Wound Care Specialist Devices Market Size (2025 – 2030)

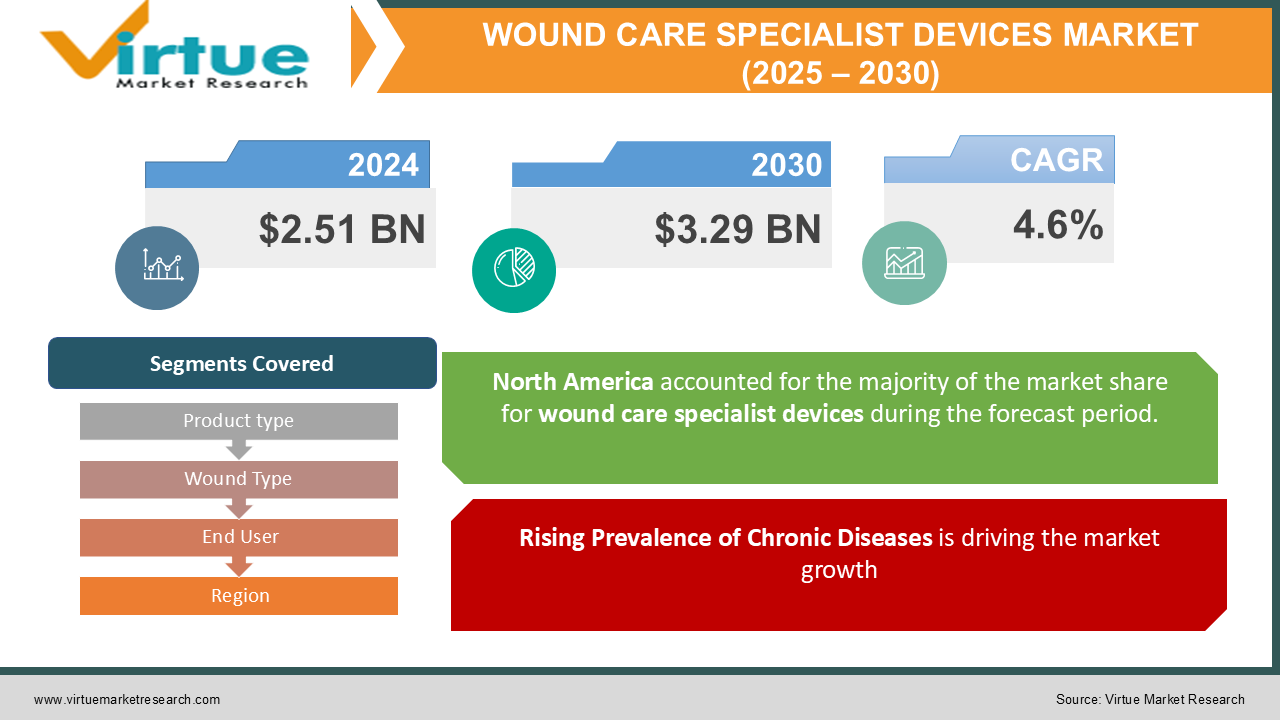

The Global Wound Care Specialist Devices Market was valued at USD 2.51 billion in 2024 and is expected to reach USD 3.29 billion by 2030, expanding at a CAGR of 4.6% during the forecast period (2025–2030).

Wound care specialists are integral to managing acute and chronic wounds, ensuring timely healing, and preventing complications. With the rise in chronic conditions such as diabetes and an aging population, the demand for wound care specialists has surged globally.

Technological advancements, increasing awareness of advanced wound care products, and growing adoption of home healthcare services are key factors contributing to the market's growth. The market is also being propelled by the expansion of healthcare infrastructure in emerging economies.

Key Market Insights

-

Advanced wound care products dominate the market, accounting for approximately 55% of total revenue, driven by their efficacy in treating chronic and complex wounds.

