Anti Aging Products Market Size (2024 – 2030)

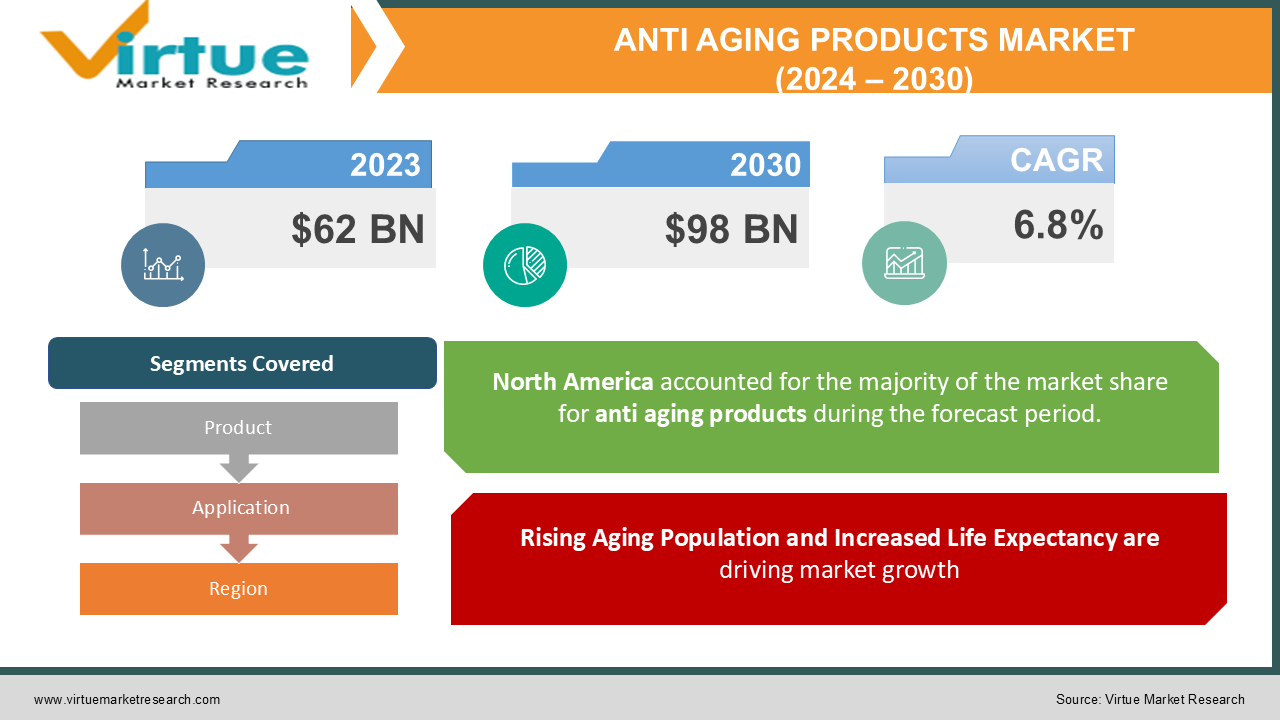

The Global Anti Aging Products Market was valued at USD 62 billion in 2023 and will grow at a CAGR of 6.8% from 2024 to 2030. The market is expected to reach USD 98 billion by 2030.

The Anti Aging Products Market revolves around products designed to reduce, delay, or eliminate signs of aging such as wrinkles, fine lines, and age spots. These products span across skincare, haircare, and supplements, with increasing demand driven by rising consumer awareness, advancements in dermatology, and an aging global population. The market has benefited from the growth in personal care trends and technological innovations, offering consumers customized and high-performance products tailored to specific skin needs.

Key Market Insights

-

Natural and organic anti-aging products are in high demand with a new interest in plant-based skincare solutions, with 40% of the consumers interested in the same for 2023.

-

The average for the Asia-Pacific region was more than the average growth, and hence more than 35% market share came from the region owing to very high demand in South Korea and Japan.

-

AI-based diagnostic innovations, for instance, for personalized skincare solutions, is one of the technological advancements that has given companies a competitive edge, having greatly increased the adoption rate of innovative anti-aging products.

-

Anti-Aging Cosmetics is expected to see a 12% increase in spending for self-care and appearance-enhancing products in the United States for 2023.

