White Goods Market Size (2024 – 2030)

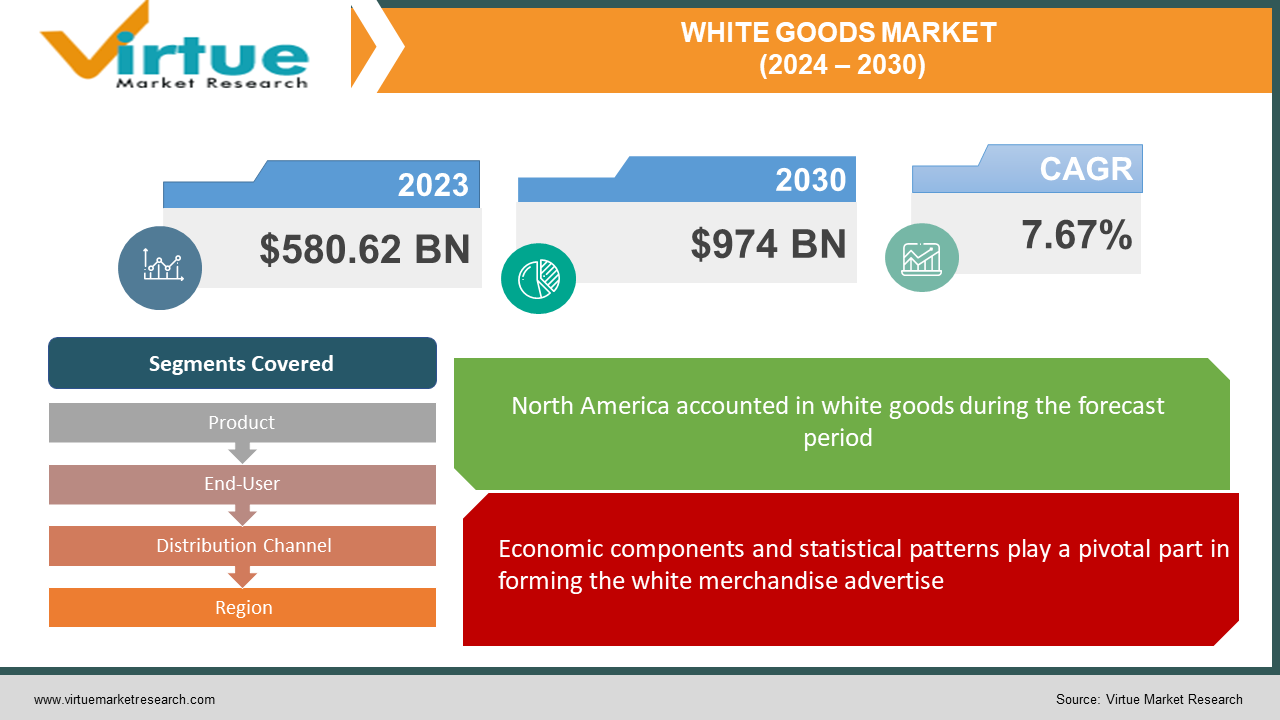

The Global White Goods Market was valued at USD 580.62 billion and is projected to reach a market size of USD 974 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.67%.

This development story is interwoven with the changing texture of buyer ways of life, innovative strides, and an ever-growing request impelled by urbanization. Over landmasses, from the bustling cities of Asia-Pacific to the set-up markets of North America and Europe, the white products industry stands flexible and versatile. It's a story of advancement, where producers endeavor to meet the desires of an energetic shopper base looking for both advancement and eco-conscious arrangements. As we navigate a long time towards 2030, the market's travel guarantees an upward direction, moved by a combination of innovation, natural mindfulness, and the advancing wants of worldwide buyers.

Key Market Insights:

As people look for more noteworthy comfort and proficiency in their everyday lives, the request for white products such as fridges, washing machines, and dishwashers proceeds to surge. Advanced shoppers progressively prioritize highlights like vitality productivity, shrewd network, and eco-friendliness, driving producers to improve. Refrigerators and washing machines dominate the white goods market, accounting for around 60% of total sales globally, indicating their significant presence and importance in households worldwide, according to survey reports by Statista.

Global White Goods Market Drivers:

Technological Progressions within the ever-evolving landscape of household machines, and innovative advancements act as an essential driver impelling the white goods market forward.

