Wooden Toys Market Size (2024 – 2030)

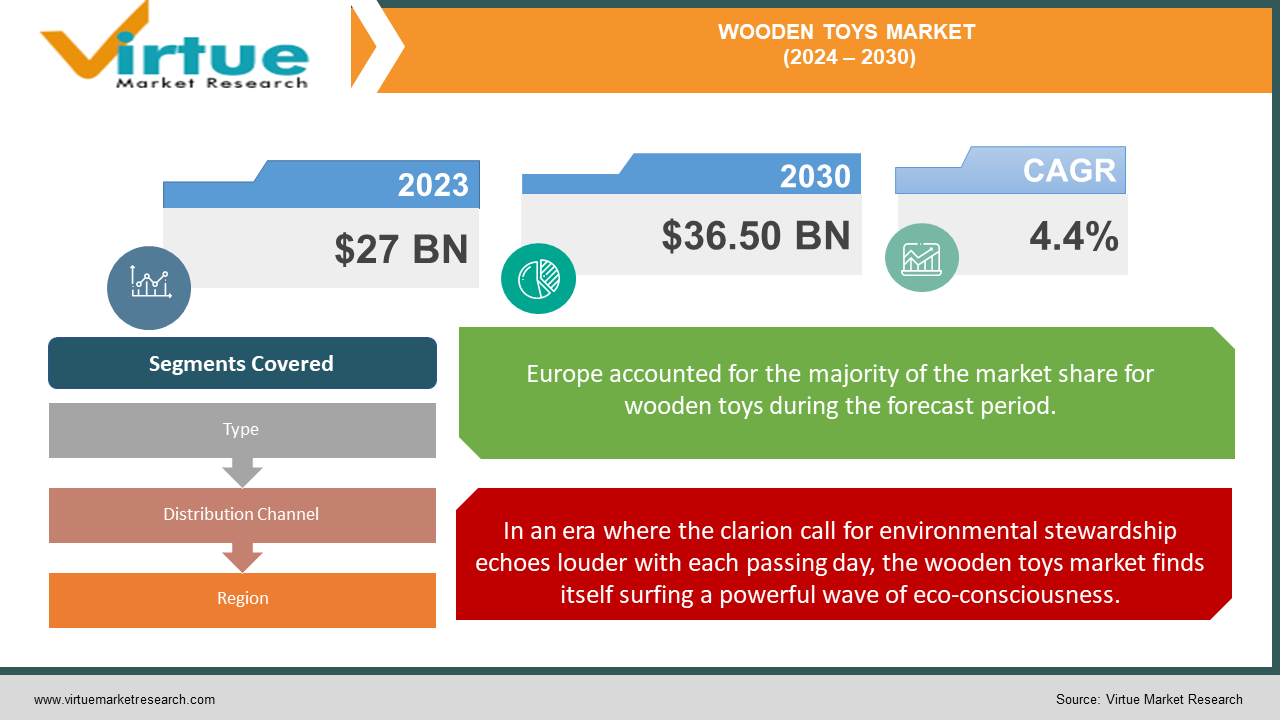

The Wooden Toys Market was valued at USD 27 Billion in 2024 and is projected to reach a market size of USD 36.50 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.4%.

In a world increasingly dominated by flashing screens and beeping gadgets, the wooden toys market stands as a bastion of simplicity and timeless charm. These playthings, crafted from nature's own building blocks, have weathered the storms of technological advancement and continue to captivate children and parents alike with their earthy appeal and nostalgic resonance. The wooden toys market is a vibrant tapestry woven from threads of tradition and innovation. At its core lie age-old classics - the humble building blocks, the sturdy pull-along duck, the ever-popular rocking horse. These stalwarts of the playroom have been joined by a new generation of wooden wonders, where imagination and craftsmanship collide to create puzzles that boggle the mind, intricate dollhouses that spark hours of storytelling, and educational toys that seamlessly blend learning with fun. The wooden toys market is also riding the wave of broader societal trends. The surge in eco-consciousness has cast a favorable light on these biodegradable beauties, positioning them as the green alternative to plastic playthings. The movement towards minimalism and decluttering has parents favoring quality over quantity, investing in fewer, better toys that can be treasured for generations.

