Wind Turbine Market Size (2024 –2030)

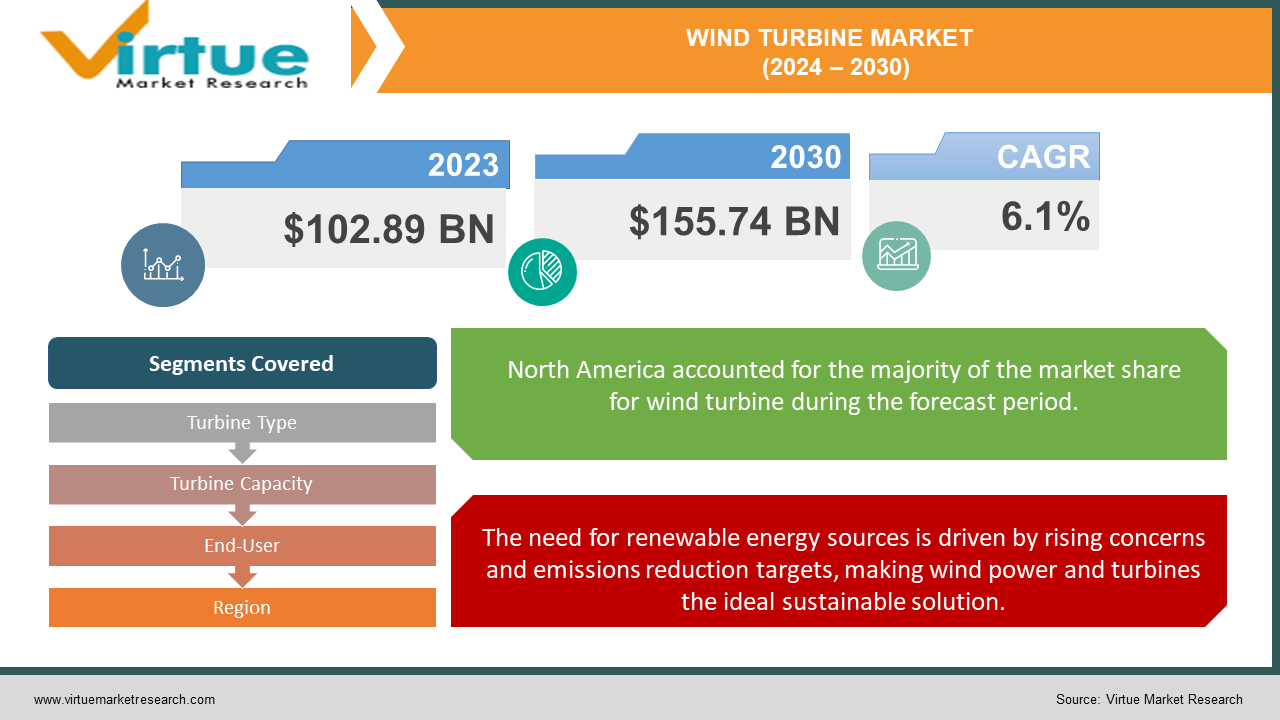

The Global Wind Turbine Market was estimated at USD 102.89 Billion in 2023 and is anticipated to have a value of USD 155.74 Billion by 2030, growing at a fast CAGR of 6.1% during the period (2024-2030).

The design, construction, and upkeep of wind turbines that transform wind energy into electricity are the main priorities of the wind turbine market. When the wind blows, the blades on these turbines spin, generating electricity through a generator. Their operation depends on parts like towers, nacelles (which house the generator), blades, and control systems. For varying project requirements, wind turbines are available in a range of sizes and capacities. Usually, wind farms—vast assemblages of turbines situated in windy regions—are where they are installed. Selecting a location, constructing foundations, moving and erecting turbines, and connecting them to the electrical grid are all part of the installation process. Turbines that receive routine maintenance, such as inspections and repairs, operate efficiently and have a long lifespan. Wind turbines and other renewable energy markets are subject to quick changes, so it's critical to stay up to date on market size, trends, and projections by consulting experts and recent industry reports.