-

Supplements and ingestible skincare products have experienced a CAGR of 9% points higher than traditional topical products. It is also in line with consumer acceptance of the well-being-based approach to anti-aging.

-

The online distribution channel has more than 25% of the market share and reflects an indication of e-commerce shift, particularly in the wake of COVID-19, where at-home and convenient solutions are the preference.

-

Increasing awareness and adoption of collagen-based products have contributed a staggering 15% growth solely to the collagen segment and taken major traction in both North America and Europe.

Global Anti Aging Products Market Drivers

Rising Aging Population and Increased Life Expectancy are driving market growth: A sizeable force behind the anti-aging products market is the increasingly aging population of developed nations. Elderly populations within Europe and North America are immense, and people age with a consciousness of health and appearance. This has brought an increase in an overall rise in life expectancy worldwide, thereby enforcing a large demand for long-term anti-aging solutions. Older consumers look for products that also leave their skin looking youthful and healthy thereby sustaining demand through various product categories including anti-wrinkle creams, serums, and supplements.

Technological Innovations and Personalized Skincare are driving market growth: There's been rapid technological advancement in anti-aging products that includes AI-based diagnostics and DNA-based formulations for skincare. These help companies deliver customized skincare solutions, improving product performance while responding to the demands of the customers for better-targeted products. The newfound cosmeceuticals interest—products that combine cosmetic as well as pharmaceutical properties—has attracted consumer attention. Innovations such as these improve brand value and expand market share by attracting a diverse customer base.

Increasing Consumer Awareness of Natural Ingredients is driving market growth: The trend toward natural and clean beauty has suddenly become the biggest influencer in the market of anti-aging. More and more consumers prefer products without poisonous chemicals, opting for organic, herbal, or plant-based solutions. This is a belief among consumers-the idea that their different natural ingredients are safer and work better over time. Companies are responding to this by reformulating products with retinol, peptides, and hyaluronic acid but excluding parabens, sulfates, and artificial fragrances.

Global Anti Aging Products Market Challenges and Restraints

High Product Costs and Market Saturation are restricting market growth: The anti-aging products market still remains competitive, with big brands competing hard not only based on quality but also on price. High-end and luxury anti-aging products tend to be sold at prices that leave a segment of the population unable to afford them. After all, mass-market products are available, but the perception that really effective anti-aging solutions only come at a high premium can simply hold growth back. In addition, as more new products become available in the market, decision fatigue might set in and impact how frequently consumers make purchases.

Regulatory and Safety Concerns are restricting market growth: Regulatory challenges are still an important factor in the market for anti-aging products. In fact, most countries strictly control the claims on cosmetics products, particularly if such product makes claims of having anti-aging capabilities. Then again, compliance would have to face a process of testing and certification within the regulatory framework. Finally, public perception remains an important hurdle due to overclaiming or even sad instances of side effects from chemical-based products. Over time, misinformation and product recall can lead to serious erosion of trust, further saddling the sales.

Market Opportunities

The global anti-aging products market will seek growth opportunities in innovation development, demographic changes, and changing consumer trends. Such a growing area comprises extending the portfolio of enhanced anti-aging supplements and ingestible products. The companies can bank upon improvements in nutraceuticals by offering their offerings as the world offers collagen-rich, vitamin-rich, and antioxidant-rich product lines that beautify from within. Another great opportunity lies in emerging markets in Asia-Pacific, South America, and the Middle East where disposable incomes are increasingly rising and awareness of skincare is growing. Further potential is emerging through digitalization. For example, virtual consultations, AI tools, and subscription models are unlocking personalized shopping experiences that increase consumer engagement and loyalty. Companies going forward with sustainable packaging and eco-friendly formulations will realize the consumers who are very keen on environmental consciousness. The company can further increase product credibility and market penetration through partnerships with dermatologists, as well as through the launching of education campaigns.

ANTI AGING PRODUCTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.8% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

L'Oréal, Procter & Gamble, Estée Lauder, Shiseido, Unilever, Beiersdorf AG, Johnson & Johnson, Coty Inc., AmorePacific, The Ordinary |

Anti Aging Products Market Segmentation - By Product

-

Skincare Products

-

Haircare Products

-

Supplements and Ingestibles

-

Cosmetic Procedures and Devices

Skincare products are the most dominant segment in the anti-aging market, accounting for over 45% of the market share. The wide range of options, including serums, creams, and masks, coupled with consistent innovation, has driven their popularity. Consumers prefer skincare products as they provide immediate visible results and are accessible without medical consultation.

