Hearing Aids Market Size (2024 – 2030)

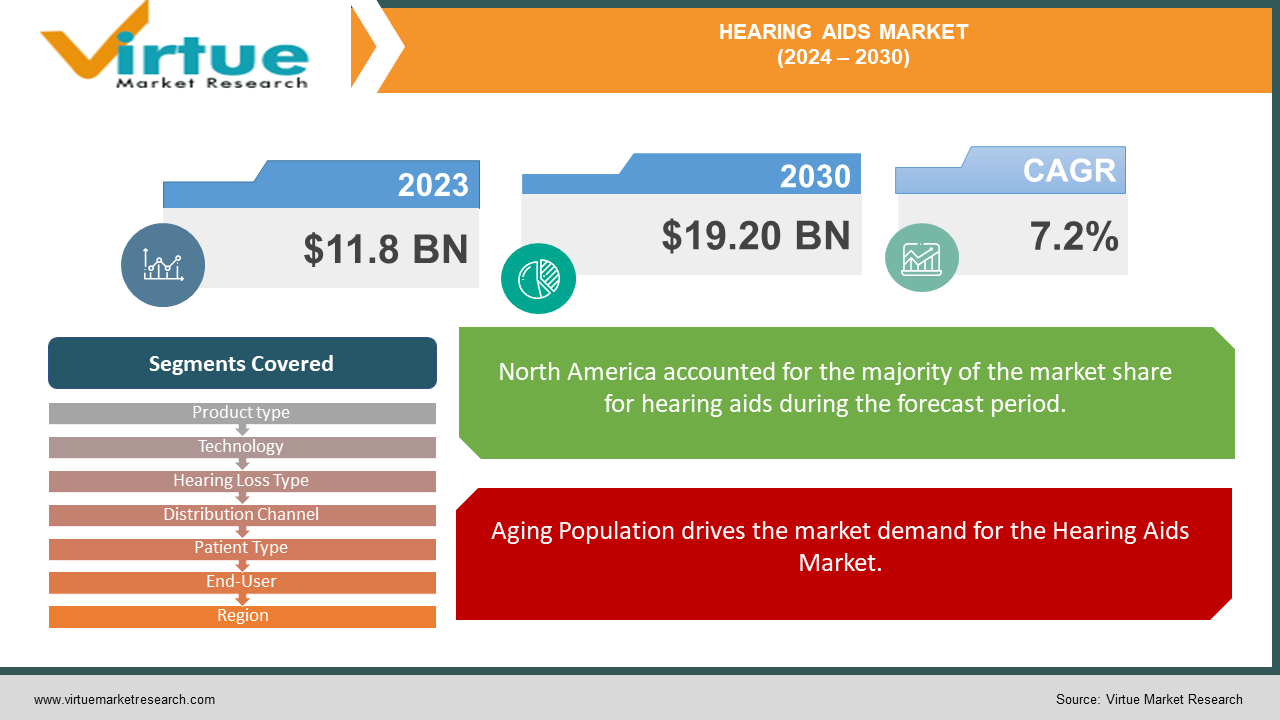

The Global Hearing Aids Market is valued at USD 11.8 Billion and is projected to reach a market size of USD 19.20 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.2%.

One significant long-term driver for the hearing aid market is the aging population. As people age, their hearing often deteriorates, leading to a greater need for hearing aids. Advances in medical technology have also improved the quality and effectiveness of hearing aids, making them more attractive to potential users. The World Health Organization estimates that by 2050, nearly 2.5 billion people will experience some degree of hearing loss. This increase in the elderly population will likely sustain the demand for hearing aids over the coming decades.

One significant opportunity in the hearing aids market is the development of over-the-counter (OTC) hearing aids. The U.S. Food and Drug Administration (FDA) has approved regulations allowing certain types of hearing aids to be sold directly to consumers without a prescription. This move is expected to reduce costs and make hearing aids more accessible to a broader audience. Companies are now focusing on creating high-quality, affordable OTC hearing aids that consumers can purchase and use independently.

An observed trend in the industry is the integration of advanced technology into hearing aids. Modern hearing aids are no longer just amplifiers; they are sophisticated devices equipped with features like Bluetooth connectivity, artificial intelligence (AI), and smartphone compatibility.

