Facial Care and Treatment Market Size (2024 –2030)

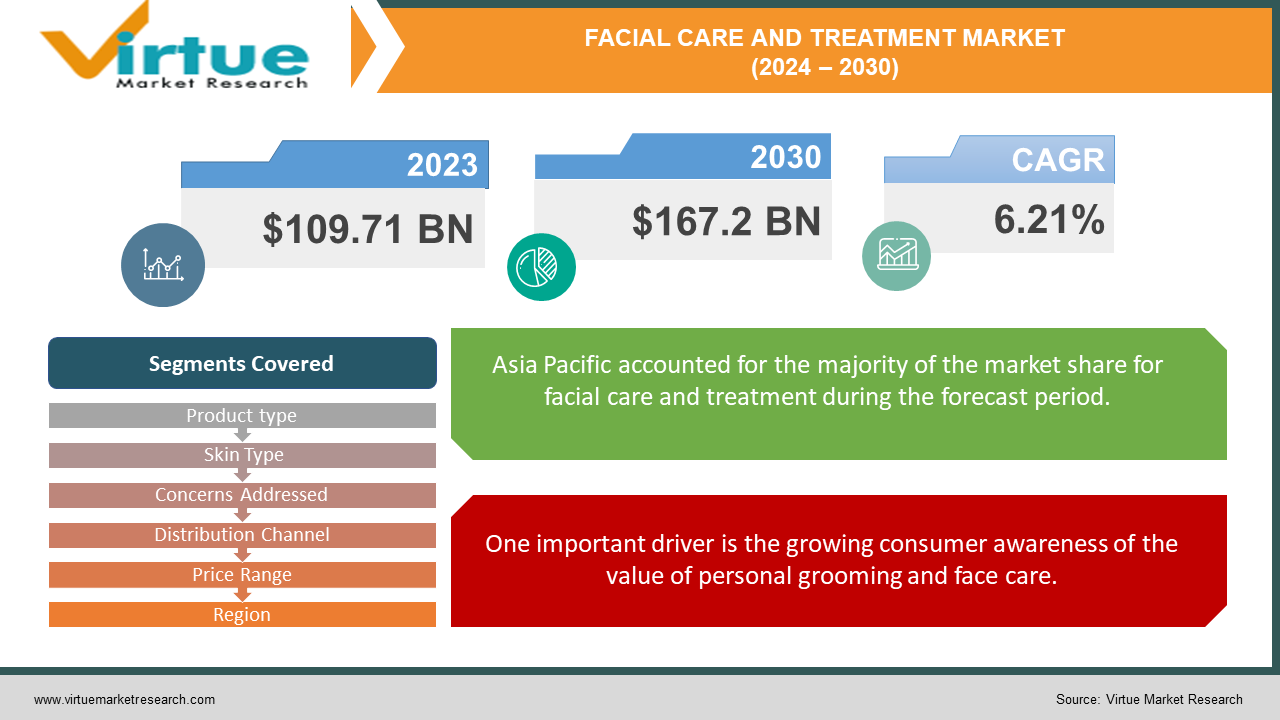

The Global Facial Care and Treatment Market was valued at USD 109.71 billion in 2023 and is projected to reach a market size of USD 167.2 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.21%.

Globally, there is a growing number of people who are very interested in facial health maintenance. To keep their skin looking and feeling good, they are purchasing a lot of cleansers, moisturizers, serums, masks, and sunscreen. The fact that purchasing these goods online is now simpler than ever is a major factor in this. The skincare market is expanding despite COVID-19's negative effects because businesses are still able to satisfy consumer demand. This rise is also being fueled by celebrities and emerging trends. Many people are interested in trying skincare brands that are endorsed by well-known individuals. Additionally, consumers have a strong affinity for natural products. There are a tonne of options available for various skin types, issues, and price ranges. So, there's a lot of opportunity to succeed in this market whether your skincare company is large or just getting started. Because people want cleansers, moisturizers, and masks to take better care of their skin, the market for facial care and treatments is expanding steadily. Getting these products has never been easier thanks to online shopping, which offers a wide selection and competitive prices. The skincare lines that celebrities like Rihanna and Kylie Jenner own have had a significant influence on consumer preferences. People are searching more and more for natural and organic products because they believe they are safer and more effective. Additionally, customized skincare products that cater to individual skin types and requirements are popular. Thanks to factors like celebrity endorsements and increased disposable income, men are also becoming more interested in skincare, so this market isn't just for women. With so many products available and a sizable global market, the facial care sector is constantly evolving and coming up with new approaches to satisfy consumers' needs.