Key Market Insights:

Onshore wind turbines account for approximately 70% of the global wind turbine market share, driven by lower installation costs and easier maintenance compared to offshore installations.

The 2-3 MW capacity segment constitutes around 45% of the market demand for wind turbines, as this range offers a balance between power output and cost-effectiveness for many wind farm projects.

In terms of region, North America holds the largest market share of about 30% for wind turbines, attributed to aggressive renewable energy targets and significant investments in wind power infrastructure, particularly in countries like China and India.

The adoption of larger rotor diameters (>150 meters) in wind turbines is growing at a rate of approximately 15% annually, driven by the need for increased energy capture and improved efficiency, especially in areas with lower wind speeds.

Global Wind Turbine Market Drivers:

The need for renewable energy sources is driven by rising concerns and emissions reduction targets, making wind power and turbines the ideal sustainable solution.

It is predicted that there will be more than 8.5 billion people on the planet by 2050, with a final population of 9.8 billion. This will pose serious challenges to the supply of food and natural resources. The scarcity of food and crops, the competition for resources, the need to boost crop yields under challenging environmental conditions, and the limited availability of land are the main problems. Concerns about food contamination during processing and storage by bacteria are also becoming more widespread. To optimize the use of natural resources, plant hormones, disease prevention, fertilizers, herbicides, metal ions, and other agricultural and food production inputs, sustainable methods and practices must be developed.

Wind power boosts energy security and lessens reliance on fossil fuels, which accelerates market growth.

By offering a dependable, domestic energy source, wind power improves energy security by helping nations diversify their energy sources and lessen their reliance on imported fossil fuels. By generating new infrastructure, tax income, and jobs in the manufacturing, construction, and maintenance of wind turbines and wind farms, the wind energy sector strengthens local economies. Significant improvements in wind turbine efficiency and design, including bigger rotor diameters, taller towers, and better turbine performance, have been made possible by ongoing research and development. These developments have increased energy output and decreased maintenance costs.

Wind Turbine Market Challenges and Restraints:

Wind energy faces a number of difficulties. Its intermittent nature, which depends on wind power, can jeopardize grid stability and necessitates the use of sophisticated infrastructure and energy storage technologies to maintain supply and demand equilibrium. Large land areas with strong wind resources are required for wind turbines, and it can be challenging to locate them, get the required permits, and secure the necessary land rights—especially in densely populated or land-limited areas. Public support is essential because local communities may be against wind farms because of worries about noise, aesthetics, and the impact on wildlife. Furthermore, even though the cost of wind turbines has come down, wind projects still require a large upfront investment, which can be difficult to finance, particularly for smaller developers or projects in developing countries.

Wind Turbine Market Opportunities:

Due to the growing need to cut carbon emissions and the increased demand for renewable energy sources worldwide, the wind turbine market offers substantial opportunities. Innovations in technology, like bigger, more dependable turbines, present opportunities, particularly in areas with low wind speeds. Because offshore wind farms have stronger and more consistent wind resources, there is significant growth potential for these projects. Opportunities are also created by investments in IoT and digitalization technologies for improved turbine monitoring and maintenance. Further improving the market prospects for wind turbines are favorable government policies, financial incentives for renewable energy projects, and rising infrastructure spending in developing nations.

WIND TURBINE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.1% |

|

Segments Covered |

By Turbine Type, Turbine Capacity, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy, General Electric Company, Goldwind, Enercon GmbH, Nordex SE, Suzlon Energy Limited, MingYang Smart Energy Group Co., Ltd., Envision Energy, Senvion S.A. |

Global Wind Turbine Market Segmentation: By Turbine Type

-

Onshore Wind Turbines

-

Offshore Wind Turbines

Onshore wind turbines are the most prevalent type globally, usually found in open spaces such as plains, hills, or coastal regions. When compared to offshore turbines, they are simpler to construct, maintain, and connect to the grid. On the other hand, offshore wind turbines are situated in bodies of water, frequently in offshore or coastal areas. These turbines are more robust and designed to endure severe maritime environments. Their ability to generate electricity is increased by their stronger and more reliable wind resources. On the other hand, there are drawbacks to offshore installations, including more intricate installation procedures, greater expenses, and more maintenance needs.

