Zero Emission Aircraft Market Size (2024 – 2030)

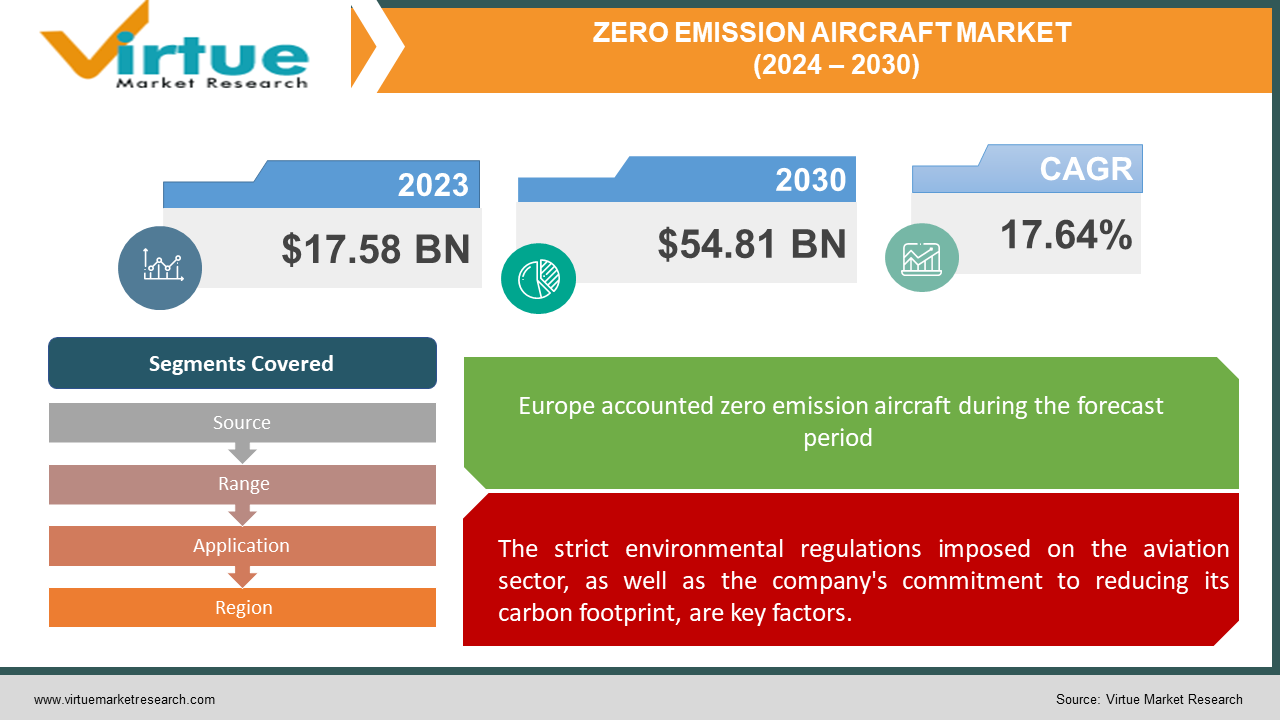

The Global Zero Emission Aircraft Market was valued at USD 17.58 billion and is projected to reach a market size of USD 54.81 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 17.64%.

Rapid advancements in battery technology and propulsion are fueling the growth of the free-flight market. Advances in electric power generation and energy storage systems are contributing to the development of efficient and powerful electric aircraft, driving innovation and attracting investment in clean and sustainable aviation solutions. For example, in July 2023, DANX Carousel Group launched the Electron 5, an electric cargo plane. This battery-powered plane aims to make air cargo transport point-to-point across Europe.

