Zirconium Silicate Market Size (2024 – 2030)

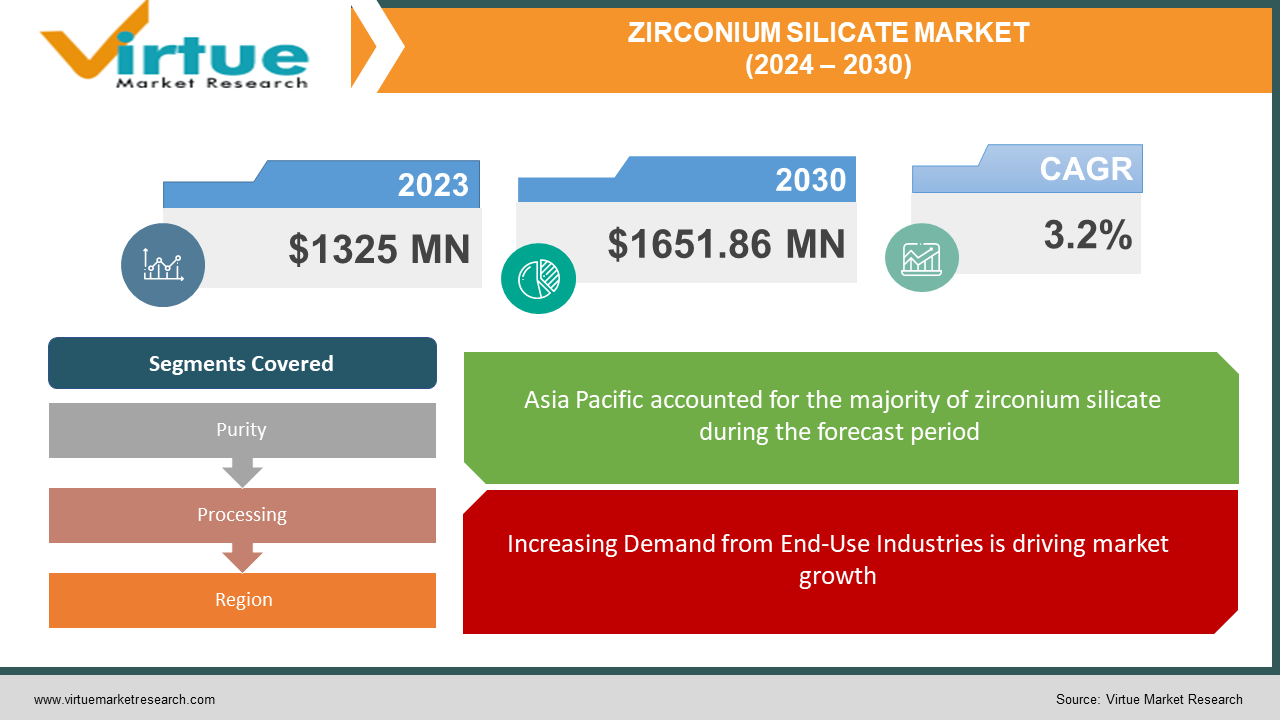

The global zirconium silicate market was valued at USD1325 million in 2023 and is projected to reach USD1651.86 million by 2030, growing at a CAGR of 3.2% from 2024 to 2030.

Zirconium silicate is a chemical compound with the chemical formula ZrSiO₄. It occurs naturally in the mineral zircon, which is found in sand and rock formations. Zirconium silicate can also be produced synthetically. The properties of zirconium silicate make it a valuable material for a variety of applications. It is resistant to heat, corrosion, and chemicals, and it has a high melting point. These properties make it suitable for use in refractories, ceramics, and foundry sand.

