Wi-Fi 7 Market Size (2023 - 2030)

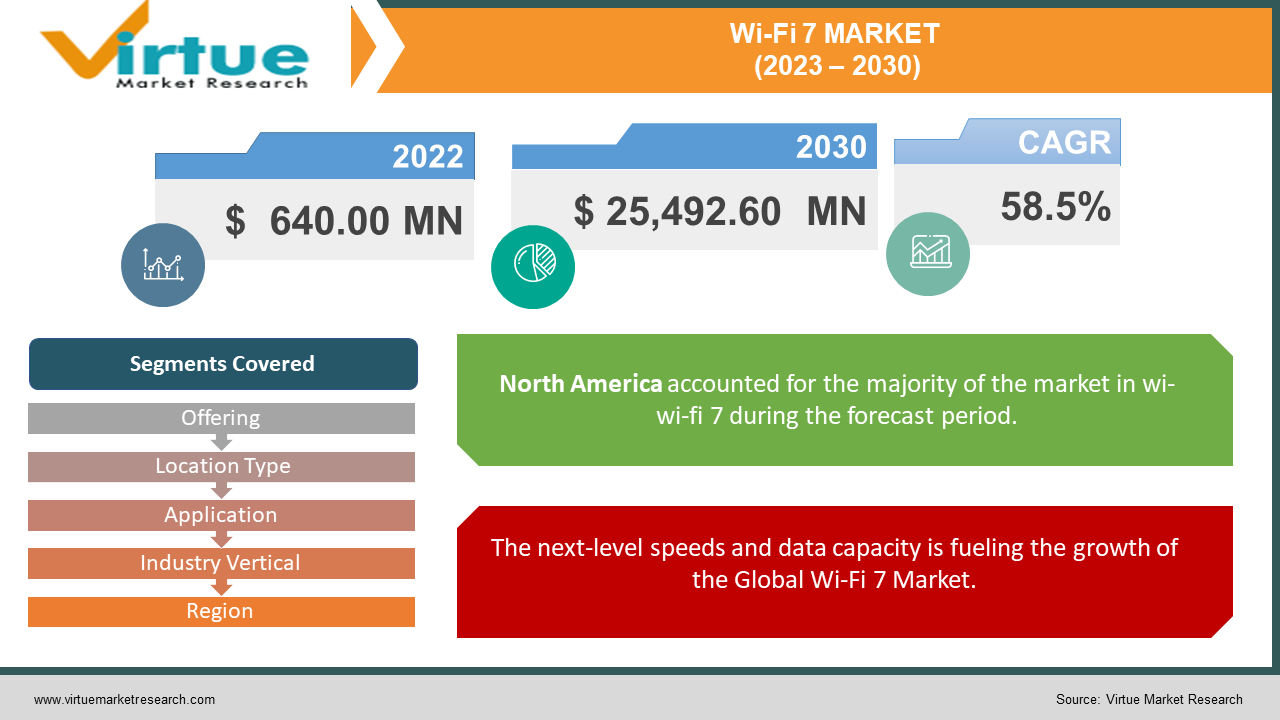

The global Wi-Fi 7 Market is estimated to be worth USD 640.00 Million in 2022 and is projected to reach a value of USD 25,492.60 Million by 2030, growing at a CAGR of 58.5% during the forecast period 2023-2030.

Wi-Fi 7, the latest evolution of Wi-Fi technology, introduces noteworthy advancements surpassing its predecessors, Wi-Fi 6 and 6E. With the potential to achieve speeds up to four times faster, Wi-Fi 7 introduces smart enhancements to decrease latency, boost capacity, and strengthen stability and efficiency. Wi-Fi 7 (IEEE 802.11be) maintains the naming patterns of earlier iterations like Wi-Fi 6 (IEEE 802.11ax) and Wi-Fi 5 (IEEE 802.11ac). While backward compatible, fully capitalizing on its new features and performance necessitates upgrading devices, including routers, access points, smartphones, laptops, and more. The benefits of Wi-Fi 7 comprise faster speeds, supporting more connections, and better adaptability for reliable low latency performance. This translates to improved video quality, enhanced cloud gaming, and seamless support for AR and VR applications with high throughput and low latency demands. Additionally, Wi-Fi 7 addresses congestion and interference, which makes it particularly valuable in densely populated areas and enterprise environments and provides a significant leap in wireless connectivity capabilities. Both Wi-Fi 7 and Wi-Fi 6E utilize the benefits of the 6-GHz band, but Wi-Fi 7 stands out owing to its broader channels, which support up to 320 MHz as opposed to 160 MHz for Wi-Fi 6E. Wi-Fi 7 also features 4K-QAM, a superior data packing capability to Wi-Fi 6's 1024-QAM and Wi-Fi 5's 256-QAM. The most notable improvement is Multi-Link Operation (MLO), which enables connections across multiple bands simultaneously for broader channels and more efficient performance. Routers with MLO can select the optimum channel to bypass congestion and interference while ensuring steady connections and low latency. Wi-Fi 7 also strengthens existing technologies, including OFDMA, MU-MIMO, and TWT, further boosting overall performance.