Key Market Insights:

Approximately 70% of wooden toy manufacturers use certified sustainable wood sources.

The premium segment of wooden toys represents 20% of total sales.

North American consumers account for 30% of global wooden toy purchases. European consumers make up 35% of the global wooden toy market.

Wooden toy exports from China account for 50% of global supply.

The global market for Montessori wooden toys is valued at $1.5 billion. Wooden toy imports in the United States are valued at $700 million annually.

Around 25% of parents prefer wooden toys due to their durability. Wooden toys designed for outdoor play account for 5% of sales.

The retail market for wooden toys in Asia is valued at $1.2 billion. Wooden toy sets for infants and toddlers account for 18% of the market.

Over 75% of parents consider wooden toys to be safer than plastic toys. Wooden toy brands with a strong online presence see 50% higher sales growth.

Wooden Toys Market Drivers:

In an era where the clarion call for environmental stewardship echoes louder with each passing day, the wooden toys market finds itself surfing a powerful wave of eco-consciousness.

This factor is mostly a result of increased awareness of the harm plastic toys due to the environment. After seeing so many pictures of landfills overflowing, and oceans choked with plastic, parents and other caregivers are starting to look for solutions that are more in line with their moral principles. In this battleground dominated by plastic, wooden toys stand out thanks to their natural origins and biodegradable nature. In this situation, wooden toys are appealing for a variety of reasons. The content itself is the most important factor. When obtained ethically, wood is a renewable resource. Wooden toys can eventually be recycled back into the earth without leaving a harmful legacy, unlike plastic toys, which can linger in the environment for generations after being made from fossil fuels.

In our rapidly digitizing world, where screens dominate both work and leisure, a powerful countercurrent is sweeping through the toy industry - a yearning for the tangible, the tactile, the real.

At its core, this driver taps into a deep-seated human need for connection - not just with others, but with the physical world around us. In an age where children can swipe before they can walk, parents and educators are increasingly recognizing the importance of tactile experiences in early childhood development. Wooden toys, with their natural textures, weight, and warmth, offer a stark and welcome contrast to the smooth, cold surfaces of electronic devices. This nostalgia isn't just about recreating the past; it's about reclaiming aspects of childhood that seem endangered in the digital age. The simplicity of wooden toys harkens back to a time when imagination was the most powerful processor, when a block could be a castle one moment and a spaceship the next. This open-ended play, unencumbered by flashing lights or pre-programmed sounds, is increasingly valued for its role in fostering creativity, problem-solving skills, and cognitive flexibility.

Wooden Toys Market Restraints and Challenges:

First and foremost, we encounter the elephant in the playroom: cost. Wooden toys, with their natural materials and often artisanal production methods, typically come with a higher price tag than their mass-produced plastic counterparts. This price differential creates a significant barrier to entry for many consumers, particularly in markets where disposable income is limited. The challenge here is twofold: educating consumers about the long-term value and durability of wooden toys and finding ways to streamline production to bring costs down without compromising quality or ethical standards. The cost factor intertwines with another formidable challenge: competition from the tech toy sector. In an age where even toddlers are digital natives, the allure of blinking, beeping, app-connected playthings are strong. Wooden toy manufacturers find themselves in a David versus Goliath battle, armed with simplicity against the Goliath of technological wow-factor. The industry must continuously innovate to prove that wooden toys can be just as engaging and educational as their high-tech rivals, without losing their essential, back-to-basics appeal.

Wooden Toys Market Opportunities:

One of the most promising opportunities lies in the intersection of wooden toys and educational technology. As schools and parents increasingly focus on STEAM (Science, Technology, Engineering, Arts, and Mathematics) education, there's a growing demand for toys that can facilitate learning in these areas. Wooden toys, with their tactile nature and versatility, are perfectly positioned to meet this need. Imagine wooden blocks embedded with conductive materials that can teach basic circuitry, or wooden puzzles that integrate with educational apps to provide an enhanced learning experience. By bridging the gap between traditional wooden toys and modern educational needs, manufacturers can tap into a lucrative market segment. The rise of the conscious consumer presents another significant opportunity. As more people become aware of environmental issues and seek out sustainable products, wooden toys can position themselves as the eco-friendly choice in the toy aisle. This goes beyond just using wood as a material – it's about telling a compelling story of sustainability throughout the supply chain. Companies that can demonstrate responsible sourcing, use of renewable energy in production, and initiatives like tree planting programs can differentiate themselves in a crowded market. There's also an opportunity to explore alternative materials that complement wood, such as bioplastics derived from plant sources, further enhancing the eco-credentials of these toys.

