Wood Fiber-based Composite Market Size (2024 – 2030)

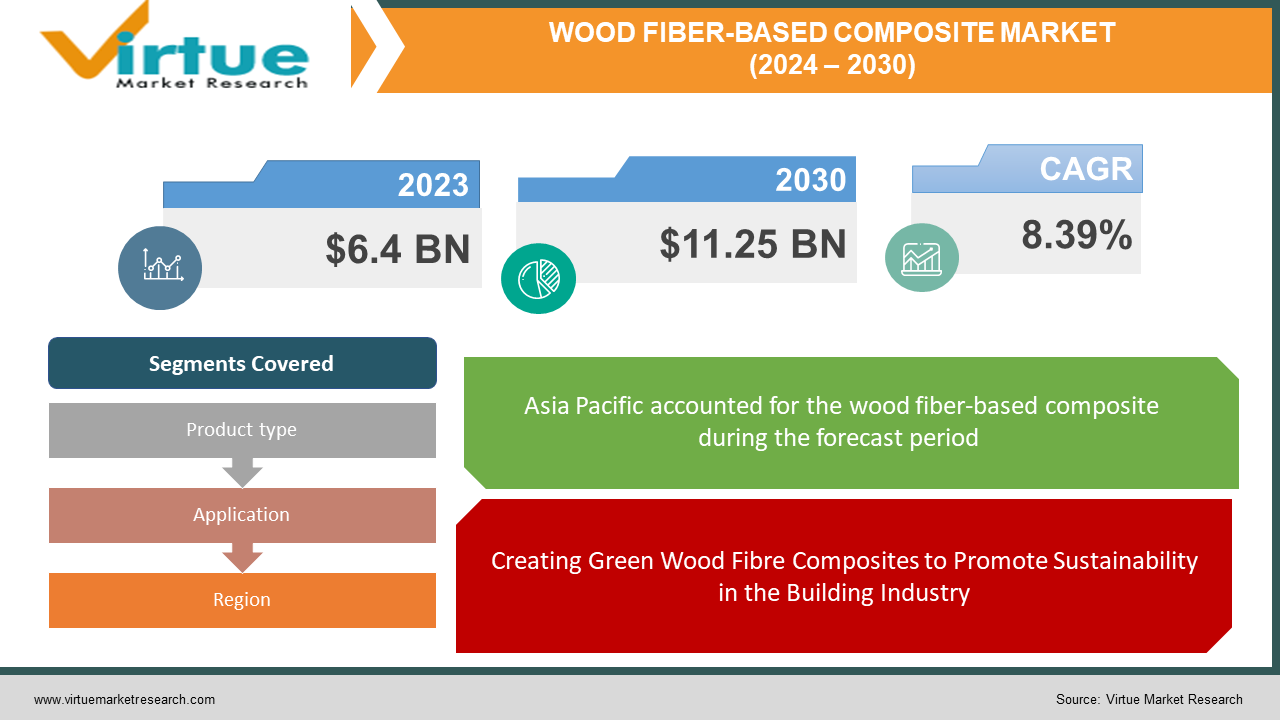

The global Wood Fiber-based Composite market size was exhibited at USD 6.4 billion in 2023 and is projected to hit around USD 11.25 billion by 2030, growing at a CAGR of 8.39% during the forecast period from 2024 to 2030.

