Wi-Fi Market Size (2024-2030)

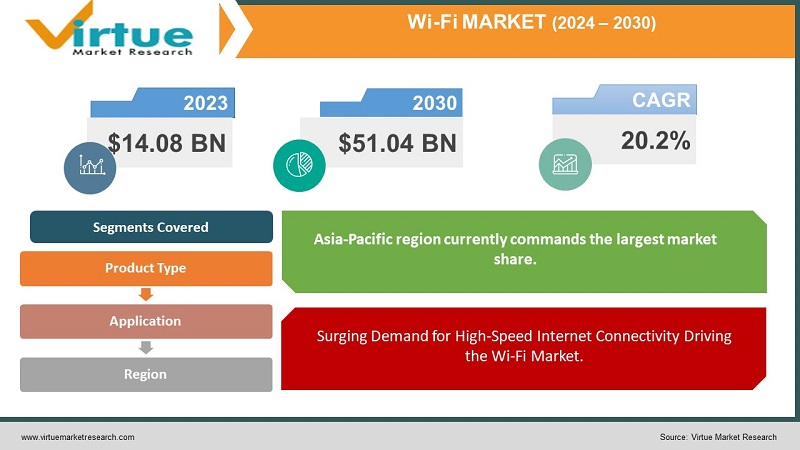

The Global Wi-Fi market was valued at USD 14.08 Billion and is projected to reach a market size of USD 51.04 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 20.2%.

The Wi-Fi market has seen robust growth, propelled by the widespread demand for wireless connectivity across diverse applications. With the increasing penetration of smartphones, tablets, and IoT devices, Wi-Fi technology plays a pivotal role in meeting the escalating need for high-speed and reliable wireless connections. The advent of Wi-Fi 6 (802.11ax) has further elevated performance standards, providing improved efficiency and expanded capacity to accommodate the ever-growing number of connected devices. Businesses are increasingly investing in advanced Wi-Fi solutions to support digital transformation efforts, while the rise of smart devices and IoT applications continues to drive the expansion of the Wi-Fi market across various sectors.

Key Market Insights:

The upward trajectory is fueled by the escalating demand for high-speed connectivity, intensified by the prevalence of data-intensive activities such as streaming and gaming. The proliferation of Wi-Fi-enabled devices, from smartphones to IoT gadgets, is further propelling market expansion, making Wi-Fi an integral component of modern digital lifestyles.

Recent developments in the Wi-Fi market include the FCC's proposed rules in May 2023, aiming to simplify the deployment of Wi-Fi 6E networks for businesses. Additionally, the Wi-Fi Alliance's announcement of Wi-Fi 7 certification in April 2023 marks a pivotal step towards the implementation of next-generation Wi-Fi technologies. Wi-Fi's integration into emerging applications like edge computing and augmented reality showcases its evolving role in shaping technological landscapes.

Dominating the Wi-Fi market are key players contributing significantly to its growth. Cisco Systems, with a 28.3% market share, remains a leader in networking solutions. Broadcom, commanding a 50.8% market share, plays a crucial role in Wi-Fi chipsets, powering diverse devices. Qualcomm, holding a 37.7% market share, stands out as an innovator in next-gen Wi-Fi chipsets. Aruba Networks (HP Enterprise) with a 15.7% market share specializes in enterprise-grade solutions, while Juniper Networks, with a 13.3% market share, focuses on high-performance Wi-Fi infrastructure for large enterprises and service providers. Together, these players drive innovation and shape the dynamic landscape of the Wi-Fi market.

Wi-Fi Market Drivers:

Surging Demand for High-Speed Internet Connectivity Driving the Wi-Fi Market.

The increasing reliance on data-intensive activities such as streaming video, online gaming, and high-quality content consumption has led to a widespread demand for high-speed internet connectivity. Wi-Fi technology has emerged as a convenient and cost-effective solution to meet this demand, providing users in homes, businesses, and public spaces with the capability to access fast and reliable internet connections. As the appetite for bandwidth-intensive applications continues to grow, the Wi-Fi market experiences a significant boost due to its crucial role in fulfilling the need for accelerated internet speeds.

Explosive Growth of Smart Devices Fuels Increasing Need for Wi-Fi Connectivity.

The proliferation of smart devices, including smartphones, tablets, laptops, and an array of smart home appliances, has driven a substantial increase in the demand for Wi-Fi connectivity. These devices rely on wireless internet access to enable seamless communication, data sharing, and access to online services. The convenience and flexibility offered by Wi-Fi make it the preferred choice for connecting and integrating these smart devices into a cohesive ecosystem. The Wi-Fi market experiences sustained growth as the number of smart devices in use continues to escalate.

