3D Printing Post Processing Market size (2025 – 2030)

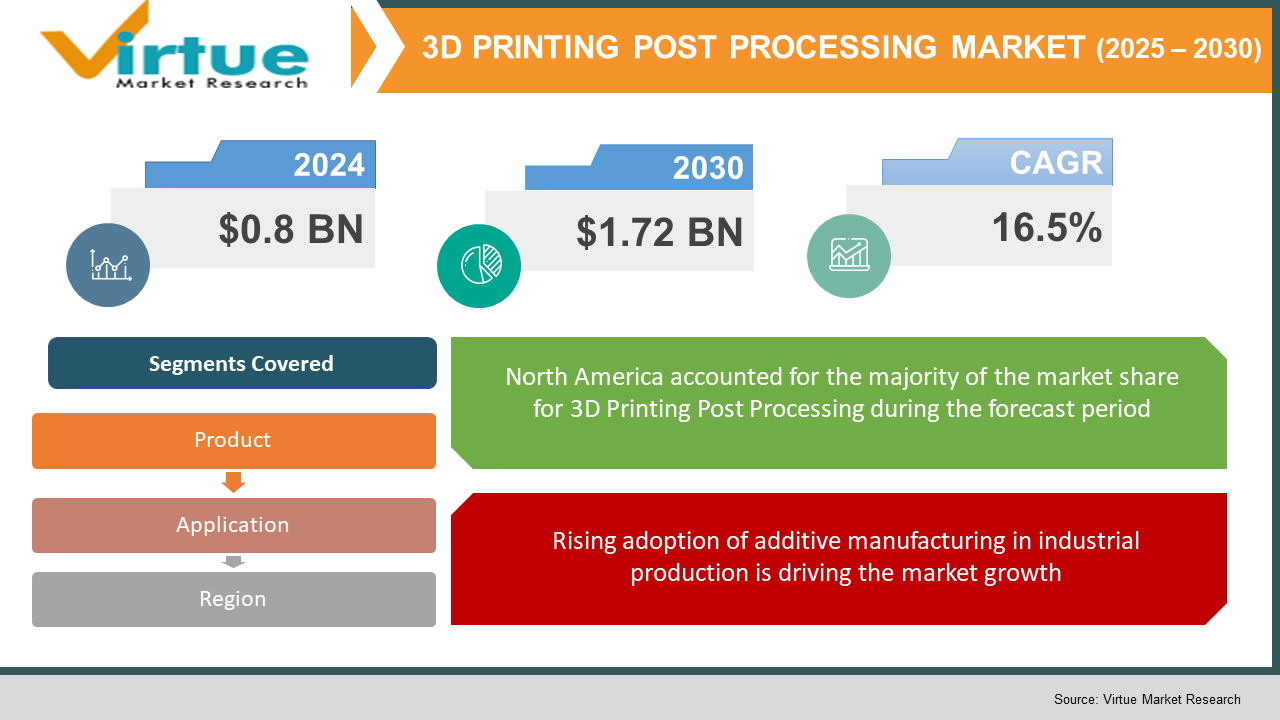

The Global 3D Printing Post Processing Market was valued at USD 0.8 billion in 2024 and will grow at a CAGR of 16.5% from 2025 to 2030. The market is expected to reach USD 1.72 billion by 2030.

3D printing post-processing refers to the finishing techniques applied to additively manufactured parts to improve their mechanical properties, aesthetics, and functionality. These processes include support removal, surface finishing, heat treatments, coloring, and sealing. The growing adoption of additive manufacturing in industries such as aerospace, healthcare, and automotive is driving the need for advanced post-processing solutions. As 3D printing technology matures, the demand for automated post-processing solutions is increasing to improve production efficiency and reduce manual labor costs. With advancements in material science and process automation, the market is poised for substantial growth in the coming years.

- Key market insights:

The increasing adoption of industrial 3D printing has led to a higher demand for post-processing solutions, with over 70% of 3D-printed parts requiring some form of finishing.

Automated post-processing solutions are gaining popularity, with a projected market growth rate of 18% annually due to their ability to reduce production time and costs.

The aerospace and defense sector holds a dominant share in the market, accounting for 35% of total demand due to stringent surface finishing requirements for lightweight and durable components.

In the healthcare industry, biocompatible post-processing techniques for medical implants and prosthetics are expected to witness a CAGR of 20%.

The automotive sector is increasingly using 3D printing post-processing to produce custom components, with a focus on high-performance finishing for end-use parts.

Chemical vapor smoothing and automated depowdering technologies are becoming mainstream, enhancing the mechanical properties and aesthetics of 3D-printed parts.

The shift towards sustainable and eco-friendly post-processing methods, including water-based and solvent-free solutions, is gaining momentum due to increasing environmental regulations.

Asia-Pacific is emerging as a key market for 3D printing post-processing solutions, driven by the rapid adoption of additive manufacturing in China, Japan, and South Korea.