Key Market Insights:

Anti-aging products account for around 35% of the facial care and treatment market share, driven by the increasing demand for products that combat signs of aging, such as fine lines, wrinkles, and age spots.

The skincare segment constitutes approximately 60% of the facial care and treatment market, reflecting the growing emphasis on maintaining healthy and youthful-looking skin.

In terms of region, Asia-Pacific holds the largest market share of around 39.65% for facial care and treatment products, attributed to the rising disposable incomes, increasing beauty consciousness, and the growing popularity of Korean beauty trends.

The adoption of advanced facial treatments, such as LED light therapy and microneedling, is growing at a rate of approximately 10% annually, driven by the demand for minimally invasive procedures with visible results.

Global Facial Care and Treatment Market Drivers:

One important driver is the growing consumer awareness of the value of personal grooming and face care.

A growing number of people are using a variety of facial care products to take good care of their skin. Companies are producing skincare products that are tailored to individuals' needs based on their skin type and concerns, increasing the personalization and enjoyment of the entire process. Because they believe these products to be safer and more effective, consumers are also searching for goods made with natural and organic ingredients. These products are becoming extremely popular as a result of this.

One of the primary market drivers in the face care and treatment market is the influence of celebrity-endorsed brands and treatments.

Celebrity endorsements for skincare products, such as Kylie Jenner and Rihanna, have played a significant role in the market's expansion. Many people are curious to try these products, especially the more expensive and novel ones when well-known individuals endorse them.

The face care and treatment industry has undergone a revolution thanks to the thriving e-commerce sector.

Online shopping is incredibly convenient and offers a wide selection of face care products. Moreover, the prices are frequently excellent. While pharmacies, convenience stores, and supermarkets carry these items as well, internet shopping is growing in popularity due to its large assortment and affordable prices. Supermarkets and large retailers are excellent sources for these products due to their abundance of options and competitive pricing.

More face care products and treatments are needed due to the aging population.

Worldwide, as the population ages, skincare products that address fine lines and wrinkles are in high demand. The desire of an increasing number of people to maintain youthful-looking skin is driving up demand for anti-aging products.

Facial Care and Treatment Market Challenges and Restraints:

For certain people, using face care products on a regular basis can occasionally cause side effects. This is a major concern because they can range from minor skin irritation to more serious allergic reactions. A further issue facing the facial care industry is a shortage of skilled workers, which can make it challenging to obtain high-quality services and treatments. The market may find it difficult to meet the rising demand as a result. Furthermore, some of these products and treatments—especially the more upscale ones—can be very costly. This may make it impossible for some people to afford the sophisticated skincare products they require.

Facial Care and Treatment Market Opportunities:

There is a lot of room for expansion for companies in the face care sector, particularly if they concentrate on Internet sales. Brands can improve their online stores by providing a seamless shopping experience and leveraging data to recommend products that customers will love, as more people shop online. Additionally, there's a lot of demand for organic and natural skincare products; therefore, companies can differentiate themselves by being open and honest about the components and manufacturing process. Businesses can seize these chances to expand their brands and establish connections with consumers who genuinely care about skincare by collaborating with skincare authorities and influencers, as well as by utilizing novel ingredients.

FACIAL CARE AND TREATMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.21% |

|

Segments Covered |

By Product type, Skin Type, Concerns Addressed, Distribution Channel, Price Range, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

L’Oréal S.A., Beiersdorf AG, Shiseido Co., Ltd., Procter & Gamble (P&G), Unilever, Johnson & Johnson, Inc., Avon Products, Inc., Coty Inc., Colgate-Palmolive Company, Revlon |

Facial Care and Treatment Market Segmentation - By Product Type

-

Cleansers and Exfoliators

-

Moisturizers and Creams

-

Serums and Essences

-

Masks and Peels

-

Sunscreen and UV Protection

-

Others (Toners, Mists, etc.)

With 42.11% of sales, face creams and moisturizers accounted for the majority of sales in the facial care market in 2023. Consumers adore these products because they are simple to use, quickly hydrate the skin, reduce the likelihood of breakouts, and leave the skin feeling fantastic. Products that provide sunscreen and UV protection are also anticipated to gain popularity, with a 5.5% growth rate predicted between 2024 and 2030. This is due to the fact that more people are purchasing these products and paying more attention to personal grooming, particularly in professional settings. Shaving creams and treatments are still very popular, particularly since advertisements, social media, and influencers have encouraged more people to take care of their personal grooming at home.

