Wind Power Market Size (2024 – 2030)

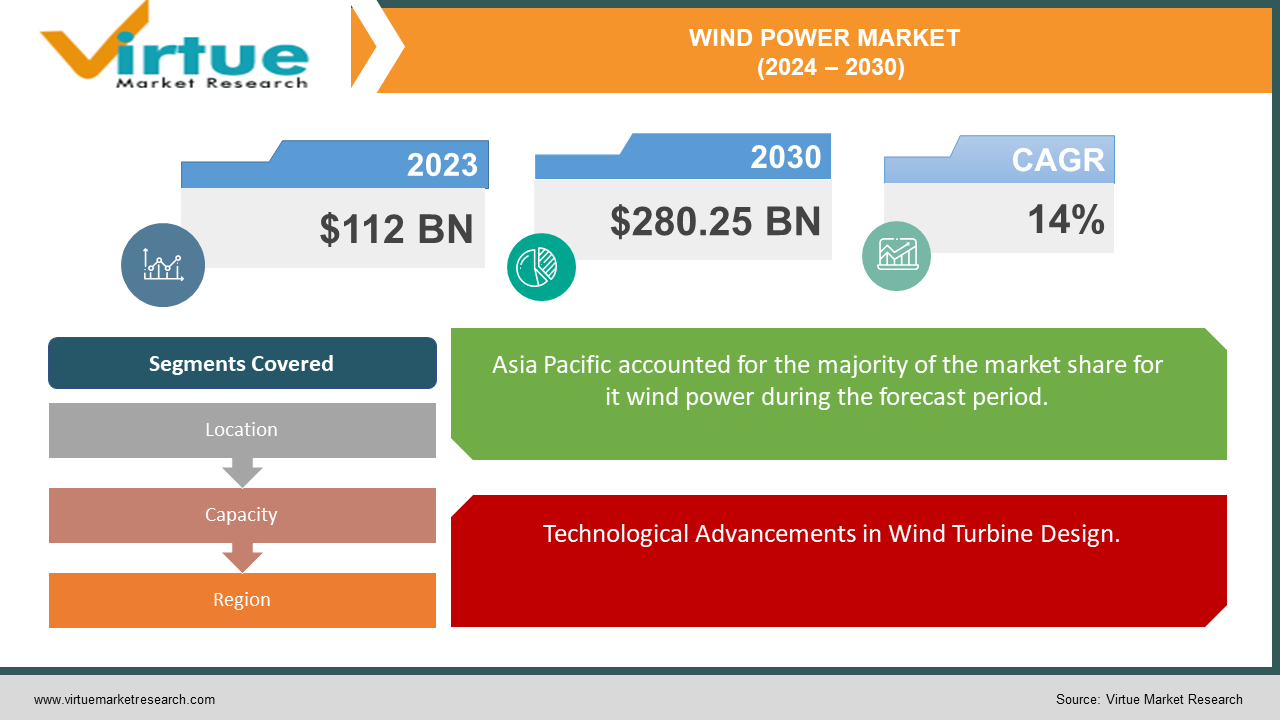

The Global Wind Power Market was valued at USD 112 billion in 2023 and is projected to reach a market size of USD 280.25 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 14% between 2024 and 2030.

The global wind power market has witnessed remarkable growth over the past few decades, emerging as a pivotal component in the transition to sustainable energy sources. Driven by increasing environmental awareness, technological advancements, and supportive governmental policies, wind energy has established itself as a reliable and cost-effective alternative to fossil fuels. This market encompasses a diverse array of onshore and offshore wind projects, with significant investments flowing into regions such as Europe, North America, and Asia-Pacific. Innovations in turbine technology, alongside enhanced grid integration capabilities, have further bolstered the efficiency and scalability of wind power. As nations strive to meet ambitious renewable energy targets and combat climate change, the wind power sector is poised for continued expansion. Key players in the industry are focusing on strategic collaborations, research and development, and large-scale installations to capture a larger share of this burgeoning market. Consequently, wind power not only contributes to energy security and economic development but also plays a crucial role in reducing global carbon emissions, marking a significant step towards a greener and more sustainable future.

Key Market Insights:

In recent years, the global wind power capacity reached an impressive 906 gigawatts (GW).

Onshore wind power holds a dominant position, comprising around 67% of the market share in recent years. Offshore wind power, though smaller, is rapidly growing, with projections suggesting its installations will triple by 2030.

