White Biotech Market Size (2025-2030)

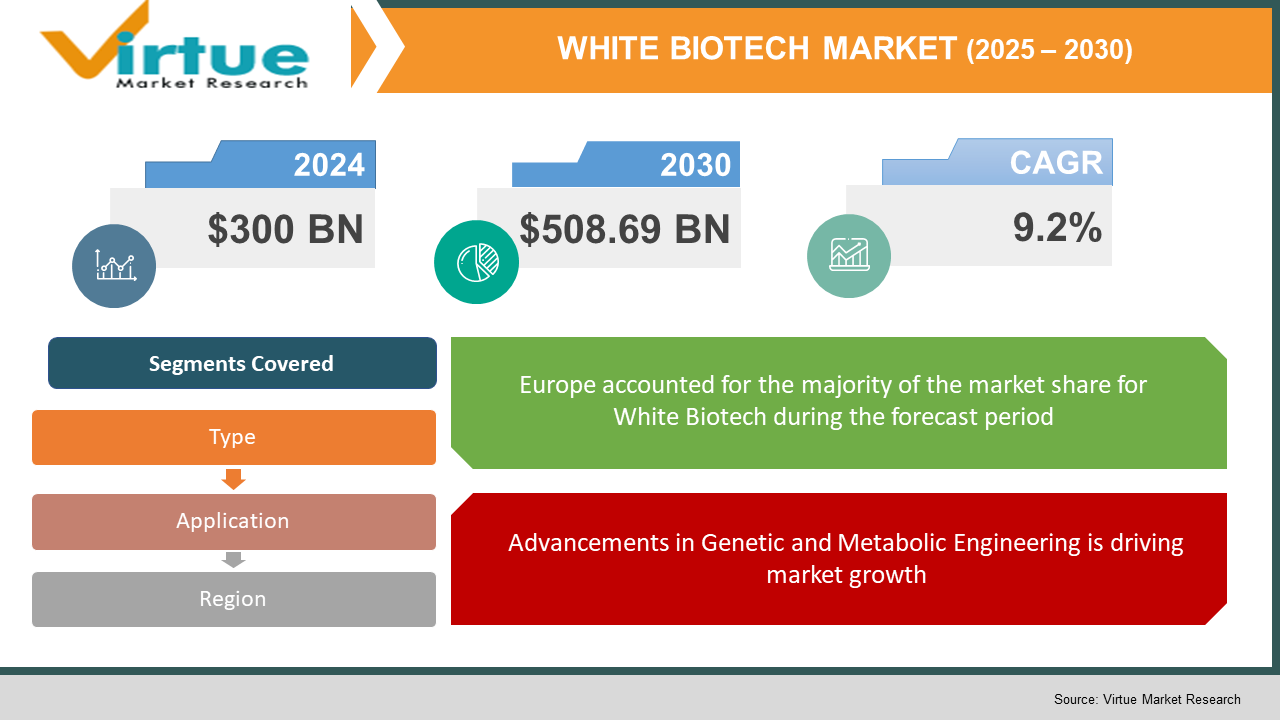

The Global White Biotech Market was valued at USD 300 billion in 2024 and is projected to grow at a CAGR of 9.2% from 2025 to 2030, reaching USD 508.69 billion by 2030.

White biotechnology, also known as industrial biotechnology, involves the use of biological processes and organisms such as enzymes, microorganisms, and bio-catalysts for industrial purposes. This market is a cornerstone of the bioeconomy, offering sustainable solutions to industries such as chemicals, energy, pharmaceuticals, and food and beverages. The growing emphasis on reducing greenhouse gas emissions, shifting from fossil fuel-based products to bio-based alternatives, and advancements in genetic engineering are driving the market forward. Additionally, government policies supporting sustainable industrial practices and the circular economy are key enablers for white biotechnology's growth.

Key Market Insights

-

Bioplastics, a rapidly growing segment, are expected to witness a CAGR of 12%, fueled by the global focus on reducing plastic waste and developing biodegradable alternatives.

