WaaS Market Size (2024-2030)

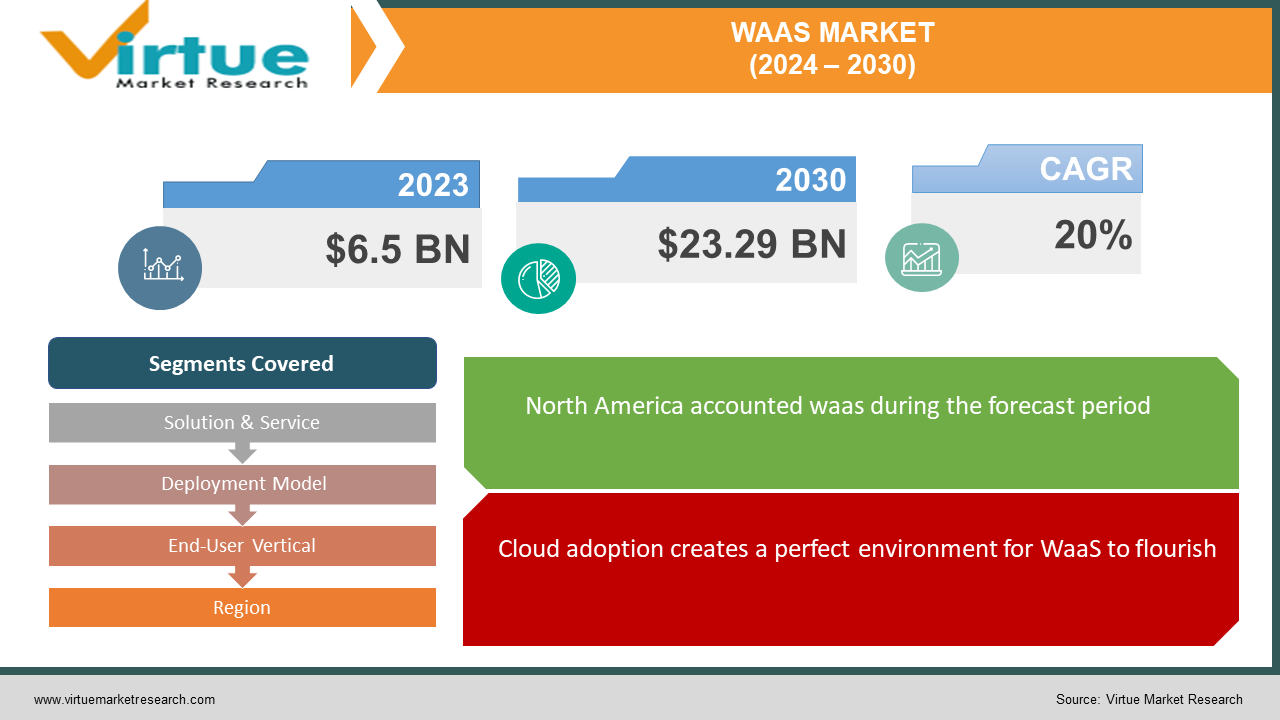

The Workspace as a Service (WaaS) Market was valued at USD 6.5 billion in 2023 and is projected to reach a market size of USD 23.29 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 20%.

The Workspace as a Service (WaaS) market is thriving, transforming how businesses access workspaces and applications. With WaaS, companies ditch the upfront costs of hardware and software, opting for a subscription-based model that provides a predictable monthly or annual fee. This shift brings significant advantages. Businesses gain enhanced flexibility, allowing them to scale their IT resources effortlessly to adapt to changing needs. Additionally, WaaS solutions leverage robust data center security offered by providers, safeguarding sensitive business information. Most importantly, WaaS empowers employees with the ability to access essential tools from anywhere, fostering increased productivity. This market flourishes due to several key trends.

Key Market Insights:

The Workspace as a Service (WaaS) market is fueled by several key trends. Cloud adoption creates a perfect environment for WaaS to flourish, as businesses already invested in cloud infrastructure can easily integrate these virtual workspaces. The booming remote work trend further fuels demand for WaaS by providing secure and accessible workspaces for geographically dispersed teams. Finally, businesses today prioritize agility and scalability in their IT infrastructure to adapt to a dynamic world, making WaaS a perfect solution.

