Wine Packaging Boxes Market Size (2024 – 2030)

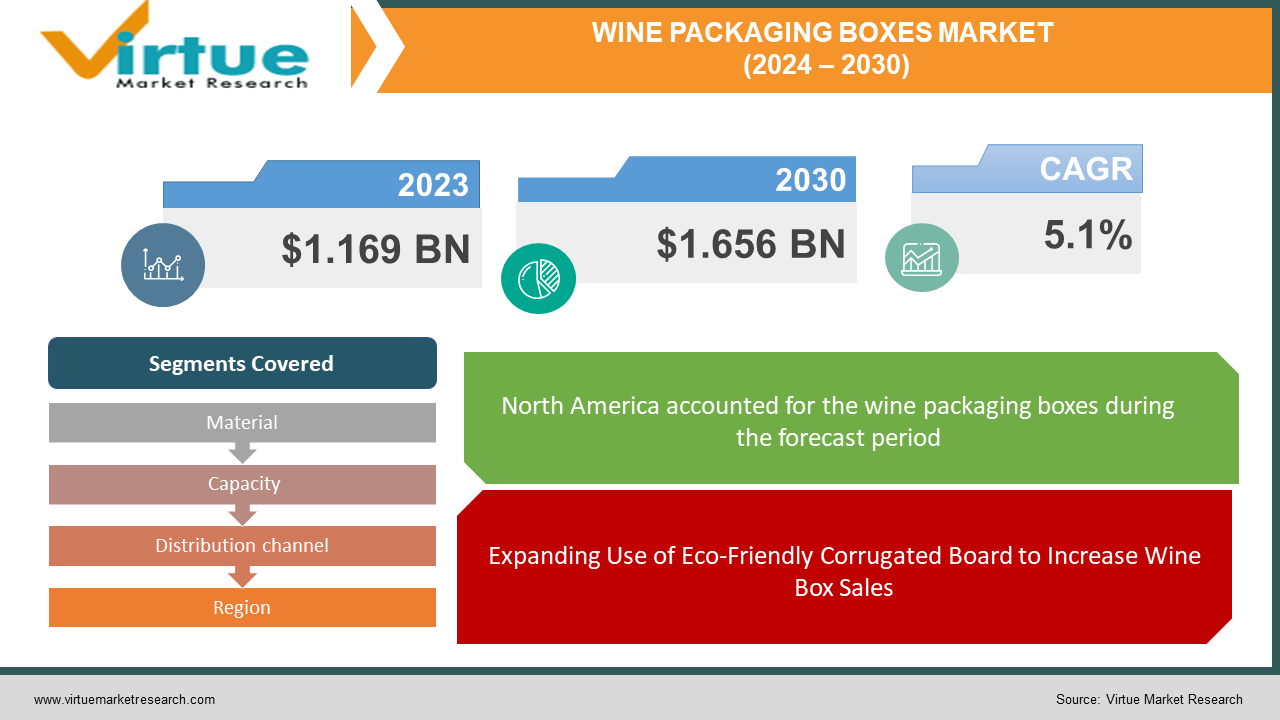

The Global Wine Packaging Boxes Market valued at USD 1.169 Billion in 2023 is projected to reach a market size of USD 1.656 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.1%.

The increasing requirement for safe storage and transportation of wine products, along with the world's growing consumption of bottled wine, is driving up demand for wine boxes. Wine boxes are set to see tremendous growth as more and more winemakers realize the value of sturdy packaging options, especially rigid boxes. These sturdy packaging choices protect wine bottles from potential harm on their route from manufacturing to consumption. They are made of materials including paper, paperboard, and wood. Looking ahead, the global wine box market is expected to grow steadily, driven by the rising demand for effective packaging in the alcohol sector and the continuous global increase in the consumption of bottled wine. The substantial increase in the number of businesses that serve alcohol in both developed and emerging countries has contributed to a noticeable rise in the demand for alcoholic beverages, particularly among younger generations. To put it simply, the market's trajectory for wine boxes shows both the changing tastes of customers and the industry's dedication to providing products in perfect condition, guaranteeing a pleasurable experience from the cellar to the table.

