Global Wheeled Tractor Machinery Market size (2024-2030)

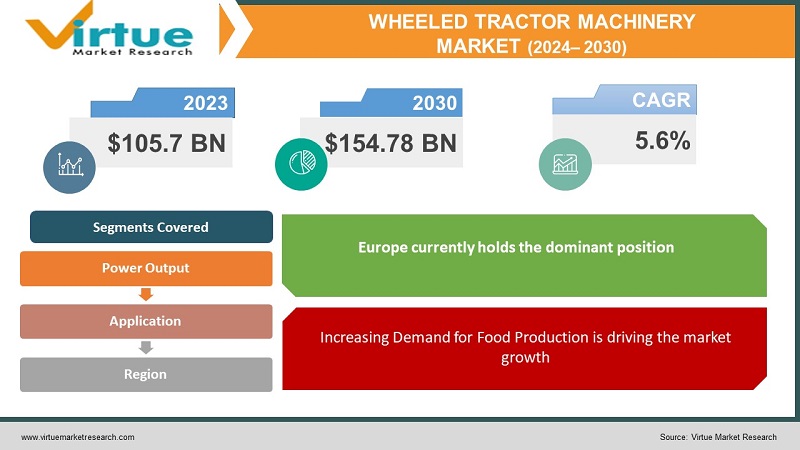

The Global Wheeled Tractor Machinery Market was valued at USD 105.7 billion in 2023 and will grow at a CAGR of 5.6% from 2024 to 2030. The market is expected to reach USD 154.78 billion by 2030.

The global wheeled tractor machinery market encompasses the production, distribution, and consumption of wheeled tractors used in various sectors. These tractors are primarily employed in agriculture for tasks like plowing, planting, and harvesting, but they also find applications in construction, mining, and logistics.

Key Market Insights:

Europe with a 30.3% market share led the market in 2023, followed by North America (20.2%) and Asia-Pacific (22.2%).

Asia-Pacific is the fastest-growing market for wheeled tractors, driven by factors like increasing mechanization in agriculture and government initiatives for farm modernization.

Four-wheeled tractors dominate the market, accounting for over 60% of the global share.

Agriculture is the primary application for wheeled tractors, followed by the construction and industrial sectors.

Global Wheeled Tractor Machinery Market Drivers:

Increasing Demand for Food Production is driving the market growth

As the global population steadily climbs, the demand for food is rising at an unprecedented rate. This places immense pressure on the agricultural sector to increase productivity and efficiently meet the needs of a growing population. To achieve this, efficient farm machinery like wheeled tractors becomes crucial. These versatile machines play a vital role in various agricultural tasks, from land preparation and sowing to harvesting and transportation. By increasing the speed and efficiency of these processes, wheeled tractors enable farmers to cultivate more land, optimize resource utilization, and ultimately produce higher yields to feed the world's ever-growing population.

Rising Penetration in Emerging Economies is driving market growth

Emerging economies in Asia, Africa, and Latin America are experiencing a significant rise in their agricultural sectors. This growth is fueled by several factors, including increasing populations, government initiatives, and a growing middle class with higher disposable income. As a result, these regions are witnessing a rapid adoption of wheeled tractors to improve efficiency and productivity in their agricultural practices. Tractors play a crucial role in various agricultural tasks, from land preparation and sowing to harvesting and transportation. By replacing manual labor and animal power, they enable farmers to cultivate larger areas of land, complete tasks faster and ultimately produce higher yields. This is particularly important in these developing economies, where food security and self-sufficiency are key priorities. Additionally, the affordability of smaller and more fuel-efficient tractors, coupled with government subsidies and financing options, is further accelerating their adoption in these regions. This trend is expected to continue in the coming years, contributing significantly to the global wheeled tractor machinery market growth.