Understanding these drivers unlocks the benefits of WaaS for businesses. Subscription-based pricing eliminates upfront costs for hardware and software, leading to predictable IT budgeting. Additionally, WaaS providers offer robust data center security, safeguarding sensitive business information. Most importantly, employees gain the flexibility to access essential tools from anywhere, fostering increased productivity and collaboration.

The WaaS market itself is dynamic. Major players compete fiercely, driving innovation and keeping pricing competitive. As reliance on cloud solutions increases, so do security concerns. WaaS providers who prioritize continuous investment in robust security measures will build trust and win in this growing market.

The WaaS Market Drivers:

Cloud adoption creates a perfect environment for WaaS to flourish.

While WaaS offers security benefits from providers' data centers, the increased reliance on cloud-based solutions fuels concerns about data breaches and unauthorized access. This concern, in turn, drives the WaaS market as businesses seek robust security features and reliable providers with a strong track record.

The booming remote work trend further fuels demand for WaaS.

The growing use of personal devices for work (BYOD) and the explosion of mobile devices necessitate solutions that function seamlessly across various platforms. WaaS offerings that provide a consistent user experience across desktops, laptops, tablets, and smartphones are becoming increasingly attractive.

Businesses today prioritize agility and scalability in their IT infrastructure, making WaaS a perfect fit.

Businesses leverage a vast array of software applications. Seamless integration of WaaS solutions with existing CRM, ERP, and other business-critical applications becomes a key driver. This allows for a more streamlined workflow and eliminates the need for complex, on-premises integrations.

Security concerns around cloud-based solutions drive the WaaS market for robust security features.

The increasing frequency and severity of cyberattacks and natural disasters highlight the importance of business continuity. WaaS solutions with built-in disaster recovery features and data backup capabilities become essential for businesses to ensure they can maintain operations even during disruptions.

The proliferation of user devices like laptops, tablets and mobiles necessitates WaaS solutions that function seamlessly across platforms.

While eliminating upfront costs is a major benefit, WaaS can further optimize costs by offering flexible pricing models based on usage. This allows businesses to pay only for the resources they use, leading to overall IT expense reduction.

The WaaS Market Restraints and Challenges:

While the WaaS market enjoys significant growth, it's not without its roadblocks. Data security remains a concern for some businesses, especially those handling sensitive information or complying with strict data privacy regulations. Even with provider-side security measures, the cloud-based nature of WaaS can raise anxieties about data breaches and unauthorized access. Additionally, integrating WaaS with existing IT infrastructure can be a challenge. Businesses with complex legacy systems may face compatibility issues and a complex integration process, hindering a smooth workflow. Furthermore, the success of WaaS hinges on reliable and high-speed internet connectivity. In areas with limited or unstable internet access, WaaS functionality and user experience can suffer. Vendor lock-in is another potential hurdle. Over-reliance on a single WaaS provider can make switching to a competitor difficult and expensive down the line. Careful evaluation of vendor lock-in risks is crucial before committing to a WaaS solution. Finally, transitioning to a WaaS environment might necessitate user training to ensure employees can effectively utilize the new tools and applications. Inadequate training can hinder user adoption of the platform and lead to decreased productivity. By acknowledging these challenges, businesses can make informed decisions about WaaS implementation and navigate the path towards a successful and secure cloud-based workspace.

The WaaS Market Opportunities:

The WaaS market isn't just overcoming challenges, it's brimming with exciting possibilities. Integration of Artificial Intelligence and Machine Learning can personalize user experiences, automate tasks, and enhance security. Imagine AI anticipating your needs and optimizing resource allocation! Furthermore, WaaS vendors can tailor solutions to specific industries like healthcare or finance, addressing unique challenges and workflows. Collaboration is another key area. WaaS can integrate advanced video conferencing, real-time document editing, and project management tools, fostering seamless teamwork across locations. Additionally, providers prioritizing a user-friendly interface will win big. A smooth experience translates to faster adoption, happier employees, and ultimately, a productivity boost. Finally, the WaaS market is ripe for expansion in developing regions with growing internet access and tech-savvy workforces. By offering localized solutions and addressing regional needs, WaaS providers can unlock a whole new world of opportunity. By capitalizing on these advancements, WaaS can revolutionize how businesses operate, empowering employees to work smarter in a secure and adaptable cloud environment.