Key Market Insights:

The Hearing Aids Market is projected to expand at a compound annual growth rate of over 7.2% in the coming seven years, propelled by increasing urbanization and population growth in major cities worldwide.

Sonova Holding AG (Switzerland), William Demant Holding A/S (Denmark), and GN Store Nord A/S (Denmark) are some examples of the Hearing Aids Market.

North America and Asia-Pacific account for approximately 65-70 % of the Hearing Aids Market, driven by the Aging Population, Technological Advancements, Increased Awareness and Early Diagnosis & Regulatory Changes, and Market Accessibility.

Hearing Aids Market Drivers:

Aging Population drives the market demand for the Hearing Aids Market.

One of the most significant drivers of the hearing aids market is the aging global population. As people age, their likelihood of experiencing hearing loss increases. According to the World Health Organization, nearly one-third of people over the age of 65 are affected by disabling hearing loss. This demographic trend is expected to continue, with the number of older adults growing rapidly worldwide. As the elderly population increases, the demand for hearing aids is projected to rise correspondingly. This long-term driver is pivotal because it ensures a steady and growing customer base for hearing aid manufacturers and healthcare providers.

Technological Advancements drive the market demand for Hearing Aids Market.

Technological advancements have revolutionized the hearing aids market, making devices more effective, comfortable, and user-friendly. Modern hearing aids are equipped with advanced features such as digital signal processing, Bluetooth connectivity, and artificial intelligence. These innovations have significantly improved the user experience. For example, digital signal processing allows for clearer sound quality by reducing background noise, while Bluetooth connectivity enables users to stream audio directly from their smartphones or other devices. AI-driven hearing aids can automatically adjust settings based on the user's environment, providing a personalized hearing experience. These technological advancements not only enhance the functionality of hearing aids but also attract tech-savvy consumers who seek the latest in auditory technology.

Increased Awareness and Early Diagnosis drive the market demand for Hearing Aids Market.

There has been a notable increase in public awareness regarding hearing health and the importance of early diagnosis and intervention. Health organizations, audiologists, and hearing aid manufacturers have been actively promoting the benefits of addressing hearing loss early. Campaigns and educational programs emphasize that untreated hearing loss can lead to social isolation, depression, and cognitive decline. As a result, more people are now aware of the signs of hearing loss and are seeking medical advice and treatment sooner. Early diagnosis and intervention are crucial because they can prevent the negative consequences of untreated hearing loss and improve the quality of life for individuals. This increased awareness is driving more people to seek hearing aids, thereby boosting market growth.

Regulatory Changes and Market Accessibility drive the market demand for Hearing Aids Market.

Recent regulatory changes, particularly in the United States, have made hearing aids more accessible to the general public. The U.S. Food and Drug Administration (FDA) has approved regulations allowing the sale of over-the-counter (OTC) hearing aids. This regulatory change means that consumers can purchase hearing aids without a prescription or a visit to an audiologist. The availability of OTC hearing aids is expected to reduce costs and increase accessibility for people with mild to moderate hearing loss. By lowering barriers to entry, these regulatory changes are likely to expand the market and reach a broader audience. Moreover, increased competition among manufacturers could drive innovation and further reduce prices, making hearing aids more affordable for consumers.

Hearing Aids Market Restraints and Challenges:

The hearing aids market faces several restraints and challenges that hinder its growth and development. One significant restraint is the high cost of hearing aids, which can be prohibitively expensive for many individuals. Despite technological advancements, hearing aids remain a substantial investment, often costing thousands of dollars per pair. This financial burden is exacerbated by the fact that many insurance plans do not cover hearing aids or offer limited coverage. As a result, a significant portion of the population with hearing loss either delays purchasing hearing aids or foregoes them altogether, leading to unmet needs and potential social and cognitive consequences.

Another major challenge is the stigma associated with hearing loss and the use of hearing aids. Many individuals, particularly older adults, are reluctant to seek help for their hearing problems due to the fear of being perceived as old or disabled. This stigma can lead to denial or resistance to using hearing aids, even when they are needed. Additionally, there is a lack of awareness and understanding about the benefits of early intervention and the advancements in hearing aid technology. People may not realize how much hearing aids can improve their quality of life, leading to lower adoption rates. Overcoming these challenges requires concerted efforts in education, public awareness campaigns, and policy changes to make hearing aids more affordable and socially acceptable.

