Wind Energy Conversion Systems Market Size (2024 – 2030)

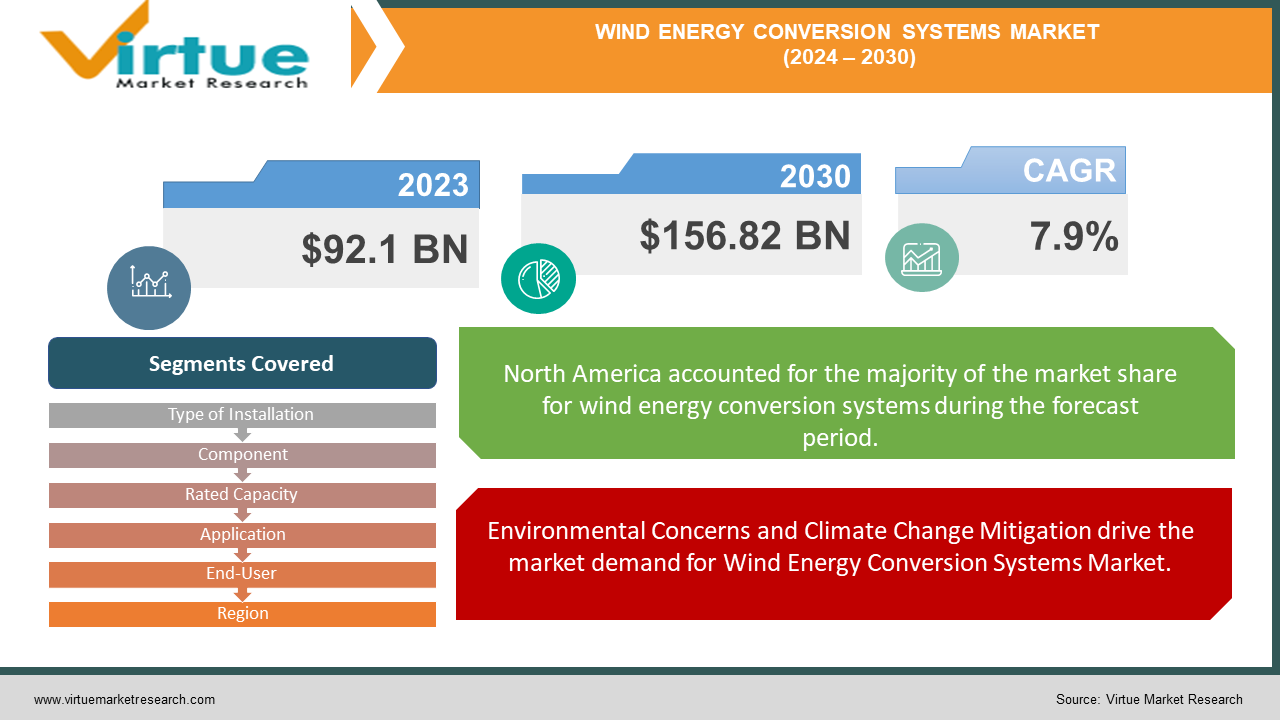

The Global Wind Energy Conversion Systems Market is valued at USD 92.1 Billion and is projected to reach a market size of USD 156.82 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.9%.

A key long-term driver for the Wind Energy Conversion Systems market is the global push towards reducing carbon emissions. Governments worldwide are setting ambitious targets to cut greenhouse gases. They are investing in renewable energy sources like wind to meet these goals. Wind energy is clean and abundant, making it a crucial part of the solution to climate change. Policies and subsidies are encouraging the development of wind farms. These initiatives are boosting the market for wind energy systems. An exciting opportunity in the WECS market is the development of offshore wind farms. Offshore wind energy has vast potential. The wind at sea is stronger and more consistent than on land. This makes offshore wind farms very efficient. Countries with coastlines are investing in these projects to harness this energy. Offshore wind farms can generate large amounts of electricity without taking up valuable land space. This opportunity is driving significant investments and innovation in the market.