The Asia Pacific region leads the global wind power market, with a market share exceeding 50% in recent years, driven by strong developments in China and India.

Wind turbines in the 3 MW to 5 MW range are currently the most popular, offering a perfect balance between efficiency and cost-effectiveness.

The wind industry is a significant job creator, employing over 120,000 people in the US alone.

Wind energy helped avoid an estimated 348 million metric tons of CO2 emissions in the US in recent years, highlighting its environmental benefits.

Recent years saw a notable 9% increase in wind power capacity, with 77.6 GW of new installations connected to the grid.

Global Wind Power Market Drivers:

Technological Advancements in Wind Turbine Design.

One of the primary drivers propelling the global wind power market is the continuous technological advancements in wind turbine design and efficiency. Innovations in aerodynamics, materials science, and control systems have significantly enhanced the performance and reliability of wind turbines. Modern turbines are now capable of capturing wind energy more efficiently, even at lower wind speeds, which has expanded the viable geographic areas for wind farm installations. Advances in blade design and turbine height have also contributed to higher energy output. Additionally, improvements in predictive maintenance and real-time monitoring systems have reduced operational downtime and maintenance costs, making wind power more economically viable. The development of larger, more powerful offshore wind turbines has further revolutionized the market, enabling the harnessing of stronger and more consistent wind resources found at sea. These technological strides not only increase the competitiveness of wind energy compared to traditional fossil fuels but also attract substantial investments from both the public and private sectors, fostering further growth and innovation in the industry.

Supportive Government Policies and Incentives

Supportive government policies and incentives are another critical driver of the global wind power market's expansion. Many countries have implemented robust regulatory frameworks and financial incentives to promote the adoption of renewable energy sources, with wind power being a key beneficiary. Policies such as feed-in tariffs, renewable energy certificates, and tax credits have made investments in wind energy projects more attractive by ensuring stable revenue streams and reducing financial risks. Governments are also setting ambitious renewable energy targets and mandating utility companies to increase the share of wind power in their energy mix. Additionally, international agreements and climate accords, such as the Paris Agreement, have underscored the global commitment to reducing carbon emissions, further galvanizing the push towards wind energy. Public funding for research and development in wind technology, coupled with streamlined permitting processes for wind farms, has accelerated project deployment. These supportive measures not only drive market growth but also enhance energy security, create jobs, and contribute to the broader goal of achieving a sustainable and low-carbon energy future.

Global Wind Power Market Restraints and Challenges:

Despite its promising growth, the global wind power market faces several significant restraints and challenges that could hinder its expansion. One of the primary challenges is the high initial capital investment required for wind power projects, which can be a barrier for smaller developers and emerging markets. Additionally, the variability of wind energy poses a challenge to grid stability and reliability, necessitating advanced storage solutions and grid management technologies that are still in developmental stages or come with high costs. Environmental and social concerns also play a role; wind farms can impact local wildlife, particularly bird and bat populations, and may face opposition from local communities due to noise and aesthetic concerns. Moreover, the lengthy and complex permitting processes in many regions can delay project timelines and increase costs. Supply chain disruptions, particularly for key components like turbine blades and rare earth materials used in generators, further complicate the market dynamics. Finally, competition from other renewable energy sources, such as solar power, which has seen rapidly decreasing costs, adds pressure on the wind power market to continually innovate and reduce expenses. Addressing these challenges is crucial for maintaining the momentum of the wind power market and achieving global renewable energy targets.

Global Wind Power Market Opportunities:

The global wind power market is poised for significant opportunities that promise to drive its growth and transformation. One major opportunity lies in the expansion of offshore wind projects. Offshore wind farms, benefiting from stronger and more consistent winds, have the potential to generate higher energy outputs and are increasingly becoming a focus for investment, particularly in regions with limited onshore space. Technological advancements in floating wind turbines further extend the potential of offshore wind, allowing installations in deeper waters. Another significant opportunity is the integration of wind power with energy storage solutions. As battery technology advances and costs decline, the ability to store and dispatch wind energy on demand will enhance grid stability and reliability, addressing one of the key challenges of wind variability. Additionally, the global push towards green hydrogen production offers a promising avenue for wind power. Wind energy can be used to produce hydrogen through electrolysis, providing a clean fuel for various sectors, including transportation and industry. Emerging markets, particularly in Asia, Africa, and Latin America, present vast untapped potential due to their favorable wind conditions and growing energy needs. By capitalizing on these opportunities, the wind power market can significantly contribute to a sustainable and resilient global energy landscape.