This mineral, prized for its heat, corrosion, and chemical resistance, finds itself primarily in the ceramic industry, shaping everything from sanitary ware to tiles and insulators. Refractory bricks and foundry sand also heavily rely on their unique properties, making them a crucial cog in the steel, cement, and casting sectors. Driving this growth is a multi-pronged force: the insatiable demand for refractories in booming steel and cement industries, the ever-expanding construction and automotive sectors propelling ceramics consumption, and the casting industry's reliance on foundry sand. However, the market faces its share of hurdles. The hefty price tag of zirconium silicate, the presence of readily available substitutes, and the environmental concerns surrounding its mining activities cast a shadow on its otherwise promising trajectory. Despite these challenges, the future of zirconium silicate appears bright. Continued expansion in its core application industries, coupled with the potential for novel uses and the adoption of eco-friendly extraction methods promises to keep this market gleaming.

Zirconium Silicate Market Drivers

Increasing Demand from End-Use Industries is driving market growth

The largest driver, accounting for about 40% of global demand. Growing construction and automotive industries fuel the need for sanitary ware, tiles, and electrical insulators, all heavily reliant on zirconium silicate. The steel and cement industries heavily utilize refractory bricks made with zirconium silicate for their heat resistance in furnaces and other high-temperature applications. This sector represents roughly 30% of market demand. Casting industries rely on zirconium silicate's properties for mold creation, accounting for nearly 20% of market demand.

Rising Urbanization is also affecting market growth

This urbanization boom directly translates to a surge in demand for ceramics and building materials, indirectly fuelling the fire of zirconium silicate consumption. Imagine towering apartments adorned with gleaming tiles and sanitary ware—each one a silent testament to zirconium silicate's presence. The very infrastructure of these urban jungles, from bridges and roads to office complexes and public spaces, relies heavily on ceramics and refractories, where zirconium silicate plays a starring role. This rise in construction isn't just about aesthetics; it's about creating functional spaces for living, working, and thriving. Within those spaces, zirconium silicate silently contributes to strength, durability, and even energy efficiency, making it an unsung hero of urban evolution.

Increasing awareness about the environment, resulting in regulation hindering the market

As environmental consciousness tightens its grip, industries like steel and cement are facing heightened pressure to curb their emissions. This isn't just an ethical imperative; it's a regulatory hurdle. High-performance refractories, the workhorses of furnaces and kilns, are increasingly incorporating this wonder mineral due to its exceptional heat resistance. Picture this: molten steel seethes within a furnace lining fortified with zirconium silicate. Not only does it withstand the scorching temperatures, but it also helps optimize the combustion process, minimizing the release of harmful pollutants. This translates to cleaner air, happier regulators, and a more sustainable future for these emission-intensive industries. The demand for these advanced refractories, of course, fuels the fire of zirconium silicate consumption.

Innovation also ignited the market of Zirconium Silicate

Beyond the familiar realms of bricks and tiles, zirconium silicate is poised to shine in the spotlight of technological advancements. Imagine water sparkling clear, freed from impurities by ultra-efficient filters woven from this versatile mineral. Its unique pore structure promises revolutionary strides in water purification, opening doors to cleaner drinking water and sustainable industrial processes. Look closer, and you might even find it nestled within the heart of a nuclear reactor. Its heat resistance and neutron compatibility make it a valuable component for safer, more efficient energy generation. These are just glimpses of the future, where zirconium silicate transcends its traditional roles and embarks on exciting new ventures. Think medical implants with enhanced biocompatibility, catalysts that accelerate green chemical reactions, or aerospace components defying extreme temperatures. With each innovative application, a new market segment blossoms, propelling the demand for this adaptable wonder material.

Zirconium Silicate market challenges and restraints

Fluctuating Raw Material Prices impose restraints on the production of Zirconium Silicate

Zirconium silicate, nestled safely in its mineral haven, awaits its transformation. But before it emerges, ready to lend its strength and resilience to the world, it must face the volatile dance of raw material prices. From the fiery furnaces that purify it to the chemicals that coax it into its final form, each ingredient plays a delicate role. And when the cost of these players swings erratically, so does the fate of our wonder mineral. A surge in the price of a key chemical can send ripples through the processing chain, inflating the final cost of zirconium silicate and making it a less tempting proposition compared to its rivals. This price waltz can sway market decisions, potentially sidelining zirconium silicate in cost-sensitive applications. It's a constant tango between potential and affordability, where every fluctuation echoes in the market's heartbeat.