A notable trend in the wind energy industry is the integration of digital technologies. Smart wind turbines equipped with sensors and software are becoming common. These technologies enable real-time monitoring and maintenance.

Key Market Insights:

The Wind Energy Conversion Systems Market is projected to expand at a compound annual growth rate of over 7.9% in the coming seven years, propelled by increasing urbanization and population growth in major cities worldwide.

Vestas Wind Systems A/S – Denmark, Siemens Gamesa Renewable Energy, S.A. – Spain, and GE Renewable Energy – USA are some examples of the Wind Energy Conversion Systems Market.

North America & Asia-Pacific accounts for approximately 65-70 % of the Wind Energy Conversion Systems Market, driven by Environmental Concerns and Climate Change Mitigation, Government Policies and Incentives, Technological Advancements & Rising Energy Demand and Energy Security.

Wind Energy Conversion Systems Market Drivers:

Environmental Concerns and Climate Change Mitigation drive the market demand for Wind Energy Conversion Systems Market.

One of the most significant drivers of the WECS market is the global effort to combat climate change. The burning of fossil fuels for energy is a major source of greenhouse gas emissions, which contribute to global warming and environmental degradation. Governments and organizations worldwide are increasingly recognizing the need to reduce carbon footprints and are therefore turning to renewable energy sources like wind power. Wind energy is a clean, sustainable, and inexhaustible resource that generates electricity without emitting greenhouse gases. This environmental benefit is a powerful driver, encouraging nations to invest in wind energy infrastructure and technologies to meet their climate goals.

Government Policies and Incentives drive the market demand for the Wind Energy Conversion Systems Market.

Government policies and incentives play a crucial role in the growth of the WECS market. Many countries have implemented supportive regulatory frameworks and financial incentives to promote the adoption of renewable energy. These include tax credits, subsidies, feed-in tariffs, and renewable energy certificates. For instance, the Production Tax Credit (PTC) and Investment Tax Credit (ITC) in the United States have significantly boosted wind energy investments. Similarly, the European Union's Renewable Energy Directive sets binding targets for member states to increase their share of renewable energy. These policies reduce the financial risks associated with wind energy projects and make them more attractive to investors and developers.

Technological Advancements drive the market demand for Wind Energy Conversion Systems Market.

Technological advancements are another major driver of the WECS market. Innovations in wind turbine design, materials, and manufacturing processes have greatly improved the efficiency, reliability, and cost-effectiveness of wind energy systems. Modern wind turbines are capable of capturing more energy from the wind due to improved aerodynamics, larger rotor diameters, and higher tower heights. Advances in control systems and predictive maintenance technologies also enhance the performance and lifespan of wind turbines. These technological improvements lower the overall cost of wind energy, making it more competitive with conventional energy sources like coal and natural gas.

Rising Energy Demand and Energy Security drive the market demand for the Wind Energy Conversion Systems Market.

The global demand for energy is increasing due to population growth, urbanization, and economic development. At the same time, there is a growing need for energy security to ensure a stable and reliable energy supply. Wind energy addresses both of these needs effectively. It provides a renewable and locally sourced energy option that can help diversify the energy mix and reduce dependence on imported fossil fuels. This is particularly important for countries that lack domestic fossil fuel resources and are vulnerable to energy supply disruptions. By investing in wind energy, these nations can enhance their energy security while meeting their rising energy demands sustainably.

Wind Energy Conversion Systems Market Restraints and Challenges:

While the Wind Energy Conversion Systems (WECS) market is experiencing significant growth, it faces several restraints and challenges that could hinder its development. One of the primary challenges is the high initial capital investment required for the installation of wind turbines and related infrastructure. The cost of land acquisition, turbine manufacturing, transportation, and installation can be prohibitively expensive, especially for offshore wind farms. These high upfront costs can be a deterrent for potential investors and developers, particularly in regions where financial incentives and government support are limited or uncertain. Additionally, the return on investment for wind energy projects can take several years, which may not align with the shorter-term profit goals of some investors.