Global Wind Turbine Market Segmentation: By Turbine Capacity

-

Up to 2 MW

-

2 MW - 3 MW

-

3 MW - 5 MW

-

Above 5 MW

Wind turbines are divided into two categories based on their capacity: those under two megawatts (MW) are usually used for medium-scale energy generation, which is commonly found in onshore wind farms, and for smaller-scale projects like residential, commercial, and community installations. Often found in both onshore and offshore wind farms, turbines in the 3 MW to 5 MW range are made to harness stronger winds for significant electricity generation. Offshore wind farms usually use turbines larger than 5 MW in order to maximize energy production in these difficult conditions by utilizing the more powerful and consistent wind resources at sea.

Global Wind Turbine Market Segmentation: By End-User

-

Independent Power Producers (IPPs)

-

Utilities

-

Commercial and Industrial (C&I) Sector

-

Residential Sector

Companies that produce energy to sell to utilities or to consumers directly are known as independent power producers or IPPs. Because they create, own, and manage wind farms that generate renewable energy, they are major players in the wind turbine industry. In order to sell the electricity produced by their wind farms, IPPs frequently enter into power purchase agreements (PPAs) with utilities or other organizations. In order to meet renewable energy targets and diversify their generation portfolios, utility companies—which normally distribute electricity to consumers and have the capacity to generate power—are also incorporating wind power into their energy mix. They could construct their own wind farms or purchase wind-generated electricity through long-term agreements with wind farm developers. In order to meet sustainability targets, cut carbon footprints, and save energy costs, the commercial and industrial (C&I) sectors—which comprise manufacturing plants, office buildings, retail establishments, data centers, and other businesses—are progressively implementing wind power. C&I organizations have the option to put up wind turbines on their land or enter into agreements to buy wind energy from neighboring wind farms. Individual households and small-scale clients are included in the residential sector. Although there are fewer home wind turbine installations than in other industries, there is growing interest in small-scale residential wind turbines. By producing clean energy for their own use and, in certain cases, selling extra electricity back to the grid, these turbines can assist homes in becoming less reliant on the grid.

Global Wind Turbine Market Segmentation: By Region

-

North America

-

Europe

-

Asia Pacific

-

Middle East and Africa

-

South America

Because of the expanding use of flexible networks, smart connected devices, and the industrial Internet of Things (IoT), North America is the leader in the global market for nano biosensors. The adoption of nano biosensors is facilitated by the growing need for IoT sensors and connected devices. The growing use of mobile and cloud technologies is also propelling the market. As smart connected devices and the Industrial IoT gain popularity, South America will see a greater demand for nano biosensors. Because of its large population and the increasing prevalence of various lifestyle diseases, the Asia Pacific region also holds a significant share of the global market for nano biosensors.

COVID-19 Impact on the Global Wind Turbine Market:

The wind turbine industry experienced notable disruptions due to the COVID-19 pandemic. Project timelines were impacted by delays in the production and delivery of wind turbine components like towers, nacelles, and blades due to plant closures, travel restrictions, and logistical difficulties. The development and installation of wind farms were further delayed by travel bans, social distancing policies, and lockdowns because of the challenges in obtaining labor, supplies, and transportation. The economic downturn made it more difficult to get funding for wind power projects; investors and financial institutions were more cautious, which resulted in delays or cancellations, particularly for smaller developers or projects in developing nations. The pandemic also hindered the development of new wind projects because it was difficult for developers to get permits, carry out environmental assessments, and interact with local communities. As a result, there were fewer project announcements and developments.