WIND POWER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

14% |

|

Segments Covered |

By Location, Capacity, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Vestas Wind Systems A/S (Denmark), Siemens Gamesa Renewable Energy SA (Spain), General Electric Company (GE Renewables) (US), Goldwind Science & Technology Co. Ltd (China), Envision Group (Envision Energy) (China), Ming Yang Smart Energy Group Co. Ltd (China), Dongfang Electric Corporation (China), Nordex SE (Germany), Enercon GmbH (Germany), Suzlon Energy Limited (India) |

Global Wind Power Market Segmentation: By Location

-

Onshore

-

Offshore

The Global Wind Power Market Segmented by Location, Onshore had the largest market share last year and is poised to maintain its dominance throughout the forecast period. Onshore wind farms are typically more affordable to install and maintain compared to offshore wind farms, making them particularly attractive to many countries, especially developing economies. The technological maturity of onshore wind turbine technology, which has been refined over the years, ensures a well-established infrastructure, readily available parts, and a broad pool of skilled labor for installation and maintenance. This maturity translates into fewer technical challenges and lower costs, enhancing the feasibility and reliability of onshore projects. Additionally, finding suitable locations for onshore wind farms is often simpler than for offshore projects. Many countries boast vast expanses of land with strong, consistent wind conditions, making onshore development not only feasible but also highly efficient. These factors combine to make onshore wind a more practical and cost-effective choice, driving its popularity and extensive adoption globally. While offshore wind farms benefit from stronger and more consistent winds, their higher installation and maintenance costs and complex logistics often outweigh these advantages. Consequently, onshore wind continues to dominate the wind energy market, supported by industry reports that highlight its substantial market share and forecast its continued prevalence shortly.

Global Wind Power Market Segmentation: By Capacity (Turbine Power Output)

-

Up to 1 MW

-

1 MW to 3 MW

-

3 MW to 5 MW

-

Above 5 MW

The Global Wind Power Market Segmented by Capacity, 3MW to 5 MW had the largest market share last year and is poised to maintain its dominance throughout the forecast period. The 3 MW to 5 MW segment is increasingly emerging as the sweet spot for wind turbine capacity, offering an optimal balance between efficiency and cost-effectiveness. While larger turbines can produce more power, their higher installation and maintenance costs can be prohibitive. Conversely, smaller turbines, while cheaper, generate significantly less electricity, making them less attractive for large-scale projects. The 3 MW to 5 MW range strikes a balance by providing substantial energy output without the steep costs associated with larger turbines. This capacity range is particularly suited for large-scale wind farms that require a cost-effective yet powerful solution. The growing demand for renewable energy and the expansion of wind power infrastructure has propelled this segment to the forefront, positioning it as the workhorse of the industry. Its popularity is driven by the need for economically viable yet efficient turbines that can meet the increasing energy demands while keeping operational costs manageable. As the wind power market continues to evolve, the 3 MW to 5 MW turbines are well-positioned to maintain their leading role, ensuring a steady growth trajectory for the sector by balancing power generation capabilities with economic considerations.

Global Wind Power Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The Global Wind Power Market Segmented by Region, Asia Pacific had the largest market share last year and is poised to maintain its dominance throughout the forecast period. The Asia Pacific region, particularly China and India, is experiencing a significant boom in wind power installations, driven by several key factors. Rising energy demand due to rapidly growing populations and increasing electricity needs makes wind power an attractive, clean, and sustainable solution. Government initiatives in these countries, including ambitious renewable energy targets and a range of subsidies and incentives, further bolster wind power development. Additionally, China’s status as a major hub for wind turbine manufacturing ensures a steady supply of turbines at reduced costs, enhancing the feasibility of new projects. Industry reports indicate that the Asia Pacific region held the largest market share in 2023, exceeding 50%, a dominance expected to continue due to these compelling factors. However, other regions remain pivotal in the global wind power landscape. Europe, a historical leader in wind power, continues to advance, particularly in offshore wind development. North America, led by the United States, also boasts a significant wind power market with expectations for continued growth. While Asia Pacific is poised to maintain its lead shortly, Europe's innovative offshore projects and North America's expanding market ensure they will remain crucial contributors to the global wind power market's overall expansion and sustainability.

COVID-19 Impact Analysis on the Global Wind Power Market.