Key Market Insights:

An emerging market for free, ready-to-fly high-flying aircraft is fueling enthusiasm for climate emergencies. Driven by growing environmental concerns, strict regulations, and incentives in battery, hydrogen, and hybrid technologies, the green change is expected to exceed $29 billion by 2030. As challenges such as high costs, battery shortages, and a shrinking hydrogen network threaten to take off its wings, huge investments from airlines, governments, and green technology enthusiasts provide fuel. By airing the airport and making a concerted effort, these friendly birds could soon rule the skies, paving the way for a cleaner future for aviation, one airplane at a time one time.

The free flight market is experiencing significant growth due to the increased focus on sustainable aviation. With the commitment of the airline industry to reduce carbon emissions, electric and hydrogen aircraft are growing in importance. Electric injection systems and hydrogen fuel cells are the key technologies driving this market. Advances in battery technology, along with government initiatives to promote eco-friendly aircraft, are fueling market expansion. Major players in the aerospace industry are investing heavily in research and development to develop cost-effective and commercially viable aircraft. Regional collaborations and partnerships are also emerging to address the infrastructure challenges associated with electric and hydrogen aircraft. The market is poised for significant growth as technological innovations and environmental issues reshape the future of air travel.

In July 2023, the International Air Transport Association (IATA) released the industry's zero-emissions monitoring system, guiding airlines in reporting their emissions. This development supports the commitment of the airline industry to achieve zero emissions. As airlines implement sustainable policies to meet these guidelines, they will promote the growth of zero-emission aviation by driving innovation and investing in environmentally friendly aviation technology.

Zero Emission Aircraft Market Drivers:

The strict environmental regulations imposed on the aviation sector, as well as the company's commitment to reducing its carbon footprint, are key factors.

Governments and international aviation organizations are pushing for cleaner and greener aviation solutions, prompting the industry to invest in non-productive technologies. Technological advancements: Rapid advances in electric power systems and hydrogen fuel technology are the highlights. Advances in battery technology, lightweight materials, and energy storage solutions are improving the efficiency and power of free-wheeling aircraft. These technological improvements help increase the range, performance, and reliability of electric and hydrogen aircraft.

Government goals and incentives are driving market growth.

Governments around the world provide incentives, grants, and subsidies to promote the development and adoption of free flight. These initiatives are aimed at facilitating the transition to sustainable aviation and supporting research and development efforts within the aviation sector.

Public Awareness and Increasing Demand for Eco-friendly Travel Options are fueling market growth.

Increasing public awareness and concern about climate change is affecting consumer preferences. As eco-consciousness increases, there is an increasing demand for eco-friendly travel options. Airlines are responding to this demand by exploring and investing in free flights, making their plans flexible and customer expectations. Strategic Partnerships and Collaborations: Industry players work together in collaboration to enhance collective expertise and address the challenges associated with developing free flights. Collaborative efforts involving governments, aerospace companies, research institutes, and other stakeholders, promote innovation and knowledge exchange. Cost Reduction and Commercial Viability: Ongoing research and development efforts focus on reducing production costs and increasing the commercial potential of zero-emission aircraft. As these technologies become more affordable, airlines can invest in cost-effective solutions, creating a sustainable future for air travel. Global events and disruptions: Global events, such as the COVID-19 pandemic, have highlighted the vulnerability of the airline industry and heightened the need for support. As the industry recovers, the focus is on rebuilding in an environmentally friendly and sustainable manner, enabling the adoption of technology to prevent extinction.

Zero Emission Aircraft Market Restraints and Challenges:

Technologies of technology: The production of electronic systems in the hydrogen system is facing restrictions, including security systems, blocks, and equipment required.

High Property: Money and review relating to a higher airport is so much, which makes it difficult to proceed. Resource limitations: Lack of charging or refueling facilities for electric and hydrogen-powered aircraft poses a major obstacle. Creating a global network to support these flights is a complex and time-consuming task. Regulatory framework: The overall regulatory framework for free aircraft manufacturing is still evolving, presenting uncertainties and challenges for manufacturers in terms of compliance and the filing process.