-

Chronic wounds, including diabetic foot ulcers and pressure ulcers, represent over 60% of the wound type segment, owing to the rising prevalence of diabetes and other chronic diseases.

-

Hospitals are the leading end-user segment, contributing more than 50% of the market share, as they are primary care centers for severe wounds and surgeries.

-

North America holds the largest share, representing over 40% of the market, due to advanced healthcare systems and a high prevalence of chronic diseases.

-

The Asia-Pacific region is expected to witness the fastest growth, with a projected CAGR of 7.2%, driven by improving healthcare infrastructure and rising health awareness.

Global Wound Care Specialist Devices Market Drivers

Rising Prevalence of Chronic Diseases is driving the market growth

The increasing prevalence of chronic diseases such as diabetes and vascular disorders has led to a surge in demand for wound care specialists. Chronic wounds, including diabetic foot ulcers and venous leg ulcers, require specialized care for effective healing and prevention of complications.

According to the International Diabetes Federation (IDF), the global diabetic population is expected to reach 783 million by 2045, indicating a significant increase in patients requiring wound care management. This trend is driving the growth of the wound care specialist market, particularly in developed and emerging economies.

Technological Advancements in Wound Care is driving the market growth

Technological innovations, such as bioengineered tissue products, advanced wound dressings, and negative pressure wound therapy (NPWT), are revolutionizing wound care. These advancements improve healing outcomes and reduce recovery times, making them increasingly popular among healthcare providers and patients.

For instance, the adoption of smart dressings that monitor wound healing and provide real-time data is gaining traction, enhancing the efficiency of wound care specialists. The integration of technology into wound care practices is expected to propel market growth further.

Increasing Geriatric Population is driving the market growth

The aging population is a significant driver of the wound care specialist market, as older individuals are more prone to chronic wounds, pressure ulcers, and surgical wounds. According to the United Nations, the global population aged 60 years or older is projected to double by 2050, reaching 2.1 billion.

With age-related physiological changes affecting wound healing, the need for specialized care is rising. This demographic trend is expected to boost the demand for wound care specialists, particularly in developed countries with a high proportion of elderly individuals.

Global Wound Care Specialist Devices Market Challenges and Restraints

High Cost of Advanced Wound Care Products is restricting the market growth

The high cost of advanced wound care products and technologies is a significant barrier to market growth, particularly in low- and middle-income countries. Products like bioengineered skin substitutes and NPWT systems are often expensive, limiting their accessibility to patients with financial constraints.

Additionally, inadequate reimbursement policies in some regions further hinder the adoption of these advanced solutions, affecting market expansion. Addressing these cost-related challenges is essential to ensuring broader access to effective wound care.

Lack of Skilled Professionals is restricting the market growth

The shortage of skilled wound care specialists poses a challenge to the market, particularly in emerging economies. Effective wound management requires expertise in selecting appropriate treatment modalities, monitoring healing progress, and preventing complications.

The lack of training programs and professional certifications in wound care exacerbates this issue, limiting the availability of qualified specialists. Addressing this gap through education and training initiatives is critical to supporting market growth.

Market Opportunities

The growing emphasis on home healthcare services presents a lucrative opportunity for the wound care specialist market. With an increasing number of patients preferring treatment in the comfort of their homes, the demand for portable wound care devices and services is rising. For instance, portable NPWT devices and telemedicine solutions enable specialists to monitor and manage wounds remotely, offering convenience and cost savings to patients. This trend is particularly significant in the context of an aging population and the rise in chronic conditions, which require ongoing wound management. Furthermore, the expansion of healthcare infrastructure in emerging economies offers significant growth potential. Governments and private players are investing in healthcare facilities, enhancing access to advanced wound care products and specialist services.