Rising Adoption of IoT Devices Boosts Wi-Fi's Popularity in Connectivity Solutions.

The Internet of Things (IoT) is witnessing widespread adoption across various industries, ranging from healthcare and manufacturing to smart cities and agriculture. IoT devices, embedded with sensors and software, require robust and reliable connectivity to exchange data efficiently. Wi-Fi technology emerges as a key enabler for connecting and managing these diverse IoT devices, contributing to the expansion of the Wi-Fi market. The flexibility and compatibility of Wi-Fi make it an attractive choice for businesses and consumers seeking to harness the potential of IoT in their daily operations and lifestyles.

Proliferation of Public Wi-Fi Networks Revolutionizes Internet Access on the Go.

The availability of public Wi-Fi networks in cities, airports, cafes, and other public spaces has transformed the way people access the internet on the go. The convenience of connecting to Wi-Fi in public places enhances accessibility and provides individuals with the flexibility to stay connected while outside their homes or offices. This trend not only caters to the needs of mobile users but also contributes to the overall growth of the Wi-Fi market as more locations invest in deploying and expanding public Wi-Fi infrastructure to meet the demands of an increasingly connected society.

Wi-Fi Market Restraints and Challenges:

Vulnerabilities in Wi-Fi Networks and the Implications for Data Security, Privacy, and Organizational Reputation.

The security challenges within the Wi-Fi market revolve around the susceptibility of Wi-Fi networks to various cyber threats. These threats include hacking, eavesdropping, and malware infections, posing significant risks to data security and privacy. Beyond the immediate consequences, security breaches can tarnish the reputation of businesses and organizations that provide Wi-Fi access, emphasizing the critical need for robust security measures to mitigate these vulnerabilities.

Examining the Financial Barriers in Deploying Wi-Fi Networks, Especially in Challenging Physical Environments and Large Organizational Settings.

The cost implications associated with deploying Wi-Fi networks present a substantial barrier, particularly for large organizations and in areas with challenging physical landscapes. Expenses related to equipment acquisition, installation, and ongoing maintenance contribute to the overall cost of deployment. This financial hurdle may hinder the adoption of Wi-Fi technology in certain environments, necessitating a careful examination of budgetary constraints and potential cost-effective solutions.

Navigating the Challenges of Wi-Fi Network Management Amidst the Growing Complexity Induced by an Increasing Number of Connected Devices.

The proliferation of connected devices brings forth a management challenge for Wi-Fi networks, particularly for organizations with limited IT resources. As the number of devices accessing the network grows, the complexity of managing and maintaining a seamless and secure Wi-Fi experience escalates. Efficient network management becomes paramount to ensure optimal performance, and organizations must grapple with strategies to streamline operations in the face of mounting complexities.

Unpacking the Issues Arising from Wi-Fi Network Operation in Crowded Radio Frequency Spectrums and Densely Populated Environments.

The inherent nature of Wi-Fi networks operating in the crowded radio frequency spectrum leads to interference and congestion challenges. In densely populated areas or environments with numerous Wi-Fi devices, competition for bandwidth intensifies. This heightened competition can result in performance degradation, slower connection speeds, and an overall diminished user experience. Addressing these issues requires innovative solutions to manage spectrum allocation and mitigate the impact of interference, ensuring a reliable and efficient Wi-Fi network operation.

Wi-Fi Market Opportunities:

Smart Home and IoT Integration in the Wi-Fi Landscape - Revolutionizing Connected Living and Business Environments.

The proliferation of smart home devices and Internet of Things (IoT) applications presents a significant opportunity for Wi-Fi to serve as the backbone of connected homes and businesses. By enabling seamless communication and data exchange between smart devices, Wi-Fi can revolutionize home automation, energy management, and security systems.

High-Speed Data Transmission and 5G Integration - Wi-Fi 6 and Wi-Fi 6E as Catalysts for Next-Generation Connectivity.

With the growing demand for bandwidth-intensive applications like video streaming, cloud computing, and virtual reality, Wi-Fi 6 and Wi-Fi 6E are poised to become the new standards for high-speed data transmission. Additionally, Wi-Fi can complement 5G networks by extending coverage in indoor environments and providing a cost-effective solution for last-mile connectivity.