Limitations and payment capabilities: Current zero-cost airline models may have limitations and limitations in payment capabilities compared to traditional airlines, limiting their application to certain routes and services.

Zero Emission Aircraft Market Opportunities:

The zero-emission aircraft market is poised for substantial growth, propelled by a confluence of global trends and opportunities. The escalating emphasis on environmental sustainability within the aviation sector, driven by stringent regulations and the industry's commitment to reducing carbon emissions, creates a robust market foundation. Technological advancements, particularly in electric propulsion systems and hydrogen fuel cells, present significant opportunities for companies to lead in innovation and enhance the efficiency and viability of zero-emission aircraft. Governments worldwide are providing incentives, grants, and subsidies, fostering an environment conducive to accelerated research and development efforts and making zero-emission solutions more economically viable. Strategic collaborations and partnerships among aerospace companies, research institutions, and governments offer avenues for shared knowledge, resources, and expertise, expediting the overall progress of zero-emission technologies. The need for charging and refueling infrastructure for electric and hydrogen-powered aircraft creates opportunities for investment and business development, further supporting the growth of the market. Additionally, consumer demand for sustainable travel, the positive impact on brand image, and opportunities in emerging markets contribute to the favorable landscape for companies aiming to play a pivotal role in shaping the future of zero-emission aviation.

ZERO EMISSION AIRCRAFT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

17.64% |

|

Segments Covered |

By Source, Range, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AeroDelft, Airbus S.A.S., Bye Aerospace, Eviation Aircraft, HES Energy Systems, Joby Aviation, Lilium, Pipistrel d.o.o, Wright Electric, ZeroAvia, Inc. |

Zero Emission Aircraft Market Segmentation: By Source

-

Hydrogen

-

Electric

-

Solar

In 2023, based on the source, the market is divided into Hydrogen, Electric, and Solar. The hydrogen segment is emerging as an important source of fuel in the aviation market, with various factors contributing to its growth. Hydrogen fuel cells provide an ideal solution for large aircraft with long range, addressing the limitations of battery systems. Growing investments in hydrogen-related technologies advances in fuel cell efficiency, and growing support from governments and industry players are fueling the expansion of hydrogen-powered aircraft. The growth of hydrogen resources and its ability to overcome the challenges of autonomy facing electric aircraft makes it a key factor in the quest for sustainable aviation. The adoption of hydrogen as an energy source is not only in line with environmental goals but also has a significant impact on the global aviation market, affecting technological progress, market competition, and housing contribution services to support the solution of air pollution.

Electric power is emerging as a significant driver in the global zero-emissions aircraft market, with several factors contributing to its growth. Technological advances in electrical systems, along with advances in battery technology, are improving the efficiency and power of electric aircraft. The reduced environmental footprint and lower operating costs associated with electric aircraft are key drivers of adoption. Governments around the world are offering incentives, coinciding with the global push for sustainable aviation. The electric sector is seeing an increase in revenue from the wind industry, driving new cars and accelerating the development of electric aircraft. As the airline industry looks for more environmentally friendly alternatives, electric power holds great promise, impacting the global zero-emissions aviation market by providing a clean solution and sustainability for short and medium flights and contributing to the overall carbon contribution of the company.

Zero Emission Aircraft Market Segmentation: By Range

-

Short Haul

-

Medium Haul

-

Long Haul

In 2023, based on the range, the market is segmented into Short Haul, Medium Haul, and Long Haul. The short-haul airline segment is emerging as a key driver of the global airline free flight market, which is influenced by many factors. The demand for sustainable air transport solutions for short distances is increasing, coinciding with the power of electric and hydrogen aircraft. Advances in battery technology and electric power generation systems have made these solutions effective for regional and short-haul flights, while the benefits of reduced emissions and operating costs are becoming increasingly apparent. The impact on the global low-cost airline market is very important as the increasing adoption of eco-friendly flights in short-haul regions is contributing to the market growth. Airlines that focus on short-haul routes can invest in zero-emission technology, thereby promoting the development and deployment of environmentally friendly aircraft and promoting a sustainable future for the airline industry.