Hearing Aids Market Opportunities:

The hearing aids market presents numerous opportunities, particularly with the advent of new technologies and regulatory changes. One of the most promising opportunities is the development and sale of over-the-counter (OTC) hearing aids. With the U.S. Food and Drug Administration (FDA) approving regulations that allow certain hearing aids to be sold directly to consumers without a prescription, there is a significant potential to reach a broader audience. This change can make hearing aids more affordable and accessible, especially for individuals with mild to moderate hearing loss. Companies can capitalize on this opportunity by developing high-quality, user-friendly OTC hearing aids that meet consumer needs while remaining cost-effective. Additionally, this shift can drive competition and innovation within the market, leading to better products and lower prices for consumers.

Another substantial opportunity lies in the integration of cutting-edge technology into hearing aids. Advances in digital signal processing, artificial intelligence (AI), and connectivity features like Bluetooth are transforming hearing aids from simple sound amplifiers into sophisticated devices that offer a personalized and enhanced user experience. AI can enable hearing aids to adapt to different environments automatically, providing optimal sound quality in various settings. Bluetooth connectivity allows users to stream audio directly from their smartphones, TVs, and other devices, enhancing their overall experience. By investing in research and development, manufacturers can create next-generation hearing aids that not only improve hearing but also seamlessly integrate into the digital lives of users. This technological innovation can attract a new segment of tech-savvy consumers and elevate the overall market.

HEARING AIDS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.2% |

|

Segments Covered |

By Product type, Technology, Hearing Loss Type, Distribution Channel, Patient Type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Sonova Holding AG (Switzerland), William Demant Holding A/S (Denmark), GN Store Nord A/S (Denmark), Starkey Hearing Technologies (USA), Cochlear Limited (Australia), Widex A/S (Denmark), Sivantos Group (Singapore), Audina Hearing Instruments, Inc. (USA), RION Co., Ltd. (Japan), MED-EL (Austria) |

Hearing Aids Market Segmentation: By Product Type

-

Behind-the-Ear

-

In-the-Ear

-

In-the-Canal

-

Completely-in-the-Canal

-

Receiver-in-Canal

-

Invisible-in-Canal

In the hearing aids market, the largest segment by product type is the Behind-the-Ear (BTE) hearing aids. BTE hearing aids are popular because they are versatile and suitable for a wide range of hearing loss levels, from mild to profound. These devices are worn behind the ear and connect to an ear-mold inside the ear canal, which allows for a comfortable fit and better sound amplification. BTE hearing aids also have a longer battery life and more power compared to other types, making them a reliable choice for many users. Their larger size allows for more advanced features, such as directional microphones and wireless connectivity, enhancing the overall user experience. This versatility and advanced functionality make BTE hearing aids the most widely used type in the market.

The fastest-growing segment by product type is the Receiver-in-Canal (RIC) hearing aids. RIC hearing aids are similar to BTE devices but have a more discreet design, with the receiver placed inside the ear canal rather than in the main body of the hearing aid. This design provides better sound quality and a more natural listening experience, which appeals to many users. RIC hearing aids are particularly popular among younger users and those with active lifestyles because they are less visible and more comfortable to wear for extended periods. Additionally, advancements in technology have enabled RIC hearing aids to include sophisticated features like Bluetooth connectivity and rechargeable batteries, further driving their rapid adoption. The combination of aesthetics, comfort, and advanced technology makes RIC hearing aids the fastest-growing segment in the market.

Hearing Aids Market Segmentation: By Technology

-

Analog Hearing Aids

-

Digital Hearing Aids

In the hearing aids market, the largest segment by technology is digital hearing aids. Digital hearing aids have overtaken their analog counterparts due to their superior sound processing capabilities and customizable features. These devices convert sound waves into digital signals, allowing for more precise and flexible sound amplification. Digital hearing aids can be programmed to match the specific hearing loss profile of the user, offering a personalized listening experience. They also include advanced features such as noise reduction, feedback cancellation, and directional microphones, which significantly enhance sound quality and user comfort. The ability to fine-tune these devices according to individual needs has made digital hearing aids the preferred choice among consumers, driving their dominance in the market.