Key Market Insights:

The need for secure and spill-proof wine packaging solutions is greatly impacted by the sharp increase in wine consumption and purchasing trends. The latest advancements in enology have led to a rise in the number of wine producers. In addition, a rise in grape yield has made it possible for wine producers to make wine year-round, regardless of the season. Along with the increase in wine manufacturers, there are an increasing number of companies offering wine packaging options for both single and multiple-bottle packaging. Wine boxes are produced in greater quantities and are used more frequently as appropriate packaging options when there are more industry participants offering wine packaging solutions. The need for wine boxes increases in direct proportion to the rising demand for wine, which in turn fuels the expansion of the wine box market worldwide. Top manufacturers are now concentrating on providing their clients with personalized alcoholic beverage packaging. They will greatly increase their market share during the evaluation period as a result of this.

Global Wine Packaging Boxes Market Drivers:

Expanding Use of Eco-Friendly Corrugated Board to Increase Wine Box Sales.

Both domestic and international producers are using recyclable corrugated boards to make wine boxes and other wine packaging alternatives. The need for packaging solutions comprised of environmentally friendly materials is growing quickly as more and more informed consumers become aware of the damaging impact of polluting materials on the environment. The need for sustainability in all stages of the product's manufacturing and packaging has arisen as a result of campaigns to protect forests. Producers are moving to use 100% recyclable corrugated board, which is easy to recycle after being disposed of properly and doesn't harm the environment. Wine box makers can differentiate their products by emphasizing the reusable aspects of their wine boxes, which presents them with profitable growth prospects in the packaging business. Prominent international brands of alcoholic beverages may also draw attention to the environmentally friendly nature of the wine box that holds the bottles. Due to the production of wine boxes using sustainable raw materials, the worldwide wine box industry is predicted to rise impressively during the next ten years.

Wine box sales have increased due to the growing desire for customization and premium wine packaging.

While consumers are demanding more distinctive and personalized packaging alternatives, the market for items with customized wine packaging is expanding quickly. In a market where brand differentiation is crucial and consumer options are expanding, the ability to personalize wine packaging is being viewed as a crucial competitive advantage. Businesses across a range of industries are understanding how crucial it is to stand out on shop shelves and in customers' minds. Customization makes it possible for visually appealing forms, trends, and branding elements to be used, which not only attract attention but also strengthen brand loyalty. This trend, which not only enhances the visual attractiveness of items but also makes shopping more memorable and interesting for customers, is driving growth in the market for customized wine packaging products.

Global Wine Packaging Boxes Market Restraints and Challenges:

With the introduction of strict laws designed to encourage ecologically friendly solutions and reduce waste, the market for wine packaging boxes may see a slower rate of growth. Businesses will need to make adjustments to comply with these new criteria. Moreover, supply chain interruptions such as transportation issues and shortages of raw materials could jeopardize the accessibility and price of materials used in wine packaging boxes, creating formidable obstacles for both consumers and businesses to overcome. Despite these difficulties, companies need to be creative and flexible to get past them. Some strategies to consider include looking into other kinds of packaging, streamlining the supply chain, and putting sustainable policies in place to lessen their negative effects on the environment. By doing this, they can take advantage of opportunities for long-term growth and sustainability in addition to addressing regulatory obligations and supply chain disruptions.

Global Wine Packaging Boxes Market Opportunities:

Wine packaging box technologies have advanced significantly with the incorporation of smart packaging and the use of biodegradable polymer materials. These developments present interesting paths toward achieving sustainability objectives and improving product distinction. Wine packaging is changing as a result of innovative technologies including flexible plastic containers designed for increased durability and visual appeal. Furthermore, companies in the wine packaging industry can reap numerous benefits by adopting the circular economy's tenets, which prioritize reusing and recycling packaging materials. Wine packaging box makers can reduce their environmental impact and improve affordability throughout the supply chain by developing effective recycling programs and utilizing recycled materials in packaging designs. Additionally, by promoting direct-to-consumer business models, these sustainability initiatives can strengthen customer relationships and increase brand loyalty. All things considered, the industry's embrace of biodegradable materials and smart packaging solutions not only improves the sustainability of wine packaging but also creates new opportunities for innovation, corporate expansion, and environmental responsibility.