WAAS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

20% |

|

Segments Covered |

By Solution & Service, Deployment Model, End-User Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Microsoft, Citrix Systems, VMware, Amazon Web Services (AWS), Unisys Corporation, IndependenceIT Corporation, Getronics Global Services BV, Dell Inc. |

WaaS Market Segmentation: By Solution & Service

-

Desktop as a Service (DaaS)

-

Application as a Service (AaaS)

-

Managed Workspace Services

Based on market research and industry reports, the most dominant segment in the WaaS market by Solution & Service is Desktop as a Service (DaaS). DaaS offers virtual desktops accessible from any device, making it a popular choice for businesses seeking a familiar and secure work environment. However, the fastest-growing segment is Application as a Service (AaaS). The increasing adoption of cloud-based applications and the ease of integration with existing workflows are driving the rapid growth of AaaS.

WaaS Market Segmentation: By Deployment Model

-

Public WaaS

-

Private WaaS

-

Hybrid WaaS

Public WaaS currently reigns supreme in the WaaS market due to its affordability and ease of use, making it ideal for businesses of all sizes. However, the fastest-growing segment is likely hybrid WaaS. As businesses prioritize both flexibility and robust security, hybrid WaaS offers the perfect blend, allowing them to leverage the scalability of the public cloud while maintaining stricter control over sensitive data on a dedicated infrastructure.

WaaS Market Segmentation: By End-User Vertical

-

Healthcare

-

Finance

-

Education

-

Retail

While pinpointing a single dominant segment is difficult due to the industry's fragmentation, Large Enterprises are likely a major force due to their resource needs and ability to invest in WaaS. The fastest-growing segment is expected to be the Asia Pacific region, driven by increasing internet penetration and a booming tech-savvy workforce. This region presents exciting opportunities for WaaS providers offering localized solutions.

WaaS Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America: This region boasts a mature WaaS market with high adoption rates. Strong existing infrastructure, a tech-savvy business culture, and widespread cloud adoption have fueled rapid growth. Leading WaaS players dominate the market, but innovation remains a key battleground as companies strive to stay ahead of the curve. Security concerns and vendor lock-in are crucial considerations for North American businesses evaluating WaaS solutions.

Europe: The European WaaS market is experiencing rapid growth. Businesses are increasingly recognizing the benefits of WaaS, such as cost savings and agility. Government initiatives promoting cloud adoption further accelerate this trend. However, strict data privacy regulations in the European Union (EU) necessitate WaaS providers to offer solutions that comply with GDPR (General Data Protection Regulation) and other regional regulations.

Asia-Pacific: This region holds the most exciting growth potential for WaaS. A surging tech-savvy workforce, rapidly increasing internet penetration, and booming economies are driving significant WaaS adoption. However, infrastructure limitations in some areas can hinder smooth WaaS implementation. Additionally, cultural nuances and diverse languages necessitate localization of WaaS solutions for broader market penetration.

South America: WaaS adoption in South America is on the rise, but faces challenges compared to more developed regions. Infrastructure limitations, particularly in remote areas, and economic instability can create hurdles for WaaS implementation. However, increasing government investments in IT infrastructure and growing awareness of cloud solutions indicate significant potential for future growth in this region.

Middle East and Africa: The WaaS market in this region is still in its nascent stages but holds promising prospects. Growing government investments in IT infrastructure are laying the groundwork for future WaaS adoption. Additionally, a burgeoning young population with increasing technological awareness opens doors for WaaS solutions that cater to the specific needs of this region.

COVID-19 Impact Analysis on the WaaS Market:

The COVID-19 pandemic significantly impacted the WaaS market, but in a surprising way. While there might have been initial disruptions, the overall effect was positive, acting as a major accelerant for growth. The surge in remote work created a massive demand for secure and accessible virtual workspaces, which WaaS perfectly addressed. Businesses needed to equip employees to work productively from anywhere, and WaaS provided the solution. Additionally, the pandemic highlighted the importance of business continuity plans, and WaaS's inherent scalability and remote access capabilities made it a vital tool for maintaining operations during disruptions. Cost optimization was another driver. With economic uncertainty, businesses sought ways to save, and WaaS's subscription-based model, eliminating upfront hardware and software costs, became very attractive. However, challenges emerged as well. Security concerns heightened with the rapid shift to remote work and increased reliance on cloud solutions. WaaS providers had to work hard to build trust with businesses hesitant to migrate sensitive data by implementing robust security measures. Network bandwidth demands also rose due to widespread remote work and video conferencing, highlighting the need for reliable and high-speed internet connectivity for a seamless WaaS experience. Overall, the pandemic acted as a catalyst for the WaaS market. The increased demand for remote work capabilities, focus on business continuity, and cost-optimization needs propelled the market forward. However, WaaS providers need to address security concerns and network bandwidth limitations to ensure continued growth.