Global Wi-Fi 7 Market Drivers:

The next-level speeds and data capacity is fueling the growth of the Global Wi-Fi 7 Market.

Wi-Fi 7 offers much swifter speeds by fitting more data into each transmission. With 4K QAM, Wi-Fi 7 can densely pack more data into each signal, surpassing the capacity of 1K QAM in Wi-Fi 6/6E, similar to how professional movers maximize truck space for more boxes. For a typical Wi-Fi 7 laptop, this signifies potential speeds of nearly 5.8 Gbps, 2.4 times quicker than Wi-Fi 6/6E's 2.4 Gbps. This enables smooth 8K video streaming and significantly reduces large file download times, which makes a 15 GB file download take about 25 seconds instead of one minute with older Wi-Fi technologies. Therefore, this factor propels the demand for Wi-Fi 7.

The enhanced reliability for smart home and industrial applications is another factor contributing to the growth of the Global Wi-Fi 7 Market.

The Internet of Things (IoT) is fueling the requirement for swifter data speeds and decreased latency. As more and more devices are connecting to the internet, data transfers have spiked, which imposed a burden on current Wi-Fi networks that find it challenging to confront the high demand. Furthermore, the IoT is driving the demand for more dependable and secure wireless connections. Especially in critical applications like healthcare and industrial automation, reliable and secure wireless connections are vital. Wi-Fi 7 addresses this by incorporating features like OFDMA and Target Wake Time (TWT), which strengthen reliability and security. Wi-Fi 7 is opening up new possibilities in the Internet of Things (IoT) space, linking smart home devices like thermostats, lighting, and security cameras, as well as industrial IoT devices like robots and sensors. Therefore, this factor also propels the demand for Wi-Fi 7.

Global Wi-Fi 7 Market Challenges:

The Global Wi-Fi 7 Market is encountering challenges, primarily in terms of costliness and complex installation. Wi-Fi 7 devices are projected to come with a higher price tag in contrast to previous generations, mainly because of the added complexity and cutting-edge features. This increased cost might hinder the ubiquitous adoption of Wi-Fi 7 devices, particularly in developing nations. Moreover, Wi-Fi 7 devices are more intricate than their predecessors, which makes installation more convoluted. Thus, these challenges inhibit the growth of the Global Wi-Fi 7 Market.

COVID-19 Impact on the Global Wi-Fi 7 Market:

The Global Wi-Fi 7 Market has been considerably influenced by the COVID-19 outbreak. The pandemic's impact on global supply chains and manufacturing brought about delays in the commercial launch and widespread adoption of Wi-Fi 7 technology as companies face challenges in product development and distribution. The Global Wi-Fi 7 Market businesses encountered monetary obstacles during the pandemic, which affected their investment in Wi-Fi 7 research, development, marketing, and commercialization. These factors negatively impacted the market's growth.

Global Wi-Fi 7 Market Recent Developments:

In July 2023, EnGenius Technologies Inc. introduced the Cloud Wi-Fi 7 series, with the ECW536 as the world's first cloud-managed Wi-Fi 7 4x4x4 Access Point.

- In March 2023, Huawei unveiled the world's inaugural 50G POL prototype, aimed at assisting industry customers in constructing cutting-edge Wi-Fi 7 campus networks.

- In October 2022, HFCL Limited, a prominent high-tech enterprise and a provider of integrated next-gen communication products and solutions, partnered with Qualcomm Technologies, Inc. to introduce the world's first open-source Wi-Fi 7 Access Points.

