AI Hearing Aids Market Size (2025 – 2030)

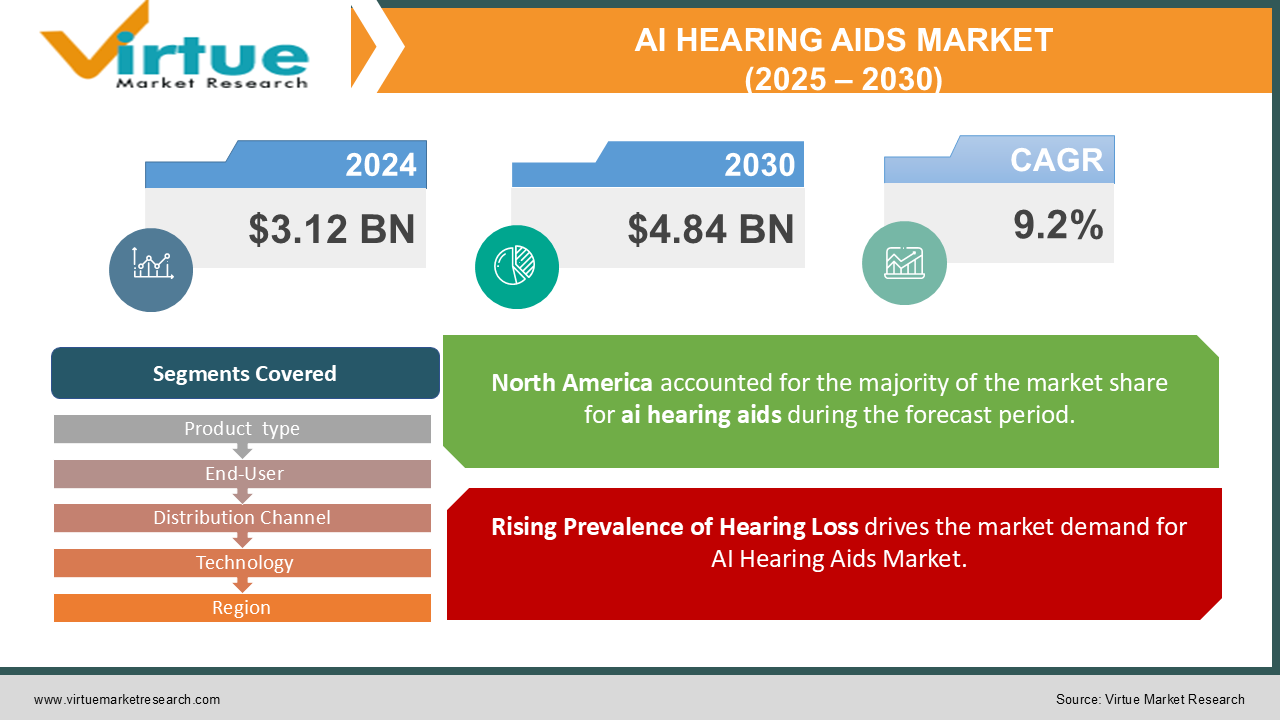

The AI Hearing Aids Market is valued at USD 3.12 Billion in 2024 and is projected to reach a market size of USD 4.84 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 9.2%.

AI-powered hearing aids represent a transformative advancement in audiology, integrating machine learning and adaptive signal processing to enhance speech clarity and noise reduction. These devices analyze sound environments in real time, providing personalized auditory experiences for users. With rising global hearing impairment cases and increasing adoption of digital health solutions, the market is experiencing rapid growth. Technological advancements, regulatory support, and consumer demand for smart healthcare devices are fueling industry expansion, with manufacturers integrating AI to improve performance and user experience.

Key Market Insights:

-

The AI Hearing Aids Market is projected to expand at a compound annual growth rate of over 9.2% in the coming seven years, propelled by increasing urbanization and population growth in major cities worldwide.

-

North America & Asia Pacific accounts for approximately 75-80 % of the AI Hearing Aids Market, driven by Rising Prevalence of Hearing Loss, Advancements in AI and Machine Learning, Growing Consumer Preference for Smart and Connected Devices & Government Support and Favorable Reimbursement Policies.

AI Hearing Aids Market Drivers:

Rising Prevalence of Hearing Loss drives the market demand for AI Hearing Aids Market.

An aging global population and increasing exposure to noise pollution are contributing to the rising incidence of hearing impairment. According to WHO, over 1.5 billion people worldwide experience hearing loss, with numbers expected to rise. AI hearing aids are becoming a critical solution, offering advanced sound processing, automatic adjustments, and real-time noise filtering to improve hearing quality. The demand for more effective and adaptive hearing solutions continues to drive innovation and market growth.