The fastest-growing segment by technology is smart hearing aids, which incorporate cutting-edge innovations like artificial intelligence (AI) and wireless connectivity. These smart devices go beyond traditional amplification, offering users seamless integration with modern digital lifestyles. AI-powered hearing aids can automatically adjust settings based on the user's environment, providing an optimized listening experience without manual intervention. Additionally, features like Bluetooth connectivity allow users to stream audio directly from their smartphones, TVs, and other electronic devices. Rechargeable batteries and smartphone apps for remote control and adjustments further enhance the appeal of smart hearing aids. The rapid adoption of these high-tech features reflects the increasing consumer demand for more convenient, efficient, and multifunctional hearing solutions, making smart hearing aids the fastest-growing segment in the market.

Hearing Aids Market Segmentation: By Hearing Loss Type

-

Mild Hearing Loss

-

Moderate Hearing Loss

-

Severe Hearing Loss

-

Profound Hearing Loss

In the hearing aids market, the largest segment by hearing loss type is mild to moderate hearing loss. This segment encompasses a broad range of individuals who experience some difficulty hearing but do not have severe or profound hearing loss. Mild to moderate hearing loss is more common in the general population, particularly among older adults and those who have been exposed to noise over long periods. The widespread prevalence of this type of hearing loss drives the demand for hearing aids that can effectively address it. Devices designed for mild to moderate hearing loss are typically smaller, more discreet, and comfortable to wear, making them appealing to a large number of users. These hearing aids often include features like noise reduction and speech enhancement, which significantly improve the user's ability to hear in various environments, thereby boosting their popularity and widespread use.

The fastest-growing segment of hearing loss type is severe to profound hearing loss. As awareness of the benefits of hearing aids increases and technology advances, more individuals with severe to profound hearing loss are seeking solutions to improve their hearing and quality of life. This segment is growing rapidly due to the development of powerful hearing aids capable of providing significant amplification and clarity. These devices often include advanced features like feedback cancellation, directional microphones, and connectivity options, which enhance their effectiveness and user experience. Additionally, the integration of cochlear implants with hearing aids has opened new possibilities for those with severe to profound hearing loss, offering improved outcomes. The increasing availability of such high-performance devices, coupled with greater awareness and acceptance, is driving the rapid growth of this segment.

Hearing Aids Market Segmentation: By Distribution Channel

-

Hospital & Clinics

-

Retail Stores

-

Online Stores

-

Others

In the hearing aids market, the largest segment by distribution channel is hospital and clinic-based sales. Hospitals and clinics have long been the primary point of contact for individuals seeking hearing health services. These medical settings provide comprehensive care, including hearing assessments, personalized fittings, and ongoing support from audiologists and hearing care professionals. The trust and reliability associated with healthcare institutions drive many consumers to seek hearing aids through these channels. Additionally, hospitals and clinics often have access to the latest hearing aid technologies and offer customized solutions tailored to the specific needs of each patient. This personalized approach and the professional support available in medical settings make hospital and clinic-based sales the dominant distribution channel in the hearing aids market.

The fastest-growing segment by distribution channel is online sales. The rise of e-commerce and digital health solutions has revolutionized the way consumers purchase hearing aids. Online platforms offer a convenient and accessible way to research, compare, and purchase hearing aids from the comfort of your home. This channel has become particularly popular among tech-savvy consumers and those seeking lower-cost options without compromising on quality. The availability of over-the-counter (OTC) hearing aids has further fueled the growth of online sales, allowing consumers to buy hearing aids directly without needing a prescription or an in-person consultation. Many online retailers also provide virtual consultations and customer support to help users select and adjust their devices. The convenience, accessibility, and often lower costs associated with online sales are driving this segment's rapid expansion, making it the fastest-growing distribution channel in the hearing aids market.

