Global Wind Turbine Testing and Certification Services Market Size (2023 - 2030)

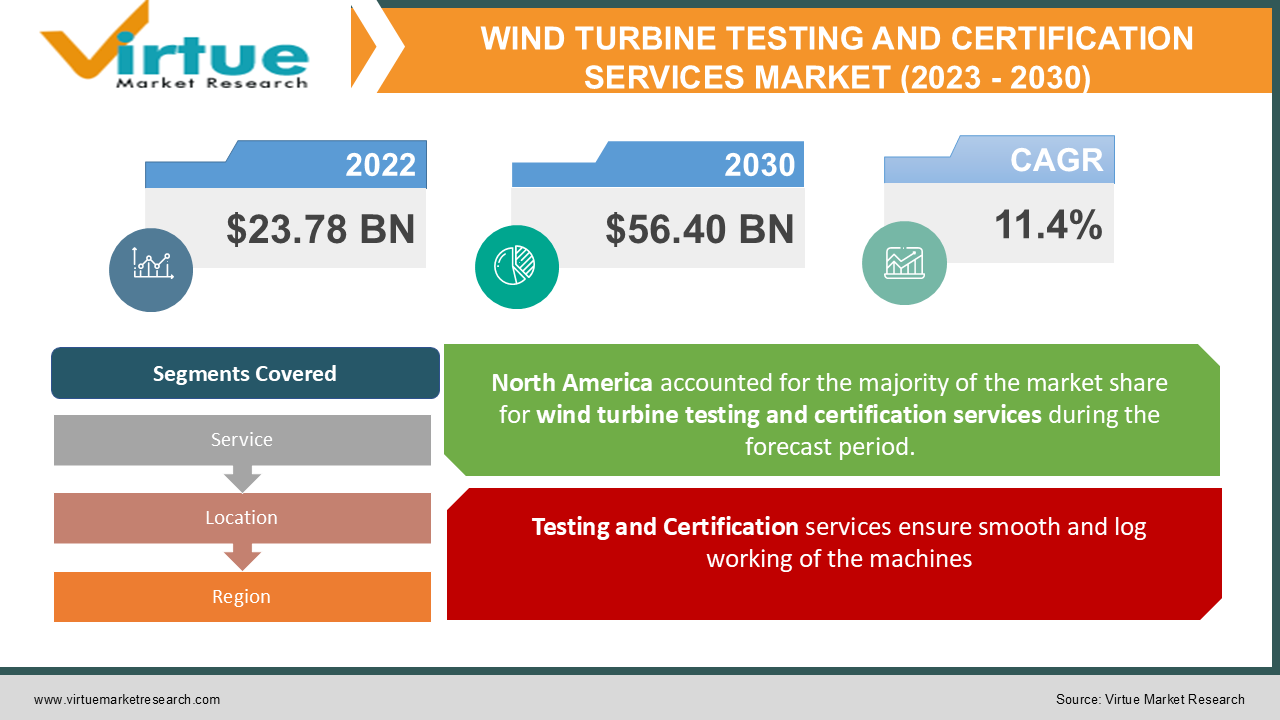

In 2022, the Global Wind Turbine Testing and Certification Services Market was valued at $23.78 billion, and is projected to reach a market size of $56.40 billion by 2030. Over the forecast period of 2023-2030, market is projected to grow at a CAGR of 11.4%.

INDUSTRY OVERVIEW

Inspections of wind turbines are essential since they need to be continuously monitored and maintained to ensure that they are operating at their best. To monitor essential components, a systematic maintenance program and frequent inspections are necessary. The turbine blades are one of the most important areas for inspection and maintenance work on wind turbines. If the blade is damaged, the wind turbine will not operate as effectively, which would reduce power production and cost the operator money. The five categories of services offered by wind turbine inspection companies include quality assurance and quality control, non-destructive examination (NDE), condition assessment and inspection, process safety management, and welding and corrosion engineering.