Wind Energy Conversion Systems Market Opportunities:

The Wind Energy Conversion Systems (WECS) market presents numerous opportunities that promise to drive its growth and innovation in the coming years. One significant opportunity lies in the expansion of offshore wind farms. Offshore wind energy has immense potential due to the stronger and more consistent wind speeds found at sea compared to land. Countries with extensive coastlines, such as the United States, the United Kingdom, and China, are increasingly investing in offshore wind projects. These projects can generate large amounts of electricity without using valuable land resources. The development of floating wind turbines, which can be deployed in deeper waters where winds are even more robust, further expands the possibilities for offshore wind energy. This technology allows for the exploitation of previously inaccessible wind resources, offering a substantial boost to the global wind energy capacity.

WIND ENERGY CONVERSION SYSTEMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.9% |

|

Segments Covered |

By Type of Installation, Component, Rated Capacity, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Vestas Wind Systems A/S - Denmark, Siemens Gamesa Renewable Energy, S.A. - Spain, GE Renewable Energy - USA, Nordex SE - Germany, Suzlon Energy Limited - India, Goldwind International - China, Envision Energy - China, Senvion S.A. - Germany, Mingyang Smart Energy - China, Dongfang Electric Corporation - China, Siemens Energy - Germany, ACCIONA Energy - Spain, Nordex Acciona Windpower - Germany/Spain, TerraForm Power - USA, RWE Renewables - Germany, Ørsted A/S - Denmark, Climniq - USA, Suzlon Energy Limited - India, United Power - China, Nordex SE - Germany |

Wind Energy Conversion Systems Market Segmentation: By Type of Installation

-

Onshore Wind Energy Conversion Systems

-

Offshore Wind Energy Conversion Systems

In the Wind Energy Conversion Systems (WECS) market, onshore wind energy conversion systems represent the largest segment by type of installation. Onshore wind farms are more prevalent because they are generally less expensive to install and maintain compared to offshore wind farms. The availability of land in various regions and the relative ease of accessing and connecting to existing power grids make onshore installations more attractive. Countries like the United States, China, and Germany have vast stretches of land suitable for onshore wind farms, contributing to the dominance of this segment. Onshore wind energy projects benefit from established technologies and lower costs, which facilitate quicker development and deployment, thereby supporting their leading position in the market.

On the other hand, offshore wind energy conversion systems are the fastest-growing segment in the WECS market. This rapid growth is driven by the significant advantages offered by offshore wind farms, such as stronger and more consistent wind speeds, which lead to higher energy production. Offshore installations also face fewer restrictions related to land use and can be located near densely populated coastal areas where energy demand is high. Technological advancements, including the development of floating wind turbines and more efficient underwater cabling, are reducing the costs and technical challenges associated with offshore wind projects. As a result, countries with extensive coastlines, like the United Kingdom, China, and several European nations, are investing heavily in offshore wind energy, spurring remarkable growth in this segment. The increasing focus on exploiting untapped offshore wind resources positions this segment for continued expansion in the coming years.

Wind Energy Conversion Systems Market Segmentation: By Component

-

Turbines

-

Blades

-

Generators

-

Controllers

-

Gearboxes

-

Towers

-

Others

In the Wind Energy Conversion Systems (WECS) market, turbines represent the largest segment by component. Turbines are the critical heart of any wind energy system, converting kinetic energy from the wind into mechanical energy and then into electrical energy. Given their fundamental role, turbines command the largest share of the market's value. The continuous innovation in turbine technology, such as the development of larger and more efficient blades and more robust turbine designs, has helped maintain this segment's prominence. The growth in onshore and offshore wind projects globally further solidifies the turbine segment's leading position. Key manufacturers are focused on enhancing turbine efficiency and reliability, driving significant investments and advancements in this segment.

