Zucchini Produce Market Size (2025-2030)

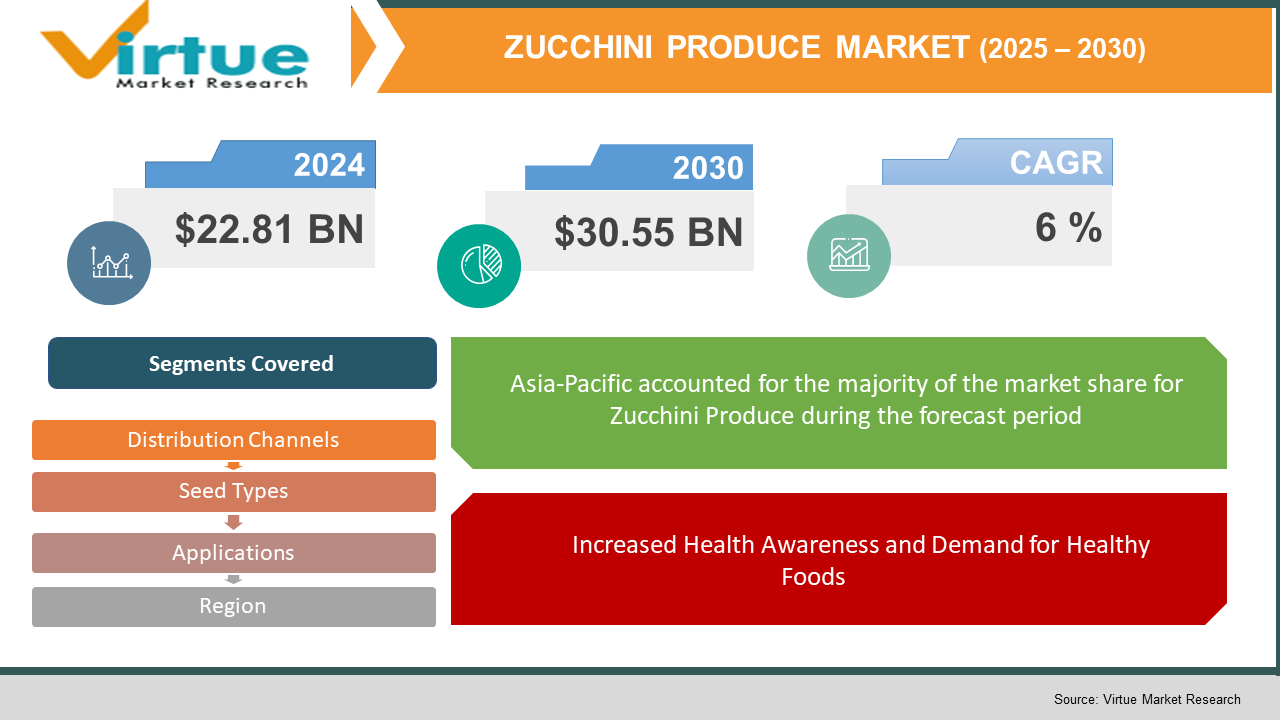

The Zucchini Produce Market was valued at $22.81 billion and is projected to reach a market size of $30.55 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 6%.

Zucchini is a warm-season crop that prefers temperatures greater than 70°F and is extremely sensitive to frost and freezing temperatures. Zucchini grows quickly—gaining one to two inches daily—and can produce as much as 10 pounds of squash per plant. With a two-month harvest period, zucchini can be planted and harvested several times in a growing season. Though most zucchini are green, others such as golden zucchini are orange or deep yellow. Fruits when mature may grow almost 3 feet long, though they are generally picked at 6–10 inches length for best flavor and texture. Technically a pepo, a berry with a hard rind, zucchini is some fruit. Though, it is traditionally prepared and consumed as a cooked vegetable in gastronomic settings. Zucchini, at times, can become contaminated with toxic cucurbitacin, rendering them intensely bitter and leading to serious gastrointestinal upset. These toxins typically occur from environmental stress or cross-pollination with show squash varieties. Zucchini is a variety of Cucurbita pepo, one of the species of summer squash with origins more than 7,000 years old that reach back to Mesoamerica. The contemporary zucchini was selectively developed in Milan, Italy, late in the 19th century. Its origin is from the Italian zucchini, "little squash," and the French-derived courgette and the British "marrow" are also used widely. Zucchini is widely eaten around the world, both raw and cooked and even the blossoms are consumed—stuffed or fried. In South Africa, the baby form called "baby marrow" is used. In the United States, demand keeps increasing, with warm climates throughout the nation favoring production. To satisfy year-round demand, the United States is still the biggest importer of zucchini, mostly from Mexico.