Versatility and Multifunctionality are driving the market growth

The versatility and multifunctionality of wheeled tractors extend far beyond the agricultural realm. These powerful machines are increasingly utilized in various sectors, contributing significantly to their overall market growth. In the construction industry, tractors equipped with loaders and backhoes handle heavy lifting and earthmoving tasks. Forestry operations leverage tractors for timber hauling and clearing, while landscaping professionals utilize them for mowing, tilling, and transporting materials. Additionally, municipal services employ tractors for snow removal, street sweeping, and other essential maintenance activities. This diverse range of applications underscores the immense value of wheeled tractors, contributing to their widespread adoption across numerous industries

Global Wheeled Tractor Machinery Market challenges and restraints:

Fluctuations in Agricultural Commodity Prices are restricting the market growth

Fluctuations in agricultural commodity prices pose a significant challenge to the wheeled tractor machinery market. Farmers' income directly depends on the prices they receive for their crops. When prices are low or volatile, it can significantly impact their profitability and discourage them from investing in new equipment like tractors. This is especially true for smaller farms with limited financial resources. Uncertainty in income makes it difficult for farmers to justify the substantial upfront cost of a new tractor, leading them to either delay or completely forego such purchases. This ultimately hinders the growth of the wheeled tractor machinery market, as the demand for new equipment slows down. Additionally, price volatility can create a sense of risk aversion among farmers, making them hesitant to adopt new technologies and invest in modern machinery, further impacting the market's potential.

Rising Fuel Costs are restricting the market growth

Rising fuel costs pose a significant threat to the profitability of using wheeled tractors. Fuel is a major operating expense for farmers, and as prices increase, it can significantly eat into their margins. This is especially true for large, fuel-guzzling tractors used in extensive agricultural operations. The increased fuel costs can lead to a decrease in overall farm income, making it harder for farmers to justify investments in new equipment or even cover existing operational expenses. This can lead to delayed maintenance, reduced productivity, and ultimately, a decline in the overall profitability of the farm. Additionally, the uncertainty associated with fluctuating fuel prices can create a sense of risk aversion among farmers, discouraging them from adopting new technologies like fuel-efficient tractors or implementing fuel-saving practices. This further hinders the growth of the wheeled tractor machinery market as demand for new, more efficient models slows down.

Market Opportunities:

The wheeled tractor machinery market offers several exciting opportunities for growth. As the demand for food production increases globally, the need for efficient and modern agricultural machinery will continue to rise. This presents a significant opportunity for manufacturers to develop and market innovative tractors that cater to specific needs and applications. Additionally, the growing focus on precision agriculture and sustainable farming practices opens up avenues for the development of technologically advanced tractors equipped with features like GPS guidance, autonomous operation, and data-driven analytics. Furthermore, the expansion of infrastructure projects in developing economies creates a demand for robust and versatile tractors suitable for construction and earthmoving tasks. By focusing on these opportunities and addressing the challenges faced by farmers, the wheeled tractor machinery market can continue to expand and play a vital role in enhancing agricultural productivity and efficiency.

WHEELED TRACTOR MACHINERY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.6% |

|

Segments Covered |

By Power output, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

John Deere, CNH Industrial, Mahindra & Mahindra, Kubota Corporation, Tractor Supply Company, AGCO Corporation, SDF Group, SAME DEUTZ-FAHR, CLAAS, Yanmar Holdings Co., Ltd. |

Wheeled Tractor Machinery Market Segmentation :

Wheeled Tractor Machinery Market Segmentation By Application:

- Agriculture

- Construction

- Forestry

- Landscaping

The agriculture segment is the most dominant application in the global wheeled tractor machinery market. This segment encompasses a wide range of essential agricultural tasks like land preparation, sowing, harvesting, and transportation. Tractors play a crucial role in increasing efficiency and productivity across the entire agricultural value chain, contributing significantly to the overall market growth. While other applications like construction, forestry, and landscaping utilize tractors for specific purposes, the sheer scale and importance of agriculture make it the leading driver of the market.

Wheeled Tractor Machinery Market Segmentation By Power Output:

- Small Tractors (Up to 50 HP)

- Medium Tractors (50-100 HP)

- Large Tractors (100+ HP)

large tractor segment (100+ HP) is the most dominant in the global wheeled tractor machinery market. These powerful machines are crucial for large-scale farming operations, heavy-duty construction projects, and demanding forestry tasks. While smaller and medium tractors have their own applications, the sheer size and power of large tractors make them essential for handling the most demanding and resource-intensive agricultural and industrial activities.

