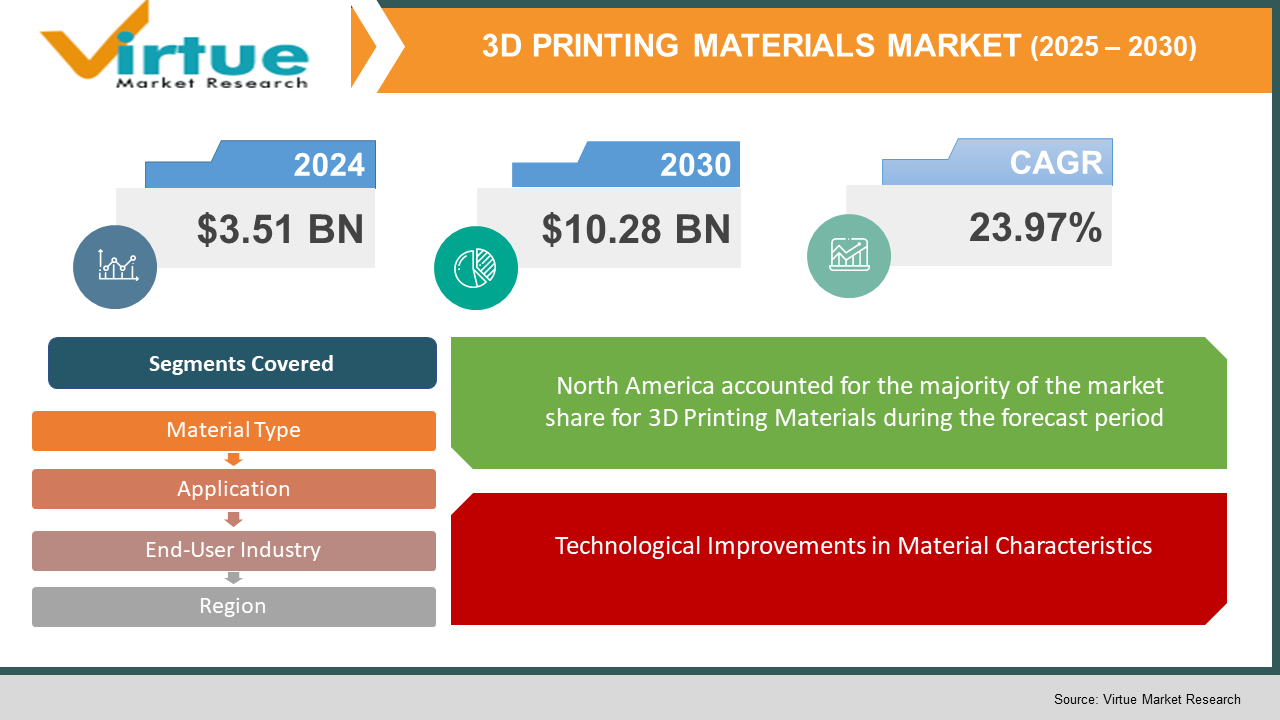

3D Printing Materials Market Size (2025-2030)

The 3D Printing Materials Market was valued at USD 3.51 billion and is projected to reach a market size of USD 10.28 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 23.97%.

The 3D printing materials market is a fast-evolving industry propelled by technology developments in additive manufacturing processes. The market includes different materials like plastics, metals, ceramics, and composites applied in industries such as aerospace, automotive, healthcare, and consumer products. The expansion of 3D printing adoption for prototyping, production, and customisation applications spurs the market. Major trends are advancements in material properties, like high-strength and heat-resistant materials, to address the requirements of varied applications. As businesses look for efficient and environmentally friendly manufacturing techniques, the 3D printing materials market will grow dramatically over the coming decade.

Key Market Insights:

- In 2023, the 3D printing materials market witnessed robust growth, with the industry expanding at a rate of 26.8% compared to the previous year. This surge is driven by increasing demand for additive manufacturing solutions across industries like aerospace, automotive, and healthcare.

- In 2024, Alloyed, a company focusing on metal 3D printing, secured substantial funding to improve its digital design software and manufacturing capabilities. This development will help meet growing demands in sectors such as aerospace, where high-performance metal materials are crucial.

- Fishy Filaments, a UK-based start-up, has introduced a process to recycle discarded fishing nets into 3D printing materials like nylon. This initiative, which has caught the attention of major companies such as Ford and Mercedes-Benz, addresses environmental issues while providing a sustainable alternative to traditional plastic production.