Wind engine testing facilities are one of the most exciting and rapidly expanding industries in the wind power sector. As a profession, providing inspection services for wind turbines is growing in demand. The need for wind turbine inspection services is rising as capacity increases occur all around the world. One of the most expensive, if not the most expensive, parts of a wind power generation system is the engine. The transmission and creator functions, for example, are just two of the many smaller parts that make up wind engines. To adequately protect themselves against unforeseen preservations, high-end wind farm builders and operators are increasingly choosing wind turbine inspection facilities during scheduled intermissions.A large loss of functionalities might occur as a result of interruptions because of the heavy dependency on proportionality and application elements.

As composite pieces of machinery, wind turbines are built to function in a composite setting. The installed volume of these farms as a whole was over 485 GW in 2019, and the all-inclusive wind power council predicts that it will continue to increase dramatically between 2022 and 2030. To assure the best planning and production, gearboxes and creators, two minor components that make up turbines and are regularly maintained and inspected, are becoming more and more crucial parts of the power generating process. Therefore, to guarantee the lifespan and correct information regarding power generation, farm contractors and drivers must work by service sector standards.Numerous advantages of wind turbines include their affordability, ability to be installed on existing farms or ranches, ability to create jobs, sustainability, clean fuel source, and domestic source of electricity. New wind farms invest close to $10 billion annually in the US economy. The United States can take part in the clean energy economy on a global scale because it has abundant domestic resources and a highly trained labour population. Over 100,000 people are employed by the US wind sector, and wind turbine technician is one of the fastest growing jobs in the nation. Over 600,000 people might be employed in production, installation, maintenance, and associated services by 2050.

COVID-19 IMPACT ON THE WIND TURBINE TESTING AND CERTIFICATION SERVICES MARKET

After the WHO designated COVID-19 a worldwide pandemic in early 2020, governments all over the world put strict measures in place to restrict the virus' spread. There were also constraints on company operations including permitting only a few personnel to work at any location, movement restrictions, and shelter-in-place directives. Few employees were present in the different manufacturing sectors across the world as a result of travel limitations. Directly impacted production levels have raised overall expenses in 2020, including uncovered overhead and logistical costs.The testing, inspection, and certification market has seen significant growth over the past few years in a variety of industries, including wind turbines. This growth has been largely attributed to mandatory certifications across industries like healthcare, consumer electronics, aerospace, and marine as well as the rise in acceptance and usage of Internet of Things-enabled devices that must be evaluated and inspected for their quality and durability. The COVID-19 outbreak, particularly between 2020 and 2021, is estimated to have reduced the need for testing, inspection, and certification. This is because the supply chain was disrupted, leaving many products in manufacturing facilities after all services had already ended.The COVID-19 pandemic outbreak caused businesses, warehouses, corporations, and institutions all around the world to shut down entirely or partially. Additionally, tight social segregation regulations, travel limitations, and limited access to industrial facilities, electronic businesses, and warehouses were implemented as part of the lockdown. Most worldwide industries have experienced disruptions to supply chain operations and services related to logistics. The lack of demand for testing, inspection, and certification services during the pandemic, lockdown procedures, constrained consumer and industrial spending, and lower manufacturing rates brought on by supply chain disruptions have all hampered the growth of the testing, inspection, and certification market.

MARKET DRIVERS:

Testing and Certification services ensure smooth and log working of the machines

Inspections of wind turbines are crucial since they must be constantly watched over and maintained to function at their optimum. A regular inspection schedule and systematic maintenance program are required to monitor vital components. One of the most crucial parts of a wind turbine for maintenance and inspection is the turbine blades. Damage to the blade will make the wind turbine run less efficiently, reducing power output and costing the operator money.Therefore, the aforementioned reasons are likely to propel the market growth

Governments' imposition of stringent regulatory requirementsis what is causing the market for testing, inspection, and certification to expand

Since the rise of liberalism and globalization, clients' top concern has been their safety. Customers are more aware of the need of putting safety first as a result of the increased risk to life. To address these safety issues, organisations are focusing on developing safety by the set rules. Safety and reducing environmental consequences are given primary priority under these criteria. Positive government initiatives to boost the several industries affected by COVID-19 are projected to promote the TIC market's strong recovery and development. A tendency that will support market expansion is also probably to be created by growing digitalization.