Advancements in AI and Machine Learning drives the market demand for AI Hearing Aids Market.

AI-driven hearing aids leverage deep learning algorithms to differentiate between speech and background noise, adapting automatically to changing environments. Features such as real-time voice enhancement, background noise suppression, and directional audio processing make AI-based devices significantly superior to traditional hearing aids. Continuous R&D investments from leading manufacturers are leading to enhanced speech recognition, natural sound reproduction, and increased consumer adoption of intelligent auditory solutions.

Growing Consumer Preference for Smart and Connected Devices drives the market demand for AI Hearing Aids Market.

With the increasing popularity of IoT-enabled healthcare devices, AI-powered hearing aids are incorporating Bluetooth connectivity, smartphone integration, and cloud-based adjustments. Users can now personalize their hearing experiences via mobile apps, enabling remote fine-tuning and real-time monitoring. This integration aligns with the broader trend of digital health adoption, driving market penetration and expanding accessibility through telehealth solutions.

Government Support and Favorable Reimbursement Policies drives the market demand for AI Hearing Aids Market.

Regulatory agencies worldwide are supporting hearing aid accessibility and affordability through policy changes and reimbursement frameworks. In the U.S., the FDA’s approval of over-the-counter (OTC) hearing aids has made AI-powered hearing solutions more accessible. Similarly, in Europe and Asia, governments are promoting hearing healthcare subsidies, making advanced hearing aids more affordable for aging populations. These policy shifts are significantly contributing to market expansion.

AI Hearing Aids Market Restraints and Challenges:

Despite advancements, high costs and affordability concerns remain significant barriers. AI-driven hearing aids are expensive compared to traditional devices, limiting adoption in low-income and underinsured populations. Additionally, limited awareness and stigma associated with hearing aid use discourage individuals from seeking treatment. Another challenge is battery efficiency, as AI-powered functions demand higher power consumption, requiring frequent recharging or replacement.

AI Hearing Aids Market Opportunities:

With the rise of telehealth and remote patient care, AI hearing aids equipped with cloud-based diagnostics and self-calibration features provide users with enhanced convenience. Audiologists can now adjust settings remotely, reducing clinic visits and improving accessibility for patients in rural or underserved regions.

Manufacturers are incorporating AI-powered tinnitus relief algorithms and cognitive health tracking features into hearing aids. These solutions not only enhance auditory experiences but also contribute to early detection of neurological conditions like dementia and Alzheimer's, creating a new avenue for AI hearing aid applications.

AI HEARING AIDS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

9.2% |

|

Segments Covered |

By Product type, End-User, Distribution Channel, Technology, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Starkey Hearing Technologies, Sonova Holding AG, GN Hearing A/S, Oticon (Demant A/S), WS Audiology, Cochlear Limited, Eargo Inc., Nuheara Limited, Resound (GN Group), MED-EL |

AI Hearing Aids Market Segmentation: By Product Type

-

Behind-the-Ear (BTE) AI Hearing Aids

-

In-the-Ear (ITE) AI Hearing Aids

-

Receiver-in-Canal (RIC) AI Hearing Aids

Behind-the-Ear (BTE) AI hearing aids dominate the market due to their versatility, powerful amplification, and ease of use. These devices are particularly beneficial for individuals with moderate to profound hearing loss, making them the most commonly prescribed option by audiologists. Their larger size allows for advanced features, including longer battery life, AI-powered speech enhancement, and superior noise reduction. Additionally, their durability and suitability for various age groups make them the preferred choice for both adults and pediatric users. The integration of smart connectivity features, Bluetooth streaming, and self-adjusting AI algorithms further strengthens their market leadership.

Receiver-in-Canal (RIC) AI hearing aids are experiencing the fastest growth due to their combination of discretion, comfort, and advanced AI-driven sound processing. These hearing aids are smaller than BTE models but offer superior sound quality and customization, making them highly attractive to tech-savvy and first-time users. AI-powered background noise filtering, automatic environment adaptation, and machine learning-based personalization are key drivers of growth. Moreover, cloud-based remote adjustments and app connectivity enable users to fine-tune their hearing experiences without frequent visits to audiologists, further accelerating adoption.

AI Hearing Aids Market Segmentation: By End-User

-

Adults

-

Pediatrics

The adult segment holds the largest market share, primarily due to the high prevalence of age-related hearing loss. With a rising geriatric population, particularly in developed regions like North America and Europe, the demand for AI-powered hearing solutions continues to grow. Many adults prefer discreet and intelligent hearing aids that seamlessly integrate with smartphones and other digital devices. Features such as real-time speech recognition, automatic volume adjustment, and tinnitus management algorithms make AI hearing aids an appealing option. Additionally, increasing awareness and reimbursement policies are further boosting adoption in this segment.