Producers continually endeavor to coordinate cutting-edge highlights such as shrewd networks, vitality productivity, and natural client interfacing into their items. The development of Web of Things (IoT) capabilities empowers apparatuses to communicate with each other and with clients, improving comfort and usefulness. As shoppers progressively look for machines that disentangle their lives and decrease vitality utilization, innovative progressions stay an urgent constraint forming the direction of the white products advertise.

Economic components and statistical patterns play a pivotal part in forming the white merchandise advertise.

Economic markers such as GDP development, business rates, and shopper certainty straightforwardly affect family investing in strong merchandise like apparatuses. In addition, statistical components such as populace development, urbanization rates, and maturing populaces impact the composition of requests for white products. For occurrence, the maturing populace in numerous created nations drives requests for machines planned with availability highlights to cater to more seasoned customers. Also, fast urbanization in developing markets creates openings for producers to tap into developing middle-class populaces looking to update their living benchmarks with advanced white merchandise machines. Understanding the transaction between financial variables and statistic patterns is fundamental for expecting and reacting to showcase requests within the white merchandise industry.

Global White Goods Market Restraints and Challenges:

The global white goods market, a domain of irreplaceable domestic machines like fridges, washing machines, and dishwashers, faces a bunch of challenges forming its scene. Additionally, the industry's sensitive move with unstable crude fabric costs, counting steel and plastics, includes a layer of complexity, requiring producers to deftly explore fetched variances without burdening shoppers. Compliance with advancing administrative guidelines, coupled with the request for energy-efficient plans, strains the industry's assets. Mechanical jumps, whereas driving development, show a double-edged sword, requesting a fine adjustment between presenting cutting-edge highlights and guaranteeing item life span in a time of fast date quality. Supply chain disturbances, be they from characteristic fiascos or worldwide emergencies, resonate through the market, disturbing generation plans and coordination.

Global White Goods Market Opportunities:

Within the ever-evolving scene of the global white goods market, a bunch of openings are standing by those prepared to improve and adjust. With an unfaltering center on vitality proficiency, companies can cater to the rising request for eco-friendly machines, joining keen sensors and optimized utilization to adjust with both shopper inclinations and administrative guidelines. The coming of the keen machine transformation calls, advertising a canvas for IoT innovation integration that changes ordinary machines into interconnected wonders. Wellbeing and wellness patterns post-pandemic have underscored the significance of cleanliness, clearing the way for white products with sanitizing highlights and progressed conservation advances. Rising markets, stamped by quick urbanization, show undiscovered potential for custom-fitted items catering to special needs and cost focuses, whereas circular economy activities and service-oriented models not as they were adjusted with supportability goals but to foster long-term customer dependability. The end of the white merchandise advertisements is shining, promising development for those willing to grasp these showcase openings with inventiveness and vision.

WHITE GOODS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.67% |

|

Segments Covered |

By Product, End-User, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Samsung Electronics Co., Ltd (South Korea), LG Electronics Inc (South Korea), Panasonic Corporation (Japan), Sharp Corporation (U.S.), M.A.C. Knife (U.S.), Messermeister (Germany), Victorinox AG (Switzerland), Friedr. Dick GmbH & Co (Germany), GLOBAL APPLIANCES USA (U.S.), KAI USA LTD (U.S.) |

White Goods Market Segmentation: By Product

-

Air Conditioner

-

Refrigerator

-

Washing Machine

-

Dishwasher

-

Microwave Oven

-

Others

The highest market share and fastest-growing segment inside the global white goods market is the Air Conditioner category. With a momentous compound yearly growth rate (CAGR) of around 7.67% over the past five a long time, this portion stands as a reference point of strong request. The surge in notoriety is fueled by heightening temperatures around the world and a developing accentuation on energy-efficient cooling arrangements. Driving the charge in this section are powerhouse economies of Asia-Pacific, especially China and India, where fast urbanization and a burgeoning middle-class populace are impelling the request for discussion conditioning frameworks to exceptional statures. As the advertisement proceeds to enhance, with keen highlights and eco-friendly choices picking up footing, producers are balanced to capitalize on this upward direction, catering to the cooling needs of a changing world.