Latest Trends/ Developments:

The WaaS market is constantly innovating to meet evolving user needs. One exciting trend is the integration of Artificial Intelligence (AI) and Machine Learning (ML) into WaaS solutions. Imagine AI personalizing your workspace, automating tasks, and even enhancing security! Additionally, user experience (UX) is a top priority. WaaS providers are creating user-friendly interfaces and streamlined workflows to ensure faster adoption and happier users. Furthermore, WaaS offerings are becoming more specialized. Industry-specific solutions, like those designed for healthcare or finance, cater to unique needs and workflows, unlocking greater value for businesses. The future also holds promise for integrating edge computing with WaaS. Processing data closer to its source can reduce latency, improve security, and enhance the overall experience, particularly for bandwidth-intensive applications. Security remains a major focus, with WaaS providers prioritizing robust security measures, compliance with regulations, and features like multi-factor authentication and data encryption. Finally, blockchain technology has the potential to revolutionize WaaS security by creating a tamper-proof record of data access. By embracing these advancements, WaaS providers can offer businesses a secure, efficient, and user-friendly experience, shaping the future of work to be smarter and more productive.

Key Players:

-

Microsoft

-

Citrix Systems

-

VMware

-

Amazon Web Services (AWS)

-

Unisys Corporation

-

IndependenceIT Corporation

-

Getronics Global Services BV

-

Dell Inc.

Chapter 1. Workspace as a Service (WaaS) Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Workspace as a Service (WaaS) Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Workspace as a Service (WaaS) Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Workspace as a Service (WaaS) Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Workspace as a Service (WaaS) Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Workspace as a Service (WaaS) Market – By Solution & Service

6.1 Introduction/Key Findings

6.2 Desktop as a Service (DaaS)

6.3 Application as a Service (AaaS)

6.4 Managed Workspace Services

6.5 Y-O-Y Growth trend Analysis By Solution & Service

6.6 Absolute $ Opportunity Analysis By Solution & Service, 2024-2030

Chapter 7. Workspace as a Service (WaaS) Market – By Deployment Model

7.1 Introduction/Key Findings

7.2 Public WaaS

7.3 Private WaaS

7.4 Hybrid WaaS

7.5 Y-O-Y Growth trend Analysis By Deployment Model

7.6 Absolute $ Opportunity Analysis By Deployment Model, 2024-2030

Chapter 8. Workspace as a Service (WaaS) Market – By End-User Vertical

8.1 Introduction/Key Findings

8.2 Healthcare

8.3 Finance

8.4 Education

8.5 Retail

8.6 Y-O-Y Growth trend Analysis By End-User Vertical

8.7 Absolute $ Opportunity Analysis By End-User Vertical, 2024-2030

Chapter 9. Workspace as a Service (WaaS) Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Solution & Service

9.1.3 By Deployment Model

9.1.4 By End-User Vertical

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Solution & Service

9.2.3 By Deployment Model

9.2.4 By End-User Vertical

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Solution & Service

9.3.3 By Deployment Model

9.3.4 By End-User Vertical

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Solution & Service

9.4.3 By Deployment Model

9.4.4 By End-User Vertical

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Solution & Service

9.5.3 By Deployment Model

9.5.4 By End-User Vertical

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Workspace as a Service (WaaS) Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Microsoft

10.2 Citrix Systems

10.3 VMware

10.4 Amazon Web Services (AWS)

10.5 Unisys Corporation

10.6 IndependenceIT Corporation

10.7 Getronics Global Services BV

10.8 Dell Inc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The WaaS Market was valued at USD 6.5 billion in 2023 and is projected to reach a market size of USD 23.29 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 20%.

Security Concerns, End-User Device Proliferation, Integration with Business Applications, Disaster Recovery and Business Continuity, Cost Optimization Beyond Upfront Costs.

Desktop as a Service (DaaS), Application as a Service (AaaS), Managed Workspace Services.

While the WaaS market is experiencing growth globally, North America is currently the most dominant region due to established infrastructure, strong cloud adoption, and leading players.

Microsoft, Citrix Systems, VMware, Amazon Web Services (AWS), Unisys Corporation, IndependenceIT Corporation, Getronics Global Services BV, Dell Inc..