Conversely, the fastest-growing segment by component in the WECS market is the energy storage systems. As the integration of renewable energy into the grid increases, the need for reliable and efficient energy storage solutions becomes more critical. Energy storage systems, including advanced batteries, are essential for addressing the intermittency of wind energy, ensuring a stable and continuous power supply even when wind speeds fluctuate. Recent technological advancements and decreasing costs of storage technologies are making them more accessible and attractive for large-scale deployment. Furthermore, regulatory frameworks and policies supporting renewable energy storage are propelling the rapid growth of this segment. The synergy between wind energy systems and energy storage is crucial for the future of renewable energy, positioning this component as a key area of expansion and innovation.

Wind Energy Conversion Systems Market Segmentation: By Rated Capacity

-

Below 1 MW

-

1 MW to 3 MW

-

Above 3 MW

In the Wind Energy Conversion Systems (WECS) market, the segment with a rated capacity of 1 MW to 3 MW stands as the largest by capacity. These medium-capacity turbines strike a balance between cost, efficiency, and applicability, making them the preferred choice for a wide range of wind energy projects, from small community wind farms to larger commercial installations. Turbines in this range are versatile and provide sufficient power output for both onshore and offshore applications. Their widespread adoption is driven by their ability to meet the energy demands of various end-users while maintaining manageable installation and maintenance costs. The extensive use of 1 MW to 3 MW turbines in existing and new wind projects underscores their dominance in the market, supported by a robust supply chain and proven performance.

Conversely, the fastest-growing segment in the WECS market is those turbines with a rated capacity of above 3 MW. This segment is experiencing rapid growth due to the increasing demand for high-capacity turbines capable of generating substantial amounts of electricity, particularly in large-scale offshore wind farms. The higher energy output of these turbines makes them ideal for meeting the growing energy needs of urban areas and industrial applications. Technological advancements are enabling the development of more efficient and reliable high-capacity turbines, which can operate in harsher conditions and generate more power with fewer units, thus reducing overall project costs. The shift towards offshore wind projects, where space constraints are minimal, is a significant factor driving the growth of this segment. As countries aim to boost their renewable energy portfolios and reduce carbon emissions, the deployment of turbines with rated capacities above 3 MW is expected to accelerate, positioning this segment for continued expansion and innovation.

Wind Energy Conversion Systems Market Segmentation: By Application

-

Residential

-

Commercial

-

Industrial

-

Utility

In the Wind Energy Conversion Systems (WECS) market, the utility segment is the largest by application. Utility-scale wind energy projects are massive in scale and are primarily designed to generate electricity for the power grid. These projects typically involve numerous high-capacity wind turbines spread over large areas, both onshore and offshore, to maximize energy production. Utilities are the main drivers of wind energy adoption due to their need to meet the rising electricity demands of large populations and industries. Additionally, government policies and incentives aimed at increasing the share of renewable energy in the overall energy mix have significantly boosted investments in utility-scale wind projects. This segment benefits from economies of scale, where the cost per unit of electricity generated decreases with the size of the project, making it a financially attractive option for energy providers.

On the other hand, the commercial and industrial segment is the fastest-growing application in the WECS market. Businesses and industrial facilities are increasingly turning to wind energy to power their operations as part of broader sustainability and cost-saving initiatives. The declining cost of wind energy technology, coupled with growing environmental awareness and corporate responsibility goals, is driving this trend. Companies are investing in on-site wind turbines or entering into power purchase agreements (PPAs) with wind energy producers to secure a stable and green energy supply. This not only helps in reducing carbon footprints but also offers protection against volatile energy prices. The commercial and industrial sector's rapid growth is further fueled by technological advancements that allow for smaller, more efficient wind turbines suitable for installation on business premises. This segment's dynamic expansion reflects the broader shift towards decentralized and renewable energy solutions in the corporate world.

