Workover Rigs Market Size (2025 – 2030)

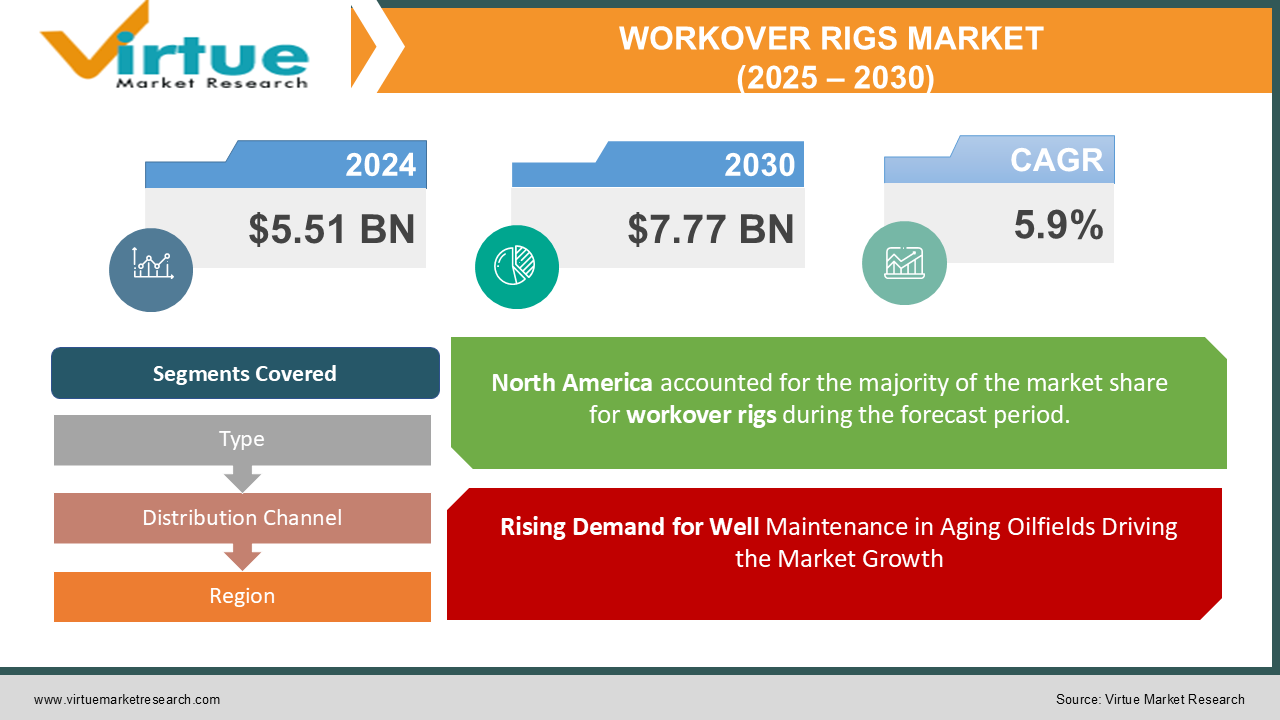

The Workover Rigs Market was valued at USD 5.51 Billion in 2024 and is projected to reach a market size of USD 7.77 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.9%.

The workover rigs market is a pivotal segment in the oil and gas industry, serving as a cornerstone for maintaining and enhancing the productivity of oil wells. These rigs are specialized equipment used for well servicing, which includes maintenance, repair, and enhancement of oil and gas wells. The dynamic growth of the global energy demand, coupled with the aging of existing wells, has heightened the need for efficient and reliable workover solutions. Workover rigs play a crucial role in extending the operational life of wells, restoring their production levels, and ensuring environmental safety during operations. With advancements in technology, workover rigs have transitioned from traditional mechanical systems to more sophisticated, automated, and efficient machines. This evolution is crucial as the industry aims to optimize performance, minimize downtime, and reduce operational costs. The increasing exploration and production activities in both conventional and unconventional oil and gas reserves have further boosted the demand for workover rigs. These rigs are indispensable in ensuring the continuity of production, particularly in mature fields where declining output necessitates frequent intervention. Environmental concerns and stringent regulations have also influenced the market dynamics, leading to the adoption of environmentally friendly and safe workover operations. The introduction of electric and hybrid workover rigs aligns with the industry's commitment to reducing carbon footprints and improving operational efficiency. Additionally, the rise of digitalization and automation in the oil and gas sector has propelled the development of smarter rigs capable of remote monitoring and predictive maintenance. This integration of technology not only enhances safety but also reduces the likelihood of unexpected downtime, ensuring a seamless workflow in oilfield operations. The market's growth is also driven by the expansion of offshore drilling activities, where the demand for specialized workover rigs is substantial. Offshore operations require high-performance rigs that can withstand harsh conditions and provide reliable services. This has led to increased investment in the development of advanced offshore workover rigs, further augmenting the market's potential. However, the industry faces challenges such as fluctuating oil prices, which directly impact investment in exploration and production activities. Despite these challenges, the workover rigs market remains robust, supported by the consistent need for well maintenance and the ongoing recovery of the oil and gas sector.