- The Asia-Pacific region is expected to see rapid growth in the 3D printing materials market, particularly in countries like China, Japan, and South Korea. The region’s automotive industry is a major driver in this growth.

- In late 2024, Sydney started exploring 3D concrete printing to combat housing shortages. This technology promises to reduce construction time and costs, potentially offering affordable housing solutions in a matter of weeks while also improving sustainability in the construction industry.

3D Printing Materials Market Drivers:

Growing Application of Additive Manufacturing Across Multiple Industries is Driving the Market Growth

The adoption of 3D printing technology continues to broaden across industries such as aerospace, automotive, and healthcare. While companies are in search of cheaper and more efficient modes of production, 3D printing facilitates quicker prototyping and bespoke manufacturing at lower costs while improving product functionality.

Environmental and Sustainability Issues

Increasing emphasis on sustainability has greatly influenced the demand for green 3D printing material. Businesses such as Fishy Filaments, which turn discarded fishing nets into printing material, are assisting in both reducing environmental pollution and the carbon impact of the usual way of making things, in line with measures to minimize plastic waste around the world.

Technological Improvements in Material Characteristics

The innovation of advanced materials for 3D printing that possess improved characteristics—high strength, heat tolerance, and resistance to wear—has created new possibilities for application in industries such as aerospace and medicine. They allow for more specialized uses, such as aircraft metal components produced by 3D printing or tailored implants for the medical sector, broadening the use of 3D printing from prototype to mass production.

These drivers highlight how industry demand, sustainability targets, and technological innovation are all combined to shape the development of the 3D printing materials market.

3D Printing Materials Market Restraints and Challenges:

High Material Expense

High-cost 3D printing material with high-performance features, i.e., metal and advanced polymer materials, still holds back bulk implementation, particularly among small- and medium-scale companies. Being costly compared to conventional manufacturing and taking up less application in more high-value offerings across industries like aeronautical and medical device production, material cost is one such major limiting factor.

Limited Material Variety and Availability

Although the variety of materials available for 3D printing is growing, it remains relatively narrow compared to conventional manufacturing. For example, there are fewer choices for some uses like construction, where a wider variety of sustainable and durable materials is required. This constraint limits the overall scalability and versatility of 3D printing across sectors.

Regulatory and Certification Issues

The absence of standardized regulations and certification protocols for 3D-printed items creates issues, especially in highly regulated industries such as aerospace, automotive, and healthcare. The lack of uniform safety and quality standards makes it challenging for companies to have confidence in the reliability and consistency of 3D-printed components, slowing down market expansion in key industries.

3D Printing Materials Market Opportunities:

The market for 3D printing materials has huge prospects, especially in the field of sustainable manufacturing. With the increasing demand for green solutions, there is an increasing potential for recycled or bio-based source materials, including biodegradable plastics and recycled metals. In addition, advances in material science, such as more durable and heat-resistant materials, will facilitate new uses in aerospace, automotive, and medical industries, such as the production of personalized implants and lightweight components. The building sector also holds great potential, with 3D-printed concrete and other building materials providing quicker, cheaper solutions for housing and infrastructure. Lastly, with the increasing availability of 3D printing technology, there will be growing opportunities in consumer products and small-scale manufacturing, allowing for more customization and on-demand production.

3D PRINTING MATERIALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

23.97% |

|

Segments Covered |

By material Type, application, end user industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Stratasys Ltd., 3D Systems Corporation, EOS GmbH, Materialise NV, HP Inc., Arkema S.A., Dow Inc., SLM Solutions Group AG, Henkel AG & Co. KGaA, ExOne Company, etc. |

3D Printing Materials Market Segmentation:

3D Printing Materials Market Segmentation: By Material Type

- Plastics (Thermoplastics, Photopolymers, etc.)

- Metals (Titanium, Aluminum, Stainless Steel, etc.)

- Ceramics, Composites (Carbon Fiber, Glass Fiber, etc.)

The material type segment in the 3D printing materials market comprises plastics, metals, ceramics, and composites. Plastics, such as thermoplastics and photopolymers, lead the market with their versatility, low cost, and ease of use, and they account for a large portion of the market, estimated at about 50% to 60%. Thermoplastics are applied extensively in rapid prototyping, consumer products, and automotive markets, whereas photopolymers find their main application in high-precision segments, including dental models and jewellery.

Metals, including titanium, aluminium, and stainless steel, have been finding increasing application, particularly in the aerospace and automotive sectors, with metals taking a market share of approximately 20% to 30%.