Medium-haul airlines, covering distances between about 500 and 3,000 kilometers, are an important, changing segment of the global aviation market. The growing demand for sustainable air travel, along with advances in electric and hydrogen technologies, is driving the development of zero-emissions transport aircraft. Factors such as government incentives, strict environmental regulations, and increasing climate change are contributing to the expansion of this market sector. Transit routes, often connecting regional stations and cities, present a good application for zero-emission aircraft because they are suitable for electric or hydrogen aircraft. The adoption of clean technologies in this area can reduce the carbon footprint of the aviation industry and contribute to the overall sustainability of air travel, making it an important part of the global commitment to achieve sustainable land.

Zero Emission Aircraft Market Segmentation: By Application

-

Passenger Aircraft

-

Cargo Aircraft

In 2023, based on the application, the market is segmented into Passenger aircraft and cargo aircraft. The passenger airline segment forms a central axis in the airline industry's quest for sustainability, influencing the state of the global low-cost airline market. Growth factors such as increased air travel, regulatory pressure to reduce carbon emissions, and environmental improvements are driving significant investment and innovation in low-cost passenger aircraft. As the major aerospace companies are leading the development of electric and hydrogen aircraft for commercial aviation, advances in battery technology and sustainable propulsion systems are critical. The impact on the global zero-cost airline market is significant, with the passenger airline sector catalyzing technological advancement and market expansion. The adoption of Zero observes the contamination of the residence but also translates the change of sellers, helping with a large change from facilities to support the environment.

Cargo aircraft play an important role in global logistics, helping to transport goods across borders. The growing demand for e-commerce, boosted by the international revolution towards online shopping, has boosted the growth of the cargo aviation sector. The growth of e-commerce, along with the need for efficient check-in solutions, is driving the expansion of the cargo fleet and impacting the organization of cargo flights. This growth in cargo transportation is having a significant impact on the global low-cost airline market. The growing demand for sustainable means of transportation has spurred research into zero-emission technologies for cargo aircraft. As the airline industry strives to reduce its carbon footprint, the development of environmentally friendly cargo aircraft is becoming a key priority, contributing to the global change in air emissions and -inventor that affects the technological development of electric and hydrogen aircraft.

Zero Emission Aircraft Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The European market is the leading region in the emission aircraft market. Europe seems to be the main point in the global market for zero-emission aircraft, which is driven by a common factor. The region's commitment to sustainable development, strong environmental regulations, and significant investment in environmentally friendly research and development are helping to grow zero-emissions technology. European governments are actively promoting green initiatives, providing financial incentives, and supporting collaborative projects between the wind industry and research institutes. This commitment is reinforced by the awareness of climate change and the increasing preference for environmentally friendly air travel options among European consumers. As Europe plays a leading role in the development of electric and hydrogen aircraft, the impact on the global zero-emission aircraft market is huge. The region's innovations, organizational processes, and marketing strategies influence and shape the company's position, contributing to its evolution on a global scale.

The Asia-Pacific region is emerging as a major player in the global free airline market, which has combined factors contributing to its growth. Rapid urbanization, increasing air travel, and the region's commitment to sustainable development promote the environment and allow for the adoption of free flight technology. Government policies and investments in green aviation solutions, as well as growing awareness of environmental issues, are driving the development and deployment of electric and hydrogen aircraft. As countries in the Asia-Pacific region strive to reduce their carbon footprints and combat climate change, their involvement in the free flight market is having a major impact on a global scale. Regional influences are expected to shape the industry's landscape, affecting innovation, market changes, and the global shift to sustainable aviation practices.