Wi-Fi 7 MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

58.5% |

|

Segments Covered |

By Offering, Location Type, Application, Industry Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Qualcomm Technologies, Inc. (United States), Intel Corporation (United States), MediaTek Inc. (Taiwan), Broadcom Inc. (United States), TP-Link Technologies Co., Ltd. (China), New H3C Technologies Co., Ltd. (China), ZTE Corporation (China), CommScope Holding Company, Inc. (United States), Huawei Technologies Co., Ltd. (China), Vantiva S.A. (France) |

Global Wi-Fi 7 Market Segmentation: By Offering

-

Hardware

-

Software

-

Services

In 2022, the Hardware segment occupied the highest market share. The growth can be ascribed to the increasing popularity of wireless access points within this segment. The soaring number of connected devices in public areas, residences, and workplaces is propelling the requirement for top-notch Wi-Fi access points, which results in a proliferating trend of adopting wireless access points. Furthermore, the hassle-free installation and the capability of wireless access points to handle a multitude of devices concurrently are key factors contributing to their rising popularity. These advantages are estimated to bring noteworthy merits to the hardware segment of the Wi-Fi market in the next decade.

Global Wi-Fi 7 Market Segmentation: By Location Type

-

Indoor

-

Outdoor

The Indoor segment occupied the highest market share in the year 2022. The growth can be ascribed to the multiple possibilities brought about by Wi-Fi 7 across various indoor applications. Smart homes benefit from Wi-Fi 7's high data rates and low latency, which enable seamless control of smart devices for automation, security, and entertainment. Organizations utilize Wi-Fi 7 for cloud computing, big data analytics, and IoT, thereby experiencing enhanced system efficiency with fast data rates and low latency for real-time processing. In the field of telemedicine, Wi-Fi 7 facilitates remote consultations and monitoring through high data rates and low latency, which improves healthcare services with real-time video conferencing and data transmission. Education embraces Wi-Fi 7 for remote learning and online education, which enhances accessibility and quality with real-time video conferencing, collaboration, and content delivery.

Global Wi-Fi 7 Market Segmentation: By Application

-

8K Video Streaming

-

Cloud-Based Gaming

-

Augmented Reality (AR) and Virtual Reality (VR)

-

Industrial Internet of Things (IIoT) and Industry 4.0

-

Smart Cities

-

Telemedicine

-

Others

The 8K Video Streaming segment occupied the highest market share in the year 2022. The growth can be ascribed to Wi-Fi 7's upcoming faster speeds achieved through a cutting-edge modulation scheme called 4k QAM (Quadrature Amplitude Modulation). This enhancement permits each signal to carry 12 bits of data instead of the previous 10 bits, which results in a 20% increase in capacity. By employing 4k QAM, Wi-Fi 7 permits more data to be packed into each signal, which leads to amplified throughput and increased capacity compared to older Wi-Fi systems using 1k QAM. Just like the 4k resolution in television, here 4k refers to the number of bits of data transmitted per signal. With Wi-Fi 7's 4k QAM, users can enjoy seamless 4k and even 8k video streaming experiences.

Global Wi-Fi 7 Market Segmentation: By Industry Vertical

-

Education

-

Healthcare and Life Sciences

-

Manufacturing

-

Media and Entertainment

-

Retail

-

Transportation and Logistics

-

Travel and Hospitality

-

Others

The Media and Entertainment segment occupied the highest market share in the year 2022. The growth can be ascribed to Wi-Fi 7's remarkable technological advancement with the potential to revolutionize the media and entertainment industries. Wi-Fi 7 brings notable improvements in speed, range, and reliability, which offers a multitude of benefits to organizations. It permits seamless streaming of high-quality content, encompassing 4K and 8K videos, and ensures smooth real-time delivery to consumers without any buffering or lag. On top of that, Wi-Fi 7 paves the way for VR and AR experiences that permits enterprises to devise immersive environments for their customers. Additionally, it revolutionizes gaming by providing high-speed content delivery, including the ability to stream games from remote servers to local devices, which eliminates the need for powerful gaming hardware and extends gaming possibilities indoors and outdoors.

Global Wi-Fi 7 Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

The region of North America dominated the Global Wi-Fi 7 Market in the year 2022. The augmenting demand for high-speed internet connectivity, the growing population of smartphone users, and the surge in smart device adoption, including smart TVs, smart speakers, and smart thermostats, are some of the pivotal factors propelling the region's growth. Furthermore, North America is home to several prominent market players, including Qualcomm Technologies, Inc., Intel Corporation, Broadcom Inc., CommScope Holding Company, Inc., and Netgear, Inc.