Global 3D Printing Post Processing Market Drivers:

Rising adoption of additive manufacturing in industrial production is driving the market growth

The growing integration of 3D printing into industrial production lines is a major driver for the post-processing market. Traditionally, 3D printing was mainly used for prototyping, but its role has expanded to include full-scale production of functional parts across various industries. With increasing adoption in aerospace, healthcare, and automotive sectors, manufacturers require high-quality finishing to meet industry standards. 3D-printed components often have rough surfaces or residual powder that must be removed before final use. Automated post-processing technologies, such as vapor smoothing, automated support removal, and depowdering, are being developed to improve efficiency. The rising focus on end-use applications is expected to drive investments in advanced post-processing solutions, further propelling market growth.

Growing demand for automation in post-processing operations is driving the market growth

Manual post-processing methods, such as sanding, polishing, and chemical treatments, are time-consuming, inconsistent, and labor-intensive. As the adoption of 3D printing scales up, manufacturers are increasingly looking for automated solutions to streamline their workflows. Automated post-processing technologies help reduce human errors, improve repeatability, and enhance productivity. Innovations in robotics, AI-driven process optimization, and machine learning-based quality control are driving the shift towards automation. Companies such as AMT and DyeMansion have introduced fully automated post-processing systems capable of handling high volumes of 3D-printed parts with minimal operator intervention. This growing demand for efficiency and cost reduction is expected to drive the market for automated post-processing solutions.

Advancements in material compatibility and finishing techniques is driving the market growth

Material diversity in additive manufacturing has expanded significantly, with the development of new metal, polymer, and composite materials. Different materials require specific post-processing techniques to enhance their mechanical properties and surface quality. For instance, metal 3D-printed parts often undergo heat treatments like annealing or hot isostatic pressing (HIP) to improve their strength and durability. Polymer-based parts require surface treatments like chemical smoothing or dyeing for better aesthetics. As 3D printing materials evolve, post-processing techniques are being tailored to match the unique characteristics of each material. The continuous innovation in finishing technologies is fueling market growth, enabling manufacturers to produce high-quality, end-use products efficiently.

Global 3D Printing Post Processing Market Challenges and Restraints:

High cost of automated post-processing solutions is restricting the market growth

Despite the advantages of automated post-processing technologies, their high initial investment remains a major challenge for small and medium-sized enterprises (SMEs). Automated systems, including depowdering and surface finishing machines, require significant capital expenditure, which may not be feasible for businesses with limited budgets. Additionally, maintenance and operational costs further increase the total cost of ownership. Many companies still rely on manual post-processing methods due to cost constraints, limiting the widespread adoption of automation. To address this challenge, industry players are focusing on developing cost-effective, modular post-processing solutions that can be integrated with existing production workflows.

Lack of standardization in post-processing methods is restricting the market growth

The absence of standardized post-processing guidelines poses a challenge for manufacturers aiming to achieve consistent quality across different 3D printing technologies. Each material and printing method requires specific post-processing techniques, making it difficult to establish universal standards. This lack of standardization affects supply chain efficiency and regulatory compliance, especially in highly regulated industries like aerospace and healthcare. Companies must invest in customized post-processing solutions tailored to their specific production needs, increasing operational complexity. Industry associations and regulatory bodies are working towards establishing guidelines for 3D printing post-processing, but widespread adoption of standardized methods remains a work in progress.

Market opportunities:

The increasing demand for high-performance, end-use 3D-printed parts presents significant opportunities for post-processing solution providers. Industries such as aerospace, automotive, and healthcare are investing in advanced post-processing technologies to enhance the mechanical properties and aesthetic appeal of 3D-printed components. The rise of on-demand manufacturing and distributed production networks is also driving the need for efficient post-processing workflows. Additionally, the development of eco-friendly post-processing methods, such as water-based smoothing and biodegradable support removal, is gaining traction as sustainability becomes a priority for manufacturers. Companies that innovate in automated, scalable, and sustainable post-processing solutions will have a competitive advantage in the evolving 3D printing landscape.

3D PRINTING POST PROCESSING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

16.5% |

|

Segments Covered |

By Product, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AMT, DyeMansion, PostProcess Technologies, 3D Systems, and Stratasys. |

3D Printing Post Processing Market segmentation:

3D Printing Post Processing Market Segmentation By Product:

- Support Removal Systems

- Surface Finishing Equipment

- Coloring and Coating Solutions

- Heat Treatment Systems

- Automated Post-Processing Machines

Surface finishing equipment dominates the market, accounting for over 35% of total revenue. Industries such as aerospace and medical require precise surface treatments to ensure durability, aesthetics, and compliance with regulatory standards. Advanced finishing technologies such as electrochemical polishing and vapor smoothing are gaining traction, particularly for metal and polymer-based 3D-printed parts.

3D Printing Post Processing Market Segmentation By Application:

- Aerospace and Defense

- Automotive

- Healthcare

- Consumer Goods

- Industrial Manufacturing

Aerospace and defense is the leading application segment, contributing to over 25% of market revenue. The industry relies heavily on 3D-printed components, particularly for lightweight and high-strength applications. Stringent quality requirements necessitate advanced post-processing techniques, including heat treatments and precision polishing, making post-processing essential in this sector.

