White Oil Market Size (2024 – 2030)

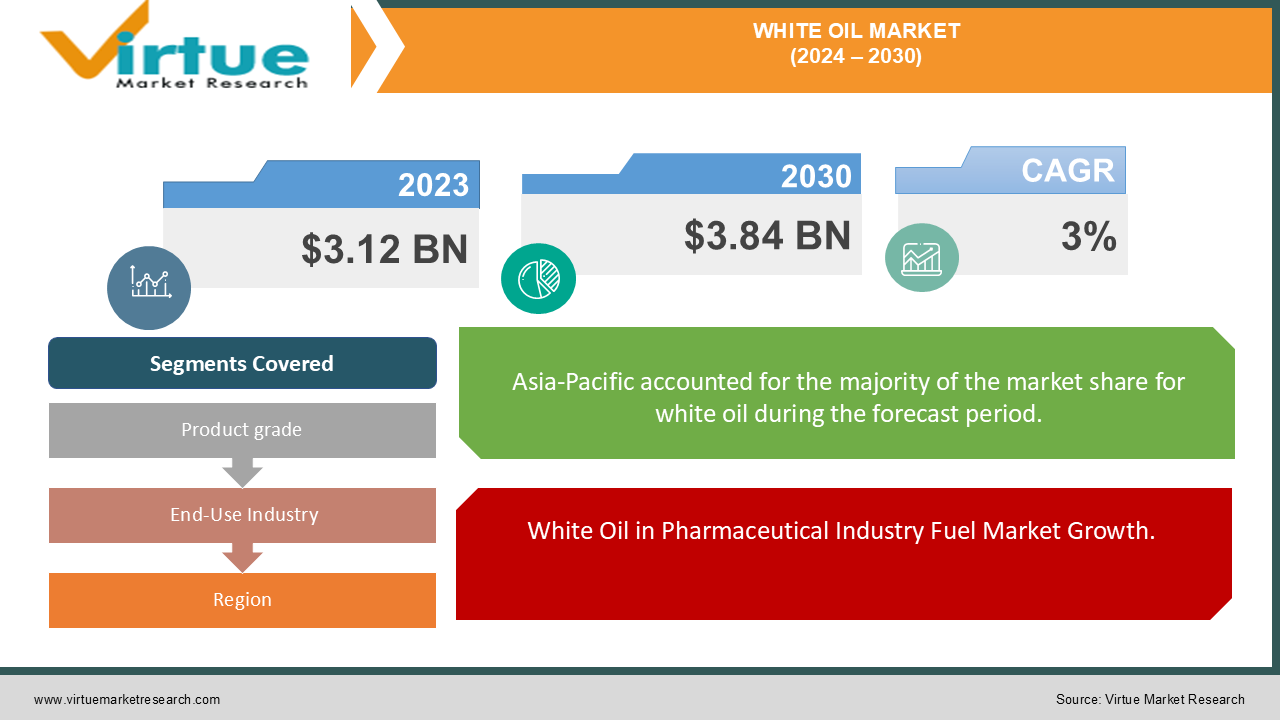

The White Oil Market was valued at USD 3.12 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 3.84 billion by 2030, growing at a CAGR of 3%.

White oils are extensively purified oils derived from paraffinic or naphthenic base stocks. These oils are devoid of color and odor and can be either mineral or synthetic. Their chemical and biological stability, along with their resistance to pathogenic bacterial growth, makes them a common and essential component across various industry sectors.

Key Market Insights:

The growing emphasis on healthy eating habits has led to a rise in the popularity of packaged food items, where white oil is used to enhance the flexibility of rubber and polymeric packaging materials.

Additionally, research indicates that utilizing white oil in food packaging offers advantages such as extended storage life, maintained freshness, and improved appearance of meats, fish, poultry, fruits, and vegetables.

Consequently, major players in the packaged food industry are increasingly inclined towards incorporating white oil. As a result, the expanding use of white oil in the food and beverage sector is expected to generate lucrative opportunities for the market.

White Oil Market Drivers:

White Oil in Pharmaceutical Industry Fuel Market Growth.

White oil is pivotal in the pharmaceutical industry, serving as a key ingredient in a range of formulations and medications. It is commonly used as an inert substance to act as a carrier or to enhance the stability and texture of medicinal products. This oil is incorporated into oral medications, ointments, creams, lotions, and other medical formulations, providing lubrication, aiding in drug solubility, and improving the overall efficacy of pharmaceutical products. Recognized for its safety, stability, and non-irritating properties, it is expected that pharmaceutical manufacturers will continue to utilize white oil in both existing and new formulations. With the global population expanding and aging, the demand for this essential component in medications and personal care products is anticipated to increase.