Latest Trend/Development:

Current developments in the wind turbine industry are a reflection of technological progress, with an emphasis on increasing turbine dependability and efficiency through improved gearbox and generator technologies, better blade designs, and sophisticated control systems. Larger rotor diameters and capacities are being developed for turbines in order to increase their size and increase the production of electricity, particularly in regions where wind speeds are lower. Because of the potential for increased energy output and less impact on the land, offshore wind farms are growing thanks to developments in floating turbine technology. IoT sensors and data analytics are contributing significantly to the improvement of turbine monitoring and maintenance through digitalization. Wind energy is becoming more competitive on a global scale as a result of efforts to cut costs through effective manufacturing, supply chain management, and project financing. Wind power is being adopted by emerging markets in Latin America and Asia-Pacific with the help of infrastructural investments and supportive policies from the government. The market for wind turbines is dynamic and expanding as a result of the successful management of variable renewable sources and improved grid stability brought about by the integration of wind with energy storage and hybrid systems.

Key Players:

-

Vestas Wind Systems A/S

-

Siemens Gamesa Renewable Energy

-

General Electric Company

-

Goldwind

-

Enercon GmbH

-

Nordex SE

-

Suzlon Energy Limited

-

MingYang Smart Energy Group Co., Ltd.

-

Envision Energy

-

Senvion S.A.

Market News:

-

Leading wind turbine manufacturer Vestas unveiled its new EnVentus platform in June 2022. To increase the effectiveness and performance of wind farms, this platform includes turbines with bigger rotor diameters, improved energy capture, and sophisticated control systems.

-

Nordex launched the N163/5.X turbine in March of 2022. This turbine can produce 5.7 MW of power and has a rotor diameter of 163 meters. It makes use of cutting-edge technology to improve performance in low-wind situations, reduce noise, and provide adaptive control.

Chapter 1. Wind Turbine Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Wind Turbine Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Wind Turbine Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Wind Turbine Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Wind Turbine Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Wind Turbine Market – By Turbine Type

6.1 Introduction/Key Findings

6.2 Onshore Wind Turbines

6.3 Offshore Wind Turbines

6.4 Y-O-Y Growth trend Analysis By Turbine Type

6.5 Absolute $ Opportunity Analysis By Turbine Type, 2024-2030

Chapter 7. Wind Turbine Market – By Turbine Capacity

7.1 Introduction/Key Findings

7.2 Up to 2 MW

7.3 2 MW - 3 MW

7.4 3 MW - 5 MW

7.5 Above 5 MW

7.6 Y-O-Y Growth trend Analysis By Turbine Capacity

7.7 Absolute $ Opportunity Analysis By Turbine Capacity, 2024-2030

Chapter 8. Wind Turbine Market – By End User

8.1 Introduction/Key Findings

8.2 Independent Power Producers (IPPs)

8.3 Utilities

8.4 Commercial and Industrial (C&I) Sector

8.5 Residential Sector

8.6 Y-O-Y Growth trend Analysis By End User

8.7 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 9. Wind Turbine Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Turbine Type

9.1.3 By Turbine Capacity

9.1.4 By End User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Turbine Type

9.2.3 By Turbine Capacity

9.2.4 By End User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Turbine Type

9.3.3 By Turbine Capacity

9.3.4 By End User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Turbine Type

9.4.3 By Turbine Capacity

9.4.4 By End User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Turbine Type

9.5.3 By Turbine Capacity

9.5.4 By End User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Wind Turbine Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Vestas Wind Systems A/S

10.2 Siemens Gamesa Renewable Energy

10.3 General Electric Company

10.4 Goldwind

10.5 Enercon GmbH

10.6 Nordex SE

10.7 Suzlon Energy Limited

10.8 MingYang Smart Energy Group Co., Ltd.

10.9 Envision Energy

10.10 Senvion S.A.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Wind Turbine Market was esteemed at USD 102.89 Billion in 2023.

The Global Wind Turbine Market drives Increasing Demand for Point-of-Care Testing, Technological Advancements, Growing Emphasis on Early Disease Detection and Monitoring, and Increasing Application in Food Safety and Environmental Monitoring.

The Segments under the Global Wind Turbine Market by Turbine Capacity are Up to 2 MW, 2 MW - 3 MW, 3 MW - 5 MW, and Above 5 MW.

China, Japan, South Korea, Singapore, and India are the most dominating countries in the Asia Pacific region for the Global Wind Turbine Market.

Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy, and General Electric Company are the three major leading players in the Global Wind Turbine Market.