Wheeled Tractor Machinery Market Segmentation Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Europe currently holds the dominant position, driven by established agricultural practices and a strong focus on farm modernization, Asia-Pacific is expected to witness the fastest growth due to factors like rising mechanization in agriculture, government initiatives promoting farm modernization, and increasing disposable incomes. North America also holds a substantial share of the market, with a well-developed agricultural sector and high adoption of advanced technologies. South America the Middle East and Africa are emerging markets with significant growth potential, driven by increasing agricultural production and infrastructure development projects. However, these regions face challenges like limited access to credit and skilled labor, which may hinder their growth compared to established markets

COVID-19 Impact Analysis on the Global Wheeled Tractor Machinery Market

The COVID-19 pandemic had a significant impact on the global wheeled tractor machinery market, initially causing disruptions to supply chains, production, and demand. Lockdowns and travel restrictions hampered the movement of raw materials and finished products, leading to production delays and shortages. Additionally, disruptions in the global financial system and decreased consumer spending initially impacted the demand for agricultural equipment, including tractors. However, the pandemic also highlighted the critical role of agriculture in ensuring food security, leading to increased government support for the sector. This, coupled with the gradual easing of restrictions and the recovery of the global economy, has led to a rebound in the wheeled tractor machinery market. Furthermore, the growing focus on self-sufficiency and domestic food production in many countries is further driving demand for these essential agricultural machines. Overall, while the pandemic initially caused challenges, the long-term outlook for the global wheeled tractor machinery market remains positive, fueled by the increasing need for efficient food production and government support for the agricultural sector.

Latest trends/Developments

The wheeled tractor machinery market is witnessing a surge in technological advancements and innovative trends. Precision agriculture is driving the development of tractors equipped with GPS guidance, autonomous operation, and data-driven analytics for optimized field management. Additionally, the focus on sustainability is leading to the adoption of electric and hybrid tractors, reducing emissions and fuel consumption. Furthermore, manufacturers are investing in features like telematics, remote diagnostics, and connectivity to enhance operational efficiency and provide real-time data insights. These advancements are transforming the way tractors are used, leading to increased productivity, improved resource utilization, and a more sustainable approach to agriculture.

Key Players:

- John Deere

- CNH Industrial

- Mahindra & Mahindra

- Kubota Corporation

- Tractor Supply Company

- AGCO Corporation

- SDF Group

- SAME DEUTZ-FAHR

- CLAAS

- Yanmar Holdings Co., Ltd.

Chapter 1. GLOBAL WHEELED TRACTOR MACHINERY MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL WHEELED TRACTOR MACHINERY MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL WHEELED TRACTOR MACHINERY MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL WHEELED TRACTOR MACHINERY MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL WHEELED TRACTOR MACHINERY MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL WHEELED TRACTOR MACHINERY MARKET – By Application

6.1. Introduction/Key Findings

6.2. Agriculture

6.3. Construction

6.4. Forestry

6.5. Landscaping

6.6. Y-O-Y Growth trend Analysis By Application

6.7. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 7. GLOBAL WHEELED TRACTOR MACHINERY MARKET – By Power Output

7.1. Introduction/Key Findings

7.2 Small Tractors (Up to 50 HP)

7.3. Medium Tractors (50-100 HP)

7.4. Large Tractors (100+ HP)

7.5. Y-O-Y Growth trend Analysis By Power Output

7.6. Absolute $ Opportunity Analysis By Power Output , 2024-2030

Chapter 8. GLOBAL WHEELED TRACTOR MACHINERY MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Power Output

8.1.3. By Application

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Power Output

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Power Output

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Power Output

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Power Output

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL WHEELED TRACTOR MACHINERY MARKET – Company Profiles – (Overview, Application Portfolio, Financials, Strategies & Developments)

9.1 John Deere

9.2. CNH Industrial

9.3. Mahindra & Mahindra

9.4. Kubota Corporation

9.5. Tractor Supply Company

9.6. AGCO Corporation

9.7. SDF Group

9.8. SAME DEUTZ-FAHR

9.9. CLAAS

9.10. Yanmar Holdings Co., Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Wheeled Tractor Machinery Market was valued at USD 105.7 billion in 2023 and will grow at a CAGR of 5.6% from 2024 to 2030. The market is expected to reach USD 154.78 billion by 2030.

Increasing Demand for Food Production, Versatility, and Multifunctionality are the reasons that are driving the market

Based on power output it is divided into three segments – Small Tractors (Up to 50 HP), Medium Tractors (50-100 HP), Large Tractors (100+ HP)

Europe is the most dominant Wheeled Tractor Machinery Market region.

SDF Group, SAME DEUTZ-FAHR, CLAAS, Yanmar Holdings Co., Ltd.