WOODEN TOYS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.4% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Littlearth, Waldorf Workshop, Muddy Fingers, Sugar Plum Toys, Petit Collage, Learning Resources, Geo Smart, Begin Again Toys, Green Toys, Nature's Little Helpers, iWood Play |

Wooden Toys Market Segmentation: By Types

-

Educational and STEM Toys

-

Pretend Play Toys

-

Building and Construction Toys

-

Puzzles and Problem-Solving Toys

-

Push and Pull Toys

-

Musical Instruments

-

Art and Craft Toys

In the wooden toy market, the most popular category is still Building and Construction Toys. Construction sets and building blocks are multipurpose tools that appeal to a broad age group and encourage repeated play. Naturally, these toys foster creativity, problem-solving abilities, and spatial reasoning. The happy times they spent playing with wooden building toys are a major factor in the shopping selections of many parents. This area is dominated because it appeals to children of all ages and can develop with them, from simple stacking activities for babies to sophisticated engineering tasks for older kids.

The wooden toys in the Educational and STEM Toys sector are made to impart particular knowledge or abilities; these toys are frequently in line with school curricula. Geometric shape sorters, letter blocks, and counting beads are a few examples. Notable among subcategories is STEM, which stands for Science, Technology, Engineering, and Mathematics. The Educational Toys subcategory with a STEM focus is growing at the fastest rate right now. This increase is the result of parents wanting to give their kids an advantage in these important professions and the growing emphasis on technical education starting at a young age. Simple machines, geometry sets, and coding blocks are examples of wooden STEM toys. These toys are especially interesting since they combine conventional materials with innovative teaching ideas.

Wooden Toys Market Segmentation: By Distribution Channel

-

Specialty Toy Stores

-

Online Retailers

-

Department Stores

-

Eco-friendly and Natural Product Stores

-

Direct from Manufacturers

Specialty toy stores remain the dominant channel for wooden toy sales, particularly for higher-end and educational wooden toys. Speciality Stores include expert staff who can provide advice and demonstrations, a curated selection of high-quality toys, ability for customers to see and touch products before purchasing, often seen as more trustworthy for child safety concerns, tendency to stock a wider range of wooden toys compared to general retailers.

The online retail channel is experiencing the most rapid growth in the wooden toy market. This growth is driven by several factors such as convenience of online shopping, especially for busy parents, Ability to easily compare products and read reviews, wider selection is available online compared to physical stores, growth of direct-to-consumer brands leveraging social media marketing, increased comfort with buying higher-priced items online. The COVID-19 pandemic has further accelerated this trend, with many consumers shifting to online shopping out of necessity and then maintaining these habits.

Wooden Toys Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

With 30% of the global market for wooden toys, Europe has the biggest stake. Sustainable and environmentally friendly items are highly preferred by European customers. The desire for wooden toys is driven by this cultural tendency, as these toys are thought to be safer and more ecologically friendly than their plastic equivalents. The buying power of European nations is high, especially that of Western Europe. The market for high-end wooden toys is growing because parents are ready to spend more on toys that are sturdy and of excellent quality. The market is strengthened in Europe by the existence of well-known wooden toy companies like HABA, Plan Toys, and Janod. Consumer confidence and market growth are further bolstered by these companies' well-known quality and adherence to safety requirements.

Strong economic growth has been witnessed in the Asia-Pacific area, especially in Southeast Asian, China, and Indian nations. The demand for high-quality toys has expanded because of this expansion, giving middle-class families more disposable income and purchasing power. The region's rapid urbanization has changed customer choices and lifestyles. Demand for wooden toys is rising as more urban parents become conscious of the advantages of sustainable and educational toys. The effects of plastic toys on the environment are becoming more widely recognized. Asia-Pacific parents are choosing eco-friendly products like wooden toys as a result of growing sustainability awareness.