-

The Asia-Pacific region shows significant growth potential due to increased investments in bio-based industrial processes and robust production capacities for bioethanol, enzymes, and biopolymers.

-

The pharmaceutical industry increasingly integrates white biotechnology to produce antibiotics, insulin, and monoclonal antibodies, leveraging bioprocesses for cost-effective and sustainable production. Emerging collaborations between biotech firms, chemical companies, and agricultural sectors are accelerating the commercialization of white biotech products globally.

Global White Biotech Market Drivers

Transition to a Bio-Based Economy is driving market growth:

The global push for sustainable industrial practices is a primary driver of the white biotech market. Industries are transitioning from fossil-based raw materials to renewable and bio-based resources due to environmental concerns and stricter regulatory policies. For instance, white biotechnology offers biofuels like bioethanol and biodiesel as renewable energy sources, reducing dependence on traditional fuels and mitigating carbon emissions. In addition, bio-based chemicals such as lactic acid, succinic acid, and citric acid are being widely adopted as alternatives to petroleum-derived chemicals in food, beverage, and pharmaceutical industries. This shift aligns with global sustainability goals and supports the circular economy, wherein biological resources are reused and recycled, minimizing waste.

Advancements in Genetic and Metabolic Engineering is driving market growth:

The integration of advanced genetic engineering tools and synthetic biology has revolutionized white biotechnology. Genetic modification of microorganisms allows for enhanced production efficiency, reduced costs, and the development of new bio-based products. For example, metabolic engineering of microbes like yeast and E. coli enables the production of complex bio-compounds such as biofuels, amino acids, and biodegradable polymers at industrial scales. Innovations like CRISPR-Cas9 and genome editing technologies further accelerate the optimization of strains, paving the way for customized, high-yield microbial processes. These advancements have also facilitated breakthroughs in enzyme engineering, boosting the efficiency of industrial bioprocesses across diverse applications.

Rising Demand for Sustainable Plastics and Chemicals is driving market growth:

The growing environmental concerns over conventional plastics have catalyzed the demand for bioplastics and bio-based chemicals. Bioplastics, derived from renewable feedstocks like corn starch, sugarcane, and cellulose, are biodegradable and offer a sustainable alternative to petroleum-based plastics. Leading industries such as packaging, automotive, and consumer goods are increasingly adopting bio-based materials to align with consumer preferences and regulatory mandates. Furthermore, bio-based chemicals are penetrating sectors like agriculture, where bio-pesticides and bio-fertilizers are gaining prominence due to their reduced environmental footprint. These trends indicate a significant shift toward adopting white biotechnology solutions for sustainable industrial processes.

Global White Biotech Market Challenges and Restraints

High Costs of Research and Commercialization is restricting market growth:

Despite its promising potential, white biotechnology faces substantial cost-related challenges. The research and development of bio-based processes involve significant investments in infrastructure, enzyme optimization, and microbial strain development. Moreover, scaling up biotechnological processes from laboratory to industrial production often encounters technical bottlenecks, further inflating costs. The initial capital expenditure required to establish fermentation facilities and bio-refineries is another limiting factor, particularly for small and medium-sized enterprises. Additionally, the commercialization of bio-based products must compete with cost-effective petroleum-based alternatives, which still dominate the market due to their established supply chains and economies of scale.

Feedstock Availability and Supply Chain Constraints is restricting market growth:

The production of bio-based products relies heavily on renewable feedstocks such as sugarcane, corn, and agricultural waste. However, the availability and pricing of these feedstocks can be volatile, influenced by factors such as climatic conditions, geopolitical dynamics, and competing uses in food and energy sectors. For instance, using corn for bioethanol production can lead to supply chain conflicts with the food industry, raising ethical and economic concerns. Furthermore, the logistics of collecting, transporting, and storing feedstocks pose additional challenges, particularly in regions with underdeveloped infrastructure. These constraints can hinder the scalability and cost competitiveness of white biotechnology processes.