The pediatric segment is the fastest-growing due to early diagnosis of hearing impairments and advancements in child-friendly hearing solutions. Governments and healthcare organizations worldwide are implementing newborn hearing screening programs, increasing early intervention rates. AI-driven hearing aids for children feature adaptive learning capabilities, enabling the devices to automatically adjust to different sound environments to support language development. The growing emphasis on speech and cognitive development in children is driving demand, with improved durability, wireless connectivity, and customizable options making AI hearing aids a preferred choice for young users.

AI Hearing Aids Market Segmentation: By Distribution Channel

-

Offline Retail (Hearing Clinics, Hospitals, Pharmacies)

-

Online Platforms

Offline retail remains the dominant sales channel, as audiologists and hearing specialists play a critical role in device selection and fitting. Hearing aid customization requires professional consultations, diagnostic assessments, and real-time adjustments, making physical retail channels indispensable. Hospitals, specialized clinics, and pharmacies serve as primary distribution points, ensuring trust and product credibility among consumers. Additionally, insurance reimbursement and government-backed programs drive traffic to offline channels, solidifying their market leadership.

The online sales segment is witnessing rapid expansion due to the rise of e-commerce and telehealth solutions. Consumers now prefer direct-to-consumer (DTC) models, offering cost savings, convenience, and doorstep delivery. Leading hearing aid brands and tech companies are leveraging AI-powered virtual consultations, self-fitting applications, and remote assistance to enhance the online purchasing experience. Furthermore, over-the-counter (OTC) regulations in markets like the U.S. are driving online accessibility, making AI hearing aids available to a broader audience.

AI Hearing Aids Market Segmentation: By Technology

-

Deep Learning-Based AI Hearing Aids

-

Cloud-Connected AI Hearing Aids

-

Self-Learning AI Hearing Aids

Deep learning-based AI hearing aids are the market leaders due to their highly adaptive and personalized hearing experiences. These devices continuously learn from user behavior and environmental conditions, refining sound quality over time. AI-driven speech enhancement, background noise cancellation, and real-time contextual adjustments make them superior to traditional hearing aids. Users benefit from automated volume adjustments, enhanced speech clarity in noisy environments, and natural sound processing, driving widespread adoption.

Cloud-connected AI hearing aids are growing at an accelerated rate, fueled by the integration of IoT and tele-audiology services. These devices enable remote fine-tuning, firmware updates, and AI-driven diagnostic monitoring, reducing the need for frequent audiologist visits. Cloud connectivity enhances user convenience, allowing real-time adjustments via smartphone apps and seamless data sharing with healthcare providers. As digital health adoption rises, cloud-enabled hearing aids are becoming the preferred choice for tech-savvy consumers, fueling strong market growth.

.

AI Hearing Aids Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America dominates the AI hearing aids market due to high healthcare expenditure, strong regulatory support, and advanced audiology infrastructure. The FDA’s approval of OTC hearing aids has further expanded market accessibility, allowing consumers to purchase AI-powered devices without medical prescriptions. Leading manufacturers such as Starkey, Oticon, and GN Hearing are headquartered in the region, driving constant innovation. Additionally, strong insurance coverage and reimbursement policies encourage adoption among the elderly, solidifying North America’s position as the largest market.

Asia-Pacific is the fastest-growing region, driven by rising awareness, increasing disposable income, and government initiatives to address hearing loss. Countries like China, Japan, and India are witnessing a surge in demand for AI-powered healthcare solutions, including smart hearing aids. The expansion of telehealth services, availability of cost-effective AI hearing aids, and increasing geriatric population are fueling rapid adoption. Additionally, strategic partnerships between global hearing aid manufacturers and local distributors are accelerating market penetration, making Asia-Pacific the next key growth hub.

COVID-19 Impact Analysis on AI Hearing Aids Market:

The COVID-19 pandemic accelerated the adoption of tele-audiology and digital hearing solutions, as in-person audiology visits were restricted. Manufacturers and healthcare providers adapted by offering remote adjustments and online consultations, leading to increased AI hearing aid sales. However, supply chain disruptions and economic slowdowns temporarily affected production and affordability. Post-pandemic, the market has rebounded strongly with higher adoption rates of digital and AI-powered healthcare solutions..

Latest Trends/ Developments:

GN Store Nord announced the launch of two new hearing aid platforms, ReSound Vivia and ReSound Savi, designed to improve speech understanding in noisy environments. The ReSound Vivia is touted as the smallest AI-powered hearing aid to date.