Wind Energy Conversion Systems Market Segmentation: By End-User

-

Utilities

-

Independent Power Producers (IPPs)

-

Commercial & Industrial (C&I)

-

Residential

In the Wind Energy Conversion Systems (WECS) market, the utilities segment is the largest end-user. Utilities are the primary purchasers of wind energy systems due to their role in generating and distributing electricity to a broad customer base. Utility-scale wind farms, which are large installations of multiple wind turbines, are designed to produce significant amounts of electricity for the grid. This segment's prominence is driven by the need for large-scale, reliable power sources to meet the electricity demands of entire regions or countries. Utilities are major investors in wind energy due to supportive government policies, long-term energy agreements, and the drive to incorporate more renewable energy into their energy portfolios. These large projects benefit from economies of scale, where the cost per unit of electricity decreases as the size of the wind farm increases, making it a favorable option for utility companies.

In contrast, the commercial and industrial segment is the fastest-growing end-user category in the WECS market. Companies across various industries are increasingly adopting wind energy solutions to power their operations and achieve sustainability goals. This growth is driven by several factors, including the declining costs of wind energy technology, which make it more feasible for businesses to invest in on-site wind turbines or enter into power purchase agreements (PPAs). Companies are motivated by the desire to reduce their carbon footprints, manage energy costs, and meet regulatory requirements for green energy. Additionally, advancements in smaller, more efficient wind turbine technologies have made it possible for commercial and industrial facilities to harness wind power effectively. This segment’s rapid expansion reflects a broader trend where businesses are seeking renewable energy sources to improve their environmental impact and secure a stable, long-term energy supply.

Wind Energy Conversion Systems Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East and Africa

In the Wind Energy Conversion Systems (WECS) market, North America stands out as the largest regional segment. This dominance is primarily due to the United States and Canada, which have been leaders in wind energy development for many years. The U.S. has one of the largest wind energy capacities in the world, thanks to extensive investments in onshore wind farms across the Great Plains and expanding offshore projects along the coasts. Federal and state-level incentives, such as tax credits and renewable energy mandates, have driven this growth. Additionally, Canada has been actively developing its wind energy resources, particularly in provinces like Ontario and Alberta, which have rich wind energy potential. The mature infrastructure, established supply chains, and supportive government policies have cemented North America’s position as the largest regional market for wind energy systems.

On the other hand, the Asia-Pacific region is the fastest-growing segment in the WECS market. This rapid growth is driven by countries like China and India, which are aggressively expanding their wind energy capacities to meet rising energy demands and reduce carbon emissions. China, in particular, has led global wind energy growth with ambitious targets and substantial investments in both onshore and offshore wind projects. The country’s vast land resources and favorable wind conditions have enabled it to develop large-scale wind farms. Similarly, India is also making significant strides in wind energy, with a focus on increasing installed capacity and advancing wind turbine technologies. The growth in this region is supported by government initiatives, such as feed-in tariffs and renewable energy targets, which encourage both domestic and international investments in wind energy projects. This dynamic development is expected to continue, driven by increasing energy needs and a strong commitment to renewable energy.

COVID-19 Impact Analysis on Wind Energy Conversion Systems Market:

The COVID-19 pandemic had a mixed impact on the Wind Energy Conversion Systems (WECS) market. On one hand, the pandemic led to significant disruptions in the supply chains for wind turbine components, such as blades, gearboxes, and generators. Lockdowns and travel restrictions caused delays in manufacturing and transportation, which slowed down the progress of new wind energy projects. Additionally, project construction faced delays due to health and safety concerns, and some planned wind farms had to be postponed. These disruptions resulted in slower project timelines and increased costs for many wind energy developers during the peak of the pandemic.