The Rise in Demand for Personal Care Products drives market growth.

White oils are a fundamental component in a wide array of cosmetic formulations. They are prevalent in nearly all cosmetic and personal care products, including emulsions, anhydrous cosmetics, lip balms, baby oils, skincare and haircare items, creams, lotions, and emollients. White oil is particularly effective in alleviating diaper rash and eczema irritation. Additionally, the cosmetic industry extensively utilizes liquid paraffin, incorporating it into various beauty products such as detergent creams, cold creams, hydrating creams, bronzing oils, and makeup products.

White Oil Market Restraints and Challenges:

Raw Material Prices to Hinder Market Growth

White oil, a refined mineral oil sourced from petroleum, is subject to variations in crude oil prices. These price fluctuations directly impact the production costs of white oil. When crude oil prices are high, the cost of producing and refining white oil increases, which may reduce profitability for manufacturers. Additionally, changes in oil prices can affect consumer behavior and demand for these oil products. Consumers might look for alternatives or decrease their use of petroleum-based products, including white oil. Such shifts in demand could adversely affect market growth.

White Oil Market Opportunities:

Beauty and Personal Care Products to create New Market Growth Opportunities

The growing demand for safe beauty and personal care products is anticipated to open new growth opportunities for the market. There is an increasing focus on incorporating non-toxic and naturally derived ingredients in personal care and beauty products. Although white oil is derived from petroleum, its inert and non-toxic nature makes it suitable for use in such formulations. Companies have the opportunity to create natural and organic products using white oil as a base. As consumer interest in clean and safe products rises, shoppers are more likely to choose items that are naturally derived, cruelty-free, and free of toxins. This shift in consumer preferences is expected to drive new opportunities for growth in the white oil market.

WHITE OIL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3% |

|

Segments Covered |

By Product grade, End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

British Petroleum, Sinopec Corporation, ExxonMobil Fuels & Lubricants, Seojin Chemical, Eastern Petroleum Pvt. Ltd, Savita Chemicals, Royal Dutch Shell, Suncor Energy, ENEOS Corporation, Apar Industries Ltd |

White Oil Market Segmentation: By Product Grade

-

Food

-

Pharmaceutical

-

Technical

The pharmaceutical grade segment led the global market due to the increasing severity of diseases, which has driven extensive R&D activities in the pharmaceutical sector. Pharmaceutical-grade white oil is extensively used in the production of various medicinal formulations. Additionally, growing awareness of personal care has heightened the demand for personal care products that utilize pharmaceutical-grade white oil. These factors are expected to boost the growth of the pharmaceutical-grade segment.

The technical grade segment was the second largest contributor in terms of revenue during the forecast period. Technical grade white oil is a refined, colorless, and odorless paraffinic mineral oil used in various industrial applications. Derived from high-quality paraffinic base oils, it is biologically stable and resistant to liver or pathogenic bacteria. Technical grade white oil is utilized as a lubricant in the textile industry, paper manufacturing, as a process oil in the food industry, and in other industrial applications.

White Oil Market Segmentation: By End-Use Industry

-

Plastics & Polymer

-

Pharmaceuticals

-

Personal Care & Cosmetics

-

Food Industry

-

Textiles

-

Others

The pharmaceuticals segment was the leading revenue contributor and is expected to continue its growth during the forecast period. This is largely due to increased investments in both developed and developing economies for pharmaceutical sector advancements, which is likely to boost the demand for white oil in producing a variety of pharmaceutical formulations. White oil is particularly important in pharmaceutical applications for its use in laxatives, which help enhance stool motility, bulk, and frequency.

The personal care and cosmetics segment was the second-largest revenue contributor during the forecast period. This growth is attributed to heightened awareness of self-grooming, which has driven increased demand in the personal care sector. White oil is extensively used in the production of various personal care products, including baby oil, baby shampoos, hair conditioners, sunscreens, and creams & lotions. Additionally, the rising elderly population in countries such as Italy and Japan has increased the demand for white oil-based anti-aging creams. This trend is expected to further boost the sales of white oil in personal care and cosmetics applications.

White Oil Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

The Asia-Pacific region led the market as both the largest and fastest-growing area. China dominates the global textile market, holding approximately 40% of the share, with India in the second position. As the world's leading textile producer and exporter, China's textile industry has become a significant pillar of its economy, with top exports including clothing accessories, textile yarns, and textile articles. The National Bureau of Statistics of China reported a textile production volume of 2.8 billion meters in November 2023, up from 2.7 billion meters in April 2023. The growing number of women in the workforce in China, along with increasing grooming awareness among men, has spurred demand in the cosmetics industry. Consumers are particularly interested in products with natural ingredients, such as those based on fruits and plants. The L'Oréal Group's new product launches and customized social initiatives in China are fueling the demand for white oil. In India, white oil is predominantly used in hair care products, making it a key component in the cosmetics and personal care industry. The cosmetics and pharmaceutical sectors collectively account for about three-fourths of white oil consumption in India.