Ceramics, which provide strength and high-temperature resistance, find niche usage in industries such as healthcare (e.g., prosthetics) and electronics but are a smaller market, at approximately 5% to 10%. Composites, including carbon fibre and glass fibre, are finding increased usage in high-performance areas, especially aerospace and automotive, accounting for an estimated 10% to 15% market share due to their strength and light weight.

3D Printing Materials Market Segmentation: By Application

- Aerospace

- Automotive

- Healthcare (Prosthetics, Implants, etc.)

- Consumer Goods, Industrial/Manufacturing

Under the application segment, 3D printing materials are utilized in multiple industries like aerospace, automotive, healthcare, consumer products, and industrial/manufacturing. Aerospace is the biggest and quickest-growing application segment, with approximately 25% to 30% of the market due to the demand for light yet robust materials for airplane and spacecraft components.

Automotive is another major industry, with the growing use of 3D printing in the form of prototyping, tooling, and production of parts, which accounts for about 20% to 25% of the market.

The medical application is also a strong impetus, especially for prosthetics, implants, and individualized medical devices, which contribute approximately 15% to 20% of the market.

The consumer products industry, such as fashion and jewellery, is growing with the need for customized products, accounting for approximately 10% to 15% of the market share.

Finally, industrial and manufacturing uses, such as tools, machine components, and manufacturing processes, account for approximately 15% to 20%, with more applications of 3D printing in producing intricate, customized components.

3D Printing Materials Market Segmentation: By End-User Industry

- Medical & Healthcare

- Aerospace & Defense

- Automotive

- Consumer Electronics

- Fashion & Jewelry

The end-user industry breakdown indicates how various industries utilize 3D printing materials. The healthcare and medical industry has a prominent share of approximately 20% to 25% due to the increasing applications of 3D printing in personalized implants, prosthetics, and surgical equipment.

The defense and aerospace industry is also a top contributor, having approximately 25% to 30% of the market share because of the huge demand for lightweight and strong materials for key components.

Automotive is a fast-growing industry, contributing around 15% to 20% to the market since 3D printing is employed for prototyping and low-volume production of components.

Consumer electronics, including 3D printing for producing housings, prototypes, and bespoke components, contribute around 10% to 15% to the market.

Lastly, jewellery and fashion are specialized but expanding segments, representing approximately 5% to 10%, fueled by the growing need for distinctive, personalized designs in the consumer market.

3D Printing Materials Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America holds a significant share of the 3D printing materials market, accounting for around 30% to 35% of the global market. The region’s strong presence in industries like aerospace, automotive, and healthcare, along with advancements in 3D printing technology, contributes to its dominance. The U.S. leads the market, driven by increased adoption of 3D printing in manufacturing and prototyping, as well as government investments in additive manufacturing research.

Asia-Pacific is experiencing the highest growth in the 3D printing materials market, with an estimated market share of 25% to 30%. Countries like China, Japan, and South Korea are at the forefront, with a rapidly expanding manufacturing base and significant adoption of 3D printing technologies in sectors like automotive, electronics, and healthcare. The region's booming industrial growth and cost-effective production practices are fueling its increasing demand for advanced 3D printing materials.

Europe accounts for around 20% to 25% of the global 3D printing materials market, with key markets including Germany, the UK, and France. The region is focused on the development of high-performance materials for aerospace, automotive, and industrial applications. Additionally, Europe's emphasis on sustainability and innovation in manufacturing drives the growth of eco-friendly and recyclable 3D printing materials.

South America holds a smaller market share of around 5% to 7%, but the region is seeing gradual adoption of 3D printing technologies, especially in countries like Brazil and Argentina. Industries such as automotive and consumer goods are leading the charge, with growing interest in prototyping and customized manufacturing. However, the market is still in its early stages compared to other regions, with more infrastructure and investment needed to spur further growth.

The Middle East and Africa region accounts for about 5% to 7% of the 3D printing materials market, with countries like the UAE and South Africa showing significant potential. The region is increasingly leveraging 3D printing in industries like construction, healthcare, and aerospace, driven by government-led initiatives and investments in technology. Despite its relatively small share, the region is expected to grow rapidly in the coming years as more industries adopt 3D printing for manufacturing and production.