Facial Care and Treatment Market Segmentation -By Skin Type

-

Normal Skin

-

Oily Skin

-

Dry Skin

-

Combination Skin

-

Sensitive Skin

With a significant share of sales (61.66%) in the face care market in 2023, women were the primary consumers in this segment. It is anticipated that this trend will continue as more women view skincare as a means of enhancing their appearance as well as their confidence. They use a variety of products with ingredients that are known to improve the health of the skin, including creams, lotions, masks, and serums. However, the market for skincare products for men is expanding quickly as well, with a 5.0% growth rate predicted between 2024 and 2030. Because they have more money to spend and are exposed to celebrity endorsements, men are beginning to focus more on hygiene and grooming. These days, they're not just sticking to necessities like deodorant and razors; they're also drawn to sun protection and anti-aging products. Thus, it appears that these kinds of men's products have a bright future.

Facial Care and Treatment Market Segmentation -By Concerns Addressed

-

Acne and Blemishes

-

Anti-Aging and Wrinkles

-

Hyperpigmentation and Dark Spots

-

Dryness and Dehydration

-

Redness and Sensitivity

-

Uneven Skin Tone

-

Others

Anti-acne facial care and treatment is a rapidly expanding global market that reached $3.1 billion in 2023 and is predicted to grow at a 9.1% annual rate from 2024 to 2030. People's self-esteem can be severely impacted by acne, which is why there is an increasing market for products that can help treat it. Men and women alike are using these products in increasing numbers to address the psychological and physical ramifications of acne, particularly in areas where skincare is becoming more and more important. Because acne is so prevalent, particularly in young people, it is anticipated to continue propelling the market in the years to come. In order to satisfy the demands of customers everywhere, businesses in this industry are probably going to keep developing new and improved products.

Facial Care and Treatment Market Segmentation -By Distribution Channel

-

Retail Stores (Pharmacies, Supermarkets, etc.)

-

Specialty Beauty Stores

-

Online Retail (E-commerce)

-

Salons and Spas

-

Others

Supermarkets and hypermarkets accounted for a significant portion of the facial care market's sales in 2023, accounting for 43.72% of total sales. Given the numerous advantages these stores provide to customers, it is anticipated that this trend will continue. In addition to offering an enormous assortment of skincare brands and products in one location, they typically have excellent prices. Additionally, they frequently feature foreign brands on display, which facilitates customer choice. Given all these benefits, it's understandable why consumers view supermarkets and hypermarkets as the preferred locations for a wide range of skincare products, making them important players in the industry. This holds true everywhere, not only in the UK.

Facial Care and Treatment Market Segmentation -By Price Range

-

Mass Market (Affordable)

-

Mid-Range

-

Premium and Luxury

Businesses need to understand how the Facial Care and Treatment market is segmented based on price range in order to understand consumer preferences and market dynamics. Products in the Mass Market category are affordable and available to a broad spectrum of customers. Due to their competitive pricing, these products will appeal to customers who value value over price. In this market segment, affordability and promotional offers are important factors that influence consumer decisions. Moving up, customers in the Mid-Range category are prepared to spend a little bit extra on skincare products in order to receive particular advantages. Their needs are met by-products such as serums and anti-aging treatments, which provide an upgrade in both quality and cost compared to mass-market products. Last but not least, the Premium and Luxury category includes high-end goods with premium price points that are frequently connected to premium brands and unique ingredients. Here, customers place a premium on exclusivity, brand loyalty, and an opulent skincare experience. They also value packaging aesthetics and quality. Different consumer preferences are catered to by each segment, which influences product offerings and marketing strategies.

Facial Care and Treatment Market Segmentation -By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East and Africa

With a substantial revenue share of 39.65% in the global market for facial care and treatments, Asia Pacific emerged as the market leader in 2023. Over the course of the forecast period, this dominance is expected to grow stronger due to a number of important factors. A primary driver of the region's growth has been the expansion of the chemical industry in nations such as China and India. These countries profit from robust regulatory support, which guarantees a consistent supply of raw materials for the production of skincare products. In the upcoming years, it is anticipated that this safe supply chain will support the skincare market in Asia Pacific even more. In terms of both production and consumption, China has become a major player in the global market for skincare and cosmetics. China's enormous consumer base and rising need for skincare products have created a vibrant market ecosystem. Growth has also been significantly fueled by government initiatives to support the facial care and treatment sector. These regulations promote investment and innovation in the industry in addition to increasing demand. Consequently, the facial care and treatment market in Asia Pacific still presents tremendous growth potential for both local and foreign companies.