Geopolitical Instability is also affecting the market

The shimmering dream of zirconium silicate and its promise of strength and heat resistance can be dimmed by the shadows of geopolitical instability. Imagine vast reserves of this wonder mineral, nestled deep within regions gripped by political turmoil. Supply chains, once arteries pulsing with efficiency, become choked by conflict; their rhythm is replaced by the staccato of disruptions. Trucks laden with zirconium ore find their routes blocked by barricades, ships hesitate to venture into volatile waters, and the delicate dance of international trade stumbles. This disruption ripples outward, creating tremors in the market. Prices, like startled birds, take flight, their erratic flutters reflecting the uncertainties that grip the source. Manufacturers, once confident in a steady flow of this vital material, now face the spectre of shortages and inflated costs. The very foundation of their industries, built on the promise of zirconium silicate's stability, can suddenly feel like shifting sand.

The presence of readily available substitutes poses a constant threat to market share.

Imagine zirconium silicate, a gleaming champion on the field of materials, facing off against a horde of challengers: the substitutes. These competitors, often cheaper and easier to find, lurk in the shadows, ready to steal market share at the slightest stumble. Zircon mullite, with its similar heat resistance, whispers sweet nothings of affordability to cost-conscious manufacturers. Meanwhile, alternative refractories, though slightly less robust, tempt them with readily available stocks and streamlined logistics. Each substitute holds a weapon, chipping away at zirconium silicate's dominance. In this battle for market supremacy, every tile, every refractory brick, and every ceramic masterpiece becomes a trophy. Manufacturers, like cunning generals, weigh the strengths and weaknesses of each contender, their decisions impacting the flow of demand. Zirconium silicate, whose price is a delicate balance between value and scarcity, must constantly prove its worth, lest it fade into the background, a once-shining star eclipsed by its nimble rivals. The fight is fierce, the outcome uncertain, and the future of the market hinges on who can strike the perfect balance between performance, affordability, and accessibility.

Environmental Concerns are affecting the market share

Zirconium silicate, the wonder material, gleams not only in its properties but also in its potential challenges. Its very birth, the act of mining, casts a shadow—an environmental one. Imagine lush landscapes scarred by extraction, rivers choked with sediment, and delicate ecosystems disrupted. These are the whispers of concern that accompany zirconium silicate, whispers that can morph into roars of public scrutiny. The scars on the earth become blemishes on the market's reputation, raising questions about sustainability and ethics. Investors, consumers, and regulators, like eco-conscious watchdogs, sniff out these concerns, potentially turning their backs on the material. Each news report of environmental damage chips away at trust and, with it, market sentiment. Zirconium silicate, once a shining star, risks being cast in the harsh light of negative publicity. To retain its lustre, the industry must tread lightly, embrace sustainable practices, and prioritize minimizing its environmental footprint. Only then can it silence the whispers and shine truly bright, a beacon of both progress and responsibility.

Zirconium Silicate Market Opportunities

Despite the murmurs of challenges, the zirconium silicate market shimmers with promising opportunities. The insatiable appetite for ceramics in the booming construction and automotive sectors, coupled with the ever-present need for refractories in the steel and cement industries, keeps the core demand robust. Beyond these familiar territories, exciting possibilities beckon. Imagine zirconium silicate woven into advanced water filtration membranes, safeguarding precious resources; picture it nestled within nuclear reactor components, contributing to cleaner energy generation; or envision its unique properties enhancing medical implants and aerospace materials. Research and development hold the key to unlocking these new avenues while addressing sustainability concerns through ethical mining practices and innovative recycling methods, which can win over cautious investors and environmentally conscious consumers. By embracing its adaptability and fostering a responsible ethos, the zirconium silicate market can rise above its limitations and shine brightly in diverse industries, shaping a future both resilient and sustainable.

