Global Forklift market.

The Global Forklift Market has segments By Power Source, End-Use Industry, Load Capacity, and Region.