GOQii launched the GOQii Smart Vital 2.0, a smartwatch with ECG and other health tracking features, in collaboration with Kotak General Insurance and Kotak Life Insurance. This partnership aims to offer dynamic health and life insurance coverage based on users' health scores.

Fitbit introduced the Sense 2, a smartwatch with comprehensive ECG tracking capabilities and various other health metrics. This device aims to provide users with a deeper understanding of their overall well-being.

Key Players:

-

Starkey Hearing Technologies

-

Sonova Holding AG

-

GN Hearing A/S

-

Oticon (Demant A/S)

-

WS Audiology

-

Cochlear Limited

-

Eargo Inc.

-

Nuheara Limited

-

Resound (GN Group)

-

MED-EL

Chapter 1. AI Hearing Aids Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. AI Hearing Aids Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. AI Hearing Aids Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. AI Hearing Aids Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. AI Hearing Aids Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. AI Hearing Aids Market – BY PRODUCT TYPE

6.1 Introduction/Key Findings

6.2 Behind-the-Ear (BTE) AI Hearing Aids

6.3 In-the-Ear (ITE) AI Hearing Aids

6.4 Receiver-in-Canal (RIC) AI Hearing Aids

6.5 Y-O-Y Growth trend Analysis BY PRODUCT TYPE

6.6 Absolute $ Opportunity Analysis BY PRODUCT TYPE, 2025-2030

Chapter 7. AI Hearing Aids Market – BY END-USER

7.1 Introduction/Key Findings

7.2 Adults

7.3 Pediatrics

7.4 Y-O-Y Growth trend Analysis BY END-USER

7.5 Absolute $ Opportunity Analysis BY END-USER, 2025-2030

Chapter 8. AI Hearing Aids Market – BY DISTRIBUTION CHANNEL

8.1 Introduction/Key Findings

8.2 Offline Retail (Hearing Clinics, Hospitals, Pharmacies)

8.3 Online Platforms

8.4 Y-O-Y Growth trend Analysis BY DISTRIBUTION CHANNEL

8.5 Absolute $ Opportunity Analysis BY DISTRIBUTION CHANNEL, 2025-2030

Chapter 9. AI Hearing Aids Market – BY TECHNOLOGY

9.1 Introduction/Key Findings

9.2 Deep Learning-Based AI Hearing Aids

9.3 Cloud-Connected AI Hearing Aids

9.4 Self-Learning AI Hearing Aids

9.5 Y-O-Y Growth trend Analysis BY TECHNOLOGY

9.6 Absolute $ Opportunity Analysis BY TECHNOLOGY, 2025-2030

Chapter 10. AI Hearing Aids Market , By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 BY PRODUCT TYPE

10.1.2.1 BY END-USER

10.1.3 BY DISTRIBUTION CHANNEL

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 BY PRODUCT TYPE

10.2.3 BY END-USER

10.2.4 BY DISTRIBUTION CHANNEL

10.2.5 By BY TECHNOLOGY

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 BY PRODUCT TYPE

10.3.3 BY END-USER

10.3.4 BY DISTRIBUTION CHANNEL

10.3.5 By BY TECHNOLOGY

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 BY PRODUCT TYPE

10.4.3 BY END-USER

10.4.4 BY DISTRIBUTION CHANNEL

10.4.5 By BY TECHNOLOGY

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 BY PRODUCT TYPE

10.5.3 BY END-USER

10.5.4 BY DISTRIBUTION CHANNEL

10.5.5 By BY TECHNOLOGY

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. AI Hearing Aids Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Starkey Hearing Technologies

11.2 Sonova Holding AG

11.3 GN Hearing A/S

11.4 Oticon (Demant A/S)

11.5 WS Audiology

11.6 Cochlear Limited

11.7 Eargo Inc.

11.8 Nuheara Limited

11.9 Resound (GN Group)

11.10 MED-EL

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The AI Hearing Aids Market is valued at USD 3.12 Billion in 2024 and is projected to reach a market size of USD 4.84 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 9.2%.

Rising Prevalence of Hearing Loss, Advancements in AI and Machine Learning, Growing Consumer Preference for Smart and Connected Devices & Government Support and Favorable Reimbursement Policies are the major drivers of AI Hearing Aids Market.

Deep Learning-Based AI Hearing Aids, Cloud-Connected AI Hearing Aids & Self-Learning AI Hearing Aids are the segments under the AI Hearing Aids Market by Technology.

North America is the most dominant region for the AI Hearing Aids Market.

Asia Pacific is the fastest-growing region in the AI Hearing Aids Market.