Market Opportunities

The white biotech market offers vast opportunities across multiple industries due to its alignment with global sustainability goals and technological advancements. The growing demand for bio-based energy sources, such as bioethanol and biodiesel, represents a significant opportunity for market players. Governments worldwide are implementing favorable policies and subsidies to promote renewable energy adoption, further driving this segment. The pharmaceutical industry also presents a lucrative opportunity, with increasing reliance on bioprocesses for manufacturing antibiotics, vaccines, and biologics, reducing production costs and environmental impact. Moreover, innovations in waste-to-biofuel technology, where industrial and agricultural waste is converted into high-value biofuels, open new avenues for sustainable energy solutions. Another promising area is bioplastics, with demand surging across packaging, automotive, and consumer goods industries due to regulatory mandates against single-use plastics. Additionally, the development of novel enzymes and microbial strains through synthetic biology and CRISPR technologies enables the efficient conversion of diverse feedstocks into bio-based chemicals. Emerging markets in Asia-Pacific and South America, characterized by abundant feedstock availability and government support, are also poised to drive growth in this sector.

WHITE BIOTECH MARKET REPORT COVERAGE:

|

REPORT METRIC A |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

9.2% |

|

Segments Covered |

By Type, Applicatio, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Novozymes, DuPont Industrial Biosciences, BASF SE, Cargill, Inc., DSM, Evonik Industries AG, Corbion, Amyris Inc., Global Bioenergies, Clariant |

White Biotech Market Segmentation

White Biotech Market By Type

-

Biofuels

-

Bioplastics

-

Biopharmaceuticals

-

Enzymes

-

Bio-Based Chemicals

Biofuels dominate the product type category, contributing over 35% of the market revenue in 2024, driven by increasing adoption of renewable energy policies and demand for sustainable fuel alternatives.

White Biotech Market By Application

-

Energy

-

Pharmaceuticals

-

Food and Beverages

-

Agriculture

-

Chemicals

-

Others

The energy segment leads the application category, accounting for a significant share, as biofuels like ethanol and biodiesel emerge as viable alternatives to fossil fuels amidst global decarbonization efforts.

White Biotech Market Regional Segmentation:

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

Europe is the leading region in the global white biotech market, accounting for nearly 40% of market share in 2024. The region benefits from strong government initiatives such as the European Green Deal and stringent environmental regulations promoting the use of bio-based products. Countries like Germany, France, and the Netherlands are at the forefront of adopting bioplastics, biofuels, and bio-based chemicals. The robust infrastructure for research and development, combined with the presence of key market players, further consolidates Europe’s dominance in the white biotech market.

COVID-19 Impact Analysis on the White Biotech Market

The COVID-19 pandemic had a mixed impact on the global white biotechnology market. On one hand, disruptions in supply chains and a temporary slowdown in industrial activities hindered growth in sectors such as biofuels and bioplastics, which rely on stable production and distribution networks. The pandemic's impact on these industries was particularly pronounced as manufacturing facilities faced closures and transportation restrictions. Conversely, the pharmaceutical industry saw a significant boost in demand for biologics and biosimilars during the pandemic. This surge in demand accelerated the adoption of bioprocessing technologies, as biopharmaceutical companies ramped up production of vaccines, therapeutics, and other biologic treatments to combat COVID-19. As a result, white biotechnology played a critical role in the healthcare sector’s response to the crisis. The pandemic also underscored the importance of sustainable industrial practices. Governments and organizations increasingly recognized the need for bio-based solutions to ensure long-term economic resilience and environmental sustainability. In this context, white biotechnology emerged as a key component of strategies focused on advancing green energy initiatives and developing sustainable products. As global investments in healthcare infrastructure and green energy initiatives accelerated, the white biotechnology market became a vital part of post-pandemic recovery strategies. Despite the challenges, the market demonstrated resilience, with continued innovation and expansion in areas like bio-manufacturing and renewable energy solutions. Looking ahead, the market is expected to experience strong growth, driven by ongoing advancements in biotechnological processes and the increasing focus on sustainability and healthcare solutions.