COVID-19 Impact Analysis on the Global 3D Printing Materials Market:

The 3D printing materials industry was initially derailed by the COVID-19 pandemic through supply chain problems and factory closures, thus hampering production and supply. The pandemic also stimulated increased demand for 3D printing in some industries, such as the health sector, in which there was an acute requirement for medical materials, PPE, and ventilator components. The pandemic has showcased the utility of localized, on-demand manufacturing, and 3D printing has picked up speed in its use for rapid production and prototyping. While the global economy is bouncing back, the market has revived with a heightened emphasis on digital manufacturing solutions, sustainability, and resilience.

Latest Trends/ Developments:

The 3D printing materials industry is experiencing a number of major trends, including a heightened trend towards sustainable, environmentally friendly materials, such as recycled plastics and bio-based polymers, based on growing environmental concerns. New materials, such as high-strength thermoplastics and metal composites, are being created to satisfy the needs of industries such as aerospace and automotive for stronger and lighter parts. Medical use of 3D printing also keeps growing with advances in bioprinting for personalized prosthetics, implants, and even organs. "Mass customization" is a key trend elsewhere, as corporations leverage 3D printing to create highly bespoke products in markets such as jewellery, fashion, and consumer durables. Moreover, the combination of artificial intelligence (AI) and machine learning is improving the accuracy and effectiveness of 3D printing operations, enabling more intelligent design and material optimization.

Key Players:

- Stratasys Ltd.

- 3D Systems Corporation

- EOS GmbH

- Materialise NV

- HP Inc.

- Arkema S.A.

- Dow Inc.

- SLM Solutions Group AG

- Henkel AG & Co. KGaA

- ExOne Company

Chapter 1. 3D Printing Materials Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. 3D Printing Materials Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. 3D Printing Materials Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Application Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. 3D Printing Materials Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. 3D Printing Materials Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. 3D Printing Materials Market – By Material Type

6.1 Introduction/Key Findings

6.2 Plastics (Thermoplastics, Photopolymers, etc.)

6.3 Metals (Titanium, Aluminum, Stainless Steel, etc.)

6.4 Ceramics, Composites (Carbon Fiber, Glass Fiber, etc.)

6.5 Y-O-Y Growth trend Analysis By Material Type

6.6 Absolute $ Opportunity Analysis By Material Type, 2025-2030

Chapter 7. 3D Printing Materials Market – By Application

7.1 Introduction/Key Findings

7.2 Aerospace

7.3 Automotive

7.4 Healthcare (Prosthetics, Implants, etc.)

7.5 Consumer Goods, Industrial/Manufacturing

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. 3D Printing Materials Market – By End-Use Industry

8.1 Introduction/Key Findings

8.2 Medical & Healthcare

8.3 Aerospace & Defense

8.4 Automotive

8.5 Consumer Electronics

8.6 Fashion & Jewelry

8.7 Y-O-Y Growth trend Analysis End-Use Industry

8.8 Absolute $ Opportunity Analysis End-Use Industry , 2025-2030

Chapter 9. 3D Printing Materials Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Application

9.1.3. By End-Use Industry

9.1.4. By Material Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Application

9.2.3. By End-Use Industry

9.2.4. By Material Type

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Application

9.3.3. By End-Use Industry

9.3.4. By Material Type

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By END-USE INDUSTRY

9.4.3. By Application

9.4.4. By Material Type

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By END-USE INDUSTRY

9.5.3. By Application

9.5.4. By Material Type

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. 3D Printing Materials Market – Company Profiles – (Overview, Type Portfolio, Financials, Strategies & Developments)

10.1 Stratasys Ltd.

10.2 3D Systems Corporation

10.3 EOS GmbH

10.4 Materialise NV

10.5 HP Inc.

10.6 Arkema S.A.

10.7 Dow Inc.

10.8 SLM Solutions Group AG

10.9 Henkel AG & Co. KGaA

10.10 ExOne Company

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The 3D Printing Materials Market was valued at USD 3.51 billion and is projected to reach a market size of USD 10.28 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 23.97%.

Growing Applications of Additive Manufacturing Across Multiple Industries, Environmental and Sustainability Issues, and Technological Improvements in Material Characteristics are some of the key market drivers in the 3D Printing Materials Market.

. Aerospace, Automotive, Healthcare (Prosthetics, Implants, etc.), Consumer Goods, and Industrial/Manufacturing are the segments by Application in the 3D Printing Materials Market.

North America is the most dominant region for the Global 3D Printing Materials Market.

Stratasys Ltd., 3D Systems Corporation, EOS GmbH, Materialise NV, HP Inc., Arkema S.A., Dow Inc., SLM Solutions Group AG, Henkel AG & Co. KGaA, ExOne Company, etc.