WINE PACKAGING BOXES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.1% |

|

Segments Covered |

By Material, Capacity, Distribution channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Graficas Digraf, Marber S.r.l., Nordpack GmbH, DS Smith plc, Stora Enso Oyj, Smurfit Kappa Group plc, Mondi plc |

Wine Packaging Boxes Market Segmentation: By Material

-

Paper and Paperboard

-

Wood

The Global Wine Packaging Boxes Market Segmented by Material, Paper, and Paperboard held the largest market share last year and is poised to maintain its dominance throughout the forecast period. With a predicted growth rate of 1.8% from 2024 to 2030, the paper and paperboard category is expected to maintain its dominant position in the global wine box market. At now, it holds a significant portion of the market. The increasing inclination towards environmentally friendly packaging options and the use of paper and paperboard in wine box manufacturing are two of the reasons for this steady growth. These materials are used because they are readily available and reasonably priced when compared to other options. Furthermore, the intrinsic qualities of paper and paperboard, such as their affordability and lightweight Ness, make them very popular for use in wine box production. Additionally, the demand for eco-friendly packaging solutions is being driven by environmental concerns, and paper and paperboard materials stand out for being recyclable and biodegradable, which increases their popularity. All things considered, the paper and paperboard industry is well-positioned to keep its dominant position in the wine box market, propelled by the ongoing need for environmentally friendly packaging options and the benefits of these materials.

Wine Packaging Boxes Market Segmentation: By Capacity

-

Single Bottle Box

-

Multi Bottle Box

The Global Wine Packaging Boxes Market Segmented by Capacity, Multi Bottle Box held the largest market share last year and is poised to maintain its dominance throughout the forecast period. The popularity of multi-bottle boxes can be attributed to the growing need for bulk packaging in the wine business, which aims to hold many wine bottles in a single container. With the help of these containers, multiple bottles can be transported and stored effectively at once, reducing the need for extra packing supplies. Multi-bottle wine boxes are becoming more and more popular among manufacturers and consumers because of their usefulness and convenience. Multi-bottle boxes provide logistical benefits and aid in environmental sustainability initiatives by minimizing waste through the streamlined packing process and decreasing the requirement for surplus materials. Furthermore, multi-bottle boxes' adaptability makes them appropriate for a range of uses, including gift wrapping and retail displays, which increases their marketability. The wine industry's persistent emphasis on efficiency and sustainability is anticipated to support the strong demand for multi-bottle packaging solutions, hence propelling the segment's expansion.

Wine Packaging Boxes Market Segmentation: Distribution channel

-

Offline Channel

-

Online Channel

The Global Wine Packaging Boxes Market is segmented by distribution channel, Offline Channel held the largest market share last year and is poised to maintain its dominance throughout the forecast period. The wine business continues to favor offline distribution methods because of its accessibility and ease, especially through local vendors and brick-and-mortar stores. An important benefit is how simple it is for wineries to get packing boxes straight from these suppliers. This expedited procedure lowers expenses related to logistics and transportation in addition to saving time. Wine businesses may guarantee a consistent supply of boxes that are customized to meet their unique needs by building direct connections with regional suppliers, thus increasing operational effectiveness. Additionally, winemakers can work closely with vendors to suit their packaging demands through offline distribution channels, which provide a personalized touch. In addition to fostering dependability and trust, this face-to-face communication offers chances for customization and input. Furthermore, wine companies can more successfully access local markets by using offline distribution methods, which capitalize on the familiarity and credibility of local sellers. Because of this, many wine producers who are looking for packaging options that are dependable, affordable, and efficient continue to Favor offline distribution.

Wine Packaging Boxes Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Global Wine Packaging Boxes Market Segmented by Region, North America Channel held the largest market share last year and is poised to maintain its dominance throughout the forecast period. During the forecast period, the USA is anticipated to control roughly 78% of the North American wine box market. The United States' rising wine consumption is the cause of this. As per the Wine Institute, the average American citizen consumed 3.2 gallons of wine in 2021. Given the growing knowledge of wine's health advantages, this number is expected to rise in the upcoming years. This will cause the demand for wine boxes to rise steadily throughout the United States. Furthermore, it is anticipated that the creation of creative wine boxes that may be utilized for aesthetic purposes in addition to the growing use of paper-based rigid boxes for wine bottle protection during transportation operations would present profitable potential for American producers. In this market, Europe is the region with the quickest growth. Because more bottled wine is being exported, the German wine box market is expected to grow at a rate of 4.9% over the projection year. The International Organisation of Vine and Wine Intergovernmental Organisation (OIV) estimates that in 2023, Germany's volume share of bottled wine exports was approximately 73%. Consequently, there will be a continued need for solid wine packaging, such as wine boxes, due to the growing export of bottled wine. Like this, it is anticipated that wine box sales will increase over the evaluation period due to the rising demand for luxury packaging among wine enthusiasts and the growing number of wineries.