Anti Aging Products Market Segmentation - By Application

-

Anti-Wrinkle Treatment

-

Skin Rejuvenation

-

Hair Regrowth and Restoration

-

Age Spot Reduction

Anti-wrinkle treatment holds the largest market share within the application segment. Wrinkles are among the first visible signs of aging, making them a priority for consumers. This category benefits from scientific advancements like retinol-infused products and non-invasive treatments, ensuring sustained growth.

Anti Aging Products Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the most dominant region in the global anti-aging products market. The region’s leadership is attributed to a combination of factors, including high consumer spending on personal care, advanced technological infrastructure, and the presence of major market players. The U.S., in particular, drives this dominance, with consumers showing strong demand for premium products and aesthetic treatments.

COVID-19 Impact Analysis on the Anti Aging Products Market

The anti-aging products market was highly disrupted by the pandemic, which means several disruptions, but also opportunities. With restrictions through lockdowns, many consumers cut back on discretionary spending, which depressed sales within the luxury and high-end cosmetic markets. However, self-care and wellness trends did spike significantly, as people adopted skincare routines in the time they had locked away. Partially offsetting the initial market drop, at-home treatments included do-it-yourself masks and skincare products. Online sales also became essential for companies as consumers migrated from physical stores to digital platforms for their skincare requirements. Companies that emerged as early movers in various aspects of their e-commerce offering or pushed virtual consultations and subscription-based models recorded increases in online sales. Many anti-aging products regained their demand as restrictions were relaxed, focusing on stress-related skin concerns and breakouts that some consumers complained broke out due to wearing face masks.

Latest Trends/Developments

Cosmeceuticals are a dominant trend in the global market, along with clean beauty and personalized skincare. Cosmeceuticals offer cosmetic and pharmaceutical properties, appealing to consumers who are looking for evidence-based solutions. This trend to sustainability also alters the way that develops a product and creates eco-friendly packaging with a clear supply chain. Moreover, AI along with machine learning technologies transform the industry so that it can provide personalized skincare recommendations. Virtual diagnostics of skincare have become more popular as consumers can now get custom-based product suggestions from home. The demand in the market for hybrid products, which are multifaceted in their benefits, including hydration and anti-aging, delivered in a single formula, is also impacting the market trends. Brands now focus on presenting multifunctional products that complement the hectic lifestyle of the consumers.

Key Players

-

L'Oréal

-

Procter & Gamble

-

Estée Lauder

-

Shiseido

-

Unilever

-

Beiersdorf AG

-

Johnson & Johnson

-

Coty Inc.

-

AmorePacific

-

The Ordinary

Chapter 1. Anti Aging Products Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Anti Aging Products Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Anti Aging Products Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Anti Aging Products Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Anti Aging Products Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Anti Aging Products Market – By Product

6.1 Introduction/Key Findings

6.2 Skincare Products

6.3 Haircare Products

6.4 Supplements and Ingestibles

6.5 Cosmetic Procedures and Devices

6.6 Y-O-Y Growth trend Analysis By Product

6.7 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Anti Aging Products Market – By Application

7.1 Introduction/Key Findings

7.2 Anti-Wrinkle Treatment

7.3 Skin Rejuvenation

7.4 Hair Regrowth and Restoration

7.5 Age Spot Reduction

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Anti Aging Products Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Anti Aging Products Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 L'Oréal

9.2 Procter & Gamble

9.3 Estée Lauder

9.4 Shiseido

9.5 Unilever

9.6 Beiersdorf AG

9.7 Johnson & Johnson

9.8 Coty Inc.

9.9 AmorePacific

9.10 The Ordinary

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Anti Aging Products Market was valued at USD 62 billion in 2023 and is expected to grow at a CAGR of 6.8%, reaching USD 98 billion by 2030.

Key drivers include the rising aging population, technological innovations in skincare, and increasing consumer demand for natural and clean beauty products.

The market is segmented by product into skincare, haircare, supplements, and cosmetic devices. By application, it includes anti-wrinkle treatments, skin rejuvenation, hair regrowth, and age spot reduction.

North America is the most dominant region, driven by high consumer spending and the presence of major market players.

Leading players include L'Oréal, Estée Lauder, Procter & Gamble, Unilever, and Shiseido.