WOUND CARE SPECIALIST DEVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

4.6% |

|

Segments Covered |

By Product type, Wound Type, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Smith & Nephew plc, Mölnlycke Health Care AB, ConvaTec Group plc, 3M Company, Johnson & Johnson, Medtronic , Coloplast A/S, Baxter International Inc., B. Braun Melsungen AG, Integra LifeSciences Holdings Corporation |

Wound Care Specialist Devices Market Segmentation - By Product Type

-

Advanced Wound Care

-

Traditional Wound Care

-

Surgical Wound Care

-

Others

Advanced wound care products and therapies dominate the wound care market due to their effectiveness in treating complex wounds and accelerating healing time. These innovative solutions offer significant advantages over traditional wound care methods, particularly in managing chronic and non-healing wounds. Advanced wound care products, such as advanced dressings, wound debridement devices, and negative pressure wound therapy systems, provide optimal wound environments that promote healing and reduce infection risk. These products are designed to address specific wound types and stages of healing, ensuring optimal patient outcomes. Additionally, advanced wound care therapies, including growth factors, stem cell therapy, and hyperbaric oxygen therapy, offer targeted interventions to stimulate healing and reduce inflammation. By accelerating the healing process and minimizing complications, advanced wound care solutions not only improve patient quality of life but also reduce healthcare costs associated with prolonged wound healing and hospitalizations.

Wound Care Specialist Devices Market Segmentation - By Wound Type

-

Chronic

-

Acute

Chronic wounds, such as diabetic foot ulcers and pressure ulcers, are a significant driver of the wound care specialist market. These chronic conditions often require specialized care and advanced therapies to promote healing and prevent complications. Diabetic foot ulcers, in particular, are a major concern for individuals with diabetes, as they can lead to serious consequences like amputation and infection. Pressure ulcers, which commonly develop in individuals with limited mobility, also pose a significant burden on healthcare systems. The increasing prevalence of these chronic conditions, coupled with aging populations and rising healthcare costs, has fueled the demand for skilled wound care specialists.

Wound Care Specialist Devices Market Segmentation - By End User

-

Hospitals

-

Clinics

-

Home Healthcare

-

Others

Hospitals remain the primary end-user segment in the wound care specialist market, serving as crucial hubs for wound management and surgical interventions. These institutions house specialized wound care units and employ dedicated wound care specialists to address a wide range of acute and chronic wounds. The complex nature of many wounds, particularly those resulting from surgical procedures, accidents, or underlying medical conditions, necessitates the expertise and resources available in hospital settings. Furthermore, hospitals play a pivotal role in providing advanced wound care treatments, such as negative pressure wound therapy, hyperbaric oxygen therapy, and advanced dressing techniques. As healthcare systems continue to evolve, hospitals will remain at the forefront of wound care, adapting to emerging technologies and treatment modalities to deliver optimal patient outcomes.

Wound Care Specialist Devices Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America is the largest market for wound care specialists, driven by advanced healthcare systems, a high prevalence of chronic wounds, and significant investment in wound care technologies. The presence of key market players and well-established healthcare infrastructure further supports market growth. Asia-Pacific is expected to experience the fastest growth during the forecast period, fueled by rising healthcare expenditure, improving access to advanced wound care products, and growing awareness of wound management. Countries such as China and India are key contributors to this growth, with government initiatives and private investments boosting healthcare infrastructure.

COVID-19 Impact Analysis

The COVID-19 pandemic significantly impacted the wound care specialist market, initially causing a decline due to the postponement of elective surgeries and hospital visits. However, the pandemic also accelerated the adoption of telemedicine and digital wound care solutions. As healthcare providers sought to maintain patient care while minimizing the risk of infection, remote monitoring and virtual consultations became essential tools for wound care specialists. This shift towards digital healthcare has not only improved patient access to care but also enhanced the efficiency and effectiveness of wound management. As the world continues to adapt to the post-pandemic landscape, the wound care specialist market is poised for growth, driven by the increasing prevalence of chronic wounds, aging populations, and the ongoing integration of advanced technologies. The focus on patient-centered care, coupled with the innovative use of telemedicine and digital wound care solutions, will further propel the growth of this specialized field.