Hearing Aids Market Segmentation: By Patient Type

-

Adults

-

Pediatrics

In the hearing aids market, the largest segment by patient type is adults. Hearing loss is more prevalent among adults, particularly as they age. Conditions like age-related hearing loss (presbycusis) and noise-induced hearing loss are common in this demographic. Adults, especially seniors, often experience gradual hearing decline and seek solutions to maintain their quality of life and stay connected with family and friends. The high prevalence of hearing loss among adults drives significant demand for hearing aids within this group. Additionally, the adult segment benefits from targeted marketing campaigns and public health initiatives that raise awareness about the importance of addressing hearing loss, further solidifying their position as the largest patient type in the market.

The fastest-growing segment by patient type is pediatrics. Awareness of the importance of early detection and intervention in hearing loss among children has increased significantly in recent years. Advances in neonatal hearing screening have made it possible to diagnose hearing impairments at a very young age, leading to earlier intervention and better outcomes for affected children. Hearing aids designed for the pediatric population are specifically tailored to meet the unique needs of children, including features like durable, tamper-proof designs and compatibility with assistive listening devices used in educational settings. The growing recognition of the critical role that hearing plays in a child's development and education is driving the rapid growth of the pediatric segment. Moreover, supportive policies and initiatives aimed at providing hearing aids to children, often through government programs or insurance coverage, are contributing to the expansion of this market segment.

Hearing Aids Market Segmentation: By End-User

-

Home Use

-

Hospitals & Clinics

-

Ambulatory Surgery Centers

In the hearing aids market, the largest segment by end-users is home use. This category includes individuals who purchase hearing aids for everyday personal use to improve their hearing in various settings, such as at home, during social interactions, or while participating in recreational activities. Home use encompasses a wide range of consumers, from older adults experiencing age-related hearing loss to individuals seeking solutions for mild hearing impairments. The convenience of home use hearing aids, which are designed for comfort and ease of use in daily life, makes them the most popular choice for many people. These devices are often available in various styles and price ranges, allowing users to select the best option for their specific needs and preferences. The broad appeal of home-use hearing aids is driven by their accessibility and the significant demand for solutions that enhance everyday hearing experiences.

The fastest-growing segment by end-users is hospitals and clinics. This segment is experiencing rapid growth due to several factors. Firstly, advancements in hearing aid technology have led to more sophisticated devices being used in medical settings for comprehensive hearing assessments and fittings. Hospitals and clinics provide a professional environment where patients can receive detailed hearing evaluations and customized hearing aid solutions. Additionally, there is a growing trend towards integrating hearing care into broader health management practices, with hospitals and clinics offering specialized hearing services as part of holistic healthcare solutions. This trend is driven by increased awareness of the importance of addressing hearing loss and the desire for high-quality, medically supervised hearing care. As more individuals seek professional guidance and support for their hearing health, the hospital and clinic segment is expanding rapidly, making it the fastest-growing end-user category in the market.

Hearing Aids Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East and Africa

In the hearing aids market, the largest segment by region is North America. This region leads the global market primarily due to its high prevalence of hearing loss among the aging population and the advanced healthcare infrastructure available. North America, particularly the United States and Canada, has a well-established market for hearing aids supported by sophisticated healthcare systems and a strong network of audiologists and hearing aid professionals. The high standard of living and increased health awareness in these countries contribute to significant demand for hearing aids. Additionally, North America benefits from extensive insurance coverage and government programs that help offset the costs of hearing aids, making these devices more accessible to those in need. This combination of factors has solidified North America’s position as the largest market for hearing aids.

The fastest-growing segment by region is Asia-Pacific. This region is experiencing rapid growth in the hearing aids market due to several key factors. First, the Asia-Pacific region has a large and aging population, particularly in countries like China and Japan, where hearing loss is becoming a significant public health concern. As the middle class expands in countries such as India and China, there is increasing access to healthcare services and a greater focus on health and well-being, which includes addressing hearing loss. Furthermore, technological advancements and the introduction of affordable hearing aids have made these devices more accessible to a broader audience. The rise of e-commerce and online sales channels in Asia-Pacific also supports this growth, offering consumers more convenient and cost-effective ways to purchase hearing aids. The combination of a growing elderly population, rising incomes, and increased availability of hearing aids is driving the rapid expansion of the hearing aids market in the Asia-Pacific region, making it the fastest-growing segment globally.