Industry leaders and investors find the wood fibre-based composite market to be a fascinating opportunity. One of the main motivators is sustainability; these composites, which are composed of wood fibres mixed with an adhesive or binder, are becoming more environmentally friendly substitutes for traditional materials like steel, concrete, or solid wood. Their frequent incorporation of reclaimed wood debris lessens their influence on the environment. One important market segment where lightweight design meets exceptional durability is the construction industry. For applications where weight reduction is necessary, wood fibre composites are perfect. This results in advantages like reduced construction costs and enhanced building performance. But there are difficulties. Their usage in some high-stress applications may be restricted due to their lower overall strength when compared to some standard choices. Continuous attention is also needed to ensure constant quality and manage raw material price variations. Notwithstanding these obstacles, innovation opens the door to a promising future. Novel applications are becoming possible thanks to developments in bio-based resins and ongoing research on performance enhancements. While the construction industry continues to be a major force driving demand for these adaptable composites, the automobile industry's need for lightweight and sustainable materials offers interesting potential. Wood fibre-based composites have the potential to become a key component of environmentally friendly construction methods and industrial processes if efforts to overcome obstacles are maintained.

Key Market Insights:

Demand for these environmentally friendly substitutes for traditional materials like solid wood, concrete, or steel is rising due to worries about sustainability. Wood fibre composites have a reduced environmental impact throughout their lifetime since they frequently contain reclaimed wood waste. This, together with their outstanding resilience and lightweight design, makes them very appealing to the construction industry. But there are difficulties in the market. Their use may be restricted situations due to their lower overall strength when compared to some standard choices. Obstacles that must be overcome include preserving constant quality and managing changes in raw material prices. Wood fibre composites appear to have a promising future despite these challenges.

Global Wood Fiber-based Composite Market Drivers:

Creating Green Wood Fibre Composites to Promote Sustainability in the Building Industry

Sustainable building practices are championed by wood fibre composites. Because their creation requires less energy than that of materials like steel or concrete, they have a lighter carbon footprint and lessen the strain on forests because they are mostly made from recovered wood waste. Bio-based resins can replace alternatives made from fossil fuels, demonstrating eco-friendliness. Because they divert wood waste and prevent methane emissions from decomposition, these composites are also heroes in landfills. Sustainable forestry methods may even be encouraged by the market for recovered wood. When examining a product's environmental impact throughout its life, wood fibre composites frequently do better than conventional materials. Programmes for green buildings encourage their use, and some composites can even decompose naturally. In a nutshell, they're adaptable, long-lasting building blocks for a cleaner future.

Wood Fibre Composites with Lightweight Strength Revolutionise Construction

Because of its flawless combination of remarkable durability and lightweight design, wood fibre composites excel in the building industry. This results in major advantages throughout a building's existence. Because these composite materials are lightweight, the overall building weight referred to by engineers as the dead load is reduced. This results in several benefits. First, lighter buildings require fewer solid foundations, which results in significant construction cost reductions. Second, architects are now able to push the envelope in high-rise building design by combining wood fibre composites into the construction. Additionally, lighter structures in seismically active areas undergo less stress during seismic events, which may enhance their structural integrity in the case of a disaster. Finally, lightweight materials are advantageous even throughout the assembly and shipping processes. Wood fibre composites can be moved around the construction site more cheaply and easily, which cuts down on labour expenses and construction time. In terms of durability, wood fibre composites outperform conventional solid wood in several important ways. Their dimensional stability is a significant advantage. They are significantly less prone to warping, bending, or twisting because of changes in temperature or humidity than solid wood is. This guarantees the building will continue to have solid structural integrity and a polished, clean appearance for many years to come. Furthermore, wood fibre composites are coated or treated with resins to improve their moisture resistance in comparison to solid wood. This greatly lowers the possibility of warping, rotting, and the growth of Mold particularly crucial in places that are exposed to water or have high humidity.

Global Wood Fiber-based Composite Market Restraints and Challenges:

Notwithstanding their benefits, there are certain restrictions facing the global market for composites made of wood fibre. One issue is the intrinsic trade-off they have: although they are often more durable than alternatives like glass fibre composites, their strength is typically lower. This may limit its use to situations requiring large structural loads. It might also be challenging to maintain a consistent level of quality in the finished product. Precision is needed in manufacturing procedures to guarantee consistent wood fibre qualities throughout since differences might affect overall strength and durability. Another obstacle is price changes. The price stability of wood fibre composites is impacted by fluctuations in the market for essential raw materials such as resins and wood fibres.