MARKET RESTRAINTS:

Regulations and standards that vary between countries and regions to limit market expansion

When commerce and industry grow more transnational, regional rules and norms may make it more difficult for products to be recognised worldwide. The difference between national and international standards might prevent the market from expanding in the future. The coming years' market growth will be impacted by disparities in tax rates brought on by discrepancies in regulatory policies and benchmark criteria by various governments across various nations. The lengthier lead time needed for all qualifying tests may also hinder the market growth for Testing and Safety Inspection Services in the renewable energy sector in the coming years.

High Cost Associated with TIC Services to Hinder the Market Growth

The price of TIC services varies according to the location, and cost of the products. TIC services are costly in wealthy nations. For instance, the SGS SA testing service provider reports that quarterly certification prices in Germany, France, and the United States range from USD 500 to USD 1,500. Additionally, according to ALS Limited, the cost of inspecting consumer and retail goods in China, India, and other countries can range from USD 200 to USD 1,000. Small and medium-sized industrial participants must pay a hefty price for the inspection and certification. As a result, the expansion of the testing, inspection, and certification of wind turbines is constrained by the high cost of these services.

WIND TURBINE TESTING AND CERTIFICATION SERVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

11.4% |

|

Segments Covered |

By Service, Location, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

INTERTEK GROUP PLC ., UPWIND SOLUTIONS INC. , TECHNICAL WIND SERVICES LTD., INVISO SERVICES LTD., CENERGY INTERNATIONAL SERVICES LLC, UL INTERNATIONAL GMBH , ASC ENGINEERING SERVICE, ADVANCED CLEANING TECHNOLOGY LTD., MISTRAS GROUP INC., MIDWEST UNDERGROUND INC., MFG ENERGY SERVICE, VESTAS, SGS SA, FORCE TECHNOLOGY, GLOBAL WIND SERVICE |

This research report on the Wind Turbine Testing and Certification Services Market has been segmented and sub-segmented based on Service, Locationand By Region.

WIND TURBINE TESTING AND CERTIFICATION SERVICES MARKET– BY SERVICE

- Quality Assurance & Quality Control

- Non-Destructive Examination (NDE)

- Condition Assessment/Inspection

- Process Safety Management

- Welding & Corrosion Engineering

- Others

Based on the Services, the market is segmented into Quality Assurance & Quality Control, Non-Destructive Examination (NDE), Condition Assessment/Inspection, Process Safety Management, and Welding & Corrosion Engineering. During the projection period of 2022–2030, the quality assurance and quality control segment is anticipated to expand quickly at a high CAGR. Time and money are both saved through quality management. It allows for evaluations of prior organizationalpractices and establishes new production and innovation models while refocusing attention on efficiency and productivity at every level of an organization. Additionally, it makes it possible for more exhaustive testing and compliance processes, which improves accountability and raises product reliability. Quality control makes ensuring that products are produced to a high standard, which is very helpful in attracting more customers and boosting sales. It is quite advantageous for both maintaining current demand and creating new demand for the product.The assertion that quality control is a potent instrument for growing domestic and foreign markets is accurate.

WIND TURBINE TESTING AND CERTIFICATION SERVICES MARKET- BY LOCATION

- Onshore

- Offshore

Based on the location, the market is segmented into Onshore and Offshore. By 2030, the offshore location segment is anticipated to control a significant percentage of the market. Major businesses and governments are turning to renewable energy, which has the potential to deliver clean energy, in response to the rising need for energy. Advanced offshore wind energy technologies have enticed nations and enterprises to make significant investments. During the forecast period of 2022–2030, the offshore industry is anticipated to continue to be the key driver of investments in the worldwide wind turbine inspection services market due to declining costs and advancing technology.