ZIRCONIUM SILICATE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.2% |

|

Segments Covered |

By Purity, Processing, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Imerys, TZ Minerals, Sibelco, Mineral Technologies Inc |

Zirconium silicate market segmentation: by Purity

-

High-grade zirconium silicate

-

Common zirconium silicate

This type contains a higher percentage of zirconium dioxide (ZrO2) and fewer impurities, making it more heat-resistant and chemically stable. It is typically used in demanding applications like refractories for high-temperature furnaces and crucibles for molten metals. This type has a lower ZrO2 content and is more affordable. It is typically used in less demanding applications like ceramics, foundry sand, and building materials.

Zirconium Silicate Market Segmentation: by Processing

-

Naturally occurring zirconium silicate

-

Synthetic zirconium silicate

This type is extracted directly from mineral deposits, primarily zircon sand. It is the most common type but may have inconsistent properties due to variations in the mineral composition. This type is manufactured from purified zirconium dioxide and other materials. It can be tailored to have specific properties for different applications.

Zirconium Silicate Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia Pacific reigns supreme (55% market share) in 2023 due to booming construction, steel, and green tech adoption. Europe has a stable demand (21% share) driven by established industries and sustainability efforts. North America (19% share) leads in cutting-edge applications like medical implants and aerospace technology. Emerging markets like Latin America, Africa, and the Middle East hold promising future growth potential (15% share) thanks to rapid urbanization and infrastructure development. Each region faces unique challenges and opportunities: Asia Pacific needs to address environmental concerns, Europe navigates slower growth, North America seeks wider adoption, and RoW requires infrastructure and regulatory advancement.

COVID-19 Impact Analysis on Zirconium silicate market

While initially disrupting supply chains and dampening demand, COVID-19's impact on the zirconium silicate market proved nuanced. Construction slowdowns and industry shutdowns caused short-term dips, but long-term trends like rising urbanization and infrastructure spending remained largely intact. The pandemic even bolstered demand for refractories in steel and cement production due to an increased focus on domestic manufacturing. Overall, the market exhibited resilience, adjusting to changing dynamics and showing signs of rebound in specific sectors.

Latest trends/Developments

Zirconium silicate is stepping beyond its traditional role! Beyond ceramics and refractories, it's shining in advanced water filtration membranes, aerospace components, and even medical implants. Research buzzes with possibilities like biocompatible coatings and catalysts for green chemical reactions. Sustainability reigns supreme, with eco-friendly mining practices and recycling gaining traction. So, the future holds a potential where this wonder material shapes not just buildings but also cleaner water, greener skies, and healthier bodies.

Key Players:

-

Imerys

-

TZ Minerals

-

Sibelco

-

Mineral Technologies Inc

Chapter 1. Zirconium Silicate Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Zirconium Silicate Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Zirconium Silicate Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Zirconium Silicate Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Zirconium Silicate Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Zirconium Silicate Market – By Purity

6.1 Introduction/Key Findings

6.2 High-grade zirconium silicate

6.3 Common zirconium silicate

6.4 Y-O-Y Growth trend Analysis By Purity

6.5 Absolute $ Opportunity Analysis By Purity, 2024-2030

Chapter 7. Zirconium Silicate Market – By Processing

7.1 Introduction/Key Findings

7.2 Naturally occurring zirconium silicate

7.3 Synthetic zirconium silicate

7.4 Y-O-Y Growth trend Analysis By Processing

7.5 Absolute $ Opportunity Analysis By Processing, 2024-2030

Chapter 8. Zirconium Silicate Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By By Purity

8.1.3 By Processing

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By By Purity

8.2.3 By Processing

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By By Purity

8.3.3 By Processing

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By By Purity

8.4.3 By Processing

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By By Purity

8.5.3 By Processing

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Zirconium Silicate Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Imerys

9.2 TZ Minerals

9.3 Sibelco

9.4 Mineral Technologies Inc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global zirconium silicate market was valued at USD 1325 million in 2023 and is projected to reach USD 1651.86 million by 2030, growing at a CAGR of 3.2% from 2024 to 2030.

Booming construction and refractories industries, especially steel and cement, are fuelled by urbanization and green tech adoption.

High-grade zirconium silicate; Common zirconium silicate.

Asia Pacific is the most dominant region for the Zirconium silicate Market.

Imerys, TZ Minerals, Sibelco, Mineral Technologies Inc