COVID-19 Impact Analysis:

The COVID-19 pandemic has adversely affected the ZEA market. Travel restrictions, economic uncertainty, and a focus on immediate concerns have diverted attention and resources away from sustainable aviation initiatives. The airline industry, struggling with the economic downturn caused by the pandemic, has faced challenges in sustaining investment and maintaining ZEA's research and development. Despite this setback, the new focus on the Sustainable Development Goals will expand interest and support for free flight technology.

Latest Trends/ Developments:

The latest trends in the free-flight market include dramatic technological advances, particularly in battery technology, electric power systems, and hydrogen fuel cells. Governments around the world are strengthening their commitment to sustainable aviation, providing financial support, grants, and regulatory frameworks to promote the development and adoption of clean aviation technologies. Collaborative efforts between the aerospace industry, research institutes, and governments are accelerating innovation and solving technical challenges. At the same time, the focus is on the development of infrastructure to support the integration of electric and hydrogen aircraft, and efforts are focused on creating a network that pays for fuel. Various aerospace companies and start-ups are actively unveiling and testing prototypes, showcasing a range of innovative features that span the spectrum from civil aviation to commercial aircraft. As customer preferences prioritize eco-friendly travel, industry players are aligning their strategies to meet the growing need for sustainable aviation solutions.

Key Players:

-

AeroDelft

-

Airbus S.A.S.

-

Bye Aerospace

-

Eviation Aircraft

-

HES Energy Systems

-

Joby Aviation

-

Lilium

-

Pipistrel d.o.o

-

Wright Electric

-

ZeroAvia, Inc.

-

In May 2023, Alaska Airlines partnered with ZeroAvia to build the world's zero-emissions airliner. This pioneering project aims to transform regional air transport by introducing hydrogen fuel technology, marking an important step towards reducing carbon emissions in the aviation industry and promoting the growth of sustainable, zero-emission aircraft.

Chapter 1. Zero Emission Aircraft Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Zero Emission Aircraft Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Zero Emission Aircraft Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Zero Emission Aircraft Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Zero Emission Aircraft Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Zero Emission Aircraft Market – By Source

6.1 Introduction/Key Findings

6.2 Hydrogen

6.3 Electric

6.4 Solar

6.5 Y-O-Y Growth trend Analysis By Source

6.6 Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 7. Zero Emission Aircraft Market – By Range

7.1 Introduction/Key Findings

7.2 Short Haul

7.3 Medium Haul

7.4 Long Haul

7.5 Y-O-Y Growth trend Analysis By Range

7.6 Absolute $ Opportunity Analysis By Range, 2024-2030

Chapter 8. Zero Emission Aircraft Market – By Application

8.1 Introduction/Key Findings

8.2 Passenger Aircraft

8.3 Cargo Aircraft

8.4 Y-O-Y Growth trend Analysis By Application

8.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Zero Emission Aircraft Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Source

9.1.3 By Range

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Source

9.2.3 By Range

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Source

9.3.3 By Range

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Source

9.4.3 By Range

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Source

9.5.3 By Range

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Zero Emission Aircraft Market – Company Profiles – (Overview, By Source Portfolio, Financials, Strategies & Developments)

10.1 AeroDelft

10.2 Airbus S.A.S.

10.3 Bye Aerospace

10.4 Eviation Aircraft

10.5 HES Energy Systems

10.6 Joby Aviation

10.7 Lilium

10.8 Pipistrel d.o.o

10.9 Wright Electric

10.10 ZeroAvia, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Zero Emission Aircraft Market was valued at USD 7.83 billion and is projected to reach a market size of USD 29.24 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 20.70%.

Proactive government initiatives towards the development of zero-emission aircraft

Based on Application, the Zero Emission Aircraft Market is segmented into Personal Aircraft and Cargo Aircraft.

Europe is the most dominant region for the Zero Emission Aircraft Market.

Wright Electric, Airbus S.A.S., HES Energy Systems, ZeroAvia, Inc., AERODELFT, PIPISTREL D.O.O., BYE AEROSPACE, Joby Aviation, Eviation Aircraft, Lilium.