Global Wood Fiber-based Composite Opportunities:

The market for composites made of wood fibre has a bright future ahead of it. The emergence of natural fibre reinforcements and bio-based resins is a significant trend that is in line with the growing need for sustainable materials. Because of this, wood fibre composites may have a major advantage over more conventional solutions. Additionally, there is a great opportunity due to the construction industry's increasing demand for sustainable and lightweight building materials. Because of their superior performance in these areas, wood fibre composites are a serious competitor to replace conventional materials for flooring, walls, and even some structural elements. The pursuit of lighter vehicles by the automobile industry to enhance fuel efficiency also presents promising opportunities for wood fibre composites in interior components such as door panels and dashboards. Lastly, there is a great deal of promise for future advancements in wood fibre composite technology.

WOOD FIBER-BASED COMPOSITE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.39% |

|

Segments Covered |

By Product type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Trex Company, UPM Biocomposites, Weyerhaeuser, The AZEK Company, Oldcastle APG |

Global Wood Fiber-based Composite Market Segmentation: By Product Type

-

Wood-Plastic Composites (WPCs)

-

Medium-Density Fiberboard (MDF)

-

High-Density Fiberboard (HDF)

-

Particleboard

-

Other

By product type, the global market for wood fibre-based composites can be divided, displaying a wide variety of materials. With the greatest market share now, Wood-Plastic Composites (WPCs) are frequently utilised in the construction of outside buildings like decks and fences. Medium-Density Fibreboard (MDF), a material commonly found in cabinets, furniture, and interior panels, is another significant market. For applications like countertops that require exceptional strength and smooth surfaces, High-Density Fibreboard (HDF) provides a denser and tougher alternative. Particleboard uses larger wood particles that are glued together to meet the demands of furniture and building at a low cost. Lastly, a developing market area is included in the "Other" category: bio-based composites. These are the most rapidly expanding and environmentally friendly options available in the wood fibre-based composite industry since they make use of bio-based resins and reinforcements made of natural fibres.

Global Wood Fiber-based Composite Market Segmentation: By Application

-

Building & Construction

-

Automotive

-

Consumer Goods

-

Packaging

Via several divisions, the global market for wood fibre-based composites serves a range of applications. The industry leader is Building & Construction, which uses these composites for everything from cabinets and furniture to walls and flooring. Competition to be the fastest-growing segment is intensifying. The automotive industry's transition to more environmentally friendly, lightweight materials makes wood fibre composites an excellent choice for interior car design and a serious contender for this award. On the other hand, bio-based composites are becoming more and more popular in a variety of applications due to their environmentally favourable qualities. They may become the fastest-growing category within application areas, such as construction or even the automotive industry, thanks to this increasing pace.

Global Wood Fiber-based Composite Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The market for wood fibre-based composites worldwide serves several geographical areas with different dynamics. With a well-established demand for wood fibre composites in the building industry and other sectors, North America is considered a mature market. But Asia-Pacific now holds the distinction of being the region with the fastest growth. Here, there is a strong tendency towards urbanisation and rising disposable incomes, which drives up demand for consumer products and building materials, both of which largely rely on wood fibre composites. An increasing number of established markets, like Europe, are showing a preference for sustainable building materials, especially wood fibre composites derived from biotechnology. This pattern points to the region's positive progress. And lastly, developing markets in South America, the Middle East, and Africa may one day help realise the full potential of wood fibre composites.

COVID-19 Impact Analysis on the Global Wood Fiber-based Composite Market:

The worldwide market for wood fibre-based composites was taken by surprise by the COVID-19 outbreak. Producers experienced hardships because of supply chain disruptions brought on by travel restrictions and lockdowns. Production and delivery schedules were impacted by delays in raw supplies and completed goods. The epidemic also caused demand to fluctuate erratically. The demand for wood fibre composites in building materials decreased as lockdowns and general economic instability caused construction projects to come to a complete stop. There might be a bright side, though. Bio-based wood fibre composites may become more popular as an alternative to conventional materials because of the increased emphasis on sustainability and environmentally friendly materials.