On the other hand, the pandemic also had some positive effects on the WECS market. The global health crisis highlighted the need for a more resilient and sustainable energy system, leading to increased support for renewable energy sources. Governments and policymakers began to prioritize green recovery plans that included significant investments in renewable energy projects as part of their economic recovery strategies. This focus on sustainability helped to drive renewed interest and funding for wind energy initiatives. As countries looked to rebuild their economies, wind energy was seen as a key component of future energy security and environmental responsibility, leading to a resurgence in new wind energy projects and long-term growth prospects for the market.

Latest Trends/ Developments:

One of the latest trends in the Wind Energy Conversion Systems (WECS) market is the rapid advancement of offshore wind farms. Technological innovations are pushing the boundaries of offshore wind energy, leading to the development of larger, more efficient turbines and floating wind farms. Recent projects are exploring deeper waters and harsher conditions, expanding the potential locations for wind farms. Floating wind turbines, in particular, represent a significant leap forward, allowing for the installation of wind farms in areas previously deemed too deep for traditional fixed-bottom turbines. This innovation is opening up new opportunities for large-scale wind energy projects and is expected to significantly boost the market's growth in the coming years. Governments and private companies are heavily investing in these advanced technologies to harness the strong and consistent winds found offshore, aiming to increase the overall efficiency and output of wind energy systems.

Key Players:

-

Vestas Wind Systems A/S - Denmark

-

Siemens Gamesa Renewable Energy, S.A. - Spain

-

GE Renewable Energy - USA

-

Nordex SE - Germany

-

Suzlon Energy Limited - India

-

Goldwind International - China

-

Envision Energy - China

-

Senvion S.A. - Germany

-

Mingyang Smart Energy - China

-

Dongfang Electric Corporation - China

-

Siemens Energy - Germany

-

ACCIONA Energy - Spain

-

Nordex Acciona Windpower - Germany/Spain

-

TerraForm Power - USA

-

RWE Renewables - Germany

-

Ørsted A/S - Denmark

-

Climniq - USA

-

Suzlon Energy Limited - India

-

United Power - China

-

Nordex SE - Germany

Chapter 1. Wind Energy Conversion Systems Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Wind Energy Conversion Systems Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Wind Energy Conversion Systems Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Wind Energy Conversion Systems Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Wind Energy Conversion Systems Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Wind Energy Conversion Systems Market – By Type of Installation

6.1 Introduction/Key Findings

6.2 Onshore Wind Energy Conversion Systems

6.3 Offshore Wind Energy Conversion Systems

6.4 Y-O-Y Growth trend Analysis By Type of Installation

6.5 Absolute $ Opportunity Analysis By Type of Installation, 2024-2030

Chapter 7. Wind Energy Conversion Systems Market – By Component

7.1 Introduction/Key Findings

7.2 Turbines

7.3 Blades

7.4 Generators

7.5 Controllers

7.6 Gearboxes

7.7 Towers

7.8 Others

7.9 Y-O-Y Growth trend Analysis By Component

7.10 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 8. Wind Energy Conversion Systems Market – By Rated Capacity

8.1 Introduction/Key Findings

8.2 Below 1 MW

8.3 1 MW to 3 MW

8.4 Above 3 MW

8.5 Y-O-Y Growth trend Analysis By Rated Capacity

8.6 Absolute $ Opportunity Analysis By Rated Capacity, 2024-2030

Chapter 9. Wind Energy Conversion Systems Market – By Application

9.1 Introduction/Key Findings

9.2 Residential

9.3 Commercial

9.4 Industrial

9.5 Utility

9.6 Y-O-Y Growth trend Analysis By Application

9.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 10. Wind Energy Conversion Systems Market – By End-User

10.1 Introduction/Key Findings

10.2 Utilities

10.3 Independent Power Producers (IPPs)

10.4 Commercial & Industrial (C&I)

10.5 Residential

10.6 Y-O-Y Growth trend Analysis By End-User

10.7 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 11. Wind Energy Conversion Systems Market, By Geography – Market Size, Forecast, Trends & Insights