WIND TURBINE TESTING AND CERTIFICATION SERVICES MARKET- BY REGION

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East

- Africa

By region, the Wind Turbine Testing and Certification Services Marketis grouped into North America, Europe, Asia Pacific, Latin America, The Middle East and Africa.By 2030, the Asia Pacific region is anticipated to have the biggest market share, at 30%. China provides more than 37% of the globally implemented components for energy generation, with over 168.73 MW projected in 2021, according to the GWEC. The fourth-highest number of units implemented globally came from India. It is anticipated that expanding arrangements in these crucial developing provinces in the zone would draw large expenditures. For wind engine testing facilities, the United States, Spain, the United Kingdom, France, and Brazil are all highly desirable nations. By 2030, with the Asia Pacific accounting for over 45% of total revenue, it is anticipated that the Asia Pacific would overtake North America as the main rival due to a considerable rise in annual implementations in China. With 23 GW, China now has the biggest yearly deployments worldwide.During the forecast period of 2022–2030, these are the main reasons that are anticipated to propel the Asia Pacific region's growth in the wind turbine testing and certification services market.

WIND TURBINE TESTING AND CERTIFICATION SERVICES MARKET- BY COMPANIES

Some of the major players operating in the Wind Turbine Testing and Certification Services Marketinclude:

- INTERTEK GROUP PLC .

- UPWIND SOLUTIONS INC.

- TECHNICAL WIND SERVICES LTD.

- INVISO SERVICES LTD.

- CENERGY INTERNATIONAL SERVICES LLC

- UL INTERNATIONAL GMBH

- ASC ENGINEERING SERVICE

- ADVANCED CLEANING TECHNOLOGY LTD.

- MISTRAS GROUP INC.

- MIDWEST UNDERGROUND INC.

- MFG ENERGY SERVICE

- VESTAS

- SGS SA

- FORCE TECHNOLOGY

- GLOBAL WIND SERVICE

Chapter 1. GLOBAL WIND TURBINE TESTING AND CERTIFICATION SERVICES MARKET– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL WIND TURBINE TESTING AND CERTIFICATION SERVICES MARKET– Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. GLOBAL WIND TURBINE TESTING AND CERTIFICATION SERVICES MARKET– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. GLOBAL WIND TURBINE TESTING AND CERTIFICATION SERVICES MARKET- Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL WIND TURBINE TESTING AND CERTIFICATION SERVICES MARKET- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL WIND TURBINE TESTING AND CERTIFICATION SERVICES MARKET– By Services

6.1. Quality Assurance & Quality Control

6.2. Non-Destructive Examination (NDE)

6.3. Condition Assessment/Inspection

6.4. Process Safety Management

6.5. Welding & Corrosion Engineering

6.6. Others

Chapter 7. GLOBAL WIND TURBINE TESTING AND CERTIFICATION SERVICES MARKET– By Location

7.1. Onshore

7.2. Offshore

Chapter 8. GLOBAL WIND TURBINE TESTING AND CERTIFICATION SERVICES MARKET– By Region

8.1. North America

8.2. Europe

8.3. The Asia Pacific

8.4. South America

8.5. Middle-East and Africa

Chapter 9. GLOBAL WIND TURBINE TESTING AND CERTIFICATION SERVICES MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. INTERTEK GROUP PLC.

9.2. UPWIND SOLUTIONS INC.

9.3. TECHNICAL WIND SERVICES LTD.

9.4. INVISO SERVICES LTD.

9.5. CENERGY INTERNATIONAL SERVICES LLC

9.6. UL INTERNATIONAL GMBH

9.7. ASC ENGINEERING SERVICE

9.8. ADVANCED CLEANING TECHNOLOGY LTD.

9.9. MISTRAS GROUP INC.

9.10. MIDWEST UNDERGROUND INC.

9.11. MFG ENERGY SERVICE

9.12. VESTAS

9.13. SGS SA

9.14. FORCE TECHNOLOGY

9.15. GLOBAL WIND SERVICE

Download Sample

Choose License Type

2500

4250

5250

6900