According to the India Brand Equity Foundation, India ranks as the second-largest global producer of garments and textiles and the fifth-largest exporter of textiles. The textile and apparel industry contributes approximately 2% to India's GDP, with textile and apparel exports reaching USD 35.58 billion in 2023. Given these industry trends across Asia, the demand for white oil is expected to rise during the forecast period.

In Europe, there is a strong focus on food safety and quality standards. The high purity and inert nature of white oil make it ideal for various food-related applications. It is extensively used as a food-grade lubricant in machinery involved in food processing, ensuring smooth production operations while adhering to strict safety regulations. As the food industry in Europe continues to evolve and respond to consumer demands, the versatility and compliance of white oil as an ingredient and lubricant are anticipated to drive continued market growth.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic adversely affected the white oil market. The imposition of various restrictive measures by countries to curb the spread of the virus generally led to a decline in demand. Industrial production across numerous sectors was impacted, with the steel industry being among the hardest hit. The pandemic caused a significant reduction in steel production due to halted operations and decreased demand from end-user industries. Similarly, the food and beverage sector experienced substantial disruptions in supply chains, further impacting the market for white oil.

Latest Trends/ Developments:

In April 2022, Indorama Ventures Public Company Limited (IVL) completed its acquisition of Oxiteno SA. This acquisition allowed IVL to expand its footprint into lucrative markets in Latin America and the United States, establishing itself as the leading producer of surfactants on the continent. The acquisition also provided IVL with additional growth opportunities in Europe and Asia.

Key Players:

These are the top 10 players in the White Oil Market:-

-

British Petroleum

-

Sinopec Corporation

-

ExxonMobil Fuels & Lubricants

-

Seojin Chemical

-

Eastern Petroleum Pvt. Ltd

-

Savita Chemicals

-

Royal Dutch Shell

-

Suncor Energy

-

ENEOS Corporation

-

Apar Industries Ltd

Chapter 1. White Oil Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. White Oil Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. White Oil Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. White Oil Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. White Oil Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. White Oil Market – By Product Grade

6.1 Introduction/Key Findings

6.2 Food

6.3 Pharmaceutical

6.4 Technical

6.5 Y-O-Y Growth trend Analysis By Product Grade

6.6 Absolute $ Opportunity Analysis By Product Grade, 2024-2030

Chapter 7. White Oil Market – By End-Use Industry

7.1 Introduction/Key Findings

7.2 Plastics & Polymer

7.3 Pharmaceuticals

7.4 Personal Care & Cosmetics

7.5 Food Industry

7.6 Textiles

7.7 Others

7.8 Y-O-Y Growth trend Analysis By End-Use Industry

7.9 Absolute $ Opportunity Analysis By End-Use Industry, 2024-2030

Chapter 8. White Oil Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Grade

8.1.3 By End-Use Industry

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Grade

8.2.3 By End-Use Industry

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Grade

8.3.3 By End-Use Industry

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Grade

8.4.3 By End-Use Industry

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Grade

8.5.3 By End-Use Industry

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. White Oil Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 British Petroleum

9.2 Sinopec Corporation

9.3 ExxonMobil Fuels & Lubricants

9.4 Seojin Chemical

9.5 Eastern Petroleum Pvt. Ltd

9.6 Savita Chemicals

9.7 Royal Dutch Shell

9.8 Suncor Energy

9.9 ENEOS Corporation

9.10 Apar Industries Ltd

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The growing emphasis on healthy eating habits has led to a rise in the popularity of packaged food items, where white oil is used to enhance the flexibility of rubber and polymeric packaging materials.

The top players operating in the White Oil Market are - British Petroleum, Sinopec Corporation, ExxonMobil Fuels & Lubricants, Seojin Chemical, Eastern Petroleum Pvt. Ltd, Savita Chemicals, Royal Dutch Shell, Suncor Energy, ENEOS Corporation, Apar Industries Ltd.

The COVID-19 pandemic adversely affected the white oil market. The imposition of various restrictive measures by countries to curb the spread of the virus generally led to a decline in demand.

The growing demand for safe beauty and personal care products is anticipated to open new growth opportunities for the market. There is an increasing focus on incorporating non-toxic and naturally derived ingredients in personal care and beauty products.

The Asia-Pacific region led the market as both the largest and fastest-growing area.