Key Market Insights:

-

The global workover rigs market generated revenues exceeding $12 billion in 2023.

-

Over 70% of workover rigs sold in 2023 were truck mounted. Hydraulic rigs accounted for 55% of the market share in terms of technology.

-

The demand for automated rigs grew by 18% compared to 2022.

-

Onshore workover rigs constituted 85% of the total market demand. Offshore rigs saw a 12% increase in sales, driven by new oilfield discoveries.

-

Nearly 65% of workover operations in 2023 involved well recompletion.

-

Electric workover rigs witnessed a growth of 22%, reflecting the shift toward sustainable practices.

-

Over 500,000 wells worldwide underwent workover operations in 2023.

-

70% of maintenance interventions focused on mature oilfields. Coiled tubing operations accounted for 25% of workover applications.

-

80% of well servicing companies reported increased reliance on digital monitoring systems.

-

The average operational lifespan of workover rigs improved by 15% with modern designs.

Market Drivers:

Rising Demand for Well Maintenance in Aging Oilfields Driving the Market Growth:

Aging oilfields around the world are experiencing natural declines in production, creating an urgent need for well maintenance and rejuvenation activities. With more than 60% of global oilfields classified as mature, operators are heavily reliant on workover rigs to restore and enhance well productivity. Well intervention techniques, such as sand cleanouts, plug milling, and casing repairs, have become indispensable in maintaining output levels. Workover rigs provide the mechanical and hydraulic power required for these tasks, making them a cornerstone of oilfield operations. In this context, workover rigs are viewed as a cost-effective alternative to drilling new wells, which involves significantly higher capital expenditure. As energy demands rise globally, operators prioritize maximizing the efficiency of existing resources, further boosting the demand for workover rigs.

Technological Advancements in Workover Rigs:

Innovations in workover rig technology have significantly enhanced their efficiency, safety, and environmental compliance. The industry has seen a shift toward hybrid and electric-powered rigs, which are designed to reduce greenhouse gas emissions and operational costs. Automated rigs equipped with remote monitoring systems have also gained traction, offering enhanced precision and reduced downtime. Advanced rigs are now capable of performing multiple functions, including coiled tubing operations and side-tracking, making them highly versatile. Additionally, the integration of predictive maintenance systems minimizes unexpected failures, ensuring seamless operations. These advancements align with the industry's broader goals of achieving sustainability and operational excellence, making modern workover rigs an attractive investment for oilfield service companies.

Market Restraints and Challenges:

The cyclical nature of oil prices remains a critical concern for the workover rigs market. Fluctuating crude prices often lead to uncertain investment patterns in upstream activities. During periods of low oil prices, operators tend to cut back on exploration and production budgets, directly impacting the demand for workover rigs. This volatility makes it challenging for manufacturers and service providers to forecast demand and allocate resources effectively. While the market has shown resilience during recoveries, prolonged periods of low prices can lead to project delays and cancellations, reducing the overall market potential. The oil and gas sector is under increasing scrutiny due to its environmental impact. Governments and regulatory bodies have implemented stringent policies to curb emissions and promote sustainable practices, posing challenges for workover rig operators. Compliance with these regulations often requires significant investments in upgrading equipment and adopting greener technologies. Smaller operators may struggle with the financial burden, leading to slower adoption rates. Additionally, the growing focus on renewable energy as an alternative to fossil fuels could potentially reduce the long-term demand for workover rigs, adding another layer of uncertainty to the market.

Market Opportunities:

The discovery of new offshore reserves in regions such as Africa, South America, and the Middle East has created substantial opportunities for the workover rigs market. Offshore wells are often deeper and more complex, requiring advanced rigs capable of operating in challenging environments. The rising investment in deepwater and ultra-deepwater projects has increased the demand for high-capacity offshore workover rigs. Additionally, offshore projects typically involve long-term contracts, ensuring a steady revenue stream for rig manufacturers and service providers. The integration of digital technologies in workover rigs represents a transformative opportunity for the market. Automation and real-time data analytics are enabling operators to monitor and optimize rig performance remotely. These advancements improve safety, enhance decision-making, and reduce operational costs. For instance, predictive maintenance systems can identify potential equipment failures before they occur, minimizing downtime and maintenance expenses. The adoption of digital technologies is particularly appealing to operators looking to improve efficiency and comply with stringent safety standards.