Key Market Insights:

- Regionally, the Asia-Pacific region dominates zucchini production and consumption, especially in nations such as China, Japan, and India, where zucchini is a common ingredient in traditional meals. North America, on the other hand, is the most likely to be the fastest-growing market, fueled by the growing awareness of consumers of zucchini's nutritional value and flexibility. In the United States alone, zucchini is one of the top ten vegetables grown, reflecting its popularity and diversification of vegetable cultivation.

- Yet, the market is experiencing difficulties, such as a significant drop in the average price paid to zucchini growers, down by 24.19% over the last three seasons—from €0.77/kg in 2021-2022 to €0.62/kg in 2023-2024. Organic zucchini has also suffered from supply shortages and resulting price hikes, as growers have cut zucchini acreage by 10-15% in favor of more lucrative crops such as tomatoes. Even with these challenges, zucchini consumption has risen in the home, a trend further supported by the COVID-19 pandemic. Demand is anticipated to improve during the winter season, even with prevailing supply issues.

Zucchini Produce Market Key Drivers:

Zucchini Market Growth Fueled by Health Trends and Plant-Based Diets

- Increased Health Awareness and Demand for Healthy Foods: People are increasingly focusing on health and wellness, which has resulted in a greater demand for nutrient-dense vegetables such as zucchini. Zucchini is low in calories and rich in essential nutrients like vitamins A and C, potassium, and dietary fiber, making it a popular choice among health-conscious consumers. This trend has greatly increased the consumption of zucchini, as more people add it to their diets for its health advantages.

- Shift Towards Organic and Sustainable Farming Practices: The consumer demand for organic fruits and vegetables is increasingly driven by pesticides and environmental issues. This change has created a strong demand for organically produced zucchini, driving farmers to take up organic practices. Organic certification not only serves the consumer requirements but also enables producers to sell at premium prices, increasing profitability.

- Growth of Plant-Based and Flexitarian Diets: Increased vegetarian, vegan, and flexitarian diets have helped increase the demand for adaptable vegetables such as zucchini. Its usability across diverse food options, such as a meat replacement in food like zucchini noodles and fritters, resonates with the dietary needs of adherents of plant-based diets. This has helped place zucchini as a household staple, contributing even further to its market expansion.

Zucchini Produce Market Restraints and Challenges:

The market for zucchini production is exposed to several major threats that affect its stability and profitability. One of the main issues is market price volatility, which may change greatly because of weather, supply and demand, and competition from large producers. This unpredictability makes it difficult for farmers to plan their finances and may result in lower profitability. Furthermore, the industry is also plagued by high production costs, particularly labor costs, which form a significant percentage of total expenses. Increased costs have led some farmers to drop zucchini production for more lucrative produce such as tomatoes and cucumbers. Climatic conditions also add to these problems; zucchinis are extremely susceptible to climatic fluctuations, with extreme temperatures and unstable weather conditions negatively impacting crop yields and quality. Additionally, zucchinis are subject to attack by a range of pests and diseases, including aphids, squash bugs, and powdery mildew, that require careful management, raising operational expenses. The market also has to deal with supply chain complications, such as logistical challenges and competition from imported products, that can affect pricing and market access. All these factors together offer significant challenges to the development and sustainability of the zucchini produce market.