COVID-19 Impact Analysis on Hearing Aids Market:

The COVID-19 pandemic had a significant impact on the hearing aids market, creating both challenges and opportunities for the industry. At the onset of the pandemic, many audiology clinics and hearing aid centers were forced to close temporarily due to lockdowns and social distancing measures. This led to a sharp decline in in-person appointments, hearing aid fittings, and sales. Patients faced difficulties accessing necessary services, which caused delays in the diagnosis of hearing loss and the acquisition of hearing aids. Additionally, supply chain disruptions affected the production and distribution of hearing aids, leading to shortages and delays. Many people who needed hearing aids either postponed their purchases or went without, which impacted overall market growth during the early months of the pandemic.

However, the pandemic also accelerated several positive changes in the hearing aids market. One of the most notable shifts was the rapid adoption of telehealth and remote services. Audiologists and hearing aid professionals quickly adapted by offering virtual consultations, remote fittings, and online support. This transition made it easier for patients to access hearing care from the safety of their homes and expanded the reach of hearing services to remote or underserved areas. Additionally, the increased use of digital technology during the pandemic led to a surge in interest in smart hearing aids that offer features like Bluetooth connectivity and smartphone integration. These advancements not only helped the industry navigate the immediate challenges of the pandemic but also set the stage for future growth. As a result, while COVID-19 initially posed obstacles for the hearing aids market, it ultimately drove innovation and broadened access to hearing care services, reshaping the market for the better in the long term.

Latest Trends/ Developments:

One of the latest trends in the hearing aids market is the integration of advanced technology to enhance user experience and functionality. Modern hearing aids are no longer just devices that amplify sound; they now come equipped with sophisticated features designed to meet the evolving needs of users. For instance, the latest hearing aids incorporate artificial intelligence (AI) to automatically adjust settings based on the environment. AI-driven hearing aids can distinguish between different sound sources, such as conversations and background noise, and adjust the volume and frequency settings accordingly to provide the best possible listening experience. Additionally, many new models offer Bluetooth connectivity, which allows users to stream audio directly from their smartphones, televisions, and other devices. This trend towards smart, connected hearing aids reflects a broader movement towards integrating technology into everyday health solutions, making hearing aids more versatile and user-friendly.

Key Players:

-

Sonova Holding AG (Switzerland)

-

William Demant Holding A/S (Denmark)

-

GN Store Nord A/S (Denmark)

-

Starkey Hearing Technologies (USA)

-

Cochlear Limited (Australia)

-

Widex A/S (Denmark)

-

Sivantos Group (Singapore)

-

Audina Hearing Instruments, Inc. (USA)

-

RION Co., Ltd. (Japan)

-

MED-EL (Austria)

Chapter 1. Hearing Aids Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Hearing Aids Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Hearing Aids Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Hearing Aids Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Hearing Aids Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Hearing Aids Market – By Product Type

6.1 Introduction/Key Findings

6.2 Behind-the-Ear

6.3 In-the-Ear

6.4 In-the-Canal

6.5 Completely-in-the-Canal

6.6 Receiver-in-Canal

6.7 Invisible-in-Canal

6.8 Y-O-Y Growth trend Analysis By Product Type

6.9 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Hearing Aids Market – By Technology

7.1 Introduction/Key Findings

7.2 Analog Hearing Aids

7.3 Digital Hearing Aids

7.4 Y-O-Y Growth trend Analysis By Technology

7.5 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 8. Hearing Aids Market – By Hearing Loss Type

8.1 Introduction/Key Findings

8.2 Mild Hearing Loss

8.3 Moderate Hearing Loss

8.4 Severe Hearing Loss

8.5 Profound Hearing Loss

8.6 Y-O-Y Growth trend Analysis By Hearing Loss Type

8.7 Absolute $ Opportunity Analysis By Hearing Loss Type, 2024-2030

Chapter 9. Hearing Aids Market – By Distribution Channel

9.1 Introduction/Key Findings

9.2 Hospital & Clinics

9.3 Retail Stores

9.4 Online Stores

9.5 Others

9.6 Y-O-Y Growth trend Analysis By Distribution Channel

9.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 10. Hearing Aids Market – By Patient Type