White Goods Market Segmentation: By Distribution Channel

-

Supermarket and Hypermarket

-

Specialty Store

-

Retail Store

-

E-commerce

-

Others

The highest market share inside the global white goods market's dispersion channels is held by kitchen appliance stores inside the strength store section. Buyers float towards these specialized outlets, looking for inventive and proficient arrangements for their culinary needs. At the same time, general stores are rising as the fastest-growing sub-segment, alluring clients with competitive estimating and alluring bundled offers. This development could be a confirmation of the offer of grocery stores and hypermarkets as helpful goals for a wide extend of family apparatuses. Nearby these stalwarts, e-commerce stages devoted to white merchandise command a critical showcase share, reflecting the advanced move in shopper shopping propensities. These stages give unparalleled comfort, permitting clients to browse and buy apparatuses from the consolation of their homes. In the meantime, coordinate deals channels, checked by personalized producer intuitive, are quickly picking up ground as customers look for more custom-made shopping encounters. Conventional retail stores, even though keeping up a steady advertise share, are seeing striking development in little to medium-sized outlets, which exceed expectations in advertising localized choices and personalized administrations. In this differing scene of dispersion channels, understanding buyer inclinations and adjusting to advancing patterns are significant for partners looking to capitalize on the dynamic openings inside the worldwide white merchandise showcase.

White Goods Market Segmentation: By End-User

-

Residential

-

Commercial

The highest and fastest-growing segment in the Global White Goods Market is the Commercial refrigeration segment. With a commanding advertise share and a momentous CAGR of 7.67%, it stands as a guide for advancement and productivity in commercial settings around the world. Its dominance in both advertising share and development underscores the immovable request for freshness and unwavering quality in businesses extending from neighborliness to healthcare. Parallel to this, within the Private portion, fridges rise as the exemplification of shopper inclination and mechanical headway, gloating a striking CAGR of 7.67%. Their omnipresent nearness in families universally, coupled with the ceaseless advancement toward energy-efficient models, positions them as the quintessential machine for present-day living. As these sections lead the charge in development and advertise share, the Worldwide White Merchandise Showcase finds itself at the crossing point of shopper wants and innovative development, balanced for proceeded development and advancement.

White Goods Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The highest market share within the global white goods market is held by North America, commanding an amazing 30% share. Meanwhile, Asia-Pacific rises as the fastest-growing region, surpassing a development rate of 6% yearly. With a showcase share of around 28%. Moving to the development showcase of Europe, Bosch stands tall with the most elevated advertising share of 25%. In South America, Electrolux captures 10% of the market share, driving the charge in refrigerators which are developing yearly at 4%. At last, within the Middle East and Africa, LG Gadgets commands a critical 7% market share, with the discussed conditioner section displaying the region's quickest development rate of 5%. These territorial bits of knowledge paint a distinctive picture of the differing and flourishing scene of the worldwide white products advertise, where companies explore changing customer inclinations, financial conditions, and innovative progressions to carve their victory stories.

COVID-19 Impact Analysis on the Global White Goods Market:

The COVID-19 pandemic resounded all through the worldwide white product advertising, activating a cascade of challenges and adjustments. Supply chains strained beneath the weight of lockdowns and confinements, causing delays in generation and deficiencies of imperative components. Buyer requests, at first buoyed by a surge in domestic machine buys before long disappeared amid financial instability and moving needs. However, amid these trials developed a wave of development, with producers creating items custom-fitted to the pandemic's unused substances. E-commerce surged, getting to be a help for deals as brick-and-mortar stores covered. Governments ventured in with boost measures, advertising a glint of trust for recuperation. As the world cautiously rises from the pandemic's hold, the white products industry stands at an intersection, balanced for a future formed by versatility, digitalization, and a sharp center on buyer needs in this advancing scene. The boom in e-commerce deals, coupled with government boost measures and a center on maintainable, health-conscious items, has given flickers of trust for recuperation. Looking ahead, the white merchandise advertise is balanced for a period of change, where nimbleness, advancement, and a sharp understanding of moving shopper inclinations will be foremost in driving development and adjustment within the post-pandemic period.