3D Printing Post Processing Market Regional segmentation:

• North America

• Asia-Pacific

• Europe

• South America

• Middle East and Africa

North America is the leading market for 3D printing post-processing solutions, driven by the strong presence of aerospace, automotive, and medical device manufacturers. The region has a well-established additive manufacturing ecosystem, supported by research institutions and government initiatives promoting industrial 3D printing. The increasing adoption of automated post-processing solutions, particularly in the United States, further strengthens North America's position in the global market. Additionally, major industry players based in the region are continuously investing in R&D to develop advanced finishing technologies, ensuring sustained market growth.

COVID-19 Impact Analysis on the 3D Printing Post Processing Market:

The COVID-19 pandemic accelerated the adoption of 3D printing across various industries, particularly in healthcare, where rapid production of medical equipment and PPE was crucial. However, the disruptions in supply chains and workforce availability initially impacted post-processing operations. Many manufacturers faced challenges in meeting demand due to labor shortages for manual post-processing tasks. This led to an increased focus on automation, with companies investing in robotic and AI-driven post-processing solutions to maintain efficiency. The pandemic highlighted the importance of flexible and scalable production methods, driving long-term investments in post-processing automation.

Latest trends/Developments:

The 3D printing post-processing market is undergoing a significant transformation driven by remarkable advancements in artificial intelligence and a growing emphasis on sustainability and efficiency. AI-driven post-processing optimization is revolutionizing the industry by enabling sophisticated predictive analytics that can anticipate and mitigate potential finishing defects, leading to consistently improved part quality and reduced waste. This intelligent automation allows for real-time adjustments to post-processing parameters, ensuring optimal surface finish and dimensional accuracy based on the specific material and printing process used. Simultaneously, the development and adoption of solvent-free chemical smoothing technologies are gaining considerable traction, reflecting a strong industry-wide commitment to environmental responsibility and worker safety by eliminating the hazardous volatile organic compounds associated with traditional solvent-based methods. These eco-friendly alternatives offer comparable or even superior surface finish quality while aligning with increasingly stringent environmental regulations. Furthermore, the emergence and increasing popularity of hybrid post-processing systems represent a significant leap towards streamlined and automated manufacturing workflows. These integrated systems cleverly combine multiple complementary finishing techniques, such as support removal, cleaning, surface smoothing, and even coloring, into a single, automated unit, drastically reducing manual intervention, processing time, and overall operational costs. This holistic approach to post-processing not only enhances efficiency but also ensures greater consistency and repeatability in the final product. As innovation continues to accelerate in both 3D printing materials and advanced surface treatment methodologies, the 3D printing post-processing market is undoubtedly poised for substantial and transformative advancements in the coming years, promising higher quality parts, more sustainable practices, and more efficient production processes across a wide range of industrial applications.

Key Players:

- AMT

- DyeMansion

- PostProcess Technologies

- Rösler Group

- Additive Manufacturing Technologies

- 3D Systems

- Stratasys

- HP

- BASF Forward AM

- EOS

Chapter 1. 3D PRINTING POST PROCESSING MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. 3D PRINTING POST PROCESSING MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. 3D PRINTING POST PROCESSING MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. 3D PRINTING POST PROCESSING MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. 3D PRINTING POST PROCESSING MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. 3D PRINTING POST PROCESSING MARKET – By Product

6.1 Introduction/Key Findings

6.2 Support Removal Systems

6.3 Surface Finishing Equipment

6.4 Coloring and Coating Solutions

6.5 Heat Treatment Systems

6.6 Automated Post-Processing Machines

6.7 Y-O-Y Growth trend Analysis By Product

6.8 Absolute $ Opportunity Analysis By Product , 2025-2030

Chapter 7. 3D PRINTING POST PROCESSING MARKET – By Application

7.1 Introduction/Key Findings

7.2 Aerospace and Defense

7.3 Automotive

7.4 Healthcare

7.5 Consumer Goods

7.6 Industrial Manufacturing

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. 3D PRINTING POST PROCESSING MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Product

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. 3D PRINTING POST PROCESSING MARKET – Company Profiles – (Overview, Packaging Type, Portfolio, Financials, Strategies & Developments)

9.1 AMT

9.2 DyeMansion

9.3 PostProcess Technologies

9.4 Rösler Group

9.5 Additive Manufacturing Technologies

9.6 3D Systems

9.7 Stratasys

9.8 HP

9.9 BASF Forward AM

9.10 EOS

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global 3D Printing Post Processing Market was valued at USD 0.8 billion in 2024 and will grow at a CAGR of 16.5% from 2025 to 2030. The market is expected to reach USD 1.72 billion by 2030.

Key drivers include industrial adoption of 3D printing, demand for automation, and advancements in material finishing techniques

The market is segmented by product (Support Removal Systems, Surface Finishing Equipment, Coloring and Coating Solutions, Heat Treatment Systems, Automated Post-Processing Machines) and application (Aerospace, Healthcare, Automotive, etc.).

North America leads due to strong adoption in aerospace, automotive, and healthcare sectors.

Key players include AMT, DyeMansion, PostProcess Technologies, 3D Systems, and Stratasys.