WORKOVER RIGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.9% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Halliburton, Schlumberger, Weatherford International, Nabors Industries, Patterson-UTI Energy, Baker Hughes, Superior Energy Services, Key Energy Services, Precision Drilling Corporation, Cactus Drilling |

Workover Rigs Market Segmentation: by Type

-

Hydraulic Rigs

-

Mechanical Rigs

-

Hybrid Rigs

-

Electric Rigs

Hydraulic rigs dominated the market in 2023 due to their reliability and ability to handle high-pressure operations. On the other hand, hybrid rigs are the fastest-growing segment, driven by their environmental benefits and cost-efficiency.

Workover Rigs Market Segmentation: by Distribution Channel

-

Direct Sales

-

Rental Services

-

Third-party Distributors

Direct sales remain the most dominant channel, as large operators prefer purchasing rigs for long-term use. Rental services, however, are growing rapidly due to their flexibility and lower upfront costs.

Workover Rigs Market Segmentation: by Regional Analysis

-

North America

-

Asia-Pacific

-

Middle East & Africa

-

Europe

-

Latin America

North America dominated the market due to its extensive oilfield operations and advanced infrastructure. The Asia-Pacific region emerged as the fastest-growing market, fueled by increasing energy demand and investments in oil and gas exploration.

COVID-19 Impact Analysis:

The COVID-19 pandemic disrupted the workover rigs market significantly, causing delays in projects and supply chain interruptions. Restrictions on movement and workforce availability led to operational slowdowns, particularly in offshore fields. The decline in global energy demand during the pandemic further exacerbated these challenges, resulting in postponed investments and reduced revenues for rig manufacturers. However, the market has shown resilience as economies recover and energy demand rebounds. The pandemic also accelerated the adoption of digital technologies and remote monitoring systems, highlighting the importance of innovation in ensuring operational continuity.

Latest Trends and Developments:

The workover rigs market is witnessing transformative trends, including the integration of automation, the development of eco-friendly rigs, and increased investments in offshore capabilities. Automated rigs equipped with AI and IoT technologies are enhancing operational efficiency and safety. The shift toward hybrid and electric rigs reflects the industry's commitment to sustainability, aligning with global efforts to reduce emissions. Additionally, the growing focus on modular rig designs facilitates easier transportation and deployment, particularly in remote locations. The market is also benefiting from increased exploration activities in untapped offshore reserves, driving demand for high-performance rigs.

Key Players

-

Halliburton

-

Schlumberger

-

Weatherford International

-

Nabors Industries

-

Patterson-UTI Energy

-

Baker Hughes

-

Superior Energy Services

-

Key Energy Services

-

Precision Drilling Corporation

-

Cactus Drilling

Chapter 1. Workover Rigs Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Workover Rigs Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Workover Rigs Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Workover Rigs Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Workover Rigs Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Workover Rigs Market – By Type

6.1 Introduction/Key Findings

6.2 Hydraulic Rigs

6.3 Mechanical Rigs

6.4 Hybrid Rigs

6.5 Electric Rigs

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Workover Rigs Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Direct Sales

7.3 Rental Services

7.4 Third-party Distributors

7.5 Y-O-Y Growth trend Analysis By Distribution Channel

7.6 Absolute $ Opportunity Analysis By Distribution Channel, 2025-2030

Chapter 8. Workover Rigs Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Workover Rigs Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Halliburton

9.2 Schlumberger

9.3 Weatherford International

9.4 Nabors Industries

9.5 Patterson-UTI Energy

9.6 Baker Hughes

9.7 Superior Energy Services

9.8 Key Energy Services

9.9 Precision Drilling Corporation

9.10 Cactus Drilling

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The growth of the Workover Rigs Market is driven by increasing well maintenance needs in aging oilfields, advancements in rig automation and hybrid technologies, rising energy demand, and expanded offshore exploration activities. These factors, coupled with cost-efficient alternatives to drilling new wells, bolster the market's appeal and operational significance globally.

The main concerns in the Workover Rigs Market include fluctuating oil prices, which create investment uncertainty, and stringent environmental regulations requiring costly upgrades. Additionally, challenges like operational risks in extreme environments, high maintenance costs, and the global shift toward renewable energy sources pose significant threats to the market’s long-term growth potential.

Halliburton, Schlumberger, Weatherford International, Nabors Industries, Patterson-UTI Energy, Baker Hughes, Superior Energy Services, Key Energy Services, Precision Drilling Corporation, Cactus Drilling.

North America currently holds the largest market share, estimated around 35%.

Asia Pacific has shown significant room for growth in specific segments.