Recent Trends and Developments in the Global Wood Fiber-based Composite Market:

In the building materials market, environmentally friendly materials are constantly in demand. Because of its many benefits, natural fibre-reinforced polymer-based composites are being used more and more in civil engineering construction applications. Composite materials are very important in the building and construction sector. Composite materials have been used in industrial supports, tanks, long-span roof structures, high-rise buildings, lightweight doors, windows, furnishings, lightweight buildings, bridge components, and entire bridge systems. To achieve long-term sustainability in the building business, composite materials are becoming more and more important. Significant investments have been made in the construction industry recently. Oxford Economics projects that between 2020 and 2030, the global construction industry will expand by USD 4.5 trillion, or 42%, to reach USD 15.2 trillion. Additionally, between 2020 and 2030, the United States, Indonesia, China, and India are predicted to account for 58.3% of the global growth in the building industry.

The building industry in North America is dominated by the United States. In addition to the US, Canada and Mexico make substantial contributions to investments in the building industry. The yearly value of public residential construction in the US was estimated by the US Census Bureau to be USD 9.15 billion in 2022, up 35.7% from USD 6.74 billion the previous year. 2022 saw a 2.5% growth in the European construction industry thanks to fresh funding from the EU Recovery Fund. Despite pricing difficulties at most EU construction enterprises, business confidence perked up in early 2022 and is predicted to return to pre-COVID-19 levels. Furthermore, builders are less hesitant to make investments in brand-new corporate structures and property renovations when the COVID-19 situation subsides.

Key Players:

-

Trex Company

-

UPM Biocomposites

-

Weyerhaeuser

-

The AZEK Company

-

Oldcastle APG

Chapter 1. WOOD FIBER-BASED COMPOSITE MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. WOOD FIBER-BASED COMPOSITE MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. WOOD FIBER-BASED COMPOSITE MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. WOOD FIBER-BASED COMPOSITE MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. WOOD FIBER-BASED COMPOSITE MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. WOOD FIBER-BASED COMPOSITE MARKET – By Product Type

6.1 Introduction/Key Findings

6.2 Wood-Plastic Composites (WPCs)

6.3 Medium-Density Fiberboard (MDF)

6.4 High-Density Fiberboard (HDF)

6.5 Particleboard

6.6 Other

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. ADHESIVE TAPES MARKET – By Application

7.1 Introduction/Key Findings

7.2 Building & Construction

7.3 Automotive

7.4 Consumer Goods

7.5 Packaging

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. WOOD FIBER-BASED COMPOSITE MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. WOOD FIBER-BASED COMPOSITE MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Trex Company

9.2 UPM Biocomposites

9.3 Weyerhaeuser

9.4 The AZEK Company

9.5 Oldcastle APG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Wood Fiber-based Composite Market size is valued at USD 6.4 billion in 2023.

The worldwide Global Wood Fiber-based Composite Market growth is estimated to be 8.39% from 2024 to 2030.

The Global Flax Fiber-based Composite Market is segmented By Product Type (Wood-Plastic Composites (WPCs), Medium-Density Fiberboard (MDF), High-Density Fiberboard (HDF), Particleboard, Other), By Application (Building & Construction, Automotive, Consumer Goods, Packaging) and Region.

Bio-based resins and natural fibre reinforcements are predicted to expand in the worldwide wood fibre-based composite market in the future, and the benefits of sustainability and lightweight will lead to more applications in the building and automotive sectors.

The COVID-19 epidemic is probably going to have a complicated effect on the global market for wood fibre-based composites. It might cause supply chain interruptions and demand fluctuations because of slowing building.