The region of Asia-Pacific is anticipated to expand at the quickest rate over the forecast period 2023-2030 owing to the region's large population, urbanization, and rising disposable income, the expanding internet user base, the growing digitization of industries, the increasing adoption of IoT devices, and the strong presence of significant market players, including MediaTek Inc., TP-Link Technologies Co., Ltd., and ZTE Corporation.

Global Wi-Fi 7 Market Key Players:

-

Qualcomm Technologies, Inc. (United States)

-

Intel Corporation (United States)

-

MediaTek Inc. (Taiwan)

-

Broadcom Inc. (United States)

-

TP-Link Technologies Co., Ltd. (China)

-

New H3C Technologies Co., Ltd. (China)

-

ZTE Corporation (China)

-

CommScope Holding Company, Inc. (United States)

-

Huawei Technologies Co., Ltd. (China)

-

Vantiva S.A. (France)

Chapter 1. Wi-Fi 7 Market – Scope & Methodology

1.1 Market Segmentation

1.2 Assumptions

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Wi-Fi 7 Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.3 COVID-19 Impact Analysis

2.3.1 Impact during 2023 – 2030

2.3.2 Impact on Supply – Demand

Chapter 3. Wi-Fi 7 Market – Competition Scenario

3.1 Market Share Analysis

3.2 Product Benchmarking

3.3 Competitive Strategy & Development Scenario

3.4 Competitive Pricing Analysis

3.5 Supplier - Distributor Analysis

Chapter 4. Wi-Fi 7 Market - Entry Scenario

4.1 Case Studies – Start-up/Thriving Companies

4.2 Regulatory Scenario - By Region

4.3 Customer Analysis

4.4 Porter's Five Force Model

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Powers of Customers

4.4.3 Threat of New Entrants

4.4.4 .Rivalry among Existing Players

4.4.5 Threat of Substitutes

Chapter 5. Wi-Fi 7 Market - Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Wi-Fi 7 Market - By Offering

6.1 Hardware

6.2 Software

6.3 Services

Chapter 7. Wi-Fi 7 Market - By Location Type

7.1 Indoor

7.2 Outdoor

Chapter 8. Wi-Fi 7 Market - By Application

8.1 8K Video Streaming

8.2 Cloud-Based Gaming

8.3 Augmented Reality (AR) and Virtual Reality (VR)

8.4 Industrial Internet of Things (IIoT) and Industry 4.0

8.5 Smart Cities

8.6 Telemedicine

8.7 Others

Chapter 9. Wi-Fi 7 Market - By Industry Vertical

9.1 Education

9.2 Healthcare and Life Sciences

9.3 Manufacturing

9.4 Media and Entertainment

9.5 Retail

9.6 Transportation and Logistics

9.7 Travel and Hospitality

9.8 Others

Chapter 10. Wi-Fi 7 Market – By Region

10.1 North America

10.2 Europe

10.3 Asia-Pacific

10.4 Latin America

10.5 The Middle East

10.6 Africa

Chapter 11. Wi-Fi 7 Market – Key Players

11.1 Qualcomm Technologies, Inc. (United States)

11.2 Intel Corporation (United States)

11.3 MediaTek Inc. (Taiwan)

11.4 Broadcom Inc. (United States)

11.5 TP-Link Technologies Co., Ltd. (China)

11.6 New H3C Technologies Co., Ltd. (China)

11.7 ZTE Corporation (China)

11.8 CommScope Holding Company, Inc. (United States)

11.9 Huawei Technologies Co., Ltd. (China)

11.10 Vantiva S.A. (France)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global Wi-Fi 7 Market is estimated to be worth USD 640.00 Million in 2022 and is projected to reach a value of USD 25,492.60 Million by 2030, growing at a CAGR of 58.5% during the forecast period 2023-2030.

The Global Wi-Fi 7 Market Drivers are the Next-Level Speeds and Data Capacity and the Enhanced Reliability for Smart Home and Industrial Applications.

Based on the Application, the Global Wi-Fi 7 Market is segmented into 8K Video Streaming, Cloud-Based Gaming, Augmented Reality (AR) and Virtual Reality (VR), Industrial Internet of Things (IIoT), and Industry 4.0, Smart Cities, Telemedicine, and Others.

The United States is the most dominating country in the region of North America for the Global Wi-Fi 7 Market.

Qualcomm Technologies, Inc., Intel Corporation, and MediaTek Inc. are the leading players in the Global Wi-Fi 7 Market.