10.1 Introduction/Key Findings

10.2 Adults

10.3 Pediatrics

10.4 Y-O-Y Growth trend Analysis Construction

10.5 Absolute $ Opportunity Analysis Construction, 2024-2030

Chapter 11. Hearing Aids Market – By End-User

11.1 Introduction/Key Findings

11.2 Home Use

11.3 Hospitals & Clinics

11.4 Ambulatory Surgery Centers

11.5 Y-O-Y Growth trend Analysis By End-User

11.6 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 12. Hearing Aids Market , By Geography – Market Size, Forecast, Trends & Insights

12.1 North America

12.1.1 By Country

12.1.1.1 U.S.A.

12.1.1.2 Canada

12.1.1.3 Mexico

12.1.2 By Product Type

12.1.2.1 By Technology

12.1.3 By Hearing Loss Type

12.1.4 By Patient Type

12.1.5 Countries & Segments - Market Attractiveness Analysis

12.2 Europe

12.2.1 By Country

12.2.1.1 U.K

12.2.1.2 Germany

12.2.1.3 France

12.2.1.4 Italy

12.2.1.5 Spain

12.2.1.6 Rest of Europe

12.2.2 By Product Type

12.2.3 By Technology

12.2.4 By Hearing Loss Type

12.2.5 By Distribution Channel

12.2.6 By Patient Type

12.2.7 Countries & Segments - Market Attractiveness Analysis

12.3 Asia Pacific

12.3.1 By Country

12.3.1.1 China

12.3.1.2 Japan

12.3.1.3 South Korea

12.3.1.4 India

12.3.1.5 Australia & New Zealand

12.3.1.6 Rest of Asia-Pacific

12.3.2 By Product Type

12.3.3 By Technology

12.3.4 By Hearing Loss Type

12.3.5 By Distribution Channel

12.3.6 By Patient Type

12.3.7 Countries & Segments - Market Attractiveness Analysis

12.4 South America

12.4.1 By Country

12.4.1.1 Brazil

12.4.1.2 Argentina

12.4.1.3 Colombia

12.4.1.4 Chile

12.4.1.5 Rest of South America

12.4.2 By Product Type

12.4.3 By Technology

12.4.4 By Hearing Loss Type

12.4.5 By Distribution Channel

12.4.6 By Patient Type

12.4.7 Countries & Segments - Market Attractiveness Analysis

12.5 Middle East & Africa

12.5.1 By Country

12.5.1.1 United Arab Emirates (UAE)

12.5.1.2 Saudi Arabia

12.5.1.3 Qatar

12.5.1.4 Israel

12.5.1.5 South Africa

12.5.1.6 Nigeria

12.5.1.7 Kenya

12.5.1.8 Egypt

12.5.1.9 Rest of MEA

12.5.2 By Product Type

12.5.3 By Technology

12.5.4 By Hearing Loss Type

12.5.5 By Distribution Channel

12.5.6 By Patient Type

12.5.7 Countries & Segments - Market Attractiveness Analysis

Chapter 13. Hearing Aids Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

13.1 Sonova Holding AG (Switzerland)

13.2 William Demant Holding A/S (Denmark)

13.3 GN Store Nord A/S (Denmark)

13.4 Starkey Hearing Technologies (USA)

13.5 Cochlear Limited (Australia)

13.6 Widex A/S (Denmark)

13.7 Sivantos Group (Singapore)

13.8 Audina Hearing Instruments, Inc. (USA)

13.9 RION Co., Ltd. (Japan)

13.10 MED-EL (Austria)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Hearing Aids Market is valued at USD 11.8 Billion and is projected to reach a market size of USD 19.20 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.2%.

Aging Population, Technological Advancements, Increased Awareness, and Early Diagnosis & Regulatory Changes and Market Accessibility are the major drivers of Hearing Aids Market.

Behind-the-Ear, In-the-Ear, In-the-Canal, Completely-in-the-Canal, Receiver-in-Canal, and Invisible-in-Canal are the segments under the Hearing Aids Market by type.

North America is the most dominant region for the Hearing Aids Market.

Asia-Pacific is the fastest-growing region in the Hearing Aids Market.