COVID-19 Impact Analysis on the Global Wine Packaging Boxes Market:

The COVID-19 epidemic significantly altered the wine industry's environment, leading to a spike in wine sales through internet channels as eateries and bars closed and customers tried to replicate restaurant experiences at home. Online wine orders skyrocketed because of dining-in bans, giving customers access to a wide variety of wines from other locations that aren't available on local store shelves. The industry saw growth as a result of wineries investing in digital marketing methods, which further fuelled the shift to e-commerce. With no middlemen, direct-to-consumer (DTC) sales became the favored method, giving winemakers more control over their profit margins. DTC sales prospered despite pandemic-related setbacks, helped by orders for home isolation. Due to the subsequent increase in wine shipments, there was a demand for packaging boxes. In 2020, the US sent 8.39 million cases of wine, a 27% increase from the year before, demonstrating the supremacy of direct-to-consumer sales. Amidst commands to stay at home, decreased average bottle costs further encouraged wine purchases and shipments. This resulted in fewer people visiting restaurants and wineries.

Latest Trends/ Developments:

Due to its many health advantages, wine is becoming more and more popular worldwide, which is driving up demand for wine packaging options like wine boxes. As a marketing and branding tool, the printability of wine boxes is becoming more and more popular among wine brands. Well-known wine bands are using wine box boxes are being used by well-known wine bands to draw in wine enthusiasts. The driving force behind major global producers in the packaging industry is innovation. These companies are recognized as industry pioneers in the introduction of innovative packaging solutions tailored to end customers' requirements. Some of these industry giants have responded to the packaging waste generated by traditional packaging by introducing corrugated wine boxes. For example, Mondi plc created wine packaging.

Key players:

-

Graficas Digraf

-

Marber S.r.l.

-

Nordpack GmbH

-

DS Smith plc

-

Stora Enso Oyj

-

Smurfit Kappa Group plc

-

Mondi plc

Chapter 1. Wine Packaging Boxes Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Wine Packaging Boxes Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Wine Packaging Boxes Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Wine Packaging Boxes Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Wine Packaging Boxes Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Wine Packaging Boxes Market – By Material

6.1 Introduction/Key Findings

6.2 Paper and Paperboard

6.3 Wood

6.4 Y-O-Y Growth trend Analysis By Material

6.5 Absolute $ Opportunity Analysis By Material, 2024-2030

Chapter 7. Wine Packaging Boxes Market – By Capacity

7.1 Introduction/Key Findings

7.2 Single Bottle Box

7.3 Multi Bottle Box

7.4 Y-O-Y Growth trend Analysis By Capacity

7.5 Absolute $ Opportunity Analysis By Capacity, 2024-2030

Chapter 8. Wine Packaging Boxes Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Offline Channel

8.3 Online Channel

8.4 Y-O-Y Growth trend Analysis By Distribution Channel

8.5 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Wine Packaging Boxes Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Material

9.1.3 By Capacity

9.1.4 By By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Material

9.2.3 By Capacity

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Material

9.3.3 By Capacity

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Material

9.4.3 By Capacity

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Material

9.5.3 By Capacity

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Wine Packaging Boxes Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Graficas Digraf

10.2 Marber S.r.l.

10.3 Nordpack GmbH

10.4 DS Smith plc

10.5 Stora Enso Oyj

10.6 Smurfit Kappa Group plc

10.7 Mondi plc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the size of the worldwide wine box market is projected to be US$ 1.169 Billion.

Demand for wine boxes is expected to rise at a CAGR of 5.1% for the projected period.

By the end of 2030, the wine box market is projected to be valued at US$ 1.656 Billion worldwide.

Paper and paperboard material is anticipated to develop at the highest rate among all material segments in the worldwide market for the forecast period.

Global demand for wine boxes is expected to be driven by rising bottled wine consumption.