11.1 North America

11.1.1 By Country

11.1.1.1 U.S.A.

11.1.1.2 Canada

11.1.1.3 Mexico

11.1.2 By Type of Installation

11.1.2.1 By Component

11.1.3 By Rated Capacity

11.1.4 By By End-User

11.1.5 Countries & Segments - Market Attractiveness Analysis

11.2 Europe

11.2.1 By Country

11.2.1.1 U.K

11.2.1.2 Germany

11.2.1.3 France

11.2.1.4 Italy

11.2.1.5 Spain

11.2.1.6 Rest of Europe

11.2.2 By Type of Installation

11.2.3 By Component

11.2.4 By Rated Capacity

11.2.5 By Application

11.2.6 By By End-User

11.2.7 Countries & Segments - Market Attractiveness Analysis

11.3 Asia Pacific

11.3.1 By Country

11.3.1.1 China

11.3.1.2 Japan

11.3.1.3 South Korea

11.3.1.4 India

11.3.1.5 Australia & New Zealand

11.3.1.6 Rest of Asia-Pacific

11.3.2 By Type of Installation

11.3.3 By Component

11.3.4 By Rated Capacity

11.3.5 By Application

11.3.6 By By End-User

11.3.7 Countries & Segments - Market Attractiveness Analysis

11.4 South America

11.4.1 By Country

11.4.1.1 Brazil

11.4.1.2 Argentina

11.4.1.3 Colombia

11.4.1.4 Chile

11.4.1.5 Rest of South America

11.4.2 By Type of Installation

11.4.3 By Component

11.4.4 By Rated Capacity

11.4.5 By Application

11.4.6 By By End-User

11.4.7 Countries & Segments - Market Attractiveness Analysis

11.5 Middle East & Africa

11.5.1 By Country

11.5.1.1 United Arab Emirates (UAE)

11.5.1.2 Saudi Arabia

11.5.1.3 Qatar

11.5.1.4 Israel

11.5.1.5 South Africa

11.5.1.6 Nigeria

11.5.1.7 Kenya

11.5.1.8 Egypt

11.5.1.9 Rest of MEA

11.5.2 By Type of Installation

11.5.3 By Component

11.5.4 By Rated Capacity

11.5.5 By Application

11.5.6 By By End-User

11.5.7 Countries & Segments - Market Attractiveness Analysis

Chapter 12. Wind Energy Conversion Systems Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 Vestas Wind Systems A/S - Denmark

12.2 Siemens Gamesa Renewable Energy, S.A. - Spain

12.3 GE Renewable Energy - USA

12.4 Nordex SE - Germany

12.5 Suzlon Energy Limited - India

12.6 Goldwind International - China

12.7 Envision Energy - China

12.8 Senvion S.A. - Germany

12.9 Mingyang Smart Energy - China

12.10 Dongfang Electric Corporation - China

12.11 Siemens Energy - Germany

12.12 ACCIONA Energy - Spain

12.13 Nordex Acciona Windpower - Germany/Spain

12.14 TerraForm Power - USA

12.15 RWE Renewables - Germany

12.16 Ørsted A/S - Denmark

12.17 Climniq - USA

12.18 Suzlon Energy Limited - India

12.19 United Power - China

12.20 Nordex SE - Germany

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Wind Energy Conversion Systems Market is valued at USD 92.1 Billion and is projected to reach a market size of USD 156.82 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.9%.

Environmental Concerns and Climate Change Mitigation, Government Policies and Incentives, Technological Advancements & Rising Energy Demand, and Energy Security are the major drivers of the Wind Energy Conversion Systems Market.

Residential, Commercial, Industrial, and Utility are the segments under the Wind Energy Conversion Systems Market by application.

North America is the most dominant region for the Wind Energy Conversion Systems Market.

Asia-Pacific is the fastest-growing region in the Wind Energy Conversion Systems Market.