COVID-19 Impact on the Global Facial Care and Treatment Market:

The market for facial care and treatments suffered greatly as a result of the global COVID-19 pandemic for a number of important reasons. Despite being necessary for skin care and personal hygiene, facial care products were frequently overlooked during the outbreak as consumers prioritized buying necessities. Demand for facial care and treatment products decreased as a result of this shift in consumer priorities, with consumers placing a higher value on necessities like hygiene and health-related products. Lockdown measures implemented in multiple nations also caused disruptions to distribution networks and supply chains, which further affected the market. Businesses had to deal with issues like labor shortages brought on by lockdowns, which had an impact on distribution and production. In addition, the pandemic changed consumer behavior by placing more emphasis on personal hygiene and health. As a result, there was a rise in demand for products like disinfectants and hand sanitizers, while facial care items lost importance. Notwithstanding these obstacles, the market for facial care and treatments is anticipated to rebound as the world economy stabilizes and people progressively resume their pre-pandemic skincare regimens. Businesses in this sector are probably going to adjust to changing market circumstances and keep coming up with new ideas to satisfy changing customer needs and preferences.

Latest Trend/Development:

Significant changes are occurring in the facial care products market as a result of shifting consumer preferences and market dynamics. Growing awareness of the potentially dangerous chemicals present in conventional beauty and personal care products has led to a notable trend in the market: a rise in demand for natural and organic face care and treatment products. Nowadays, consumers are looking for products without chemicals like sulfates, phthalates, or parabens; instead, they prefer products with natural, plant-based ingredients that nourish and protect the skin. This preference also applies to clean-labeled products, which are advertised as being free of dangerous chemicals and have transparent ingredient lists. In response to this trend, businesses are creating and marketing organic products, like those that Colgate-Palmolive (India) Limited has introduced. These products are made of natural ingredients. Additionally, the promotion of organic products on social media sites like YouTube and Instagram is increasing demand and pique consumer interest. Due to the influence of fashion and celebrity culture, growing working populations, and rising disposable incomes, the Asia-Pacific region is driving this market transformation. The fashion industry and celebrity culture in nations like China, Korea, and Japan have normalized rigorous skincare regimens, which has raised demand for sun protection products, face masks, and anti-aging creams. These developments highlight how the facial care industry is changing and how natural, organic, and clean-labeled products are becoming more popular, especially in areas where fashion and celebrity culture have a significant influence.

Key Players:

-

L’Oréal S.A.

-

Beiersdorf AG

-

Shiseido Co., Ltd.

-

Procter & Gamble (P&G)

-

Unilever

-

Johnson & Johnson, Inc.

-

Avon Products, Inc.

-

Coty Inc.

-

Colgate-Palmolive Company

-

Revlon

Market News:

-

Acquiring Skin Better Science, a reputable American face care brand recognized for its physician-dispensed products, in September 2022 was a calculated strategic move by L'Oréal SA. The innovative formulations of Skin Better Science, which contain active ingredients aimed at different skincare needs like anti-aging, moisturizing, cleansing, exfoliating, peeling skin, and sun protection, have earned them recognition.

-

An interesting partnership between E.L.F. Cosmetics and Dunkin' Donuts was announced to the beauty and cosmetics industry in April 2022, leading to the launch of the "E.l.f.ing Sweet Collection." The only places to purchase this limited-edition makeup line were elfcosmetics.com, Ulta Beauty stores, and ulta.com.

-

April 2022 saw the release of The Avon Company's newest cosmetic innovation, the "New Ultra Color lip gloss." With its special formula that included 3D-light reflecting pigments to accentuate lip contours and produce an eye-catching effect, this lip gloss was truly unique.

Chapter 1. Facial Care and Treatment Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Facial Care and Treatment Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Facial Care and Treatment Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Facial Care and Treatment Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Facial Care and Treatment Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Facial Care and Treatment Market – By Product Type

6.1 Introduction/Key Findings

6.2 Cleansers and Exfoliators

6.3 Moisturizers and Creams

6.4 Serums and Essences

6.5 Masks and Peels

6.6 Sunscreen and UV Protection

6.7 Others (Toners, Mists, etc.)

6.8 Y-O-Y Growth trend Analysis By Product Type

6.9 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Facial Care and Treatment Market – By Skin Type

