Global Yeast for Poultry Feed Market Size (2024– 2030)

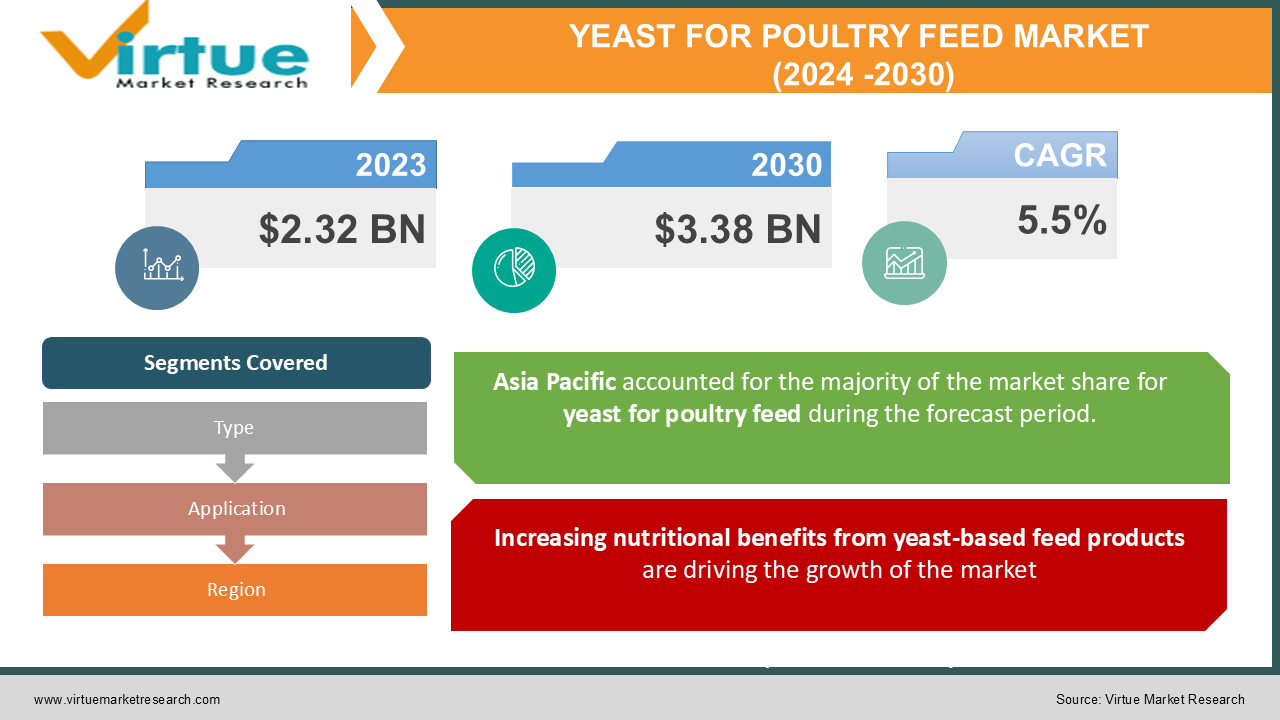

The Global Yeast for Poultry Feed Market was valued at USD 2.32 billion and is projected to reach a market size of USD 3.38 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.5%.

Industry Overview:

Yeast in animal feed is regarded as a primary protein-rich ingredient as it doubtlessly valorizes non-food lingo cellulosic biomass into treasured protein resources. It is used as a supplement in animal feeds due to its exceptionally excessive protein and. amino acid, energy, and micronutrient content material over different supplementary products. Feed yeast additionally helps in improving feed consumption and rumen bacterial populace whilst decreasing protozoa and methanogen populace in cattle. Feed yeast performs a crucial position to supply diet to the animals such as pets such as dogs, cats, and horses, amongst others, aquatic animals, poultry, pigs, and ruminants, amongst others. It gives flea control, and wholesome skin, coat, and eyes, to puppies as nicely as cats.

The European Union has multiplied hobby in evaluating the impact of yeast merchandise on the gastrointestinal ecosystem, rumen microbial populations, and common animal performance. Hence, the demand for feed yeast is developing among one-of-a-kind farm animals globally. Also, policies concerning pet care, pet health, and diet are turning vital in quite a number of international locations around the world. Such indispensable and stringent rules may resource the increase of the Global & Asia Pacific Feed Yeast Market over the forecasted period.

Moreover, retaining animal fitness is critical. If the fitness of the animals is no longer maintained properly, it can lead to serious fitness damage to human existence too. The proper diet for the animals can assist to construct a robust immune system. Feed yeast helps beautify the immune system, supply digestive support, and make bigger meals palatability to animals However, the utility of yeast is developing throughout distinctive enterprise verticals such as agriculture, food, and beverages, pharmaceutical, and additives, amongst others. Thus, the furnish of yeast and raw fabric throughout the feed yeast enterprise may be impacted due to the upward push in demand from different industries. Hence, excessive opposition from uncooked substances wanted for yeast manufacturing and different elements would possibly strangle the boom of the market over the forecasted period.