WI-FI MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

20.2% |

|

Segments Covered |

By Product Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cisco Systems, Aruba Networks (HP Enterprise), CommScope (Ruckus Networks (Arris International)), Juniper Networks Inc., Telefonaktiebolaget LM Ericsson, Huawei Technologies Co., Ltd., Fortinet, Zyxel Communications, Broadcom, Qualcomm |

Wi-Fi Market Segmentation:

Wi-Fi Market Segmentation: By Product Type

- Access points

- Routers

- Gateways

- Extenders

In the realm of Wi-Fi products, access points currently claim the lion's share of the market. Serving as foundational elements in wireless networking, access points are integral to establishing and extending Wi-Fi connectivity. They facilitate the creation of robust wireless networks, allowing numerous devices to seamlessly connect and communicate. The enduring popularity of access points can be attributed to their versatility and widespread application across residential, commercial, and public settings. As the demand for ubiquitous connectivity continues to rise, access points remain a staple in providing reliable and efficient Wi-Fi access.

Simultaneously, the Wi-Fi market is witnessing a notable surge in the router segment, marking it as the fastest-growing category. Routers, essential for managing data traffic between devices and ensuring efficient network performance, are experiencing accelerated adoption. This growth is propelled by the escalating demand for high-speed internet connectivity, particularly in the context of the burgeoning smart device ecosystem. The proliferation of Internet of Things (IoT) applications, coupled with the increasing need for robust home and business networks, positions routers at the forefront of innovation within the Wi-Fi market. This dual momentum of access points maintaining dominance and routers charting impressive growth underscores the dynamic nature of the Wi-Fi industry as it adapts to the evolving landscape of connectivity demands.

Wi-Fi Market Segmentation: By Application

- Residential

- Enterprise

- Education

- Public services

- Transportation

- Public utilities

In the Wi-Fi market, the distribution of market share among different applications sheds light on the varied needs across sectors. Currently, the residential segment commands the largest market share. This dominance can be attributed to the widespread adoption of Wi-Fi connectivity in homes, where it serves as the backbone for a myriad of connected devices. The growing reliance on smart homes, online streaming, and digital communication has fueled the demand for robust residential Wi-Fi solutions. As a result, technologies tailored to enhance connectivity within the home environment, such as mesh networks and Wi-Fi extenders, contribute significantly to the prevalence of Wi-Fi in residential settings.

Concurrently, the enterprise segment emerges as the fastest-growing sector within the Wi-Fi market. Enterprises are increasingly recognizing the critical role of Wi-Fi in facilitating seamless communication, enhancing productivity, and supporting the connectivity needs of a growing number of devices within corporate networks. Factors such as the rise of remote work, the adoption of Internet of Things (IoT) devices in business operations, and the demand for secure and high-performance wireless networks are propelling the accelerated growth of Wi-Fi solutions tailored for enterprise applications. As businesses prioritize digital transformation and the deployment of advanced technologies, the enterprise segment stands out as a dynamic force propelling innovation and expansion within the Wi-Fi market.

Wi-Fi Market Segmentation: By Region:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Within the global Wi-Fi market, the Asia-Pacific region currently commands the largest market share. This dominance can be attributed to the region's immense population, rapid urbanization, and the widespread adoption of digital technologies. Countries in the Asia-Pacific, such as China and India, have witnessed a surge in internet penetration and an exponential increase in the number of connected devices. The flourishing demand for Wi-Fi-enabled devices, coupled with the expansion of smart cities and digital infrastructure, has solidified the region's position as a major hub for Wi-Fi technology.

In contrast, North America stands out as the fastest-growing segment within the Wi-Fi market. This growth is propelled by several factors, including the continuous evolution of technology, increasing demand for high-speed connectivity, and the rapid deployment of advanced wireless networks. The region has been at the forefront of technological innovation, with a significant focus on the development and implementation of 5G networks. The proliferation of Internet of Things (IoT) devices, coupled with the escalating need for seamless connectivity in both urban and rural areas, has contributed to the exponential growth of the Wi-Fi market in North America. As the region embraces the digital age and witnesses a surge in smart home technologies, the demand for Wi-Fi solutions is expected to maintain its upward trajectory.

COVID-19 Impact Analysis on the Global Wi-Fi market:

The COVID-19 pandemic has triggered several positive impacts on the Wi-Fi market. The widespread shift to remote work and online learning has resulted in an unprecedented surge in demand for residential Wi-Fi solutions. Individuals spending more time at home have increased reliance on Wi-Fi for connectivity, driving notable sales growth in Wi-Fi routers and extenders. Additionally, governments and businesses have responded to the need for enhanced connectivity by expanding public Wi-Fi access. This proactive measure supports remote work and online learning, fostering increased availability of Wi-Fi in public spaces like parks, libraries, and community centers.