COVID-19 Impact Analysis on the Wooden Toys Market:

Parents started to become cautious about possible toxins in plastic toys as public health became an urgent concern. Wooden toys became more popular because people believed that their natural materials and easier manufacture made them safer overall. Wooden toys are known for their longevity and are simple to clean using natural cleaning agents. This feature of reusability appealed to parents looking for toys that would survive regular washing sessions throughout the pandemic. Lockdowns and other social distancing tactics meant that people, especially kids, spent more time at home. Wooden toys have gained popularity as a welcome substitute for screen time because of their versatility and capacity to inspire creativity. Screen fatigue became a growing concern with increased reliance on digital devices for learning and entertainment. Wooden toys, encouraging unplugged and imaginative play, emerged as a healthy alternative to counter excessive screen time. Wooden toys provide a unique tactile experience, stimulating children's senses in a way that plastic toys often cannot. This focus on sensory development resonated with parents seeking well-rounded play experiences for their children.

Latest Trends/ Developments:

In an age of growing environmental concern, parents are increasingly seeking eco-friendly toys for their children. Wooden toys, made from a naturally renewable resource, resonate with this desire for sustainability. The trend towards minimalism and reducing plastic consumption extends to the toy box. Wooden toys offer a durable and plastic-free alternative, appealing to parents seeking a more natural and eco-friendly approach to playtime. Modern wooden toys are cleverly designed to encourage STEM learning through play. Imagine wooden gears that demonstrate motion or building blocks that introduce spatial concepts – all while sparking a child's curiosity. Handmade wooden toys offer a unique charm and a connection to the craftsmanship behind them. In today's mass-produced world, parents appreciate the individuality and artisanal quality of handcrafted wooden toys. Modern wooden toymakers are blending traditional craftsmanship with contemporary design sensibilities.

Key Players:

-

Littlearth

-

Waldorf Workshop

-

Muddy Fingers

-

Sugar Plum Toys

-

Petit Collage

-

Learning Resources

-

Geo Smart

-

Begin Again Toys

-

Green Toys

-

Nature's Little Helpers

-

iWood Play

Chapter 1. Wooden Toys Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Wooden Toys Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Wooden Toys Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Wooden Toys Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Wooden Toys Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Wooden Toys Market – By Types

6.1 Introduction/Key Findings

6.2 Educational and STEM Toys

6.3 Pretend Play Toys

6.4 Building and Construction Toys

6.5 Puzzles and Problem-Solving Toys

6.6 Push and Pull Toys

6.7 Musical Instruments

6.8 Art and Craft Toys

6.9 Y-O-Y Growth trend Analysis By Types

6.10 Absolute $ Opportunity Analysis By Types, 2024-2030

Chapter 7. Wooden Toys Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Specialty Toy Stores

7.3 Online Retailers

7.4 Department Stores

7.5 Eco-friendly and Natural Product Stores

7.6 Direct from Manufacturers

7.7 Y-O-Y Growth trend Analysis By Distribution Channel

7.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Wooden Toys Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Types

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Types

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Types

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Types

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Types

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Wooden Toys Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Littlearth

9.2 Waldorf Workshop

9.3 Muddy Fingers

9.4 Sugar Plum Toys

9.5 Petit Collage

9.6 Learning Resources

9.7 Geo Smart

9.8 Begin Again Toys

9.9 Green Toys

9.10 Nature's Little Helpers

9.11 iWood Play

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Growing environmental awareness is leading parents to seek eco-friendly alternatives for their children's toys. Wooden toys, made from a naturally renewable resource, align perfectly with this desire for sustainability.

Wooden toys, due to the use of natural materials and potentially handcrafted elements, can be more expensive than their plastic counterparts. This can be a deterrent for price-sensitive consumers.

Littlearth, Waldorf Workshop, Muddy Fingers, Sugar Plum Toys, Petit Collage, Learning Resources, Geo Smart, Begin Again Toys, Green Toys, Nature's Little Helpers, iWood Play.

Europe is the most dominant area in the cards and payments market. Its substantial market share of 35%.

The Asia Pacific, while currently holding a smaller market share of 20%, is the fastest growing region in Wooden Toys Market.