COVID-19 impact on the Yeast for Poultry Feed Market

China, a predominant provider of natural soybean has triggered disruptions for international natural feed producers in view of its draconian measures imposed to curb the Covid-19 pandemic. Moreover, the grant of containers and vessels has additionally been affected alongside with transport of positive micro-ingredients due to China’s logistics issues. The Indian Government has ordered the partial closure of its global ports promotion similarly to disruptions in the animal feed provide chain.

The animal feed enterprise has additionally been badly affected by the closure of eating places around the globe. The dramatic shift in consumers’ consumption sample in the mild of the SARS-CoV-2 outbreak has compelled producers to rethink their insurance policies and strategies. Lamb production, aquaculture, pork, and veal sectors in specific are amongst the worst affected. Aquaculture farmers and EU cattle have been referred to as disaster administration measures to mitigate the influence of Covid-19. Private storage resource is the chief mitigation measure being demanded with the aid of aquaculture farmers.

MARKET DRIVERS:

Increasing nutritional benefits from yeast-based feed products are driving the growth of the market

An ample volume of yeast is current in the environment. Some yeasts are remoted from herbal merchandise such as honey, fruits, soil, water, flowers, leaves, and stems. Feed components such as grains, silage, and hay additionally have yeasts current in them. Most yeast species have no effect on animals and humans, whilst some have bad or fantastic effects. It has been located that yeasts such as Saccharomyces cerevisiae, Kluyveromyces marxianus, and Candida utilis have a fantastic effect on animal health; they supply vitamins to animals and for that reason are used as feed additives.

New innovations in the feed industry will also drive the market

technological improvements in the animal feed region had created large possibilities for the producers to come up with new merchandise in the animal vitamin and feed components segments. This technology, which is a yeast-based innovation, was once developed for the use of yeast as a feed additive in the diets of swine, ruminants, and poultry. This is one of the first-class replacements for antibiotic use to enhance animal fitness and performance. As the use of antibiotics is banned in the animal feed sector, such yeast-based bioactive technological know-how can serve as an appropriate choice for farm animal producers in the coming years.

MARKET RESTRAINTS:

Competition for basic raw materials is restraining the growth of the market

The world furnish of uncooked substances for yeast production can have an extensive effect on the manufacturing of feed yeast and its extracts. The necessary supply of yeast manufacturing is primarily based on a sugar by-product, molasses. The scarcity of molasses is a primary difficulty for the international yeast market due to the excessive opposition to these uncooked substances from one-of-a-kind industries such as food, pharmaceutical, feed, and others. Such a scarcity has arisen due to many reasons—poor sugarcane and sugar beet yield being the main ones. Therefore, this is anticipated to restrict its furnish in the manufacturing of yeast ingredients.

YEAST FOR POULTRY FEED MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.5% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Archer Daniels Midland Company, Angel yeast Co., Ltd., Lallemand Inc., Leadfree, Leiber GmbH, Associated British Foods Inc., Nutreco N.V., Cargill Incorporated, Alltech, Diamond, Biomin GmbH, Titan Biotech, Liaoning Joysun Group Co., Ltd, Futures Group Co. Limited, Lesaffre, Bio Sunkeen Co. |

This research report on the global Yeast for Poultry Feed Market has been segmented and sub-segmented based on Type, Application, and region.

Yeast for Poultry Feed Market- Type:

-

- Yeast derivative

- Spent Yeast

- Live Yeast

Based on Type, The market is bifurcated into Yeast Derivatives, Spent Yeast, and Live Yeast. Yeast Derivatives accounted for the greatest market share and are projected to develop at the easiest CAGR of 5.70% throughout the forecast period. Yeasts are nicely recognized for their use in brewing, and alcohol fermentation, alongside wine and bread production. In the meals industry, Yeast Derivatives are extensively used for their purposeful traits such as excessive dietary cost and the potential to in part replace salt for style enhancement.

Increasing fitness worries and fitness recognition around the globe are growing a promising market probability for healthful and nutritious ingredients. Being a by-product, Yeast Derivatives are low-priced meals and dietary supplements and secure for human and animal consumption. The growing consumption of meal merchandise such as baked goods, dairy products, etc. is growing the demand for Yeast Derivatives in the world market.

Yeast for Poultry Feed Market - By Application:

- Poultry

- Romanent

- Swine

- Aquatic

- others

On the basis of application, The market is bifurcated into Poultry, Ruminants, Swine, Aquatic Animals, Pet Animals, and Other Livestock. Poultry accounted for the biggest market share and is projected to develop at a CAGR of 5.39% at some point in the forecast period. Poultry consists of chickens, ducks, turkeys, and geese, amongst others. Chickens, ducks, turkeys, and geese have main industrial significance as they have a greater demand for consumption around the world. While there are different birds such as guinea fowl, squabs, and the relaxation the others have regional or nearby demands.