Latest Trends/ Developments:

Within the bustling world of family machines, the global white goods market is experiencing an intriguing transformation, driven by a joining of development and buyer requests. From the consistent integration of IoT innovation, empowering further control and observing of apparatuses, to an undaunted commitment to vitality effectiveness and maintainability, producers are making a future where usefulness meets eco-consciousness. Compact and space-saving plans cater to the urban tenant, whereas customization choices permit shoppers to tailor apparatuses to their tastes. Wellbeing and wellness highlights, a reaction to increased cleanliness concerns, are becoming standard, nearby progressed clothing innovations that change feared chores into easy errands. Subscription-based models and cross-industry collaborations include layers of oddity and comfort, whereas a center on client encounter guarantees that interaction with apparatuses is natural and consistent. In the midst of it all, the resurgence of retro plans includes a touch of wistfulness to the cutting-edge domestic. In this energetic scene, white products rise not fair as utilitarian apparatuses, but as indispensable components of a way of life characterized by development, maintainability, and personalized comfort.

Key Players:

-

Samsung Electronics Co., Ltd (South Korea)

-

LG Electronics Inc (South Korea)

-

Panasonic Corporation (Japan)

-

Sharp Corporation (U.S.)

-

M.A.C. Knife (U.S.)

-

Messermeister (Germany)

-

Victorinox AG (Switzerland)

-

Friedr. Dick GmbH & Co (Germany)

-

GLOBAL APPLIANCES USA (U.S.)

-

KAI USA LTD (U.S.)

Market News

-

In 2023, the global white goods market saw the revealing of another chapter in its story of mergers and acquisitions. Haier Group, the Chinese combination with a sprawling worldwide impression, made features with its procurement of Bosch Domestic Machines

-

In 2024, the global white goods market proceeded with its story of combination and development. Panasonic Enterprise, the Japanese stalwart with a bequest of exactness building, made waves with its procurement of Sharp Corporation's Domestic Machine Trade.

Chapter 1. WHITE GOODS MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. WHITE GOODS MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. WHITE GOODS MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. WHITE GOODS MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. WHITE GOODS MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. WHITE GOODS MARKET – By Product

6.1 Introduction/Key Findings

6.2 Air Conditioner

6.3 Refrigerator

6.4 Washing Machine

6.5 Dishwasher

6.6 Microwave Oven

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Product

6.9 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. WHITE GOODS MARKET – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarket and Hypermarket

7.3 Specialty Store

7.4 Retail Store

7.5 E-commerce

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Distribution Channel

7.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. WHITE GOODS MARKET – By End-User

8.1 Introduction/Key Findings

8.2 Residential

8.3 Commercial

8.4 Y-O-Y Growth trend Analysis By End-User

8.5 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. WHITE GOODS MARKET , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product

9.1.3 By Distribution Channel

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product

9.2.3 By Distribution Channel

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product

9.3.3 By Distribution Channel

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product

9.4.3 By Distribution Channel

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product

9.5.3 By Distribution Channel

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. WHITE GOODS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Samsung Electronics Co., Ltd (South Korea)

10.2 LG Electronics Inc (South Korea)

10.3 Panasonic Corporation (Japan)

10.4 Sharp Corporation (U.S.)

10.5 M.A.C. Knife (U.S.)

10.6 Messermeister (Germany)

10.7 Victorinox AG (Switzerland)

10.8 Friedr. Dick GmbH & Co (Germany)

10.9 GLOBAL APPLIANCES USA (U.S.)

10.10 KAI USA LTD (U.S.)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global White Goods Market was valued at USD 580.62 billion and is projected to reach a market size of USD 974 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.67%.

Technological Progressions within the ever-evolving landscape of household machines, and innovative advancements act as an essential driver impelling the white goods market forward.

Based on Product, Global White Goods Market is segmented into Air conditioners, refrigerators, Washing machines, dishwashers, Microwave ovens, and Others.

North America is the most dominant region for the Global White Goods Market.

M.A.C. Knife (U.S.), Kiya Corp. (Japan), Messermeister (Germany), Friedr. Dick GmbH & Co (Germany), Victorinox AG (Switzerland), KAI USA LTD (U.S.), GLOBAL APPLIANCES USA (U.S.), Anker Innovation Technology Co., Ltd. (China), Shenzhen Proscenic Technology Co. Ltd. (China), Samsung Electronics Co., Ltd (South Korea), L.G. Electronics Inc (South Korea), Neato Robotics, Inc. (U.S.), Cecotec Innovaciones S.L. (Spain), Dyson Limited (U.K.), Panasonic Corporation (Japan), Sharp Corporation (U.S.)