Conversely, the COVID-19 pandemic has brought about challenges for the Wi-Fi market. Global supply chain disruptions, a consequence of the pandemic, have made it difficult for manufacturers to source components and produce Wi-Fi equipment. This disruption has led to shortages of Wi-Fi devices and delays in product deliveries, impacting the overall market efficiency. Furthermore, the economic slowdown triggered by the pandemic has had a negative impact on consumer spending. Reduced consumer spending on Wi-Fi equipment, coupled with businesses cutting back on their IT budgets, has resulted in a decline in overall Wi-Fi spending.

Latest Trends/Developments:

- Mesh Wi-Fi systems are becoming increasingly popular as they offer a more seamless and reliable Wi-Fi experience. Mesh Wi-Fi systems use multiple access points to create a blanket of Wi-Fi coverage throughout a home or business. This eliminates dead zones and ensures that users have a strong Wi-Fi connection everywhere they go.

- The proposed FCC rules are expected to have a significant positive impact on the adoption of Wi-Fi 6E networks. These rules would make it easier for businesses to obtain licenses for the 6GHz band, which would make Wi-Fi 6E networks more affordable and accessible. As a result of these factors, the market share of Wi-Fi 6E networks is expected to grow rapidly in the coming years. The market share of Wi-Fi 6E networks is expected to reach 50% by 2026. This growth will be driven by the increasing demand for high-bandwidth connectivity and the desire of businesses to take advantage of the latest Wi-Fi technology.

Key Players:

- Cisco Systems

- Aruba Networks (HP Enterprise)

- CommScope (Ruckus Networks (Arris International))

- Juniper Networks Inc.

- Telefonaktiebolaget LM Ericsson

- Huawei Technologies Co., Ltd.

- Fortinet

- Zyxel Communications

- Broadcom

- Qualcomm

- In February 2023, Federated Wireless and Cisco unveiled an exciting collaboration with the shared objective of introducing Wi-Fi 6E technology to enterprises. By combining Federated Wireless' expertise in shared spectrum technology and Cisco's proficiency in networking solutions, this partnership aims to enhance Wi-Fi connectivity in business environments, catering to the increasing demand for advanced wireless capabilities.

Chapter 1. GLOBAL WI-FI MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL WI-FI MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL WI-FI MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL WI-FI MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL WI-FI MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL WI-FI MARKET – By Product Type

6.1. Introduction/Key Findings

6.2. Access points

6.3. Routers

6.4. Gateways

6.5. Extenders

6.6. Y-O-Y Growth trend Analysis By Product Type

6.7. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. GLOBAL WI-FI MARKET – By Application

7.1. Introduction/Key Findings

7.2 Residential

7.3. Enterprise

7.4. Education

7.5. Public services

7.6. Transportation

7.7. Public utilities

7.8. Y-O-Y Growth trend Analysis By Application

7.9. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. GLOBAL WI-FI MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Product Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Application

8.2.3. By Product Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Application

8.3.3. By Product Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Application

8.4.3. By Product Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Application

8.5.3. By Product Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL WI-FI MARKET – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Development

9.1. Cisco Systems

9.2. Aruba Networks (HP Enterprise)

9.3. CommScope (Ruckus Networks (Arris International)

- 9.4. Juniper Networks Inc.

- 9.5. Telefonaktiebolaget LM Ericsson

- 9.6. Huawei Technologies Co., Ltd.

- 9.7. Fortinet

- 9.8. Zyxel Communications

- 9.9. Broadcom

9.10.Qualcomm

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Wi-Fi market was valued at USD 14.08 Billion and is projected to reach a market size of USD 51.04 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 20.2%.

Cisco Systems, Juniper Networks Inc., Telefonaktiebolaget LM Ericsson, Huawei Technologies Co., Ltd., Fortinet, Zyxel Communications, Broadcom, and Qualcomm

The Asia-Pacific region is expected to be the fastest-growing segment of the global Wi-Fi market during the forecast period, with a CAGR of 20.2%.

North America holds the largest market share of the global Wi-Fi market, accounting for 35% of the total revenue in 2023.

The Global Wi-Fi Market is driven by the escalating demand for high-speed internet connectivity, the proliferation of smart devices, the expansion of Internet of Things (IoT) applications, and the continuous growth of public Wi-Fi networks, fostering increased accessibility on the go.