According to the Department of Animal Biosciences, University of Guelph, Canada, December 2019, the addition of yeast derivatives in the hen feed helps in ameliorating deleterious consequences of Coccidiosis on intestinal fitness and feature in broiler chickens. Furthermore, total yeast (live or dead) and its derivatives can modulate coccidiosis and affect beneficially in stimulating the restoration of the intestinal mucosal floor in the body of chickens. The rooster section is keeping the greatest share of the Global Feed Yeast Market.

Yeast for Poultry Feed Market - By Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East

- Africa

Geographically, Asia Pacific dominated the market with an income share of greater than 31.00% in 2021. This is attributed to the growing manufacturing of farm animal merchandise in the vicinity due to a range of factors, such as dietary changes, populace growth, and fast urbanization. The Asia Pacific is one of the important pig-breeding areas and thus, requires an excessive volume of animal feed. China has the biggest stay pig populace in the world accounting for 415.9 million pigs. In latest years, China’s farm animals enterprise has grown unexpectedly as the diets have shifted toward animal proteins. China is one of the distinguished producers of animal feed and cattle merchandise owing to which, the feed manufacturing for sheep, aquaculture, egg-laying poultry, and cattle has elevated rapidly.

This increase in China has boosted the demand for tremendous and exceptional feed ingredients, in addition to propelling the market increase over the forecast period. Europe accounted for the second-largest income share in 2021 due to the growing consumption of processed meals in the shape of meat and meat merchandise coupled with the developing cattle production. European countries, such as the U.K., Germany, Italy, and France, have witnessed an upward jab in meat consumption over the previous few years. The growing use of yeast extract in animal feed for enhancing animal boom performance, digestibility, and others is predicted to force the market. In addition, the growing demand for extraordinary meat and meat merchandise is expected to improve the market increase in the region.

Yeast for Poultry Feed Market Share by Company

Companies like

- Archer Daniels Midland Company

- Angel yeast Co., Ltd.

- Lallemand Inc.,

- Leadfree

- Leiber GmbH

- Associated British Foods Inc.,

- Nutreco N.V.,

- Cargill Incorporated

- Alltech

- Diamond

- Biomin GmbH

- Titan Biotech

- Liaoning Joysun Group Co., Ltd,

- Futures Group Co. Limited

- Lesaffre

- Bio Sunkeen Co.

And others are playing a pivotal role in the market.

For example, Ohly (UK) and Lallemand (Canada), entered into a strategic partnership for the divestment of Ohly’s Hutchinson Torula Yeast facility and associated Torula whole cell business in the US. The long-term supply partnership between these companies aims at benefitting Ohly by ensuring the sustainable security of the Hutchinson site.

Bigsal was purchased by Nutreco N.V. from H.I.G. Capital. It will also become a division of Nutreco’s animal nutrition division Trouw Nutrition.

The international market is aggressive owing to the robust presence of multinational groups working to attain a strategic and aggressive gain over the others. The aggressive nature of yeast extracts in the animal feed market has inspired gamers to put into effect a number of boom strategies. Key techniques adopted by way of yeast extract producers consist of new product launches, distribution agreements, and mergers & acquisitions. Companies in the market house have been an increasing number venturing into a range of enterprise techniques to amplify their product attain and market presence in u. s . and on global grounds. Manufacturers have been actively participating with market leaders to produce yeast extracts to beautify their market penetration and product positioning.

NOTABLE HAPPENINGS IN THE GLOBAL YEAST FOR POULTRY FEED MARKET IN THE RECENT PAST:

- Acquisition- In March 2021, Nutreco NV acquired Bigsal from H.I.G. Capital, and it will become part of Nutreco’s animal nutrition division Trouw Nutrition. This investment is key to expanding and strengthening Trouw Nutrition’s business in northern Brazil and the availability of feed yeast products in the country.

- Acquisition- In June 2021, ADM acquired Neovia (Chicago) which is a global leader in value-added products and solutions for both production and companion animals.

Chapter 1. Yeast for Poultry Feed Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Yeast for Poultry Feed Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Yeast for Poultry Feed Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Yeast for Poultry Feed Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Yeast for Poultry Feed Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Yeast for Poultry Feed Market – By Type

6.1. Yeast derivative

6.2. Spent Yeast

6.3. Live Yeast

Chapter 7. Yeast for Poultry Feed Market – By Application

7.1. Poultry

7.2. Romanent

7.3. Swine

7.4. Aquatic

7.5. others

Chapter 8. Yeast for Poultry Feed Market- By Region

8.1. North America

8.2. Europe

8.3. Asia-Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. Yeast for Poultry Feed Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1 Archer Daniels Midland Company

9.2 Angel yeast Co., Ltd.

9.3 Lallemand Inc.,

9.4 Leadfree

9.5 Leiber GmbH

9.6 Associated British Foods Inc.,

9.7 Nutreco N.V.,

9.8 Cargill Incorporated

9.9 Alltech

9.10 Diamond

9.11 Biomin GmbH

9.12 Titan Biotech

9.13 Liaoning Joysun Group Co., Ltd,

9.14 Futures Group Co. Limited

9.15 Lesaffre

9.16 Bio Sunkeen Co.

Download Sample

Choose License Type

2500

4250

5250

6900