Latest Trends/Developments

The field of wound care is undergoing a transformative shift, driven by technological advancements and a growing emphasis on sustainability and personalized medicine. Artificial intelligence (AI) is revolutionizing wound care by enabling precise wound analysis, predictive healing assessments, and tailored treatment plans. This empowers healthcare professionals to optimize patient outcomes and improve the overall efficiency of wound management. Simultaneously, the industry is embracing eco-friendly practices, adopting sustainable manufacturing processes and packaging solutions to minimize its environmental impact. In parallel, advancements in tissue engineering are leading to the development of innovative bioengineered skin substitutes, offering effective solutions for complex wounds. Furthermore, the integration of genomics and molecular biology is paving the way for personalized wound care, allowing healthcare providers to tailor treatments to individual patient needs. To address the growing demand for skilled wound care specialists, efforts are underway to expand training and certification programs globally, ensuring a well-prepared workforce to meet the evolving needs of the field.

Key Players

-

Smith & Nephew plc

-

Mölnlycke Health Care AB

-

ConvaTec Group plc

-

3M Company

-

Johnson & Johnson

-

Medtronic plc

-

Coloplast A/S

-

Baxter International Inc.

-

B. Braun Melsungen AG

-

Integra LifeSciences Holdings Corporation

Chapter 1. Wound Care Specialist Devices Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Wound Care Specialist Devices Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Wound Care Specialist Devices Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Wound Care Specialist Devices Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Wound Care Specialist Devices Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Wound Care Specialist Devices Market – By Product Type

6.1 Introduction/Key Findings

6.2 Advanced Wound Care

6.3 Traditional Wound Care

6.4 Surgical Wound Care

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2025-2030

Chapter 7. Wound Care Specialist Devices Market – By Wound Type

7.1 Introduction/Key Findings

7.2 Chronic

7.3 Acute

7.4 Y-O-Y Growth trend Analysis By Wound Type

7.5 Absolute $ Opportunity Analysis By Wound Type, 2025-2030

Chapter 8. Wound Care Specialist Devices Market – By End User

8.1 Introduction/Key Findings

8.2 Hospitals

8.3 Clinics

8.4 Home Healthcare

8.5 Others

8.6 Y-O-Y Growth trend Analysis By End User

8.7 Absolute $ Opportunity Analysis By End User, 2025-2030

Chapter 9. Wound Care Specialist Devices Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Wound Type

9.1.4 By End User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Wound Type

9.2.4 By End User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Wound Type

9.3.4 By End User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Wound Type

9.4.4 By End User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Wound Type

9.5.4 By End User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Wound Care Specialist Devices Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Smith & Nephew plc

10.2 Mölnlycke Health Care AB

10.3 ConvaTec Group plc

10.4 3M Company

10.5 Johnson & Johnson

10.6 Medtronic plc

10.7 Coloplast A/S

10.8 Baxter International Inc.

10.9 B. Braun Melsungen AG

10.10 Integra LifeSciences Holdings Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Wound Care Specialist Devices Market was valued at USD 2.51 billion in 2024 and is expected to reach USD 3.29 billion by 2030, expanding at a CAGR of 4.6% during the forecast period (2025–2030).

Key drivers include the rising prevalence of chronic diseases, technological advancements in wound care, and an increasing geriatric population.

Segments include Product Type (Advanced Wound Care, Traditional Wound Care, Surgical Wound Care), Wound Type (Chronic, Acute), and End User (Hospitals, Clinics, Home Healthcare).

North America dominates the market, representing over 40% of the global revenue, driven by advanced healthcare infrastructure and a high prevalence of chronic wounds.

Major players include Smith & Nephew plc, Mölnlycke Health Care AB, ConvaTec Group plc, and 3M Company.