Zucchini Produce Market Opportunities:

The market for zucchini production offers several promising opportunities fueled by changing consumer trends and market forces. The growing consumer consciousness regarding healthy eating and nutrition is fueling the demand for zucchini. With its high content of vitamins, minerals, and antioxidants, zucchini is preferred for its low-calorie nature and health benefits, which are in high demand among health-conscious consumers and diet followers. Moreover, the increasing popularity of vegetarianism and veganism increases demand for plant foods such as zucchini. As people increasingly embrace these diets, demand for healthy and versatile vegetables grows. In addition, increased demand for organic food enables zucchini farmers to seek organic certification and supply health-conscious consumers who are willing to pay a premium price for organically produced vegetables. Adopting agritourism activities, including farm tours and workshops, can diversify revenue streams and increase community participation. Creating collaborations with local restaurants and retailers can also ensure a consistent demand for zucchini, guaranteeing consistent sales and driving business development. Together, these opportunities place the zucchini market on the path to significant growth and innovation.

ZUCCHINI PRODUCE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By seeds type, application, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Rijk Zwaa, Robinson Fresh, Frieda’s Inc, Parks Brothers Farm, Henderson Farms, Petrocco Farms, Del Cabo, Colorado Specialty Crop, Frog Hollow Farms, Pinnacle Fresh |

Zucchini Produce Market Segmentation:

Zucchini Produce Market Segmentation By Distribution Channels:

- Grocery Stores

- Online Retailers

- Supermarkets and Hypermarkets

- Others

Grocery stores have dominated the zucchini production market in terms of their status as the leading distribution outlet, providing zucchini consumers direct access to zucchini. Still, online markets are becoming the quickest-growing marketplace. The luxury of home delivery and the choice of comparing online have drawn increased customers to buy zucchini on online platforms. Such a growth pattern is also strong in zones of high penetration in the use of the Internet as well as in urban development. In contrast, supermarkets and hypermarkets persist as prominent channels by offering a vast range of zucchini products under a single roof for consumers desirous of an encompassing shopping experience. As a whole, these channels are evolving according to changing consumer tastes, with online retailing set to grow immensely soon.

Zucchini Produce Market Segmentation By Seed Types:

- Open-Pollinated Seeds

- Hybrid Seeds

In the zucchini seed industry, open-pollinated seeds have the greatest market share currently because they are cost-effective and save seeds, hence their popularity among small-scale and organic farmers. Hybrid zucchini seeds are, however, growing very fast, led by their increased yield, disease tolerance, and uniformity, which attract commercial farmers seeking greater productivity. This development shows a movement towards hybrids among large-scale farmers, while open-pollinated seeds are still the most dominant among conventional and sustainable agriculture practitioners.

Zucchini Produce Market Segmentation By Applications:

- Commercial Farming

- Home Gardening

- Seed Breeding

Commercial farming is the largest use in the zucchini crop market, with increasing worldwide demand for fresh crops and the use of hybrid seeds that have improved yields and disease tolerance. Home gardening is second, with an increased focus on self-sufficiency and a healthy diet, with most people growing zucchinis in individual gardens. Seed breeding, though essential to creating better varieties of zucchini, is a more specialized area in the market.

Zucchini Produce Market Regional Analysis:

The world production of zucchini is characterized by significant regional differences, with the Asia-Pacific being at the top through high contributions from nations such as China and India accounting for 50% market share. Europe comes next through high outputs from nations such as Italy and Spain and now has a market share of 20%. North America, specifically the United States and Mexico, is also a significant contributor to zucchini production and holds a market share of 15%. Other regions, such as South America, the Middle East, and Africa, provide smaller but significant amounts to the global supply accounting for 5% each.

COVID-19 Impact Analysis on the Zucchini Produce Market:

The COVID-19 pandemic severely disrupted the zucchini produce market, reflecting challenges that existed in the larger vegetable industry. Lockdowns and movement restrictions hindered farmers from gaining access to local and urban markets, with huge post-harvest losses resulting from spoilage and poor storage facilities. For example, in Burkina Faso, 94% of vegetable producers indicated decreased access to local markets, and 90% had the same problem with urban markets, leading to higher post-harvest losses. In areas such as India, even when there was a bumper crop, the lockdown resulted in transport problems and market closures, and farm produce prices fell to their lowest level in recent years. Further, shortages in labor became an imperative concern in countries that have a dependency on migrant workers to do the harvests, for instance, Canada and the United States. Closure at the borders and health matters cut down the pool of available critical laborers needed for timely harvests and deliveries of produce such as zucchini. But the pandemic also stimulated changes in the way people shop and eat, and the dramatic rise in home cooking and healthy eating sent household consumption of zucchini soaring. This was some respite for the market, which had initially lost trade during the early stages of the pandemic. In general, whereas the market for zucchini suffered immensely because of COVID-19, responsive adjustments as well as altered consumer demands have contributed to a slow but continued recovery.