7.1 Introduction/Key Findings

7.2 Normal Skin

7.3 Oily Skin

7.4 Dry Skin

7.5 Combination Skin

7.6 Sensitive Skin

7.7 Y-O-Y Growth trend Analysis By Skin Type

7.8 Absolute $ Opportunity Analysis By Skin Type, 2024-2030

Chapter 8. Facial Care and Treatment Market – By Concerns Addressed

8.1 Introduction/Key Findings

8.2 Acne and Blemishes

8.3 Anti-Aging and Wrinkles

8.4 Hyperpigmentation and Dark Spots

8.5 Dryness and Dehydration

8.6 Redness and Sensitivity

8.7 Uneven Skin Tone

8.8 Others

8.9 Y-O-Y Growth trend Analysis By Concerns Addressed

8.10 Absolute $ Opportunity Analysis By Concerns Addressed, 2024-2030

Chapter 9. Facial Care and Treatment Market – By Price Range

9.1 Introduction/Key Findings

9.2 Mass Market (Affordable)

9.3 Mid-Range

9.4 Premium and Luxury

9.5 Y-O-Y Growth trend Analysis By Price Range

9.6 Absolute $ Opportunity Analysis By Price Range, 2024-2030

Chapter 10. Facial Care and Treatment Market – By Distribution Channel

10.1 Introduction/Key Findings

10.2 Retail Stores (Pharmacies, Supermarkets, etc.)

10.3 Specialty Beauty Stores

10.4 Online Retail (E-commerce)

10.5 Salons and Spas

10.6 Others

10.7 Y-O-Y Growth trend Analysis Distribution Channel

10.8 Absolute $ Opportunity Analysis Distribution Channel, 2024-2030

Chapter 11. Facial Care and Treatment Market, By Geography – Market Size, Forecast, Trends & Insights

11.1 North America

11.1.1 By Country

11.1.1.1 U.S.A.

11.1.1.2 Canada

11.1.1.3 Mexico

11.1.2 By Product Type

11.1.2.1 By Skin Type

11.1.3 By Concerns Addressed

11.1.4 By Distribution Channel

11.1.5 Countries & Segments - Market Attractiveness Analysis

11.2 Europe

11.2.1 By Country

11.2.1.1 U.K

11.2.1.2 Germany

11.2.1.3 France

11.2.1.4 Italy

11.2.1.5 Spain

11.2.1.6 Rest of Europe

11.2.2 By Product Type

11.2.3 By Skin Type

11.2.4 By Concerns Addressed

11.2.5 By End-User

11.2.6 By Distribution Channel

11.2.7 Countries & Segments - Market Attractiveness Analysis

11.3 Asia Pacific

11.3.1 By Country

11.3.1.1 China

11.3.1.2 Japan

11.3.1.3 South Korea

11.3.1.4 India

11.3.1.5 Australia & New Zealand

11.3.1.6 Rest of Asia-Pacific

11.3.2 By Product Type

11.3.3 By Skin Type

11.3.4 By Concerns Addressed

11.3.5 By End-User

11.3.6 By Distribution Channel

11.3.7 Countries & Segments - Market Attractiveness Analysis

11.4 South America

11.4.1 By Country

11.4.1.1 Brazil

11.4.1.2 Argentina

11.4.1.3 Colombia

11.4.1.4 Chile

11.4.1.5 Rest of South America

11.4.2 By Product Type

11.4.3 By Skin Type

11.4.4 By Concerns Addressed

11.4.5 By End-User

11.4.6 By Distribution Channel

11.4.7 Countries & Segments - Market Attractiveness Analysis

11.5 Middle East & Africa

11.5.1 By Country

11.5.1.1 United Arab Emirates (UAE)

11.5.1.2 Saudi Arabia

11.5.1.3 Qatar

11.5.1.4 Israel

11.5.1.5 South Africa

11.5.1.6 Nigeria

11.5.1.7 Kenya

11.5.1.8 Egypt

11.5.1.9 Rest of MEA

11.5.2 By Product Type

11.5.3 By Skin Type

11.5.4 By Concerns Addressed

11.5.5 By End-User

11.5.6 By Distribution Channel

11.5.7 Countries & Segments - Market Attractiveness Analysis

Chapter 12. Facial Care and Treatment Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 L’Oréal S.A.

12.2 Beiersdorf AG

12.3 Shiseido Co., Ltd.

12.4 Procter & Gamble (P&G)

12.5 Unilever

12.6 Johnson & Johnson, Inc.

12.7 Avon Products, Inc.

12.8 Coty Inc.

12.9 Colgate-Palmolive Company

12.10 Revlon

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Facial Care and Treatment Market was valued at USD 109.71 billion in 2023 and is projected to reach a market size of USD 167.2 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.21%.

Growing awareness among consumers and the Influence of Celebrity-Backed Brands and treatments are the market drivers of the Global Facial Care and Treatment market.

Retail Stores (Pharmacies, Supermarkets, etc.), Specialty Beauty Stores, Online Retail (E-commerce), Salons, and Spas are the segments under the Global Facial Care and Treatment Market by distribution channel.

Asia-Pacific is the most dominant region for the Global Facial Care and Treatment Market

Asia-Pacific is the fastest-growing region in the Global Facial Care and Treatment Market.