Latest Trends/Developments

The white biotechnology market is undergoing rapid transformation, driven by several key trends that are reshaping its future. Synthetic biology remains at the forefront of innovation, enabling the cost-effective production of complex bio-based chemicals, fuels, and materials. By reengineering organisms at the genetic level, synthetic biology is unlocking new possibilities for scalable production of high-value bioproducts. Another notable trend is the rise of waste-to-value technologies, where agricultural and industrial waste is repurposed into valuable biofuels, bioplastics, and other bio-based materials. This approach not only addresses waste management issues but also contributes to the development of a circular economy by reducing dependence on virgin resources. The white biotech market is also seeing significant advancements in bioreactor design and fermentation processes. These innovations are enhancing scalability and reducing production costs, making large-scale bio-manufacturing more feasible and cost-competitive with traditional methods. As a result, the production of bio-based products is becoming more economically viable for a broader range of industries. Collaborations between biotech firms and traditional chemical manufacturers are accelerating the commercialization of novel bio-based products. By combining the strengths of both sectors, these partnerships are driving the development of innovative solutions that meet the growing demand for sustainable alternatives to petrochemical-based products. Sustainability remains a core focus in the industry, with manufacturers investing in feedstock diversification and eco-friendly production methods to minimize environmental impact. Emerging markets, particularly India, Brazil, and China, are becoming key hotspots for white biotech. Government support, along with abundant raw material availability, makes these regions attractive for investment and innovation. Lastly, the integration of AI and big data analytics into bioprocess optimization is marking a significant leap forward. These technologies help improve operational efficiency, reduce costs, and enable more precise control over biotechnological processes, driving further growth and innovation in the white biotech market.

Key Players

- Novozymes

- DuPont Industrial Biosciences

- BASF SE

- Cargill, Inc.

- DSM

- Evonik Industries AG

- Corbion

- Amyris Inc.

- Global Bioenergies

- Clariant

Chapter 1. GLOBAL WHITE BIOTECH MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL WHITE BIOTECH MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL WHITE BIOTECH MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL WHITE BIOTECH MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL WHITE BIOTECH MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL WHITE BIOTECH MARKET– BY Type

6.1. Introduction/Key Findings

6.2. Biofuels

6.3. Bioplastics

6.4. Biopharmaceuticals

6.5. Enzymes

6.6. Bio-Based Chemicals

6.7. Y-O-Y Growth trend Analysis By Type

6.8. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. GLOBAL WHITE BIOTECH MARKET– BY APPLICATION

7.1. Introduction/Key Findings

7.2. Energy

7.3. Pharmaceuticals

7.4. Food and Beverages

7.5. Agriculture

7.6. Chemicals

7.7. Others

7.8. Y-O-Y Growth trend Analysis By APPLICATION

7.9. Absolute $ Opportunity Analysis By APPLICATION , 2024-2030

Chapter 8. GLOBAL WHITE BIOTECH MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Application

8.2.3. By Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Application

8.3.3. By Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Application

8.4.3. By Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Application

8.5.3. By Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL MARKET – Company Profiles – (Overview, Product Type Product Type s Portfolio, Financials, Strategies & Development

9.1. Novozymes

9.2. DuPont Industrial Biosciences

9.3. BASF SE

9.4. Cargill, Inc.

9.5. DSM

9.6. Evonik Industries AG

9.7. Corbion

9.8. Amyris Inc.

9.9. Global Bioenergies

9.10. Clariant

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global White Biotech Market was valued at USD 300 billion in 2024 and is projected to grow at a CAGR of 9.2% from 2025 to 2030, reaching USD 508.69 billion by 2030.

Key drivers i nclude the transition to a bio-based economy, advancements in genetic and metabolic engineering, and the rising demand for sustainable plastics and chemicals.

The market is segmented by product type (biofuels, bioplastics, biopharmaceuticals, enzymes, bio-based chemicals) and application (energy, pharmaceuticals, food and beverages, agriculture, chemicals).

Europe is the dominant region, contributing nearly 40% of the global market share in 2024, due to strong government initiatives and advanced infrastructure for bio-based industries.

Leading players include Novozymes, DuPont Industrial Biosciences, BASF SE, DSM, and Cargill, Inc.