Recent Trends/Developments:

The market for zucchini produce is now controlled by a few important trends. Organic production techniques are the subject of considerable change as the consumer bases of pesticide-free and environmentally sustainable products continue to expand. It has caused a shortage in organic zucchini and pushed up their price as farmers cut down acres for zucchini and shifted production towards higher revenue streams. The market has also gone through price uncertainty; the three seasons' average price paid for zucchini to producers has lost around 24%, and prices for green zucchini have dipped from €0.77/kg in 2021-2022 to €0.62/kg in 2023-2024. Despite these issues, the use of technology in agriculture, including the development of products such as CHV's Croptimum, can potentially increase zucchini output by 15 to 30%, providing a window for higher yields and profitability. In addition, growing health awareness among consumers has fueled demand for nutrient-dense, low-calorie vegetables like zucchini, driving market growth even further. Such happenings all individually show the evolving dynamic nature of the zucchini industry, led by changing customers' needs, the economy, and technological advances.

Key Players in the Zucchini Produce Market:

- Rijk Zwaan

- Robinson Fresh

- Frieda’s Inc

- Parks Brothers Farm

- Henderson Farms

- Petrocco Farms

- Del Cabo

- Colorado Specialty Crop

- Frog Hollow Farms

- Pinnacle Fresh

Chapter 1. Zucchini Produce Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Zucchini Produce Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Zucchini Produce Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Packaging Distribution Channels Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Zucchini Produce Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. Zucchini Produce Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Zucchini Produce Market – By Distribution Channels

6.1 Introduction/Key Findings

6.2 Grocery Stores

6.3 Online Retailers

6.4 Supermarkets and Hypermarkets

6.5 Others Y-O-Y Growth trend Analysis By Distribution Channels

6.6 Absolute $ Opportunity Analysis By Distribution Channels , 2025-2030

Chapter 7. Zucchini Produce Market – By Seed Types

7.1 Introduction/Key Findings

7.2 Open-Pollinated Seeds

7.3 Hybrid Seeds

7.4 Y-O-Y Growth trend Analysis By Seed Types

7.5 Absolute $ Opportunity Analysis By Seed Types , 2025-2030

Chapter 8. Zucchini Produce Market – By Applications

8.1 Introduction/Key Findings

8.2 Commercial Farming

8.3 Home Gardening

8.4 Seed Breeding

8.5 Y-O-Y Growth trend Analysis Applications

8.6 Absolute $ Opportunity Analysis Applications , 2025-2030

Chapter 9. Zucchini Produce Market Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Seed Types

9.1.3. By Applications

9.1.4. By Distribution Channels

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Seed Types

9.2.3. By Applications

9.2.4. By Distribution Channels

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Seed Types

9.3.3. By Applications

9.3.4. By Distribution Channels

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By Applications

9.4.3. By Seed Types

9.4.4. By Distribution Channels

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By Applications

9.5.3. By Seed Types

9.5.4. By Distribution Channels

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Zucchini Produce Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Rijk Zwaan

10.2 Robinson Fresh

10.3 Frieda’s Inc

10.4 Parks Brothers Farm

10.5 Henderson Farms

10.6 Petrocco Farms

10.7 Del Cabo

10.8 Colorado Specialty Crop

10.9 Frog Hollow Farms

10.10 Pinnacle Fresh

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Zucchini Produce Market was valued at $22.81 billion and is projected to reach a market size of $30.55 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 6%.

The market's expansion is primarily driven by increasing consumer awareness of zucchini's health benefits, its versatility in culinary applications, and the rising demand for low-calorie, nutrient-rich vegetables.

The Asia-Pacific region, particularly countries like China and India, leads in both production and consumption of zucchini, followed by Europe and North America.

The market faces challenges such as price volatility, labor shortages, and the impact of adverse weather conditions on crop yields.

The growing consumer preference for organic produce has led to supply shortages and increased prices for organic zucchini, as some growers have reduced zucchini acreage in favor of more profitable crops.