The COVID-19 pandemic significantly impacted the global wind power market, creating both challenges and opportunities. Initially, the pandemic caused widespread disruptions in the supply chain, delaying the production and delivery of key components such as turbines and blades. Lockdowns and restrictions hindered construction activities and led to labor shortages, stalling many wind power projects. Financial uncertainties and shifts in investment priorities also slowed down new project developments. However, the pandemic underscored the importance of renewable energy for economic resilience and sustainability, prompting many governments to reinforce their commitment to green energy transitions. Stimulus packages and recovery plans in several countries included substantial support for renewable energy projects, providing a much-needed boost to the wind power sector. Additionally, the temporary reduction in energy demand during the pandemic highlighted the resilience and reliability of wind power compared to more volatile fossil fuel markets. As economies recover, there is a renewed focus on sustainable development, with wind power playing a crucial role. This has accelerated investments and policy support, paving the way for long-term growth. Overall, while COVID-19 posed significant short-term disruptions, it also catalyzed a strategic shift towards bolstering the global wind power market's robustness and future expansion.

Latest trends / Developments:

The global wind power market is witnessing several key trends and developments that are shaping its future trajectory. One prominent trend is the rapid advancement in wind turbine technology, with a focus on larger and more efficient turbines. Innovations such as taller towers, longer blades, and improved materials are enhancing the efficiency and output of wind turbines, making wind power more competitive. Another significant development is the increasing investment in offshore wind farms, particularly in Europe and emerging markets like Asia-Pacific, driven by the availability of stronger and more consistent wind resources at sea. Hybrid projects that integrate wind power with solar and energy storage solutions are also gaining traction, providing a more stable and reliable energy supply. Additionally, digitalization and the use of artificial intelligence in wind farm operations are optimizing maintenance, predicting failures, and improving overall efficiency. Policy support continues to be strong, with many governments worldwide setting ambitious renewable energy targets and offering incentives for wind power development. Moreover, corporate demand for renewable energy is rising, with many companies committing to 100% renewable energy and entering into power purchase agreements (PPAs) with wind power producers. These trends are collectively driving the global wind power market towards greater growth, sustainability, and technological sophistication.

Key Players:

-

Vestas Wind Systems A/S (Denmark)

-

Siemens Gamesa Renewable Energy SA (Spain)

-

General Electric Company (GE Renewables) (US)

-

Goldwind Science & Technology Co. Ltd (China)

-

Envision Group (Envision Energy) (China)

-

Ming Yang Smart Energy Group Co. Ltd (China)

-

Dongfang Electric Corporation (China)

-

Nordex SE (Germany)

-

Enercon GmbH (Germany)

-

Suzlon Energy Limited (India)

Chapter 1. Wind Power Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Wind Power Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Wind Power Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Wind Power Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Wind Power Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Wind Power Market – By Location

6.1 Introduction/Key Findings

6.2 Onshore

6.3 Offshore

6.4 Y-O-Y Growth trend Analysis By Location

6.5 Absolute $ Opportunity Analysis By Location, 2024-2030

Chapter 7. Wind Power Market – By Capacity

7.1 Introduction/Key Findings

7.2 Up to 1 MW

7.3 1 MW to 3 MW

7.4 3 MW to 5 MW

7.5 Above 5 MW

7.6 Y-O-Y Growth trend Analysis By Capacity

7.7 Absolute $ Opportunity Analysis By Capacity , 2024-2030

Chapter 8. Wind Power Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Location

8.1.3 By Capacity

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Location

8.2.3 By Capacity

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Location

8.3.3 By Capacity

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Location

8.4.3 By Capacity

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Location

8.5.3 By Capacity

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Wind Power Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Vestas Wind Systems A/S (Denmark)

9.2 Siemens Gamesa Renewable Energy SA (Spain)

9.3 General Electric Company (GE Renewables) (US)

9.4 Goldwind Science & Technology Co. Ltd (China)

9.5 Envision Group (Envision Energy) (China)

9.6 Ming Yang Smart Energy Group Co. Ltd (China)

9.7 Dongfang Electric Corporation (China)

9.8 Nordex SE (Germany)

9.9 Enercon GmbH (Germany)

9.10 Suzlon Energy Limited (India)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the Global Wind Power market is expected to be valued at US$ 112 trillion.

Through 2030, the Global Wind Power market is expected to grow at a CAGR of 14%.

By 2030, the Global Wind Power Market is expected to grow to a value of US$ 280.25 billion.

Asia Pacific is predicted to lead the Global Wind Power market.

The Global Wind Power Market has segments By Location, Capacity, and Region